Ethereum may dominate institutional-level complex financial scenarios, while Solana has greater advantages in pure consumer-level scenarios.

Written by: E2M Research

Network Data Comparison

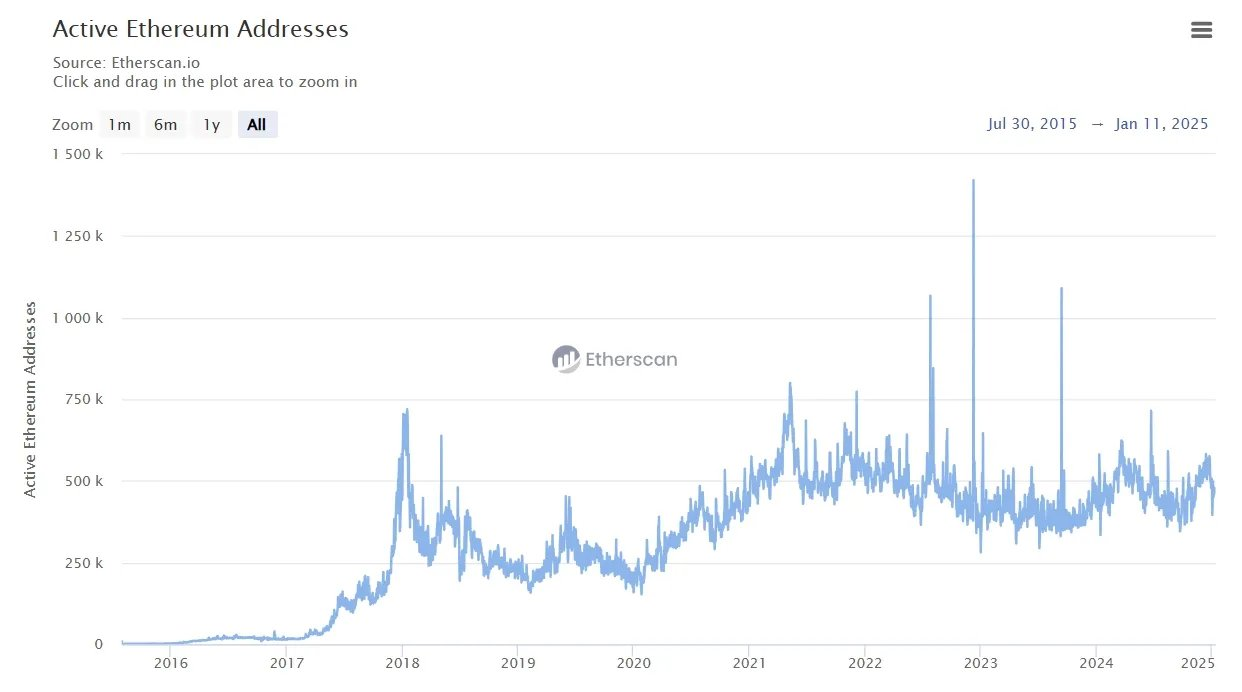

In terms of active user data, the Ethereum ecosystem shows that the mainnet's daily active users are basically maintained at around 400,000 to 500,000.

