Short Selling for Eternal Profit.

Written by: Shaofaye123, Foresight News

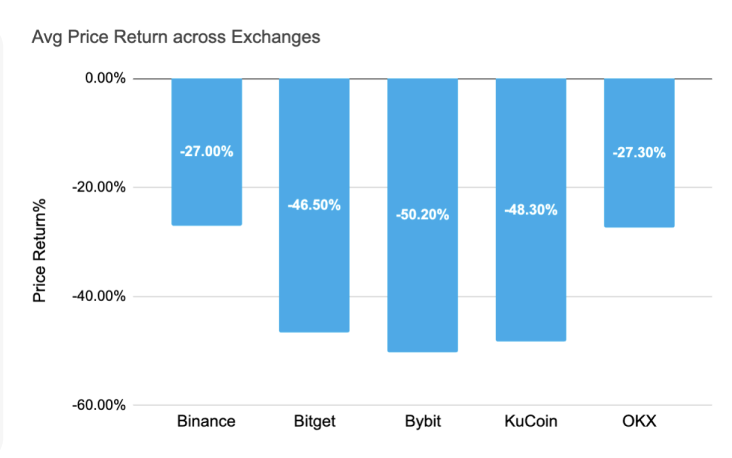

The performance of centralized exchanges in 2024 has been disappointing, mocked as the exit liquidity on-chain. According to a research report released by Animoca Digital Research, the average return rate of major exchanges in the first three quarters was negative.

As we enter 2025, the listing of new coins on centralized exchanges remains a tombstone for new coins. Can short selling really achieve eternal profit? This article provides an overview of the new coin listings on major exchanges in January.

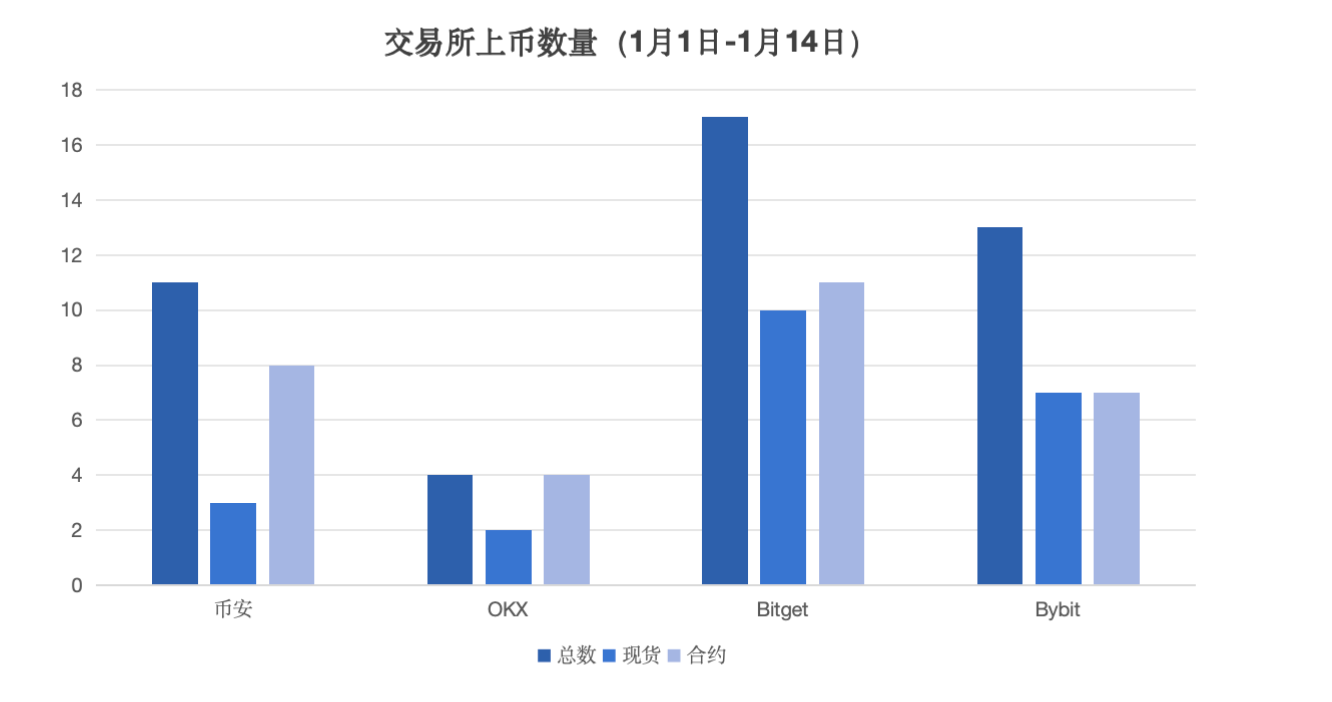

Overview of New Listings in January by Exchanges

Major exchanges have already begun listing new coins at the start of this year. From the data, OKX has the most conservative listing strategy, launching only 4 tokens. Bitget, on the other hand, has adopted a more proactive listing strategy, having listed 17 tokens so far this year, with the highest proportion of spot listings. Binance and Bybit have listed 11 and 13 tokens respectively, with Binance having the lowest proportion of spot listings.

