The Turmoil Behind the TikTok Ban

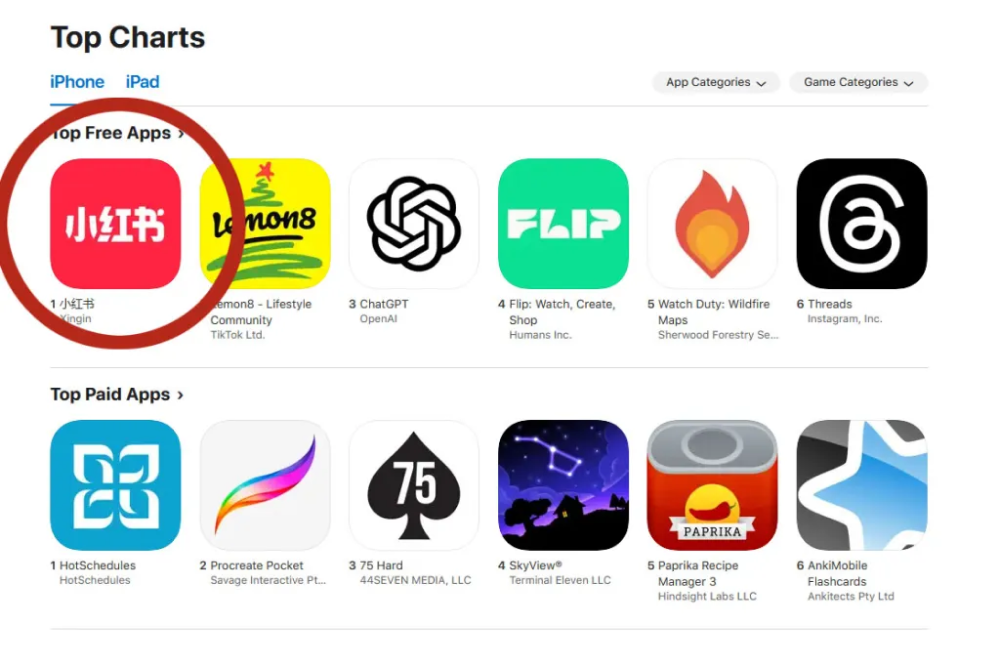

The U.S. government has forcefully demanded that TikTok's Chinese parent company, ByteDance, divest its business in the U.S. under the pretext of national security, or face a ban. Although the final ruling on this ban remains undecided, a large number of TikTok users have already begun to find new digital habitats for themselves. Xiaohongshu (RedNote), a platform known for its rich content and active community, has quickly become a new choice for these "TikTok refugees." Data shows that in just two days, Xiaohongshu welcomed an influx of 700,000 new users. TikTok refugees are flocking to Xiaohongshu, and Rednote has quickly topped the App Store charts in various regions.

With this wave of user migration, some investors in the cryptocurrency market have also sensed an opportunity. They have once again resorted to the magical tool of meme coins, attempting to cash in on the popularity of Xiaohongshu. Consequently, several meme coins closely related to Xiaohongshu have emerged:

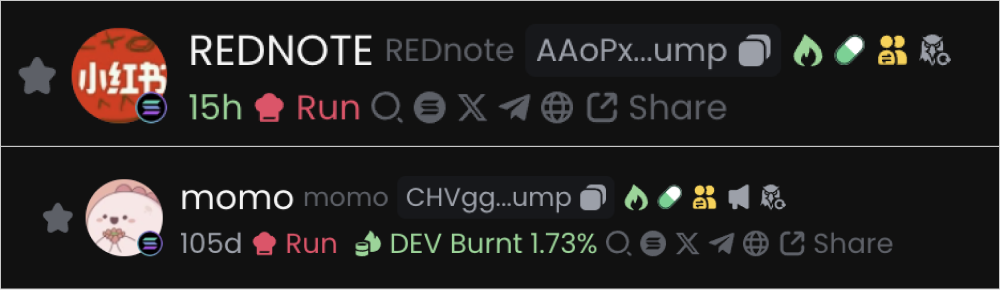

- $momo: The default account name on Xiaohongshu, now represents the meme culture that emphasizes privacy and mutual trust on the platform. Those with the momo name and avatar are referred to as the momo army, with a market cap rapidly swelling to $7.29 million, achieving an astonishing increase of over tenfold within 24 hours.

- Sweet Potato Captain: The official account of Xiaohongshu, represented by a sweet potato image, has 7.436 million followers and is known as "the top influencer on Xiaohongshu." Although its market cap is only about $330,000, it still attracts considerable attention from speculators.

- $REDNOTE: Named after Xiaohongshu's overseas name, it has reached a market cap of $1 million, experiencing dozens of times in price increase within 24 hours.

Despite the astonishing rise of these meme coins, none have truly emerged as high-market-value coins. Investors must remain clear-headed, as meme coins are highly volatile, and whether the underlying internet hype can sustain itself remains uncertain.

REDNOTE and momo Tokens

Based on the market performance of REDNOTE and momo tokens, we delve into the underlying logic and phenomena from five aspects: speculative behavior in the crypto market, liquidity issues, fundamental analysis, price manipulation, and the macroeconomic environment.

Market Sentiment Driven: Hotspot Speculation and FOMO Effect

- Hotspot Trigger

- REDNOTE and momo are concept coins related to "Xiaohongshu" and "TikTok refugees." Due to the recent strong attention on the "Xiaohongshu" platform from overseas markets (especially the U.S.), this cross-cultural hotspot event has quickly triggered a market emotional response. Investors, driven by expectations of emerging concepts, tend to invest funds into these hotspot-related tokens. The social attributes of meme coins

- Successful cases of meme coins (like DOGE and SHIB) have created a sort of "money-making myth" in the market, and REDNOTE and momo are essentially concept coins replicating this model. They rely on emotional dissemination on social media, attracting a large number of speculators through viral marketing and short-term hype. The FOMO effect amplifies the surge.