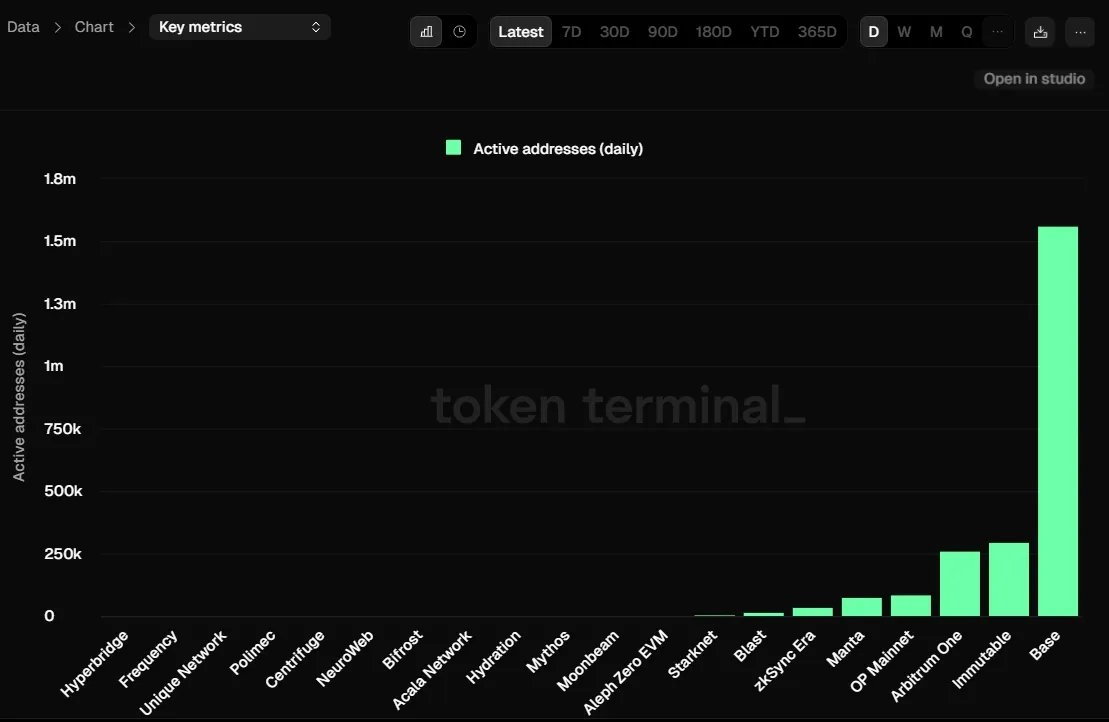

Looking at Layer 2, Base occupies the vast majority, with about 1.5 million daily active users. Immutable has about 300,000, Arbitrum around 260,000, and OP about 90,000. All data combined with the mainnet totals less than 3 million daily active users.

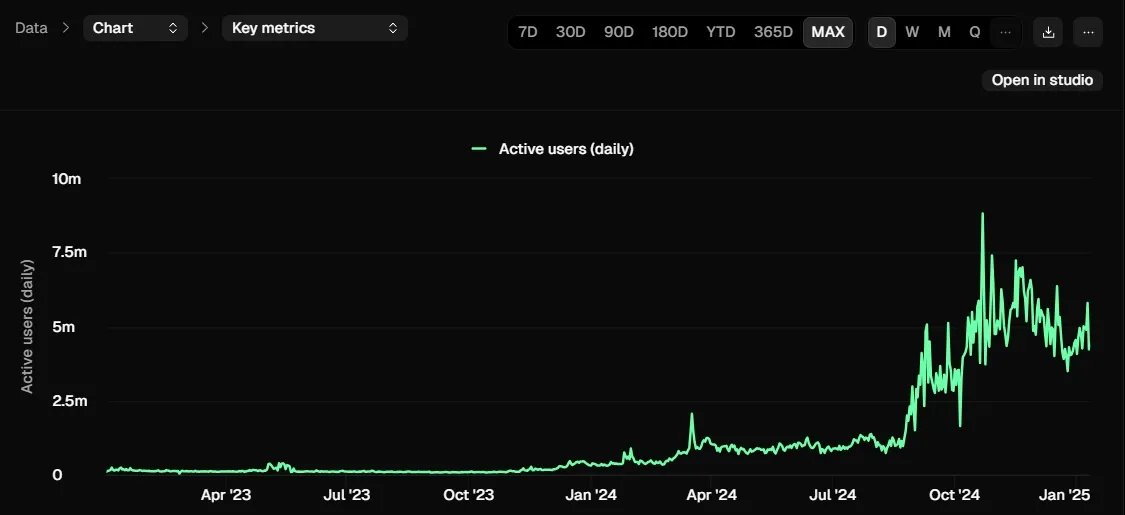

Solana's data has seen significant growth starting in 2024, typically finding its "bowling lane," showing S-shaped growth. It now maintains around 5 million daily active users.

From the daily active user data, Solana has already surpassed the Ethereum ecosystem, with 5 million compared to 3 million.

This is different from the previous round of BSC data prosperity, where BSC's data boom still relied on Ethereum's EVM architecture, essentially influenced by Ethereum's structure, which could not significantly impact Ethereum's status. However, Solana uses a completely different architecture, similar to a chimpanzee company, aiming to establish its own standards. If a large number of users enter the Solana ecosystem, it will drive projects to migrate to the Solana ecosystem.

Recently, projects like PENGU launching tokens on Solana, DePin projects, and AI Agents are more inclined to issue assets on Solana, which in turn will drive up DEX trading volumes. This can be referenced by comparing mainstream DEX data:

There are slight differences in the data from several statistical platforms, but it does not affect the analysis. Taking defillama as an example, we can see that the trading volumes of the Ethereum ecosystem and Solana ecosystem are basically at equal levels.

