In 2025, the vision of HashKey Chain continues to evolve and land as planned. Though the dream is distant, it can be reached through pursuit; though the wish is difficult, it can be fulfilled through perseverance.

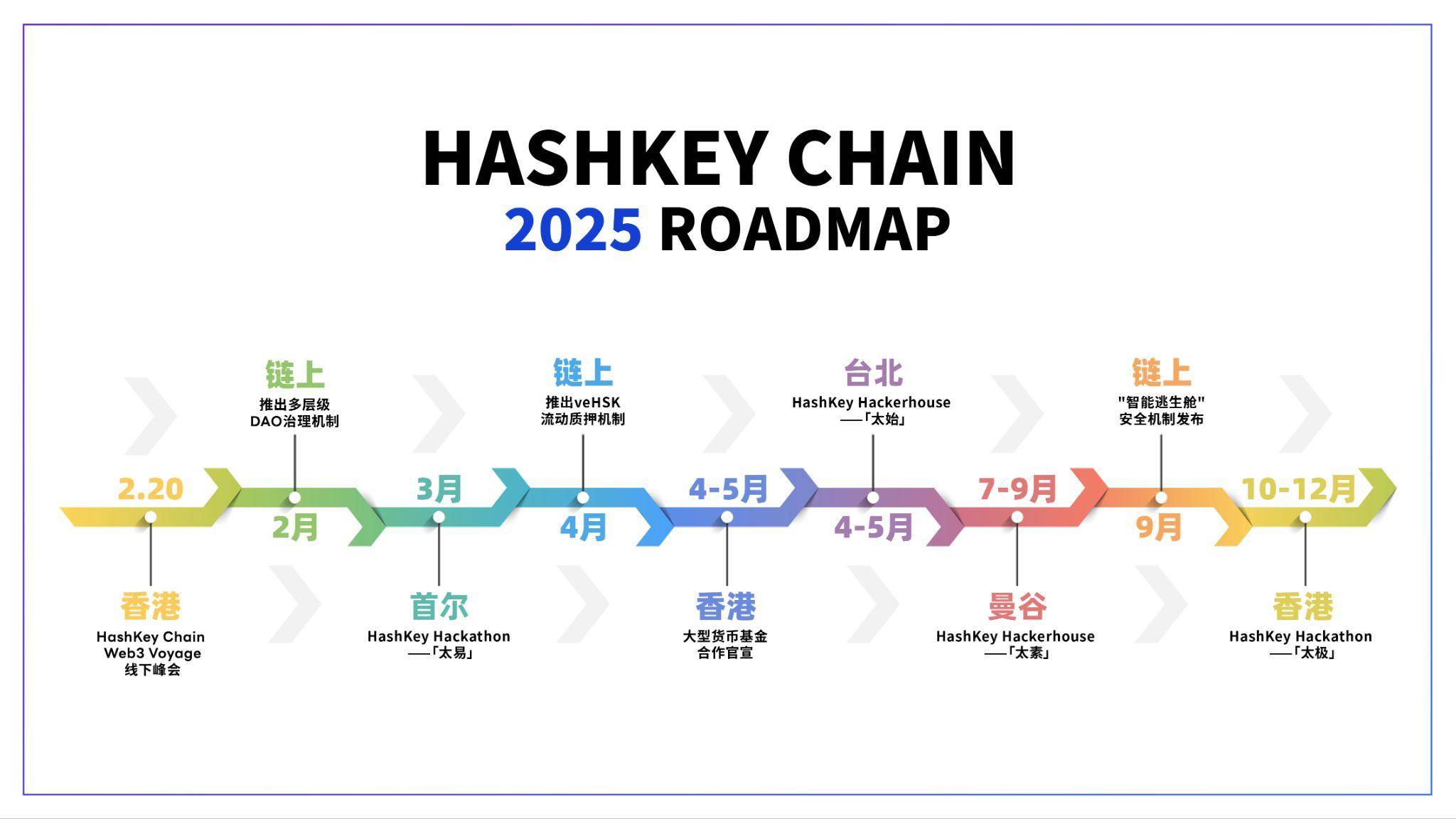

As the years change, new chapters emerge. At the turn of the year, HashKey Chain officially releases its 2025 roadmap, showcasing the latest development plans for 2025 to our users, developers, communities, and other ecological partners who have always supported us.

