The primary market for crypto assets and the secondary market for funds in Hong Kong have not yet fully welcomed the dawn of a new era, and there is an urgent need for further promotion and resolution.

Written by: Bai Lu, Bo Wen

On December 17, 2024, BTC reached an all-time high of $108,365, doubling from less than $50,000 at the beginning of the year, leading the virtual asset sector and establishing a firm foothold on the world stage.

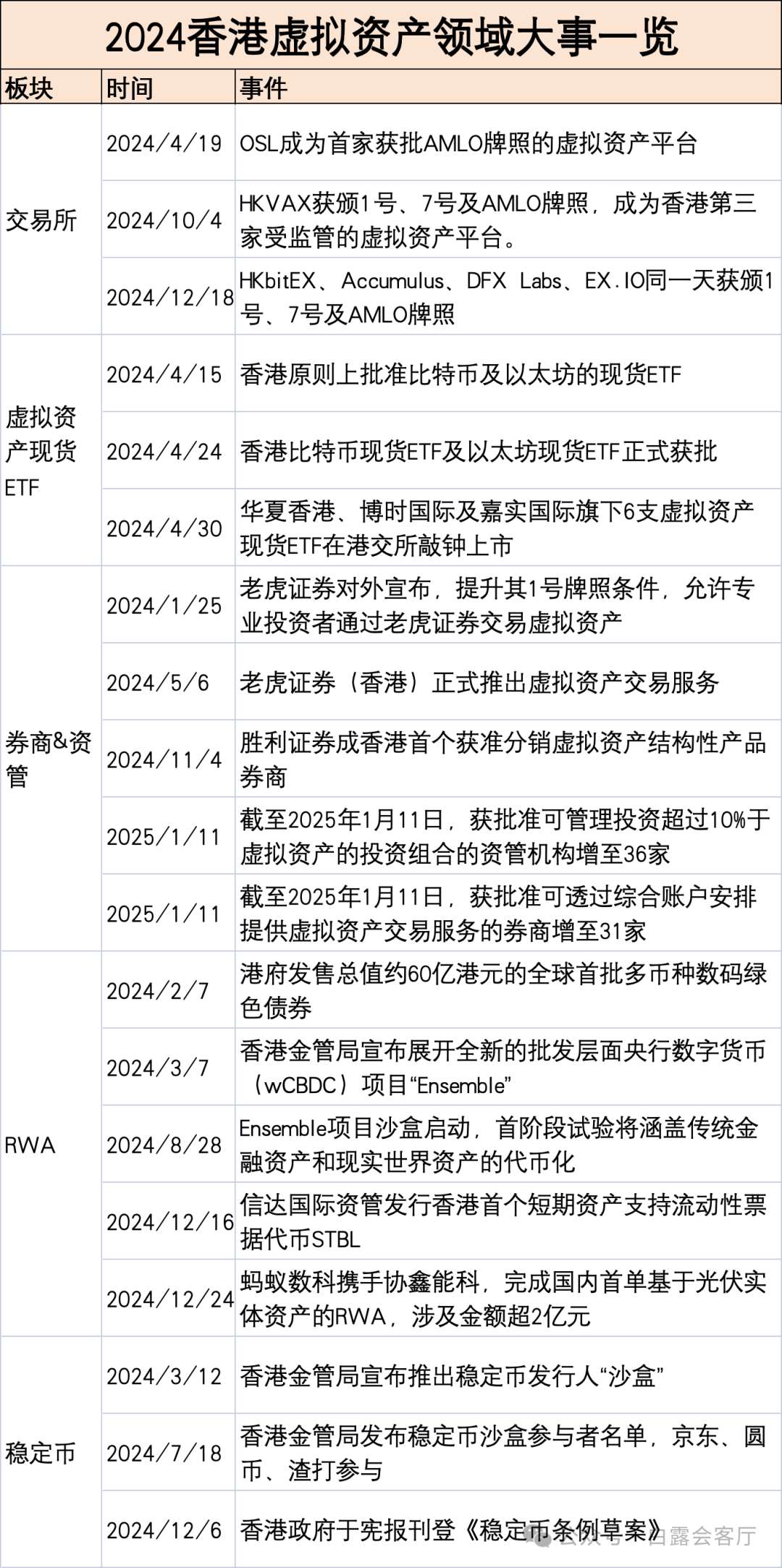

In the past year, Hong Kong has made ample preparations for the integration of "old money"; various sub-sectors have delivered their results.