In terms of fees, Solana has an advantage, mainly because meme trading users are less sensitive to high fees.

Project Revenue Data

The following is a ranking of recent 24-hour revenue data for projects. It can be seen that apart from stablecoins Tether and Circle, the rest are mainly from the Solana ecosystem. This data can be seen as an expensive signal, representing users' willingness to pay for products. It is clear that projects in the Solana ecosystem are significantly more popular.

Another point worth noting is that the revenue of the public chains themselves is not the highest. For example, Solana, Ethereum, and Tron all have lower revenues than mainstream applications on the chain. This raises the debate about fat protocols versus fat applications, but currently, it seems that applications capture value more effectively.

The reason may lie in the fact that applications on each chain are basically monopolized by a few, and if the ecosystem develops to a larger scale, this phenomenon should weaken.

Fidelity's Report

The Fidelity Digital Currency 2025 Outlook Report also compares Ethereum and Solana.

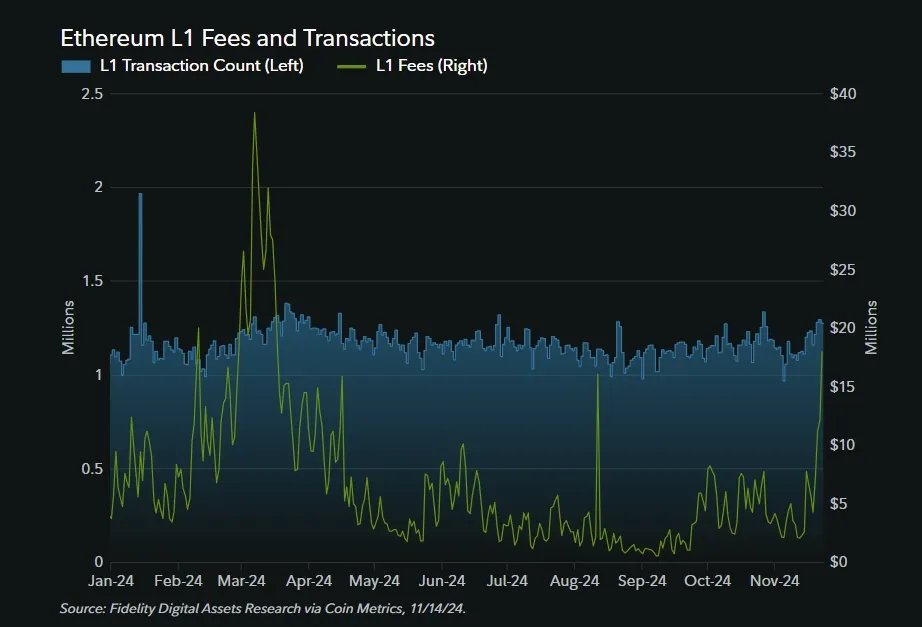

The article points out: The Rollup-Centric roadmap aims to scale Ethereum while maintaining the usability of Layer 1 blockchains. Although the Layer 1 fees have significantly decreased after the Deneb-Cancun upgrade, the team still believes that while the revenue from the Blob market may not compensate for the revenue decline caused by the upgrade in the short term, this change will bring positive network effects in the long run.

The relationship between Layer 2 and Ethereum is mutually beneficial, with Layer 2 benefiting from Ethereum by providing low-cost transaction execution and further expanding ETH.

The following chart shows the trend of changes in the number of Blobs and Blob fees.

Blob fees are seen as a long-term positive driving force for Ethereum's network effects, especially in helping Layer 2 attract more users to interact with ETH. This does not mean that Ethereum has completely abandoned future cash flows. Developers indicate that the most likely ultimate goal is that as network effects grow significantly, cash flows will form naturally.

Ethereum core developers point out that low fees are a key factor driving Layer 2 user growth. It is expected that by 2025, more Layer 2 solutions focused on specific use cases will emerge. Although Solana seems to have an advantage in the short term, in the long run, Ethereum's foundational strength may be more solid.

Ethereum tokens are expected to remain stable after the Deneb-Cancun upgrade, with an estimated annual inflation rate of 0.22% in 2024. Ethereum's scaling plan aims to gradually increase the number of blobs, and more blobs combined with Layer 2 user demand may prompt Ethereum's total fees to exceed the annual ETH issuance.