As a public chain that has been online for less than a month, HashKey Chain is still very young. We are grateful for the support and trust of every user, community, and partner. In just a few months since announcing the launch of HashKey Chain, we have delivered a satisfactory report card. During the testnet period, HashKey Chain achieved over 25.816 million transactions on-chain, registered over 870,000 wallet addresses, maintained an average block time of 2 seconds, with gas fees as low as 0.1 Gwei, successfully deployed 50 projects, and engaged 300,000 community members. After the mainnet launch, in less than a month, 11 project teams successfully deployed, with a cumulative on-chain transaction volume of 980,000 transactions, and it has been predicted by many media and institutions to be the Ethereum Layer 2 with the most growth potential in 2025.

The native ecological token of HashKey Chain, HSK, has also been successively listed on several mainstream exchanges such as HashKey Global, KuCoin, Gate.io, BingX, MEXC, and WOO X since November 2024. Within less than a month of the TGE launch, it achieved a maximum increase of 270%.

The vision of HashKey Chain is to become a bridge connecting Web2 and Web3, bringing Web2 assets into Web3, enriching Web3 with more assets and application scenarios, while innovatively applying Web3 asset issuance methods to Web2, liberating the liquidity of traditional Web2 assets, and ultimately forming a new world where Web2 and Web3 are seamlessly integrated.

Around this vision, HashKey Chain constructs a compliance-oriented on-chain financial infrastructure focusing on tracks such as BTCFi, PayFi, RWA, and stablecoins, aiming to create financial infrastructure that connects Web2 and Web3 and a full-stack Web3 solution. This not only reflects HashKey Chain's unique competitive advantages but also demonstrates HashKey Group's mission and determination as an industry pioneer.

In 2025, the vision of HashKey Chain continues to evolve and land as planned. Though the dream is distant, it can be reached through pursuit; though the wish is difficult, it can be fulfilled through perseverance.

Technical Breakthrough: Introducing the "Smart Escape Pod" Security Mechanism and Multi-Level DAO Governance Mechanism

Security Mechanism: Smart Escape Pod

In the development of blockchain technology, Layer 2 solutions have brought unprecedented scalability but have also introduced new security challenges. At the beginning of 2025, HashKey Chain proposed the "Smart Escape Pod" mechanism, introducing revolutionary security guarantees for the Layer 2 ecosystem. This mechanism synchronizes the state Merkle tree to Layer 1 at fixed block intervals, achieving ultimate asset security. When anomalies occur in the Layer 2 network or DeFi protocols, smart contracts will automatically trigger protective mechanisms to ensure that user assets can be safely and quickly withdrawn to the mainnet. This innovative design provides users with unprecedented asset security guarantees, eliminating concerns about "asset black holes" in Layer 2.

Governance Mechanism: Multi-Level DAO

The governance mechanism of HashKey Chain is built on a well-thought-out multi-level DAO structure. Our DAO is not just a voting system; it is a complete risk prevention and decision-making execution system. The Security Committee DAO is responsible for quickly responding to potential security threats, while the Technical Audit DAO focuses on in-depth analysis and verification. This layered governance structure ensures both the professionalism of decision-making and sufficient flexibility. Through staking mechanisms and reputation systems, we have established effective incentive models to ensure that every participant receives rewards commensurate with their contributions. A fair and transparent dispute resolution mechanism provides a solid trust foundation for the entire ecosystem.

Through the close integration of these two core mechanisms, HashKey Chain is redefining the security standards and governance models of Layer 2. We not only provide users with unprecedented asset security guarantees but also create a truly decentralized and sustainable ecosystem. Here, security is no longer an option but a core feature embedded in the protocol architecture; governance is no longer empty talk but a reality ensured by clear mechanisms and incentives.