7 virtual asset trading platforms have been approved for Type 1, Type 7 licenses, and AMLO licenses;

6 virtual asset spot ETFs have been listed on the Hong Kong Stock Exchange;

31 brokerages have upgraded to virtual asset Type 1 licenses;

36 asset management firms have upgraded to virtual asset Type 9 licenses;

In the highly anticipated RWA sector, the Hong Kong government issued over 6 billion in multi-currency digital green bonds, the Monetary Authority's Ensemble sandbox, stablecoin sandbox, and Ant Group's collaboration with Xinyi Energy on over 200 million in photovoltaic physical asset RWA, among others.

However, it cannot be denied that the primary market for crypto assets and the secondary market for funds in Hong Kong have not yet fully welcomed the dawn of a new era, and there is an urgent need for acceleration and resolution. In terms of the primary market for crypto assets, Hong Kong's virtual asset trading platforms have very strict screening for crypto assets. While the high threshold ensures market compliance and stability, it also sets significant barriers for the entry of emerging assets. In terms of the secondary market for funds, mainland China has not yet opened up due to policy restrictions, and the secondary market for funds can only target local and overseas users in Hong Kong; meanwhile, overseas market user resources have long been occupied by platforms like Binance, OKX, and Coinbase, making it difficult to shift.

How to find a balance between ensuring market safety and promoting innovation in quality projects and assets to attract "old money" that has yet to enter? This is the core question for the Hong Kong market in 2025.

This issue of Bai Lu's Salon leads readers to comprehensively review the development of Hong Kong's virtual asset market in 2024, exploring new opportunities for 2025 from the trends.

7 Virtual Asset Trading Platforms

As of January 11, 2025, Hong Kong has 7 virtual asset trading platforms that have received formal approval from the Hong Kong Securities and Futures Commission (SFC) to conduct virtual asset business in compliance with local regulations.

The 7 licensed virtual asset trading platforms

OSL and Hashkey Continue to Lead

On April 19, 2024, OSL Group (00863) announced that its wholly-owned subsidiary, OSL Digital Securities Limited, which holds a license issued by the Hong Kong SFC, became the first virtual asset platform approved for a license based on the Anti-Money Laundering and Counter-Terrorist Financing Ordinance (AMLO). In May, Hashkey Exchange followed closely, also becoming one of the first fully licensed virtual asset service providers in Hong Kong. Both companies continue to maintain an advantage on the compliance front.

From a business perspective, Hashkey Exchange launched an institutional-grade comprehensive service, HashKey Pro, integrating virtual asset trading capabilities for institutions such as ZhongAn Bank and Victory Securities, with a cumulative trading volume exceeding 5 billion HKD. As of November 2024, Hashkey Exchange's asset management scale exceeded 10 billion HKD, with a cumulative trading volume reaching 580 billion HKD. OSL has a broad layout in virtual asset spot ETFs and RWAs.

HKVAX Rises Later

On October 4, 2024, the Hong Kong SFC announced that the Hong Kong Virtual Asset Exchange (HKVAX) received formal approval from the SFC, issuing Type 1 (securities trading) and Type 7 (providing automated trading services) licenses, as well as a license for "operating a virtual asset trading platform" under the AMLO. HKVAX became the third regulated virtual asset platform in Hong Kong.

For more information, refer to: HKVAX Officially Licensed, Becomes Hong Kong's Third Licensed Virtual Asset Trading Platform

From left to right: Su Shuhui, Chairman of the International Clean Energy Forum (Macau), Carlos Costa Pina, Chairman of Fórum Oceano, Mauricio Marques, Founder and CEO of Yacooba Labs, and Wu Weiliang, Co-founder and CEO of HKVAX

HKVAX focuses on security token offerings (STOs) and the tokenization of physical assets (RWAs). On October 18, 2024, HKVAX signed a memorandum of understanding with Fórum Oceano and Yacooba Labs for a blue economy security token project, collaborating on high-quality security token projects related to the European blue economy, covering tokenization, distribution, listing, trading, and token custody. On November 29, 2024, HKVAX established a strategic partnership with Alibaba Cloud, focusing on technology infrastructure, security framework construction, and services related to STOs and RWAs. Whether HKVAX, centered on RWAs, can successfully find its business niche will continue to attract market attention.

4 Institutions Approved Simultaneously in December

According to the SFC's official website, on December 18, 2024, HKbitEX, Accumulus, DFX Labs, and EX.IO were approved by the Hong Kong SFC on the same day, receiving Type 1 (securities trading) and Type 7 (providing automated trading services) licenses, as well as a license for "operating a virtual asset trading platform" under the AMLO.

HKbitEX is launched by Hong Kong Digital Asset Trading Group Limited, with its parent company being Taiji Capital Group, which includes services in capital markets and wealth management, digital asset exchanges, and Web3 SaaS and technology development. Taiji Capital's founder, Gao Han, previously worked at the Hong Kong Stock Exchange, primarily responsible for promoting the exchange's products in mainland China, including Stock Connect and Bond Connect.

