Analyzing Future Trends from Multiple Dimensions

Authors: Dan Morehead, Paul Veradittakit, Franklin Bi, Jeff Lewis, Erik Lowe, Mason Nystrom

Translation: Deep Tide TechFlow

This article is Pantera Capital's outlook on the development of cryptocurrency by 2025. It is a collection of four articles that analyze future trends from multiple dimensions, including the mainstream adoption of blockchain, three key trends for 2025, how cryptocurrency will support the dominance of the dollar, and how RWAs will drive the integration of DeFi protocols.

Deep Tide TechFlow hereby translates the full text, and the following is the content of the articles.

The Hundredfold Growth Opportunity of Blockchain: The Path to Mainstream Adoption

Author: Franklin Bi, General Partner

How can cryptocurrency truly move towards mainstream adoption?

When we set aside the noise and speculation, this is the only question worth focusing on. As investors, our responsibility is to find the path to widespread adoption of cryptocurrency, as that is where the next hundredfold growth opportunity lies.

However, top venture capitalists are not prophets. They focus on the present and have great clarity in understanding reality. One thing is certain: 2025 will be a turning point for the cryptocurrency industry.

Imagine if Jeff Bezos were imprisoned for selling books online; what would the internet look like? What if Steve Jobs were sanctioned for launching the App Store, or Jensen Huang had to establish Nvidia abroad due to a frozen bank account? This is the predicament the blockchain industry has faced in recent years.

However, 2025 will be an important milestone in the history of blockchain—entrepreneurs, regulators, and policymakers will have the opportunity to clear the obstacles to mainstream adoption for the first time.

In light of this increasingly clear path, we need to rethink: what opportunities will arise on the future adoption path? Which areas might give birth to hundredfold or even thousandfold investment opportunities?

Just as "Social/Local/Mobile (SoLoMo)" unleashed the potential of the internet in the 2010s, starting in 2025, the convergence of three major trends will drive the large-scale adoption of blockchain:

Gateways: Connecting traditional financial systems to blockchain;

Developers: Lowering the barriers to development, enabling more people to easily build blockchain-based applications;

Applications: Creating truly meaningful blockchain applications that integrate into daily life.