Product Innovation: Launching the veHSK Liquid Staking Mechanism to Capture HSK Value

With the development of the market and the continuous changes in user demand, traditional staking yield methods have gradually revealed some limitations. For example, despite high annualized returns, the liquidity of staking is poor, and users cannot enjoy the gains brought by other on-chain DeFi protocols, posing new challenges for users seeking higher returns and liquidity flexibility.

To address this issue, HashKey Chain has decided to further improve the staking platform by introducing the innovative veHSK mechanism, making staking not just a simple yield model but a dynamic and expandable ecosystem that can provide users with more robust and diverse yield options.

In HashKey Chain's staking system, veHSK is not just a "derivative" of staking; it is a token generated by staking HSK, with multiple uses and significant advantages. After users stake HSK to generate veHSK, they can enjoy a series of additional rights:

● Higher Yield Rates: As an "upgraded version" of staking, veHSK allows users to earn higher additional returns by participating in liquidity provision, lending, and other DeFi applications while obtaining stable base returns. This portion of the yield comes from the platform's revenue appreciation and broader ecosystem participation.

● Enhanced Governance Weight: veHSK holders will receive additional voting rights for platform governance. Through veHSK, users can not only enjoy economic benefits but also gain greater say in key decisions such as platform development direction and parameter settings. This mechanism enhances the decentralization of the platform and ensures that users' interests are more closely tied to the platform.

● Liquidity Incentives and Market Efficiency: In future ecosystem designs, the introduction of veHSK will encourage it to play a more important role in liquidity pools. By integrating veHSK with DeFi protocols, users can enjoy fixed returns from staking while participating in market liquidity provision, earning transaction fees and liquidity incentives. This mechanism not only improves the efficiency of asset utilization but also enhances the activity and diversity of the ecosystem.

Compared to traditional staking methods, HashKey Chain brings users higher flexibility and yield potential by combining veHSK with liquidity protocols. By staking HSK to generate veHSK, users can transfer it into the platform's liquidity pool, compatible with other DeFi protocols, injecting funds into the entire ecosystem. This not only solves the liquidity problem of traditional staking but also allows users to participate in more types of DeFi applications.

For example, under the veHSK system, holders can convert their staked veHSK into liquidity assets for participating in protocols. In this way, veHSK holders can earn returns from liquidity activities such as trading and lending, maximizing their investment returns. This mechanism combines staking, liquidity, and governance, providing users with multiple yield models, thus forming a more sustainable and diversified economy.

Additionally, the liquidity of veHSK can interoperate with other protocols through smart contracts, further enhancing users' capital efficiency. In this process, the platform can not only provide high liquidity investment opportunities for veHSK holders but also enhance the platform's market performance, improving users' asset liquidity and market participation.

Building a Vibrant Developer Ecosystem

Ecosystem and users are the two key factors determining whether a public chain can ultimately succeed, while the innovation and contributions of developers lay the foundation for ecological prosperity and user scale.

Therefore, in ecological development, HashKey Chain always places developers at the core. On the technical level, HashKey Chain relies on OP-Stack technology to provide developers with high-performance infrastructure and a complete toolchain, simplifying the deployment and building process, and quickly realizing the transformation from ideas to products. In addition, to support developers in building the HashKey ecosystem, HashKey Chain has launched generous Grant incentives and ecological resource support, leveraging the multi-channel advantageous resources of the entire HashKey Group ecosystem, its global investment layout, and rich blockchain project experience to provide early support for developers and quality projects, achieving a cold start for projects.

On December 11, 2024, HashKey Chain launched the $50 million Atlas Grant program, aimed at deeply exploring quality projects in the Web3 field and providing comprehensive empowerment to achieve exponential growth in HashKey Chain's application layer and on-chain users. The first phase of the Atlas Grant prize pool is $10 million in HSK Tokens, and the awarded project teams will receive non-dilutive funding, technical guidance, collaboration opportunities, and chances to participate in hackathons and other activities.