Accumulus is backed by a Chinese Fortune 500 company and launched by Cloud Account Greater Bay Area Technology (Hong Kong) Limited. Cloud Account Hong Kong is registered by Cloud Account and is the only overseas business headquarters, with the group obtaining a direct investment quota of 985 million RMB approved by the National Development and Reform Commission and others in mainland China. According to official information, Cloud Account is China's largest online human resources service enterprise, having served 110 million new employment form workers (freelancers) from 138 countries and regions, and was selected as one of the "2024 China Top 500 Enterprises" with a revenue of 108.4 billion this year.

DFX Labs is the last applicant for a Hong Kong virtual asset trading platform last year, launched by DFX Labs Company Limited. The DFX Labs team has rich experience in blockchain and fintech, with Chief Operating Officer Simon Au Yeung having previously served as CEO of Blockchain Finance and virtual asset trading platform BGE, as well as co-chair of IEEE Hong Kong; Chief Technology Officer David H. has worked at well-known institutions such as Morgan Stanley, Dell Technologies, and HashKey Group.

EX.IO is launched by Thousand Whales Technology (BVI) Limited. The main investors of EX.IO include Huasheng Capital Group, a subsidiary of Sina, as well as Longling Capital, Weixin Jinke Investment, and others. EX.IO was originally named xWhale and was established after a strategic agreement between the original Web3 trading platform BusyWhale and Huasheng Securities in May last year.

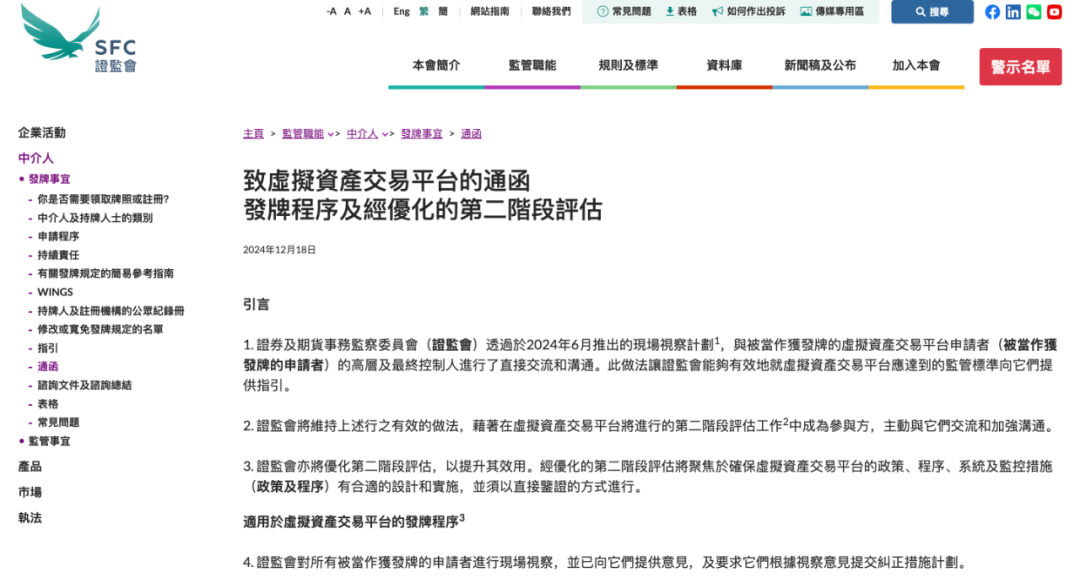

Regarding the "Licensing Procedures and Optimized Second Phase Assessment" SFC Circular

On December 18, 2024, the Hong Kong SFC issued a circular titled "To Virtual Asset Trading Platforms - Licensing Procedures and Optimized Second Phase Assessment," providing a clear roadmap for the 11 institutions still waiting for license applications; at the beginning of 2025, the SFC will establish a formal advisory group for all licensed platforms, with each licensed institution appointing senior personnel as representatives to facilitate the SFC's full consideration of institutional views and systematically prioritize development matters based on investor protection. In the new year, more excellent teams are expected to join the ranks of virtual asset trading platforms, driving the market to continue to grow.

11 virtual asset trading platform applicants still waiting for licensing

Virtual Asset Spot ETFs

The listing of the Bitcoin spot ETF in the United States took nearly 10 years; in contrast, the rapid listing of virtual asset spot ETFs in Hong Kong has become a significant highlight of Hong Kong's determination.

On April 15, 2024, Hong Kong approved the spot ETFs for Bitcoin and Ethereum in principle; on April 24, the Hong Kong Bitcoin spot ETF and Ethereum spot ETF were officially approved; on April 30, six virtual asset spot ETFs under Huaxia Hong Kong, Bosera International, and Harvest International were listed on the Hong Kong Stock Exchange and opened for trading.

