On one side, SBF is still in prison eating vegetarian food, while on the other side, FTX, which lost its leader, has welcomed a new turning point.

After nearly two years of back-and-forth, and countless instances of rekindled hope and shattered dreams, investors' money finally has a chance to be returned. On January 3, according to the official announcement from FTX, the restructuring plan for FTX debtors officially took effect. Customers can file claims through the official website to receive refunds, with the first round of distributions set to begin within 60 days after the effective date. The initial phase of compensation is approximately $1.2 billion, and after a long bankruptcy and recovery process, FTX now has between $14.7 billion and $16.5 billion available to repay customers and other creditors.

Upon hearing this news, creditors were understandably ecstatic. Although cash compensation means they bear potential losses, the long road to debt recovery has finally come to an end, and most users are still overjoyed. However, for the market, the mixed feelings seem more apparent; FTX's compensation means liquidity may flood in, but its sell-off fundraising has also cast a shadow over some cryptocurrencies.

It must be acknowledged that this black swan event from two years ago continues to have a profound impact on the crypto market even today.

The FTX incident is undoubtedly a significant negative mark in the not-so-distant history of cryptocurrency. At that time, the collapse of FTX swept through the entire crypto space, triggering a chain reaction that affected hundreds of crypto companies and caused losses for over a hundred investment institutions. It not only dealt a heavy blow to the market but also completely obliterated the mainstream recognition of cryptocurrency, which had just begun to improve. On the other hand, the various outrageous actions of SBF and his team, including fund misappropriation, financial fraud, and lottery-style decision-making, led to extreme anger among users who felt manipulated and toyed with.

Returning to the debt issue, on November 12, 2022, SBF announced on social media that over 130 affiliated companies, including the exchange FTX.com and the related trading company Alameda Research, had voluntarily filed for bankruptcy under Chapter 11 of the U.S. Bankruptcy Code to "orderly assess and liquidate assets from the perspective of global stakeholders." Initially, The Wall Street Journal reported that FTX had a funding gap of about $8 billion. However, as the court hearings progressed, the total amount of debt grew astonishingly, with claims exceeding 36,000 and the total debt amounting to approximately $16 billion.

Since then, creditors and FTX have engaged in a long tug-of-war, with the restructuring "wolf coming" continuously, and FTT becoming a core subject of this narrative.

As early as January 2023, FTX's newly appointed CEO John J. Ray III stated plans to restart the exchange, but at that moment, no one cared due to the collapse of trust. It wasn't until three months later, in April 2023, that Andy Dietderich, a lawyer from FTX's law firm Sullivan Cromwell, stated that FTX was considering reopening its exchange business at some point in the future. As some debts had already been recovered by then, the market began to shift its perspective from a frantic debt collection view to a restructuring plan. Subsequently, more good news for the restructuring emerged; in May, John J. Ray III confirmed the FTX 2.0 plan, and in June, court documents even showed that several companies, including Nasdaq, Ripple, and BlackRock, had acquisition plans for it.

Affected by the news, although the market had temporarily quieted down, confidence in the restructuring plan gradually increased. By November 2023, after SEC Chairman Gary Gensler mentioned that "restarting FTX within the legal framework is possible," the market officially began to price in the restructuring narrative. The directly affected FTT was snatched up in the over-the-counter market, surging by 40% to a peak of $5.54. However, with the disclosure of court documents, the court's confirmation of the utility token's attributes declared FTT's intrinsic value to be zero, shattering the dreams of its holders once again.

Although the dreams of FTT holders were shattered, the compensation for creditors was a certainty. With the continued rise of the crypto market, in February 2024, FTX stated that it had sufficient funds to fully pay all approved claims from customers and creditors. By October 8, a U.S. court judge officially approved FTX's restructuring plan, allowing FTX to make its first repayments to creditors, involving amounts exceeding $14 billion.