Insufficient Liquidity: Low Market Cap Amplifies Price Volatility

- Low market cap leads to severe fluctuations

- As emerging meme coins, REDNOTE and momo have low market caps and insufficient liquidity. On one hand, this low market cap means that a small amount of capital can significantly raise prices; on the other hand, when market sentiment reverses, prices can also quickly plummet. Weak trading depth

- From the K-line chart, it can be seen that during price crashes, trading volume significantly increases. This indicates that a small amount of large capital selling can quickly break through market support, further amplifying price declines. The plight of retail investors

High volatility is particularly detrimental to retail investors. They often cannot access market information in a timely manner or quickly close positions, leading to significant losses during price crashes.

Fundamental Analysis: Lack of Actual Value Support

- The essential problem of meme coins

- The value of REDNOTE and momo is not based on real technology or application scenarios, but solely relies on the short-term hype brought by hotspot events. These tokens lack fundamental support for long-term development and are quickly forgotten by the market once the hype fades. Weak actual association with Xiaohongshu

- Although these two tokens use the popularity of "Xiaohongshu" as a gimmick, they have no actual association or cooperation with the Xiaohongshu platform. This has led investors to gradually realize that their hype logic is not solid. Lack of long-term demand

The overlap between investors and target users is low; meme coins attract mostly speculators rather than users who genuinely believe in the long-term potential of the tokens. In other words, once speculators withdraw their investments, the demand for the tokens will quickly dry up.

Possibility of Price Manipulation: Pump and Dump

- Market dominated by manipulators

- The price trends of REDNOTE and momo exhibit typical characteristics of "Pump and Dump." Early funds (possibly controlled by manipulators or token issuers) create the illusion of price surges through concentrated buying, attracting retail investors to follow suit. Precise timing for selling

- From the K-line chart of REDNOTE, it can be seen that the price stays at high levels for a very short time. This indicates that early investors quickly sell for profit after a large influx of retail investors, leading to a price crash. Lack of regulation

The crypto market still lacks strict regulatory mechanisms, and similar price manipulation behaviors are very common among low market cap tokens. If investors do not exit in time, they often become "bag holders."

Impact of Macroeconomic Environment and Market Structure

- Market's patience for meme coins is waning

- After the successes of DOGE and SHIB, a large number of meme coins attempting to replicate their model have emerged in the market. This has made investors more cautious about similar projects. As the market matures, the hype effect of meme coins has marginally weakened, and speculative enthusiasm has rapidly declined. Macroeconomic suppression of speculative behavior

- In the current global economic environment, market interest in high-risk assets has diminished. Due to their high volatility and speculative nature, meme coins are more susceptible to shocks from macroeconomic uncertainties. Overall weak performance of the crypto market

If the entire crypto market is in a bear or weak state, the appeal of high-risk, high-volatility assets like meme coins will further decline.

Conclusion: Risks and Insights of Meme Coins

The price performance of REDNOTE and momo reveals two core characteristics of meme coins: emotion-driven short-term surges and the long-term risks of lacking fundamentals. Investors need to recognize the following points:

- Short-term windfalls are hard to replicate: The price volatility of meme coins is extreme, and relying solely on speculation makes stable profits difficult.

- DYOR (Do Your Own Research) is crucial: Before investing, one should examine the fundamentals of the tokens to avoid following market trends blindly.

- Diversified investment and risk management: Reasonably allocate funds to avoid putting all assets into high-risk areas.

- For retail investors, rather than chasing short-term trends, it is better to focus on quality projects driven by technology with real application scenarios.

Xiaohongshu and the Broad Prospects of Decentralization

Of course, we must also see the positive side; the migration of TikTok users is not just a simple transfer between social platforms, but it also brings new vitality to decentralized finance (DeFi) and blockchain technology. With the surge in Xiaohongshu users, more people will have the opportunity to engage with blockchain and cryptocurrencies, undoubtedly opening up new user markets and potential application scenarios for decentralized finance. The potential applications of blockchain technology in Xiaohongshu are also highly anticipated. For instance, leveraging blockchain technology can provide users with safer cross-border payment and transaction services, ensuring personal privacy and data security while greatly enhancing user trust.

As the number of Xiaohongshu users rises, decentralized applications (DApps) also show tremendous development potential on this platform. DApps can offer users a rich variety of service options, including decentralized content creation, social interaction, and e-commerce. This not only enhances the overall user experience but also provides developers with fertile ground for innovation.

The widespread application of decentralized applications means greater user autonomy and data control, allowing users to enjoy an efficient and convenient digital lifestyle without relying on centralized platforms. These changes will also drive further development of blockchain technology, laying the foundation for the future digital world.

The migration of TikTok users has not only changed the ecology of social media but has also sparked new transformations in the cryptocurrency market, decentralized finance, blockchain technology, and decentralized applications. This phenomenon demonstrates the profound impact of user migration on social platforms while also bringing new opportunities and challenges to the crypto world. In the future, with more active participation from users and developers, these fields are bound to witness more innovations and breakthroughs.

In this migration of users between social platforms, we not only see the potential of the cryptocurrency market and blockchain technology but also foreshadow more changes and innovations that may emerge in the future. As time goes on, how these fields will continue to evolve is something we should look forward to.

Related Articles:

If you have any questions, you can contact us through the following official channels:

AICoin Official Website: www.aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AICoincom

Email: support@aicoin.com

Group Chat: Customer Service Yingying, Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。