The following chart shows the fees and transaction volumes of L1. The data shows that although more transactions are conducted on L2, the transaction volume of L1 has not decreased compared to before the upgrade, even though L1 transaction fees have significantly decreased. This indicates that even if Ethereum prioritizes L2 improvements, a large number of users still choose to use L1 for transactions.

Thoughts

The above considerations are based on the situation of 5 million daily active users. When considering what happens if daily active users reach 50 million or 500 million, who has a better chance?

Given the different characteristics of the two, at a scale of 500 million daily active users, the two ecosystems may present a "division of labor and cooperation" situation:

Solana is more likely to become the main carrier for consumer-level applications, especially in high-frequency, low-value transaction scenarios such as gaming, socializing, and payments.

Ethereum (and its L2 ecosystem) may dominate institutional-level services and complex financial applications in high-value transaction scenarios.

Overall, Solana may have greater advantages in pure consumer-level scenarios, stemming from its Web2-like user experience and high-performance characteristics.

However, considering the long-term ecological health and security, the Ethereum ecosystem, with its modular architecture and mature infrastructure, has stronger sustainability in supporting large-scale adoption. The most ideal development path may be for both ecosystems to grow together in their respective advantageous areas, jointly promoting the large-scale adoption of Web3. Of course, if the market grows 100 times, ETH's captured value should be less than 100 times, with a significant amount of value being captured by Layer 2 and upper-layer applications.

Views of Solana's Founder

Although Ethereum has fewer users than Solana, for example, Apple phones have a low market share but generate the highest profits. Is Ethereum in a similar situation?

Currently, this is not the case. The previous analysis shows that Ethereum actually captures very little value on Layer 2, while applications on the chain capture a large amount of value. From a long-term perspective, in a market of 500 million users, Ethereum may dominate institutional-level services and complex financial applications in high-value transaction scenarios, similar to Apple's business model, where a small number of high-value transactions can generate greater economic value. As the Layer 2 ecosystem matures, Ethereum will further expand its competitiveness across various value levels. The revenue of public chains is more like paying for space or bytes, rather than paying for asset value, leading to lower profitability. Upper-layer applications have more flexible charging methods, capturing higher value. However, through Ethereum's scaling approach, if a prosperous Layer 2 ecosystem emerges in the future, it may reverse the issue of low value capture.

Referring to the chimpanzee game, Solana is more like a chimpanzee company, which needs to find its niche market. Currently, it seems to be the meme issuance trading market, hoping for chimpanzees to make mistakes or to open up new markets in a tornado, such as AI agents. Only when the chimpanzee company has a chance to become a chimpanzee company in the new tornado will it consider investing in it. (Even if Solana succeeds, the value may not necessarily be captured by SOL.) The meme coin market is not a proprietary architecture market with high migration costs.

With the development of wallets, support for multiple chains means that the meme market does not strongly depend on the underlying public chain architecture. Ethereum has established a foothold in the DeFi industry, which is Ethereum's bowling lane. The migration costs in the DeFi industry are high, giving Ethereum an advantage. The stablecoin industry has high conversion costs, but its architecture is unrelated to specific public chains. Bitcoin has high conversion costs as a non-proprietary architecture. This indicates that the standards of the blockchain industry cannot simply replicate the chimpanzee game model. Consensus seems to be a more important link, with strong network effects.

Solana has already become an indispensable part of the blockchain, with almost all mainstream cross-chain bridges and multi-chain wallets prioritizing EVM and Solana chains. The blockchain is an open system, which may not be like the closed ecosystems of every application on the internet; value networks can interchange.

Users do not necessarily have to be limited to one ecosystem; they can trade memes on Solana and engage in DeFi on Ethereum. Full-chain wallets or chain abstraction may become new points of contention, as full-chain wallets are the applications closest to users, revolving around user key management solutions, user data identity systems, and the social relationship networks derived from them, which may serve as the moat for wallets.

cm: In this round, SOL is a worthy bet, very similar to the previous round of Ethereum, and SOL needs to participate in this round of the meme market. Solana has not considered the importance of decentralization; without decentralization, it has advantages in the impossible triangle. In the long run, both have their own advantageous markets, but Ethereum's irreplaceability is stronger. The next Solana may emerge, but the next Ethereum is hard to come by.

dz: Bitcoin has no competitors as a value reserve market, Ethereum does not require permission for the global financial market and serves as the underlying support for Layer 2. Solana is still a meme casino with low irreplaceability.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。