For an overview of the participants, refer to: Expected to be approved as early as next Monday! A look at the strengths of the 7 Hong Kong Bitcoin spot ETF players

Unlike the United States, Hong Kong's virtual asset spot ETFs support physical subscriptions and redemptions, allowing investors to redeem ETF shares by delivering physical virtual assets, rather than just trading through cash. Physical redemption means that the underlying assets do not have to be sold immediately, bringing advantages in terms of cost and liquidity. Once the physical subscription and redemption process is completed, investors will be able to directly obtain virtual assets such as Bitcoin and Ethereum corresponding to the spot ETF fund, providing more diversified investment options.

As of January 11, SoSoValue statistics on Hong Kong Bitcoin spot ETF and Ethereum spot ETF data

On the first trading day, the fundraising scale of Hong Kong's spot virtual asset ETFs was approximately 2 billion HKD, with a calculated net asset value of 293 million USD. The total trading volume of the six ETFs on the first day was approximately 87.58 million HKD (about 12.7 million USD).

As of January 7, 2025, according to data from the Hong Kong Stock Exchange, the total trading volume of the three Bitcoin spot ETFs in Hong Kong reached 5.257 billion HKD in 2024; in terms of market share, the 129 billion USD Bitcoin ETF asset management scale in the U.S. accounts for 1.2% of its ETF market, while the same figure for Hong Kong is 0.66%, showing no significant difference in scale. Since their listing, Hong Kong's Bitcoin spot ETFs have seen a net inflow of approximately 380 BTC, with total asset management scale increasing by about 66%.

In 2025, under the influence of a world pattern dominated by the United States, the impact of Hong Kong's virtual asset ETFs on the local financial market will become increasingly significant. Tools like ETFs have the potential to encourage more traditional institutions to truly embrace virtual assets; when "old money" floods in, the liquidity of Hong Kong's virtual asset market can undergo a qualitative change.

Brokerages and Asset Management Firms Pouring In

The launch of ETFs only represents the completeness of the tools; the enthusiasm of brokerages and asset management firms to enter the market reflects the trend of "old money embracing" in Hong Kong.

Tiger Brokers Makes a High-profile Entry

On May 6, 2024, according to Yahoo Finance, Tiger Brokers (Hong Kong) officially launched virtual asset trading services; professional investors in Hong Kong can trade 18 types of virtual assets through the Tiger Trade investment platform.

On January 25, 2024, Tiger Brokers announced that it had obtained approval from the Hong Kong SFC to upgrade its Type 1 license, allowing professional investors to trade virtual assets on the SFC licensed platform.

On March 28, 2024, Tiger Brokers (Hong Kong) received approval from the Hong Kong SFC to provide asset management services under the Type 9 license, enabling it to offer a range of asset management services, including dedicated account services for retail and professional investors, as well as managing collective investment schemes for professional investors.

On May 6, 2024, Tiger Brokers (Hong Kong) officially launched virtual asset trading services, becoming one of the first technology brokerages in Hong Kong to support one-stop trading management of traditional securities and virtual assets. At the launch, the trading commission for virtual assets was as low as 0.2% of the transaction amount, and custody fees were waived, demonstrating Tiger Brokers' strong execution in securing a foothold in the virtual asset market.

For more details, refer to: Tiger Brokers Launches Virtual Asset Trading Services in Hong Kong, Officially Entering Web3

Victory Securities Maintains First-Mover Advantage

Local Hong Kong brokerage Victory Securities is a pioneer in the virtual asset field; thanks to its comprehensive compliance licenses, Victory Securities has consistently maintained a leading position in its business.

On April 23, 2024, Victory Securities announced that it was the only participating brokerage among the first Bitcoin and Ethereum spot ETFs in Hong Kong to accept physical subscriptions; on October 15, 2024, Victory Securities announced that it had successfully passed the relevant regulatory inquiry procedures on October 10, 2024, allowing it to initiate and manage the Victory VSG multi-strategy fund, as well as the first Web3 multi-strategy compliant fund initiated by a Hong Kong SFC licensed virtual asset investment organizer company, which accepts investments from investors in stablecoins; on November 4, 2024, Victory Securities announced that it had received permission from the SFC to sell cash-settled virtual asset structured products to qualified professional investors, once again becoming the first licensed brokerage in Hong Kong to obtain approval for this business.

Regardless of how high Victory Securities ultimately reaches in the virtual asset field, they have already proven through their own experience that the compliance route is always a race against time; the earlier one embraces regulation, the more opportunities there are to seize the market.