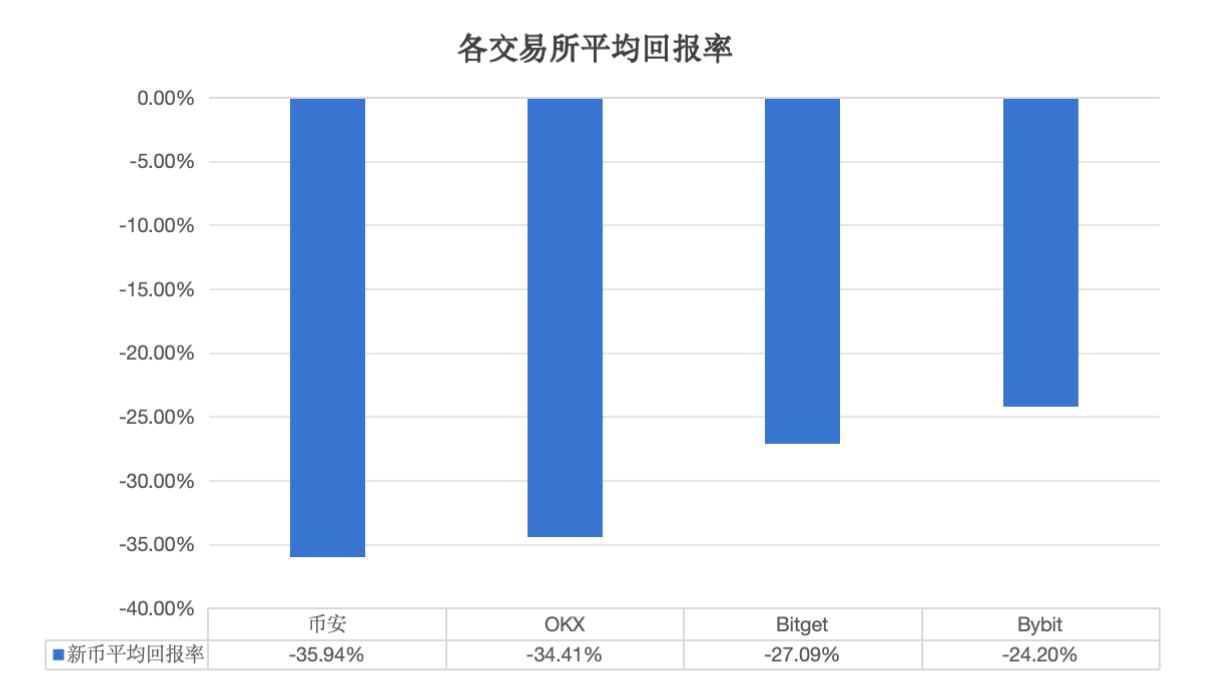

Performance of New Coins on Exchanges

From the beginning of the year to now, the average return rate of exchanges remains negative, with Binance experiencing the largest decline of about 10%, resulting in an average return rate of -36%. The data from other exchanges is not significantly different, with Bitget, despite having the highest number of listings, seeing a decline of about -27%.

The table above lists all tokens launched by the four major exchanges since January (both spot and contracts). To avoid price manipulation, the prices recorded are the higher of the opening and closing prices on the day. From the data, all new coins on Binance have negative returns, without exception. Bitget has 2 projects that rose against the trend in a sea of declines, while Bybit has 1 token with positive returns, with the rest failing. OKX's 4 listed projects also all declined.

Additionally, most tokens launched in January are still concentrated in AI agent projects. After being criticized by the community for only listing VC coins, Binance significantly reduced the number of VC coins listed in January. Among the 11 tokens it launched, 9 are related to AI agents, accounting for as much as 81%. However, since Binance's listing time is on average 1 month later than other exchanges, the market capitalization at the time of listing had already surged, leading to a dismal outcome. AI16Z dropped sharply after announcing its listing on Binance, with a decline of over 10% in 5 minutes. Furthermore, the market capitalization of the projects listed by Binance is generally high, almost never below 100 million USD, which results in subsequent price weakness and lack of upward momentum. In contrast, the few tokens that rose on Bitget, SWARMS and AVAAI, had market capitalizations below 100 million USD at the time of listing, indicating that the odds for small-cap tokens are gradually improving.

He Yi once stated in the community, "If you don't like it, you can short it." It now seems that shorting new tokens on Binance is a surefire profitable business, and not only that, other exchanges are also performing quite poorly. If one shorts a new coin on the day it is listed, there are rarely any pullbacks; more tokens continue to decline, often halving from their starting point. The notion that listing on Binance guarantees a price increase has become a thing of the past, with "soul-drenched" becoming the community's impression of the continuous decline of new listings on Binance.