The application period for the first phase of the Atlas Grant is from December 10, 2024, to January 10, 2025, with the selected list to be announced on January 20. So far, over 100 projects have applied for the first phase of the Atlas Grant, and the application link is: https://github.com/orgs/HashkeyHSK/discussions/new?category=session-1.

In 2025, HashKey Chain will successively launch the second, third, fourth, and fifth phases of the Atlas Grant in Q1, Q2, Q3, and Q4, respectively, with each phase providing quality developers with $10 million worth of HSK as incentive funds. We hope to grow together with developers and jointly build a prosperous and open Web3 ecosystem, creating phenomenal application products that can have real traffic across multiple mainstream public chains while achieving exponential growth in HashKey Chain's application layer and on-chain users.

In addition to the substantial Grant incentives, HashKey Chain has launched the first series of developer activities inspired by ancient Chinese philosophy. This series is designed based on the five stages of cosmic generation in ancient Chinese philosophy: "Tai Chi, Tai Yi, Tai Shi, Tai Su, and Tai Ji," creating a complete progressive innovation framework that covers the entire journey of developers from idea generation to outcome realization. This series includes three Hackerhouses and two Hackathons, providing unprecedented comprehensive support for developers in terms of technical assistance, ecological resources, and cultural inspiration.

The first HashKey Hacker House successfully concluded on December 22, 2024, in Hong Kong, attracting participation from hundreds of outstanding developers and project teams from around the world. It not only showcased the technical strength and market insight of global developers but also established HashKey Chain's image of innovation and trust within the global developer community. In 2025, HashKey Chain will host four Hackathons/Hackerhouses in South Korea, Taiwan, Japan, and Thailand: "Tai Yi," "Tai Shi," "Tai Su," and "Tai Ji." We welcome excellent developer teams from around the world to compete in the Hackathons for generous prizes and investment opportunities.

Continuously Empowering BTCFi, RWA, and PayFi, Building a Bridge Between Web2 and Web3

HashKey Chain constructs compliance-oriented on-chain financial infrastructure focusing on tracks such as BTCFi, PayFi, RWA, and stablecoins, aiming to create financial infrastructure that connects Web2 and Web3 and a full-stack Web3 solution.

1. BTCFi (Bitcoin Financial Applications)

In the past two years, the cryptocurrency industry has undergone tremendous changes, especially in the Bitcoin ecosystem, which has exhibited new ecological characteristics. This is reflected in the emergence of BTC Layer 2 networks carrying TVL, Bitcoin on-chain players seeking passive income, and traditional compliant institutions that have made significant purchases of Bitcoin following the approval of Bitcoin spot ETFs, gradually forming an ecosystem and infrastructure around these players and groups.

The popularity of the Bitcoin ecosystem has also driven the rapid development of the BTCFi ecosystem, with the total market size of BTCFi approaching $50 billion by the end of 2024. The TVL of the Bitcoin network is approximately $2 billion (including Layer 2 and sidechains), accounting for only 0.1% of Bitcoin's total market value, while Ethereum is at 15.7% and Solana at 5.6%. We believe BTCFi still has tenfold growth potential.

In 2025, HashKey Chain will issue a wrapped Bitcoin asset—HashKey BTC—on-chain, bringing robust and considerable on-chain returns to BTC holders while ensuring the absolute security of user assets, unlocking the trillion-dollar market size of BTCFi. HashKey BTC will ensure network security through an over-collateralization mechanism to avoid systemic risks.

Additionally, HBTC will provide staking yields above the market average, packaging a range of returns including lending yields, liquidity mining yields, re-staking yields, and HashKey platform point incentives for HBTC holders. We will actively select quality project teams to help users mitigate risks and create a safe and open BTCFi ecosystem on-chain, allowing BTC players and institutional investors to use our BTCFi financial derivative assets based on compliance and security.