31 Brokerages and 36 Asset Management Firms Are Also Ready

Tiger Brokers and Victory Securities represent a type of brokerage that remains active in the market and attracts significant attention; in fact, a large number of traditional and emerging institutions have already been granted virtual asset-related licenses and are ready to make their mark.

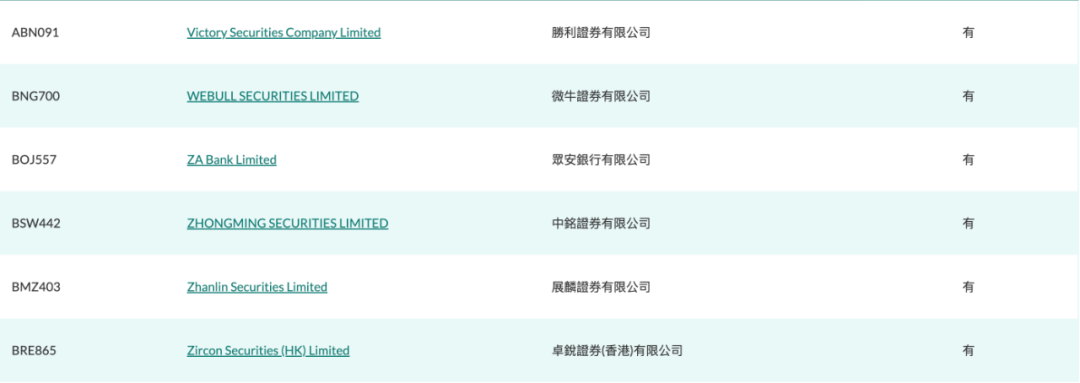

In terms of the number of brokerages, as of January 11, 2025, 31 brokerages have been approved to complete the upgrade to virtual asset Type 1 licenses, allowing them to provide virtual asset trading services through comprehensive account arrangements.

Based on the Hong Kong SFC's official website, 31 brokerages have been approved to provide virtual asset trading services through comprehensive account arrangements

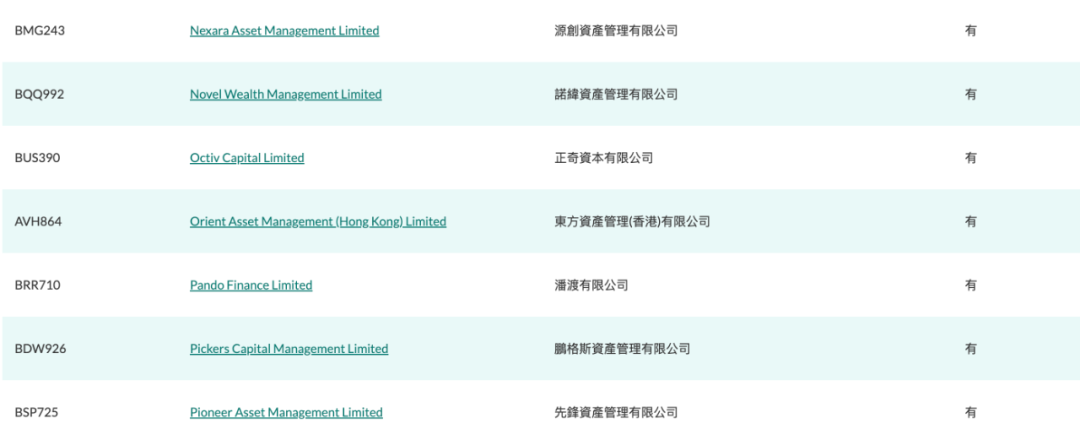

In terms of the number of asset management firms, only 11 asset management institutions were approved to upgrade to virtual asset Type 9 licenses at the beginning of 2024, allowing them to manage portfolios with over 10% invested in virtual assets; as of January 11, 2025, the number of asset management institutions with the same compliance qualifications has increased to 36.

Based on the Hong Kong SFC's official website, 36 asset management institutions have been approved to manage portfolios with over 10% invested in virtual assets

With the rollout of virtual asset licenses, financial institutions in Hong Kong are preparing for the rapid development of RWAs in 2025. From brokerages to asset management firms, both traditional and emerging institutions have established a dual foundation of compliance and technology; on this basis, the entry points for more "old money" have been fully opened. Hong Kong's financial ecosystem is ready to sprint in this wave.

RWA, The Next Development Focus

Breaking the barrier between the virtual world and the real world, allowing assets and funds to flow freely between the two systems, is a global trend and also a key focus for Hong Kong's next stage of development.

RWA is important because, on one hand, it leverages blockchain technology to enhance transparency and security, addressing issues present in the traditional financial system; on the other hand, if the market buys in, it can fundamentally activate more physical assets, attracting a broader range of small and medium investors into the market, thereby injecting more liquidity into the real industry and digital economy.

