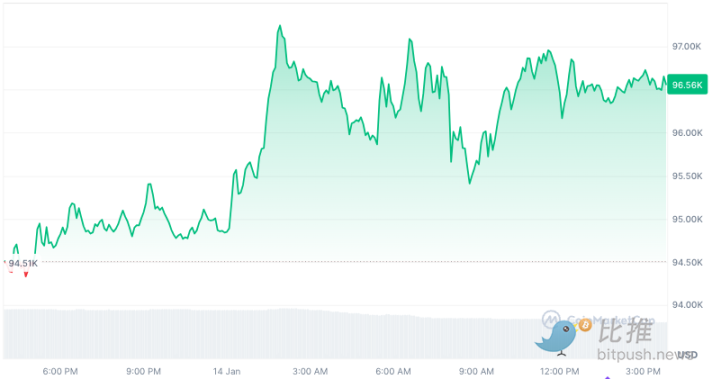

After the release of the U.S. Producer Price Index (PPI) data, Bitcoin continued to rebound, rising above $96,000, with a 2.5% increase in the past 24 hours. Among mainstream altcoins, XRP and DOGE led the way with gains of 6% to 7%.

The report shows that the U.S. PPI for December only increased by 0.2% month-on-month, lower than last month's 0.4% and also below the consensus expectation of economists at 0.4%. As a leading indicator of the Consumer Price Index (CPI), PPI plays an important role in the overall inflation level, and a cooling PPI is a positive signal for the Federal Reserve's next actions.

The day before, The Washington Post reported that sources close to Trump's new administration revealed that the elected president would issue executive orders related to cryptocurrencies after taking office. These orders are expected to address the so-called "de-banking" issue and reverse the controversial SAB 121 policy, which restricts banks from providing services to cryptocurrency companies.

Cryptocurrency billionaire and Galaxy Digital founder Mike Novogratz mentioned last year that SAB 121 is one of the policies from the Joe Biden era and would be quickly abolished after Trump takes office.

The Washington Post reported that Trump is willing to support a cryptocurrency legislative strategy in the early days of his presidency, driven by a group of Silicon Valley tycoons, including A16Z general partner Marc Andreessen. Following this news, the cryptocurrency market immediately surged.

Derivatives Market Indicators Show Market Volatility

Data from the derivatives market indicates that the volatility of Bitcoin and other cryptocurrencies is expected to continue rising. The short-term implied volatility of Bitcoin options remains high, while the VIX index, which measures volatility in the U.S. stock market, also remains elevated, indicating increased overall market uncertainty.

According to Deribit data, the first Bitcoin options expiration date this year is January 24, just two days after Trump's inauguration. The market's attitude towards this timing is slightly optimistic, with relatively high demand for call options. Among them, call options with a strike price of $99,000 are the most concentrated. QCP Capital analysts believe that derivatives market data indicates that market volatility will persist in January.

K33 Research had previously predicted that the inauguration day could be a good selling opportunity, but the recent general decline in the stock market and digital assets has led them to adjust this view. The agency stated that while the appeal of selling on inauguration day has diminished, the market still needs to closely monitor price trends next week. The report noted: "While our previous monthly outlook leaned towards selling on inauguration day, given that the recent stock market and Bitcoin both hit two-month lows, the attractiveness of this strategy has significantly decreased. The S&P 500 index filled the post-election gap yesterday, and Bitcoin also reached a two-month low. De-risking operations will entirely depend on next week's price trends, and their impact will be short-lived, as we remain optimistic about Trump's long-term impact on BTC."

Cryptocurrency research firm 10x Research stated in a report that as the Federal Reserve considers the impact of inflation, "lower-than-expected inflation data could trigger a rise in Bitcoin."

Geoffrey Kendrick, head of digital asset research at Standard Chartered Bank, stated in a research report on January 14 that Bitcoin currently faces macro risk pressures, and any pullback below $90,000 represents a "mid-term" buying opportunity.

The report stated: "If we do indeed test that level (if it falls below $90,000, I expect it to drop below $80,000), I would view it as an excellent mid-term buying opportunity." Despite short-term risks, Standard Chartered reiterated its long-term price target for Bitcoin to reach $200,000 by the end of 2025.

Cryptocurrency traders should be accustomed to significant short-term pullbacks during bull markets. Fundstrat co-founder Tom Lee stated on CNBC's "Squawk Box" that Bitcoin's price may pull back to $70,000 before reaching new highs, ultimately reaching between $200,000 and $250,000 by the end of the year.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。