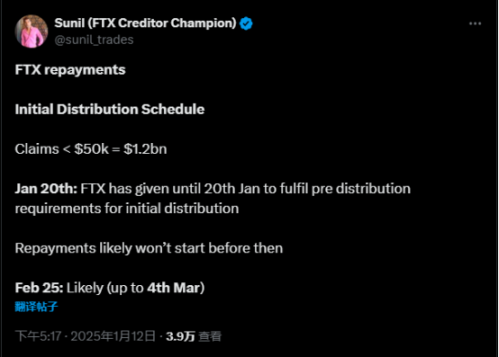

The timeline for the compensation plan was pushed back repeatedly, but finally, on January 3 of this year, the FTX debtor restructuring plan officially took effect. The first batch of debts will begin compensation within 60 days after the effective date of January 3. According to FTX's plan, creditors need to complete tax form submissions and KYC verification by January 20, with the first batch of "convenience class" users receiving repayments first. This includes users with claims of $50,000 or less, which account for about 98% of the total, who are expected to receive a repayment of 119% of their claimed value, with the first batch of compensation estimated at $1.2 billion, while the timeline for remaining payments is still unspecified. BitGo and Kraken will assist FTX in the compensation process, both of which have initiated customer notifications in the compensation process.

FTX has not forgotten to add interest over time on top of the debt, seemingly a win-win situation, but for creditors, it is not a perfect ending. The reason is that FTX mentioned that compensation can only be made in the form of stablecoins and fiat currency, and it specified that the compensation amount is based on the value of the claim submission date, which is concentrated around November 2022. However, at that time, the crypto market was in turmoil, with Bitcoin dropping to $16,000, while now, Bitcoin has risen to $95,000, an increase of over four times, which is clearly far from the so-called 119% "benevolent" repayment.

In response, some creditors have expressed dissatisfaction, especially major creditors. For instance, Sunil Kavuri, the representative of FTX's largest creditor group, stated that FTX should compensate in "physical BTC" rather than cash equivalents. However, it is evident that FTX will not agree, and even if it wanted to, it would be unable to do so; the FTX liquidation team has lamented that when they took over, only 0.1% of BTC remained on the books.

Overall, most creditors are still satisfied with the compensation, as the road to debt recovery is not smooth, and securing funds is key. On the other hand, such a large compensation amount naturally draws the market's attention. How will FTX come up with $16 billion? Where will the funds flow?

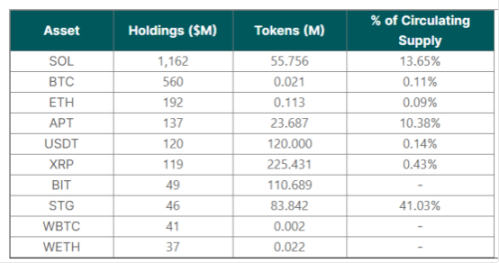

As for how it will come, FTX's wallet is sufficient to explain the issue. As early as the end of August 2023, shareholder reports disclosed FTX's crypto assets, with the top ten cryptocurrencies accounting for 72% of FTX's total crypto holdings, which were valued at approximately $3.2 billion at that time. Among them, SOL had the largest holding, reaching 55 million coins, while BTC held about 21,000 coins, and ETH held 113,000 coins.

Since the restructuring plan began, FTX has been continuously selling coins to repay debts. In early 2024, FTX liquidated all of its 22 million shares of GBTC, including about 20,000 BTC. In October, FTX sold $28 million worth of SOL, and in December, it again released $178,000 worth of SOL from staking.

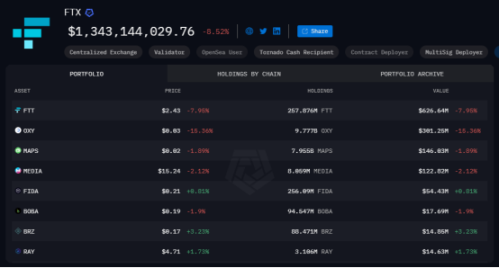

From the current holdings, FTX has completed most of the mainstream coin sales, with total crypto assets amounting to $13.43 billion. There are 20 cryptocurrencies with holdings exceeding $1 million, among which FTT has the most concentrated value, totaling $626 million, followed by OXY with a total of $301 million, and MAPS and Media also holding over $100 million.

The sell-off will undoubtedly impact prices in the short term, especially for cryptocurrencies with low liquidity or those with a higher concentration of FTX holdings; those at the forefront of the holdings are more likely to be widely affected. FTT is the first to bear the brunt; this coin, which has already become a MEME, is unlikely to find a buyer, while OXY, MAPS, MEDIA, FIDA, BOBA, SRM, AMPL, and others will be significantly impacted due to FTX's large holdings.