Hong Kong Government Takes the Lead, Issues Second Batch of Digital Green Bonds

On February 7, 2024, the Government of the Hong Kong Special Administrative Region of the People's Republic of China announced the successful issuance of digital green bonds valued at approximately 6 billion HKD, denominated in HKD, RMB, USD, and EUR, making it one of the world's first multi-currency digital bonds.

In 2021, the Hong Kong Monetary Authority (HKMA) and the Bank for International Settlements Innovation Hub Hong Kong Centre completed Project Genesis, testing the issuance of tokenized green bonds in Hong Kong. This issuance is a further development based on the project, and according to official news from the HKMA, new breakthroughs have been achieved in four areas: expanding investor participation, streamlining the issuance process, introducing standardized elements, and integrating disclosures into digital asset platforms.

As one of the world's first multi-currency digital bonds, the settlement and delivery of this batch of digital green bonds used the CMU system, with HSBC Orion serving as the digital asset platform. HSBC, Bank of China (Hong Kong), Amundi, Goldman Sachs, Industrial and Commercial Bank of China (Asia), UBS, Allen & Overy, Ashurst, and NTD Law Firm all participated in the preparation for the issuance.

HKMA Ensemble Sandbox to Promote Tokenization Applications

On March 7, 2024, the HKMA announced the launch of a new wholesale central bank digital currency (wCBDC) project called "Ensemble." The HKMA stated that the project will initially focus on tokenized deposits, which are digital forms of commercial bank deposits issued and provided to the public by commercial banks.

