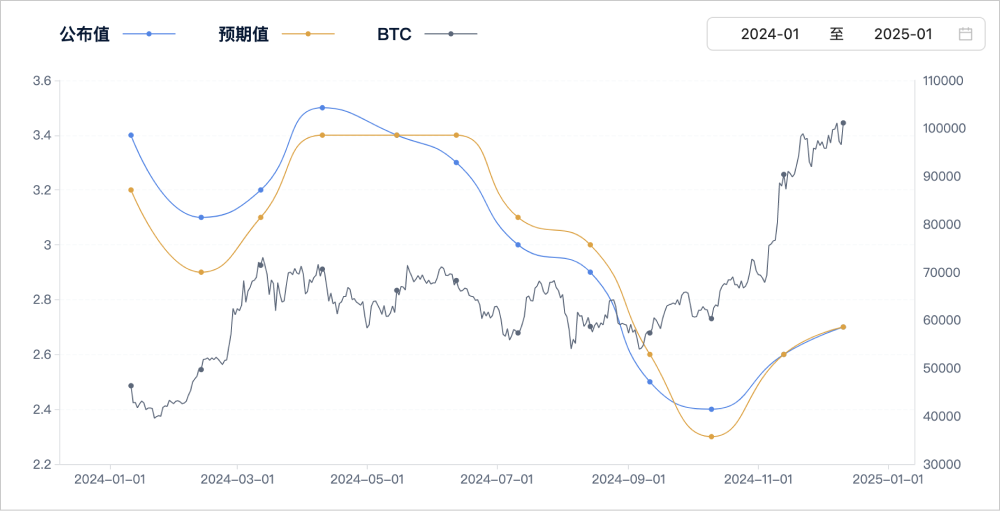

The Consumer Price Index (CPI), as a barometer of inflation, directly affects various financial assets, including Bitcoin. Each release of CPI data stirs ripples in the market, becoming a focal point for investors. As global economic uncertainty intensifies, the impact of CPI data on Bitcoin becomes particularly significant.

When CPI data exceeds expectations and inflation rises, it is like a dark cloud passing over the Bitcoin market. The Federal Reserve may be forced to adopt a tougher monetary policy, such as raising interest rates or reducing asset purchases. This policy acts like an invisible shackle on Bitcoin, as the opportunity cost of holding non-yielding assets (like Bitcoin) increases in a high-interest-rate environment, prompting investors to sell off to mitigate risk.

Conversely, when CPI data falls below expectations, inflationary pressures ease, and the market seems to welcome a long-awaited spring. The Federal Reserve may opt for a more accommodative monetary policy, lowering interest rates or continuing asset purchases. This shift injects a warm current into the Bitcoin market, reducing the opportunity cost of holding non-yielding assets, boosting investor confidence, and paving the way for a potential new surge in Bitcoin prices.

On January 10, 2025, a strong employment report in the U.S. shook the market, causing Bitcoin prices to drop below $93,000. This data heightened market expectations for the Federal Reserve to delay interest rate cuts, strengthening the dollar and putting pressure on risk assets, with Bitcoin being the most affected.

A few days later, Steno Research predicted that the CPI report on January 15 would show an inflation rate higher than expected, casting a shadow over the Bitcoin market and causing prices to fall below $90,000.

Analyst Brent Donnelly from Spectra Markets pointed out that while weak PPI data does not necessarily indicate weak CPI, historical data shows that when PPI is below expectations, the likelihood of CPI being above expectations is only 21%. This data discrepancy acts like a variable in the market, making the direction of Bitcoin prices full of uncertainty.

Analyst Omkar Godbole observed that the stagnation of major stablecoin supply may suggest a lack of new capital inflow into the market. If CPI data exceeds expectations and market liquidity is insufficient, the Bitcoin market may experience a significant downward fluctuation. The supply status of stablecoins becomes an invisible hand of market heat, where every subtle change can impact Bitcoin's price trajectory.

Although CPI data may cause fluctuations in Bitcoin prices in the short term, Steno Research believes that 2025 will be a golden year for the crypto market, with Bitcoin prices expected to rise to $150,000. This optimistic forecast stems from expectations of a favorable regulatory environment, loose macroeconomic policies, and the effects of Bitcoin halving. The future of Bitcoin seems to shimmer with the light of hope just ahead.

Overall, the impact of CPI data on Bitcoin's trajectory should not be underestimated. Market participants need to closely monitor the upcoming CPI data to adjust their investment strategies, as whether the CPI data is above or below expectations could significantly affect the Bitcoin market. Investors must be prepared to navigate market fluctuations, like an experienced sailor, flexibly responding to the winds and waves to steadily advance in an uncertain market.

If you have any questions, you can contact us through the following official channels:

AICoin Official Website: www.aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AICoincom

Email: support@aicoin.com

Group Chat: Customer Service Yingying, Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。