Author: Techub Selected Translation

Written by: arndxt

Translated by: Glendon, Techub News

As 2024 comes to a close and 2025 begins, I reflect on my cryptocurrency journey and draw insights from "OpenGuild Vietnam" and discussions surrounding Ethereum and the Optimism Superchain.

Based on this, I will explore the key technological and strategic developments that will significantly impact the Ethereum and Polkadot ecosystems in 2025.

Cryptocurrency Market Overview

Currently, the entire market is facing regulatory and technological changes, particularly in Vietnam and the intersection of artificial intelligence (AI) and cryptocurrency.

Legalization of Cryptocurrency in Vietnam

The Vietnamese government plans to complete the legal framework for cryptocurrency by May 2024, a move that may herald a new wave of legitimate cryptocurrency businesses.

Clear regulations can reduce uncertainty, attracting more high-quality projects and institutional interest. If designed properly, Vietnam could become a hub for blockchain startups, connecting Southeast Asia's thriving tech ecosystem with the global cryptocurrency market.

Stablecoins and User Adoption

Currently, the usage of stablecoins has significantly increased and shows potential for continued growth. Behind this, the increasingly robust stablecoin infrastructure may drive broader adoption, especially in regions with volatile local currencies.

At the same time, stablecoins serve as one of the most powerful gateway use cases in cryptocurrency. By providing a secure medium of exchange, they facilitate everyday transactions and protect value during local currency fluctuations. Ongoing improvements (such as more efficient on/off-ramp channels) may further integrate stablecoins into the global financial system.

AI Agent Ecosystem

Since the end of 2024, the rise of AI x cryptocurrency solutions has become a focal point for investors and incubators (such as Y Combinator).

The AI agent ecosystem (e.g., fully autonomous trading bots, decentralized AI modules, on-chain AI oracles) is expected to simplify tasks that traditionally require human intervention. However, as these systems mature, they may raise legal and technical issues regarding governance, accountability, and data privacy.

Proof of Personhood

The integration of AI and cryptocurrency naturally raises concerns about identity verification, especially in light of the surge in deepfakes and AI-generated virtual personas. Proof of Personhood, based on decentralized identity solutions, can ensure independent human identity verification.

If AI can simulate human behavior on-chain, robust identity verification mechanisms will become even more critical. Therefore, proof of personhood mechanisms may become the standard for social applications, decentralized autonomous organization (DAO) memberships, or token airdrops. More innovations in cryptographic methods (such as zero-knowledge proofs) are expected to emerge to protect user privacy while verifying authenticity.

Ethereum Ecosystem

The evolution of Ethereum in 2025 will focus on chain abstraction and protocol-level upgrades to enhance network efficiency, L2 throughput, and user experience.