Currently, FTX's address for compensation is still being prepared, and funds are frequently flowing to exchanges daily, but at this stage, it has not yet caused significant impact on the cryptocurrencies, and the effects seem relatively controllable. The phase of impact is still present, but the market has begun to view the sell pressure from a longer-term perspective.

After the $16 billion compensation is in place, will it flow into the crypto market? Coupled with the special date of January 20 when Trump takes office, some industry insiders optimistically suggest that this move may catalyze the next round of increases in the cryptocurrency market cycle in 2025, allowing Bitcoin to break new highs again.

This statement is not unfounded; the creditors of Mt. Gox serve as a precedent. In a disclosure on July 30, 2024, Mt. Gox completed the distribution of 41.5% of Bitcoin to creditors, with creditors collectively receiving 59,000 Bitcoin. However, Glassnode shows that despite Mt. Gox creditors receiving Bitcoin worth nearly $4 billion, most of the group did not sell but instead became steadfast holders.

Of course, whether the battered creditors will choose to hold depends on individual preferences and cannot be generalized. It is worth noting that due to the prolonged debt recovery process, the vast majority of original creditors will have isolated or sold their debts to debt compensation companies early on to quickly obtain funds. This proportion is not small, and it is expected that this portion of funds is unlikely to flow back.

But regardless, some of the funds from the crypto space will inevitably flow back into crypto, which is still a positive development for the crypto sector that frequently faces liquidity crises.

Returning to the current market, the "garbage time" continues. Rising macro data, uncertainties in external situations, and the U.S. authorities' debt crisis have significantly increased the market's risk-averse sentiment, impacting risk assets. Even recent natural disasters and man-made calamities in the U.S. have once again heightened concerns about liquidity in the market.

On January 7, wildfires ignited in California, a common occurrence every year. However, this year's fires have been particularly devastating due to record summer heat and drought. According to the latest data from California's disaster relief department on the 12th, the wildfires have resulted in 24 deaths and 16 missing persons. The total area burned by four wildfires in the county has exceeded 160 square kilometers, larger than the area of San Francisco. AccuWeather analysts estimate the economic losses to be between $135 billion and $150 billion. Currently, the Biden administration has stated that the U.S. government will cover "100% of all costs" related to the disaster and will request additional financial assistance from Congress.

In the face of this natural disaster, the economic impact is significant. Whether due to the long-term effects of insurance assessments, personal risk aversion, or longer-term concerns about U.S. inflation and debt, the trend of liquidity conservatism will only become more pronounced. More notably, the emotional volatility experienced by risk markets is continuing to expand.

After the incident, California Governor Newsom blamed local governments, while incoming President Trump pointed out that Democratic Governor Newsom and current President Biden should be held responsible for the fire. The opposition and conflict between the two major parties have not slowed even in the face of a unified natural disaster; the shifting of blame and internal strife will only undermine global confidence in the stability of the U.S. financial markets.

As Trump approaches his inauguration, any event can easily trigger the sensitive nerves of the crypto and risk markets. Even if the direct impact is limited, there are still risks and concerns. Just recently, Wall Street's staunch bull, Fundstrat Capital's Chief Investment Officer Tom Lee, expressed a bearish outlook, suggesting that due to the reduction in global liquidity, although the long-term bullish expectation of $250,000 remains unchanged, Bitcoin could significantly retreat from recent highs, potentially testing support levels of $70,000 or even $50,000.

In adversity lies opportunity, and it is precisely at the time of Trump's inauguration that Bitcoin's expected support remains relatively strong. Early this morning, The Washington Post reported that David Sacks and Trump's transition team are closely collaborating with leaders in the crypto industry to develop legislative strategies. Trump is expected to sign an executive order on his first day in office, which may involve "de-banking" and the repeal of controversial crypto accounting policies that require banks to include digital assets they hold on their balance sheets.

As a result, Bitcoin has once again risen above $95,000. As of the time of writing, BTC is reported at $95,452, and ETH is at $3,183.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。