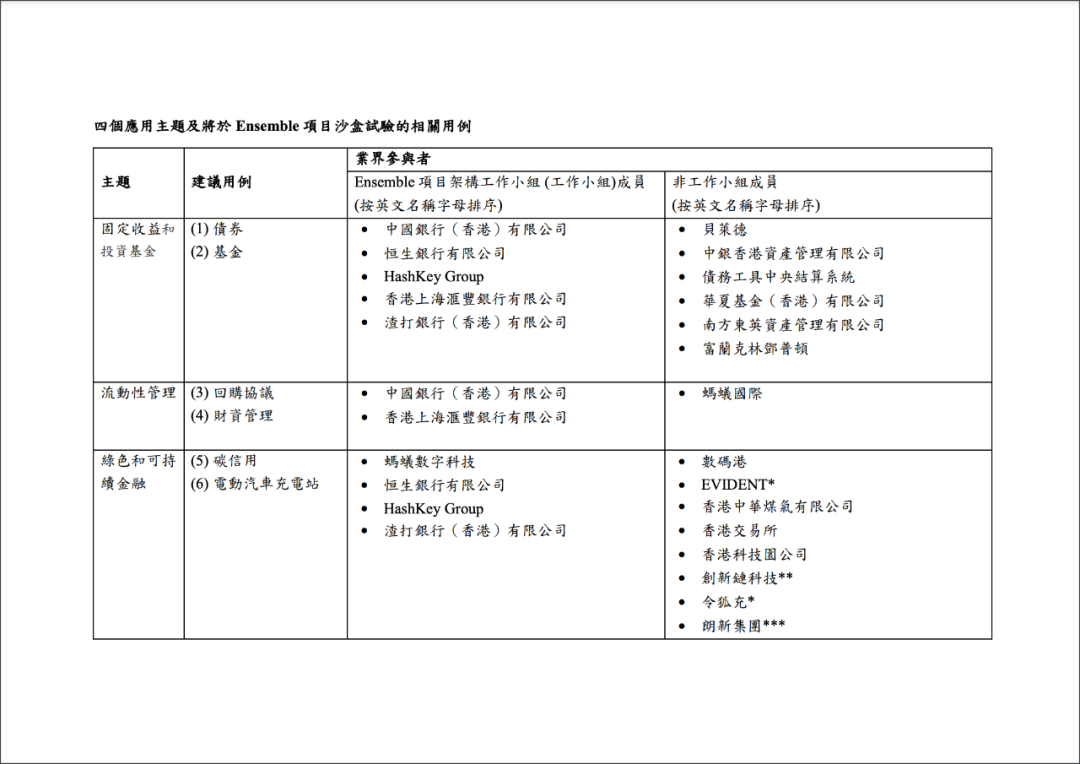

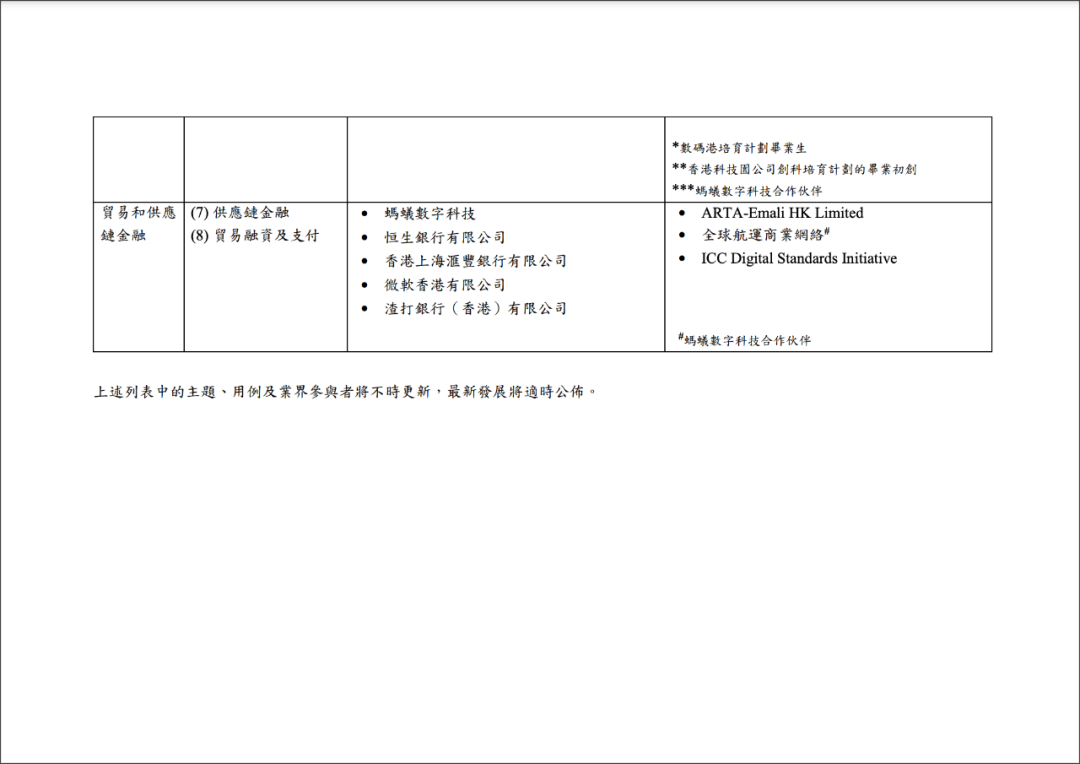

On August 28, 2024, the HKMA held a launch ceremony for the Ensemble project sandbox, announcing that the first phase of the sandbox trials would cover the tokenization of traditional financial assets and real-world assets, focusing on four major themes: fixed income and investment funds, liquidity management, green and sustainable finance, and trade and supply chain financing. Through the trials, the HKMA will verify the technical interoperability between tokenized assets, tokenized deposits, and wCBDC, and allow industry participants to conduct end-to-end testing of tokenized asset transactions in real business scenarios.

HKMA Chief Executive Eddie Yue delivers an opening speech at the Ensemble project sandbox launch ceremony

According to official news from the HKMA, the Ensemble project working group includes well-known financial and technology companies such as Bank of China (Hong Kong), Hang Seng Bank, Hashkey Group, HSBC, Standard Chartered Bank, Ant Digital Technology, and Microsoft (Hong Kong). At the international level, the HKMA will explore cooperation opportunities with the Bank for International Settlements Innovation Hub Hong Kong Centre on one or more tokenization themes and collaborate with members of the CBDC expert group to promote the development of the sandbox.

Stablecoin Sandbox and Stablecoin Bill

Stablecoins, as the cornerstone of RWA, are also the focus of development. As early as January 2022, the HKMA published a discussion paper on extending the Hong Kong regulatory framework to stablecoins, inviting industry stakeholders to discuss and clarifying the preliminary direction of the regulatory framework. In January 2023, the HKMA released a consultation summary on crypto assets and stablecoins, outlining the expected regulatory scope and key regulatory requirements.

In March 2024, the HKMA announced the launch of a stablecoin issuer "sandbox," allowing testing of stablecoin issuance within the regulatory sandbox. On July 18, 2024, the HKMA released the list of stablecoin sandbox participants: JD.com, Yuan Coin, and Standard Chartered became official participants, with proposed main application scenarios including payments, supply chain management, and capital market use cases, as well as secondary scenarios such as Web3, gaming, and virtual asset trading.

The HKMA stated that currently, fund transfers in these scenarios may involve financial institutions, payment service companies, settlement systems, etc., across different time zones. These "intermediaries" or financial infrastructures do not operate 24/7, and they often incur high costs and exhibit low efficiency. Stablecoins can not only serve as a medium of exchange, reducing costs and transaction times but also leverage their programmable features to develop various innovative solutions, automating and smartening financial service processes, facilitating fund flows, and managing various transaction-related risks more precisely.