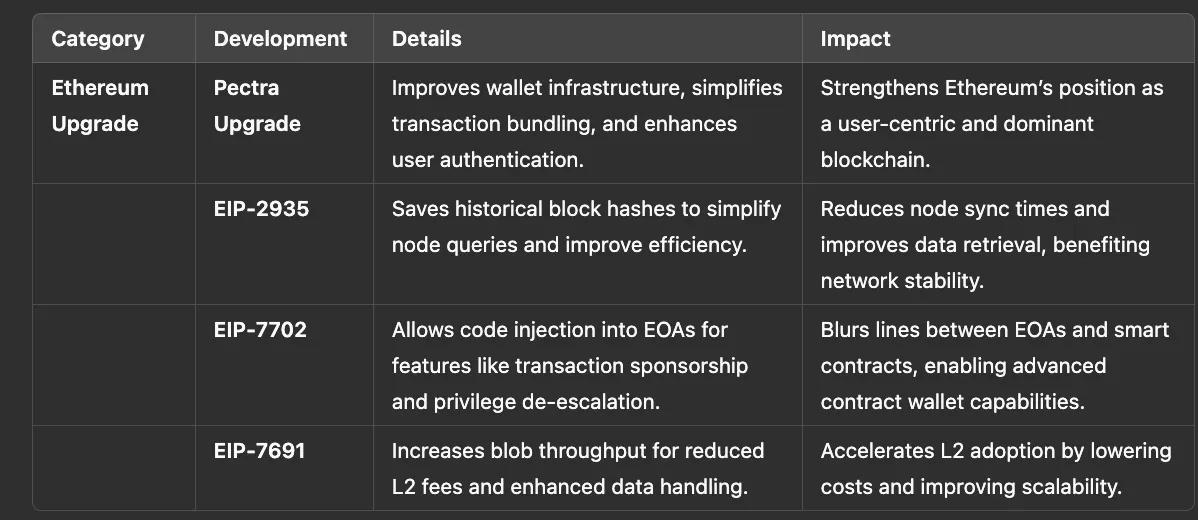

Pectra Upgrade

The Pectra upgrade for Ethereum is undoubtedly a milestone event, focusing on improving wallet infrastructure and addressing broader ecosystem challenges. As chain abstraction becomes a key priority for various blockchain platforms, the successful implementation of the Pectra upgrade could redefine how users interact with Ethereum.

In my view, the Ethereum mainnet is at a crossroads. The rise of powerful L2s like Optimism, Arbitrum, and zkSync has intensified the pressure to maintain Ethereum's status as the "gold standard." Pectra has the potential to bridge critical gaps by addressing pain points such as high gas fees, transaction bundling, and user verification, thereby simplifying the wallet experience. If effectively implemented, it could significantly enhance user engagement while solidifying Ethereum's dominance in an increasingly competitive ecosystem. For me, this represents Ethereum's doubled efforts in user-centric innovation, ensuring its position within the blockchain hierarchy.

Key EIPs to Watch in 2025

Important Ethereum Improvement Proposals (EIPs) for 2025 include EIP-2935, EIP-7702, and EIP-7691.

- EIP-2935: Storing Historical Block Hashes in State

Storing block hashes over a definable period can simplify node verification queries, improving efficiency and reducing overhead.

Analysis: This is a "network pipeline" improvement that, while not flashy, is significant for node operators. Improved data retrieval can also help reduce chain reorganization and node synchronization times.

- EIP-7702: Setting EOA Account Code for Single Transactions

This proposal expands the functionality of externally owned accounts (EOAs) by allowing the injection of code through specialized transaction types, unlocking features such as batch processing, sponsorship (paying gas fees for others), and permission downgrading (lowering permissions without changing the address).

Analysis: This proposal may blur the lines between EOAs and smart contracts, driving the development of more complex contract wallets (e.g., ERC-4337-based solutions). If widely adopted, it could catalyze user-friendly features such as transaction sponsorship or advanced multi-signature solutions.

EIP-7691: Increasing Blob Throughput

This EIP builds on EIP-4844 (Proto-Danksharding), which introduced "Blobs" to reduce L2 costs, by increasing the number of Blobs per block, further lowering L2 costs and increasing throughput.

Analysis: The synergy between L1 and L2 scaling is crucial for Ethereum. By expanding Blob capacity, Ethereum reaffirms its commitment to maintaining an affordable L2 environment. If L2 can handle more data without incurring high costs, user adoption of second-layer solutions may accelerate.

Polkadot Ecosystem

To date, Polkadot remains a hotbed for cross-chain experimentation. Some significant developments in 2025 aim to solidify Polkadot's position as an infrastructure for interoperability and high-throughput decentralized applications.