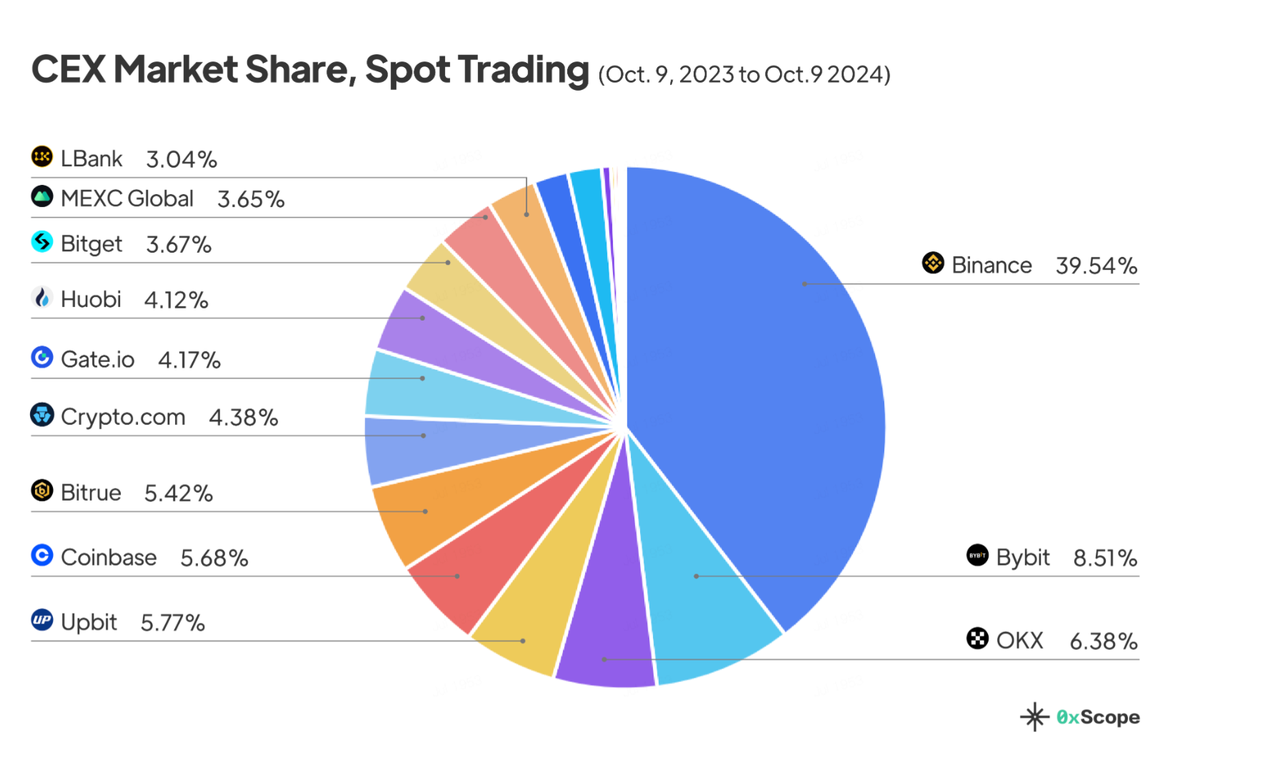

According to the recent "2024 CEX Market Report" released by 0xScope, in the spot market trend, Binance's market share has shrunk from 50.9% to 42.5% year-on-year.

The Battle for Liquidity

Centralized exchanges have long dominated liquidity due to their mature infrastructure, strong market depth, and efficient matching mechanisms. However, with the continuous improvement of on-chain infrastructure, centralized exchanges are gradually becoming exit liquidity, and their effect on new coin listings is weakening. Previously, Pump.fun completed the rapid issuance of Memecoins with its unique pricing curve, and now on-chain DEXs like Hyperliquid are attracting significant attention through large airdrops, leading to a continuous decline in the overall market share of centralized exchanges. On-chain DEXs are rapidly eroding the traditional advantages of centralized exchanges.

As the on-chain user experience continues to improve and numerous DeFi innovations emerge, more users and funds will migrate to on-chain platforms. The high transparency, decentralization, and user ownership of funds in the on-chain ecosystem will further accelerate this shift. However, this does not mean that centralized exchanges will exit the stage; with their advantages in compliance operations and trading convenience, centralized exchanges will still play an important role in user education, new asset introduction, and institutional capital entry.

In the future, the boundaries between CEX and DEX may gradually blur. This liquidity battle will ultimately shift from competing for users and funds to enhancing user experience and promoting industry development.

The battle for liquidity will bring more innovation and progress, and the crypto industry will ultimately prevail.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。