For more details, refer to: JD.com, Yuan Coin, and Standard Chartered Join the Hong Kong Stablecoin "Sandbox" – Who Will Prevail?

On December 6, 2024, the Hong Kong government published the "Stablecoin Bill" in the Gazette, aiming to improve the regulatory framework for virtual asset activities to address potential risks posed by fiat-backed stablecoins and ensure transparency and consumer protection.

The "Stablecoin Bill" proposes strict licensing and compliance requirements. While it helps stabilize the system, it may also exclude smaller or emerging market participants. Whether startups will face difficulties due to high auditing costs, strict governance requirements, and capital adequacy requirements is a balance that the Hong Kong government must carefully weigh between innovation and safety in the future.

First Domestic RWA Based on Photovoltaic Physical Assets Exceeding 200 Million Yuan

On December 23, 2024, China Fund News reported that Ant Digital Technology, in collaboration with green energy service provider GCL-Poly Energy Holdings, successfully completed the first domestic RWA based on photovoltaic physical assets, involving an amount exceeding 200 million yuan. Hong Kong's Victory Securities also participated in this project.

Ant Digital Technology, a division of Ant Group focused on technology commercialization, began independent operations in April 2024. To date, Ant Digital Technology has served over 10,000 enterprise clients in collaboration with more than 300 partners. GCL-Poly Energy Holdings is a subsidiary of GCL Group, primarily engaged in digital energy and clean energy businesses. Currently, the company has 225 energy experts, 192 software copyrights, and 324 patents, and participates in three national key R&D program projects.

GCL-Poly Energy will use approximately 82MW of "Xinyangguang" household photovoltaic systems located in Hubei and Hunan provinces as the RWA anchor assets. By integrating blockchain technology and IoT (Internet of Things) technology, the intrinsic value, operation, revenue, and other data of the household photovoltaic projects will be packaged and stored on the blockchain to form digital tokens. On the day of issuance completion, Ant Digital Technology and GCL-Poly Energy signed a strategic cooperation agreement in Suzhou. The two parties will comprehensively cooperate in areas such as distributed photovoltaic power stations, energy storage power stations, and integrated energy services, continuing to explore integration paths for digital industrialization and industrial digitalization.

For more details, refer to: Ant Digital Technology and GCL-Poly Energy Complete RWA Issuance Exceeding 200 Million Yuan Based on Photovoltaic Physical Assets

Hong Kong's First Short-Term Asset-Backed Liquidity Note Token STBL

Various institutions in Hong Kong have also begun their RWA attempts. On December 16, 2024, Cinda International Asset Management Limited (hereinafter referred to as "Cinda International Asset Management") announced the successful issuance of the short-term asset-backed liquidity note token STBL on the Ethereum blockchain, becoming the first case of a transferable tokenized packaged restructured note arranged by a financial institution in Hong Kong.

Cinda International Asset Management will act as the manager of STBL, with NVT providing blockchain operation services as the blockchain agent for STBL and offering technical support solutions for STBL's issuance on the blockchain. GF Securities (Hong Kong) Brokerage Limited and HashKey Exchange serve as the first distributors of STBL.

Through note tokenization, the issuance and transfer of STBL do not rely on third-party intermediaries such as clearing houses; both issuance and transfer are automatically recorded in real-time on the blockchain, allowing anyone to view and verify the transfer records on the blockchain, thereby enhancing transparency. Each STBL has a par value of 1 USD and maintains a stable value, automatically distributing daily accumulated interest to professional investors' wallets in the form of newly issued tokens on each monthly dividend day. The STBL manager (Cinda International Asset Management) will publish the average daily yield and underlying MMFs of its related assets from the previous week on a public website weekly.

At the same time, Cinda International Asset Management and HashKey Group are also exploring the possibility of further cooperation, intending to expand the issuance of STBL to the Ethereum Layer 2 network HashKey Chain, continuing to broaden STBL's investor base.

Looking Ahead to 2025

Reflecting on 2024, Hong Kong has laid a more solid foundation in the virtual asset field. From virtual asset trading platforms to spot ETFs, and the vigorous rise of RWAs, the potential for compliance and innovation is continuously being demonstrated in Hong Kong's financial market.

Looking ahead to 2025, with "old money" gradually accepting the market, Hong Kong is expected to accelerate the deep integration of virtual assets and traditional finance. Especially with the development of stablecoins and RWAs, as long as Hong Kong finds the right balance between ensuring safety and promoting innovation, it will undoubtedly usher in its golden moment in the global virtual asset market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。