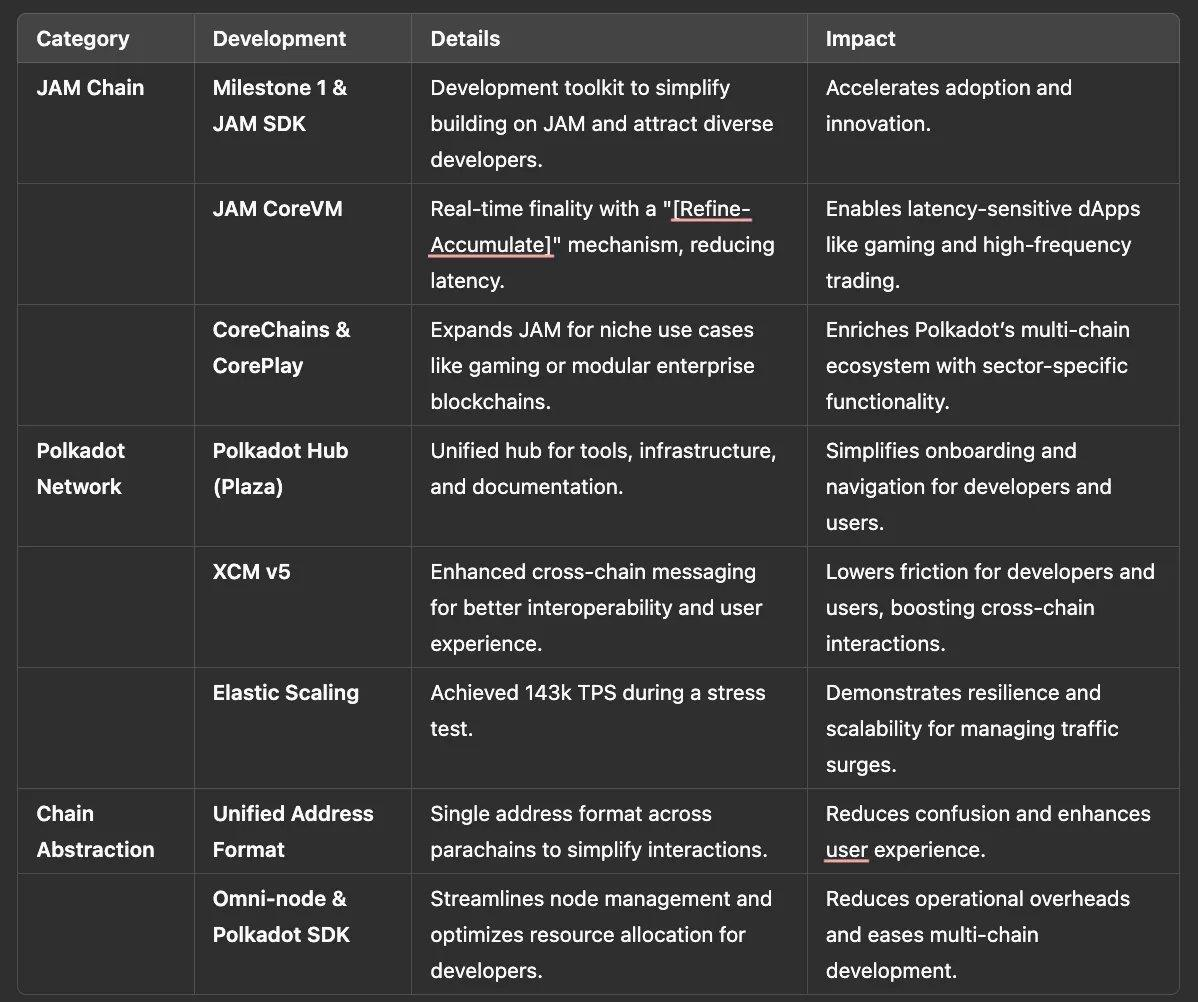

JAM Chain and Its Innovations

JAM Chain, a next-generation blockchain protocol within the Polkadot ecosystem, is currently attracting widespread attention. If successful, JAM could showcase Polkadot's commitment to plug-and-play multi-chain architecture.

Milestone 1 and JAM SDK

A significant milestone for the JAM team is the completion of "JAM Milestone 1," which includes the launch of a development toolkit called JAM SDK. This toolkit can simplify application building on JAM, potentially attracting a broader range of developers (from traditional backend engineers to specialized blockchain developers).

JAM CoreVM

The introduction of JAM CoreVM may redefine how real-time transactions and application executions are processed. By replacing traditional block finalization methods with a "Refine-Accumulate" mechanism, JAM CoreVM will provide near real-time finality.

