Author: Weilin, PANews

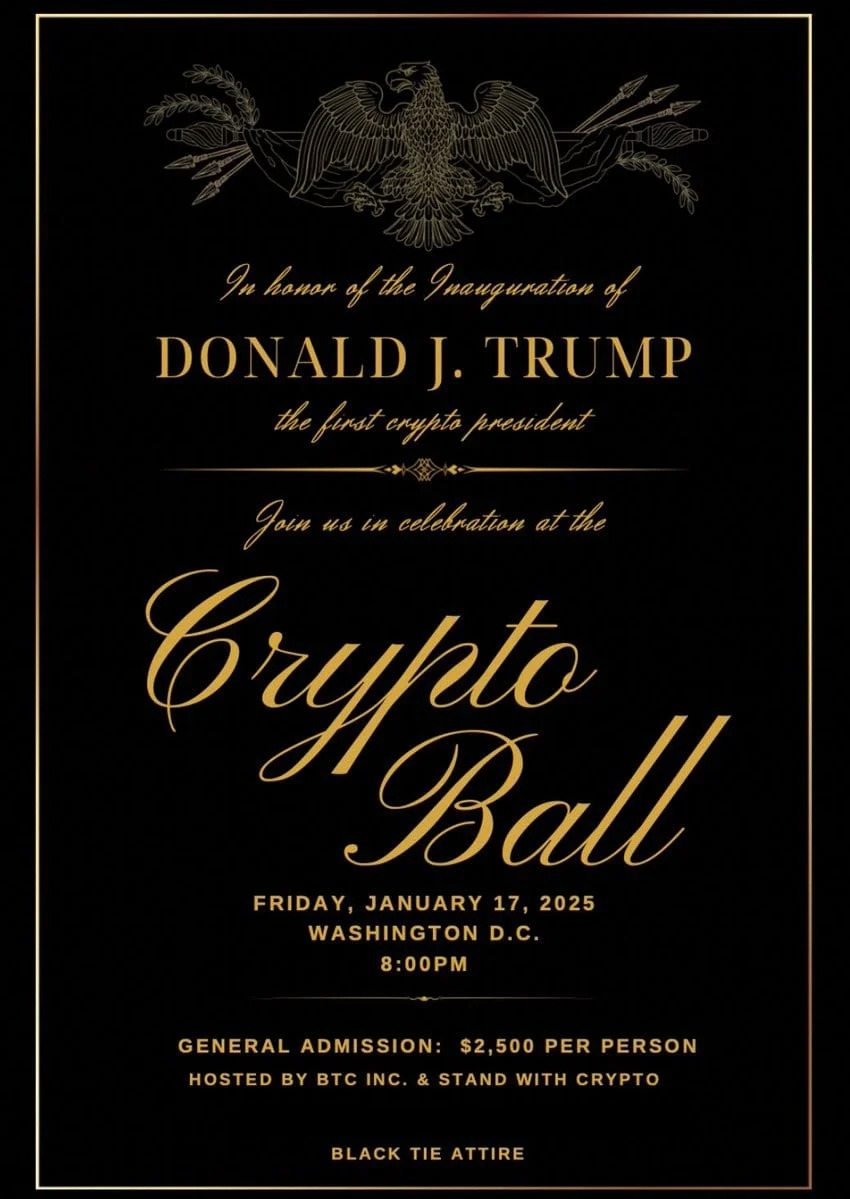

As the inauguration of the U.S. President-elect Trump approaches on January 20, leaders from the crypto and tech industries are preparing to participate in a grand celebration. Among them, a crypto ball will be held in Washington on January 17, hosted by David Sacks, the White House's AI and cryptocurrency director, who will oversee the VIP reception. Although Trump himself will not attend, top companies and leaders in the crypto industry have actively raised funds for this ball and a series of celebratory events, setting records.

Will the market see another surge brought by Trump in January? Bitcoin's price trajectory is approaching several key points, and analysts have provided their predictions regarding the new policies and price movements.

Celebrating Trump's Inauguration, "Crypto Tsar" David Sacks to Host the Crypto Ball

On January 20, Trump will take the oath of office for his second term as President of the United States, marking an important moment in American history. The crypto ball on January 17 has already attracted significant attention. In addition to regular tickets, the event will feature a VIP reception hosted by Trump's super PAC, MAGA Inc. Although Trump will not be present, David Sacks will appear as the host of the VIP event.

The ticket prices for the event are steep, with general admission starting at $2,500, but the real allure lies in the VIP and private packages. For $100,000, VIP guests can network with leading figures in the crypto space. A $1 million ticket package offers four tickets and an opportunity to dine with Trump himself at a later date.

The event is organized by BTC Inc, with co-hosts including Stand With Crypto, Exodus, Anchorage Digital, and Kraken. The sponsorship package for co-hosting the event costs $5 million. Other sponsorship opportunities range from $150,000 to $1 million. Current sponsors of the event include well-known crypto companies such as Coinbase, Sui, MetaMask, Galaxy Digital, Ondo, Solana, Metaplanet, MARA, Satoshi Action Fund, and MicroStrategy.