2. RWA (Real World Assets on Chain)

According to The Defiant, the total market capitalization of RWA reached a historical high of $14 billion in December 2024. Tokenized private credit and tokenized government bonds are the two largest segments in this market, accounting for $9.5 billion and $3 billion in market share, respectively, totaling 89% of the entire on-chain RWA field. Since the beginning of 2024, the RWA market size has grown by 66%, indicating strong interest from institutional investors.

The RWA track originates from the narrative of massive adoption, with key factors driving significant market growth including the trend of tokenizing traditional financial assets and investors' demand for higher liquidity and transparency.

As a global financial hub, Hong Kong provides a favorable environment for RWA tokenization innovation. HashKey Chain, based in Hong Kong, aims to bring high-quality financial products from traditional financial institutions into the blockchain world, starting from compliance.

In December 2014, HashKey Group partnered with Cinda International Asset Management to launch the first STBL project issued by a Hong Kong financial institution. Hash Blockchain Limited ("HashKey Exchange") serves as the first distributor of the short-term asset-backed liquidity note token STBL issued by Cinda International Asset Management. In the future, Cinda International Asset Management plans to expand the issuance of STBL to HashKey Chain and introduce innovative incentive mechanisms to broaden the investor base.

The related assets of STBL are AAA-rated money market fund (MMF) portfolios. Each STBL has a par value of $1, can be transferred 24/7, and will automatically distribute daily accumulated interest to professional investors' wallets in the form of newly issued tokens on the monthly distribution day.

In 2025, HashKey Chain will support developers in tokenizing traditional assets such as real estate, commodities, and artworks, promoting asset liquidity and market transparency, injecting new momentum into the practical application of blockchain technology.

3. PayFi (Payment Financial Solutions)

PayFi, short for Payment Finance, is an innovative paradigm that integrates payment and finance, emphasizing "instant transactions" to enhance the efficiency of speculative trading and various financial operations.

Traditional payment systems rely on banks and third-party institutions as intermediaries, leading to high fees and slow transaction times. PayFi achieves peer-to-peer payments through blockchain, eliminating the high fees of intermediaries. At the same time, the automatic execution of smart contracts reduces human intervention, ensuring that the payment process is secure, transparent, and unbiased.

HashKey Chain can provide underlying technical support to help developers create secure and efficient payment solutions, promoting the digital transformation of global payment systems.

4. Stablecoins

Stablecoins serve as a trading medium connecting Web2 and Web3, with broad application scenarios in real life.

Currently, Hong Kong has strict regulatory systems for fiat stablecoin issuers, requiring issuers to ensure that fiat stablecoins are fully backed by high-quality and highly liquid reserve assets. Currently, only licensed fiat stablecoin issuers, recognized institutions, licensed corporations, and licensed virtual asset trading platforms can provide stablecoins. As one of the first licensed trading platforms in Hong Kong catering to retail users, HashKey Exchange has reached cooperation plans with companies like YuanCoin Technology and Allinpay International to issue Hong Kong dollar stablecoins. In 2025, more compliant stablecoin issuers will issue regional stablecoins on HashKey Chain.

Through the construction of a stablecoin ecosystem, HashKey Chain promotes the practical application of blockchain technology in cross-border payments and decentralized finance, enhancing global transaction efficiency.

In 2025, the competition landscape for new public chains remains fierce. As one of the more than 200 Ethereum Layer 2 solutions, HashKey Chain must carve out its own path to stand out.

Backed by HashKey Group, HashKey Chain has a leading advantage in compliance, global ecological resources, and the bidirectional bridge relationship with Web3 entities. Furthermore, unlike other Layer 2 solutions, HashKey Chain is not born to launch a chain but is driven by real demand. Our ultimate goal is to achieve large-scale application of Web3 in real life, helping developers create Web3 applications with a user base of one billion, bringing Web2 assets into Web3, and ultimately forming a new world where Web2 and Web3 are seamlessly integrated.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。