This approach can significantly reduce latency, a long-standing challenge for blockchains in pursuing fast confirmations without sacrificing security. If executed well, it could encourage more latency-sensitive DApps (such as high-frequency trading, real-time gaming, or event-driven DeFi) to migrate to or launch on Polkadot's parachains powered by JAM.

CoreChains and CorePlay

After completing the virtual machine layer, the JAM team plans to expand functionality through CoreChains and CorePlay. Although specific details currently disclosed are limited, these solutions seem to extend the application boundaries of the JAM architecture, particularly for gaming ecosystems or specific niche scenarios critical to enterprise-level blockchain modular design.

Polkadot's core vision revolves around specialized parachain construction. JAM's approach to building CoreChains indicates a potential trend toward industry-specific functionalities. If these specialized parachains each address unique challenges (such as compliance, gaming, or data management), they will greatly enrich Polkadot's value proposition as a multi-chain network.

Comprehensive Improvements to the Polkadot Network

In addition to JAM's initiatives, Polkadot itself will undergo significant upgrades to reflect the lessons learned from network stress tests and community feedback over the past year.

Polkadot Hub (Plaza)

The completion of Polkadot Hub (Plaza) focuses on integrating ecosystem tools, infrastructure, and documentation.

Analysis: As the ecosystem expands, a unified center makes sense for both newcomers and seasoned developers. Centralizing resources can significantly reduce complexity, which is an important step for Polkadot in attracting more developers and end-users amid fierce competition with other L1s and L2s.

XCM v5

Cross-Chain Messaging (XCM) is key to Polkadot's interoperability vision. XCM v5 will improve and upgrade cross-chain messaging, enhancing interoperability and enabling more efficient, secure cross-chain communication and better user experiences.

Analysis: Cross-chain operability remains the holy grail in the cryptocurrency space. While existing solutions (such as Wormhole and LayerZero) help connect ecosystems, XCM serves as Polkadot's dedicated tool. Making XCM more efficient and secure could make cross-parachain operations more "native," potentially reducing friction between users and developers.

Resilient Scaling

After a severe spam attack on Kusama in December 2024, Polkadot's Elastic Scaling mechanism demonstrated its adaptability under high load, capable of handling 143k TPS.

Analysis: For a chain, having the ability to effectively respond to sudden spikes in traffic is crucial. Successfully fending off spam attacks can enhance its marketing effectiveness, showcasing the chain's resilience and reliability. However, a more severe test lies in managing the sharp increase in legitimate traffic, especially as Polkadot-based DApps gain widespread attention and usage.

Chain Abstraction and Omni-Network Development

Polkadot's overall strategy increasingly focuses on enhancing developer and user friendliness while ensuring that the underlying technical complexities remain hidden behind the scenes.

Unified Address Format

Polkadot aims to eliminate the confusion caused by multiple wallet standards by introducing a single address format for parachains.

While simplifying addresses is no easy task, this move is a key step in reducing cross-chain interaction barriers and improving user experience. It is similar to Apple's iOS ecosystem, which enhances consistency across multiple applications and services through a unified user experience.

Omni-node and Polkadot SDK

Maintaining up-to-date node software for dozens of parachains requires significant resources. Omni-node aims to simplify this process by optimizing resource allocation.

From a developer's perspective, initiatives that reduce operational overhead are undoubtedly welcome. However, the complexity of Polkadot's multi-chain approach may require ongoing improvements in developer tools, so in addition to Omni-node, other tools' iterative enhancements can also be expected.

Final Thoughts

As mentioned earlier, Ethereum will continue to iterate through the Pectra upgrade and improvement proposals (EIPs), solidifying its L1 status as a reliable settlement layer for a thriving L2 ecosystem. Polkadot, on the other hand, will optimize cross-chain usage and scaling through innovations like JAM Chain, Omni-node, and improved XCM.

Moreover, broader market trends, including regulatory initiatives in Vietnam, improvements in stablecoins, and AI-driven crypto agent systems, all highlight the rapidly evolving landscape of the cryptocurrency space. So, what will the cryptocurrency sector look like in 2025? Let's wait and see!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。