Multiple Crypto Institutions Donate to Trump's Inaugural Committee, Ripple Donates the Most

As part of the new president's inauguration, Trump's inaugural committee's fundraising activities have attracted significant participation from crypto industry companies. Crypto firms are donating funds to Trump's inaugural committee in hopes of securing a place in the influence of the new government.

Trump's inaugural committee has set a record for fundraising, raising over $170 million. Donors began receiving notifications during the week of January 10, with some event seats in Washington already filled. The inaugural activities will commence on January 17. Donors who contribute $1 million or raise $2 million will receive six tickets to different events, including the January 20 inauguration ceremony and a "candlelight dinner" with Trump and his wife Melania on January 19, described as the "peak event" of the weekend. They will also receive two tickets to dinner with Vice President-elect JD Vance and his wife.

Among the crypto companies donating, Ripple is undoubtedly the leader, donating $5 million worth of XRP to Trump's inaugural fund. Following Trump's successful re-election on November 5 last year, the value of Ripple's held XRP reserves has increased by over $85 billion. Ripple CEO Brad Garlinghouse and Chief Legal Officer Stuart Alderoty recently met with Trump.

Companies such as Robinhood, Coinbase, Circle, and Kraken have also donated to the inaugural committee, contributing $2 million, $1 million, $1 million USDC, and $1 million, respectively.

Circle CEO Jeremy Allaire stated in a post on X platform: "We are excited to build a great American company, and the committee's acceptance of USDC payments shows how far we have come and demonstrates the potential and power of the digital dollar."

Additionally, a company spokesperson confirmed that Moonpay recently donated funds to support the presidential candidate's inauguration, but the donation amount was not disclosed. New York-based Ondo Finance also donated $1 million to Trump's inauguration at the end of December last year.

Trump May Release Crypto-Related Policies on His First Day, Implementation Will Take Time

According to Reuters, Trump is expected to issue at least 25 executive orders on his first day in office, which may include policies related to cryptocurrency. According to The Washington Post, Trump may announce the repeal of the controversial crypto accounting policy SAB 121 on his first day, which requires banks to treat their held digital assets as liabilities, thus reflecting them on their balance sheets.

However, while the crypto industry is filled with anticipation for Trump's presidency, the implementation of policies may not be so swift.

NYDIG, a Bitcoin financial services firm, stated that it may take time for Trump to fulfill his campaign promises. NYDIG noted that changes in crypto policy will not happen immediately after the inauguration, especially since some high-level government positions have yet to be filled. "We advise against having overly high expectations for immediate changes. Key officials still need to be appointed, and those already appointed need to go through confirmation processes, and once confirmed, they will need to build their own teams."

Moreover, Trump has not yet announced who will lead agencies such as the Commodity Futures Trading Commission (CFTC), the Office of the Comptroller of the Currency (OCC), and the Federal Deposit Insurance Corporation (FDIC). However, NYDIG expects that the heads of these agencies "will support Bitcoin and cryptocurrencies."

Meanwhile, whether the market has already "priced in" Trump's policy changes remains an open question. Analysts Dan Gambardello and Hoeem believe that the market has not yet priced in Trump's inauguration. This means that once Trump officially takes office, there may still be room for the cryptocurrency market to rise.

"People think that the impact of a pro-crypto Trump administration and governments around the world rushing to buy Bitcoin has already been priced in. But in reality, it clearly has not been priced in," Gambardello posted on the X platform.

Crypto expert Hoeem expressed a similar view: "Trump's inauguration has not been priced in." Hoeem further added: "Trump will repeal any policies that negatively impact the crypto market while doubling down on any measures that positively affect the crypto market. From day one, he hopes the market will continue to rise, not only because his team and family have close ties to the market but also due to his personal pride."

Bitcoin Price Trends: Mixed Effects of Interest Rate Expectations and New Policies

As the market anticipates potential policy changes following Trump's inauguration, analysts are also focusing on Bitcoin's price trends.

As 2025 begins, the cryptocurrency trading environment has shown a mixed trend following the December FOMC meeting and holiday season. According to a report from 10x Research, the first quarter of 2025 may not exhibit the same scenario as late January to March or late September to mid-December 2024.

The consumer price index (CPI) data released on January 15 has become a key event of interest. The market may experience a pullback before the CPI data is released, and if the data results are favorable, the market may rebound again.

"Favorable inflation data could reignite optimism and drive the market to rebound before Trump's inauguration on January 20," said Mark Thielen, founder of 10x Research. However, the momentum from this rebound may be short-lived. Thielen added that the market may retreat before the January 29 FOMC meeting. He predicts that Bitcoin will be in the range of $96,000 to $98,000 by the end of January.

Crypto investment firm QCP Capital published an analysis on January 13, stating that despite the unfavorable macro environment and persistent rumors about Silk Road, cryptocurrencies seem to have stabilized, as the support levels of $91,000 and $3,100 remain intact. Implied volatility is also at relatively low levels and continues to decline, with a slight bearish skew in the front-end market just before Trump's inauguration.

Although the volatility market has not reacted significantly, cryptocurrencies have not escaped their troubles. A macro storm still looms, with the Producer Price Index (January 14), Consumer Price Index (January 15), and initial jobless claims (January 16) set to be released, all of which could fuel the market's momentum. As the U.S. economy heats up, this week will be a true test for cryptocurrencies to see if they can serve as a hedge against inflation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。