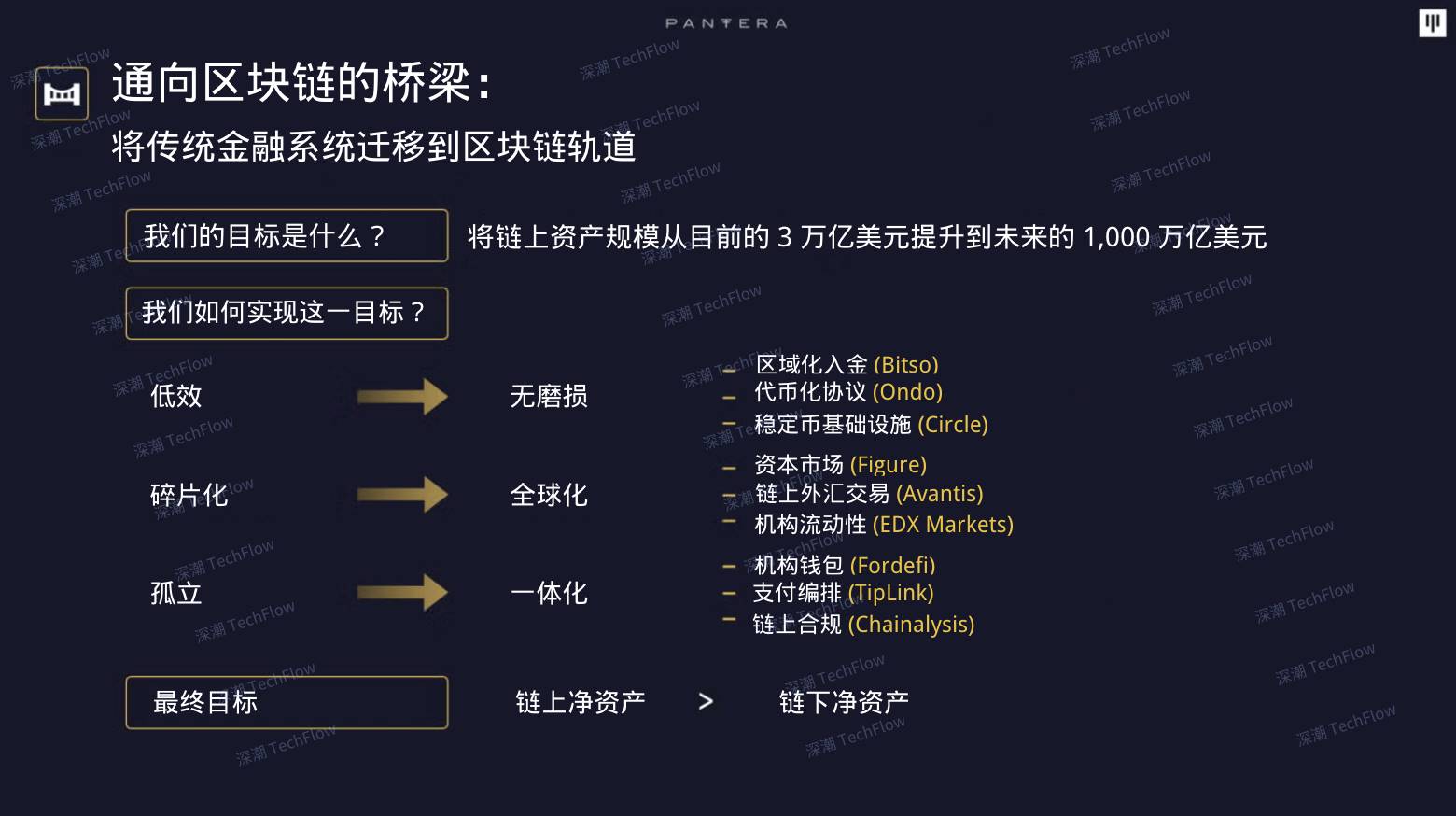

Gateways: The Bridge Between Traditional Finance and Blockchain

Looking back at the history of Wall Street, from the introduction of electronic trading in the 1970s to today's digital payments, this 50-year technological upgrade tells us an important fact: all financial assets will ultimately flow to places that can achieve the most free movement, the most efficient trading, and create the most value.

Currently, blockchain networks hold $30 trillion worth of crypto assets (such as Bitcoin and Ethereum), as well as a portion of asset-backed tokens (such as tokenized dollars and government bonds). But globally, the total financial assets held by households, governments, and businesses exceed $1,000 trillion. This means that blockchain still has 300 times the growth potential in the financial asset space.

So, what stage are we currently in? It can be said that the race has not even begun; the players are still warming up. The global balance sheet has only just begun to migrate to blockchain. To achieve this goal, we need powerful gateways to connect traditional financial systems with the blockchain world.

We need to expand platforms that can efficiently onboard new users and existing assets. For example, Bitso in Latin America has utilized blockchain technology to process over 10% of remittance transactions between the U.S. and Mexico. Platforms like Ondo are competing with financial giants like Franklin Templeton and BlackRock, planning to move over $20 trillion of U.S. government bonds onto the blockchain.

Cryptocurrency: A New Era for Global Capital Markets

Cryptocurrency is driving the formation of the first truly global capital market, thanks to its real-time settlement and borderless liquidity. However, to realize this vision, global markets need matching global trading platforms. For example, exchanges like Figure and Avantis are gathering global supply and demand while driving transformation in the foreign exchange (FX), credit, and securities markets.

Additionally, we need products that can be compatible with existing traditional financial systems, not just limited to a parallel ecosystem of cryptocurrencies. These products could be advanced wallets designed for institutions by Fordefi, or simple payment solutions provided by TipLink that even the elderly can easily use.

What will the future look like when cryptocurrency truly integrates into the mainstream? We believe that one day, the on-chain value of people's wealth will exceed that of off-chain. Once assets migrate on-chain, they can circulate globally in an instant, completing transactions at low costs without intermediary fees, and accessing global markets for maximum value. This will be an irreversible turning point.

Original image from Franklin Bi, translated by Deep Tide TechFlow

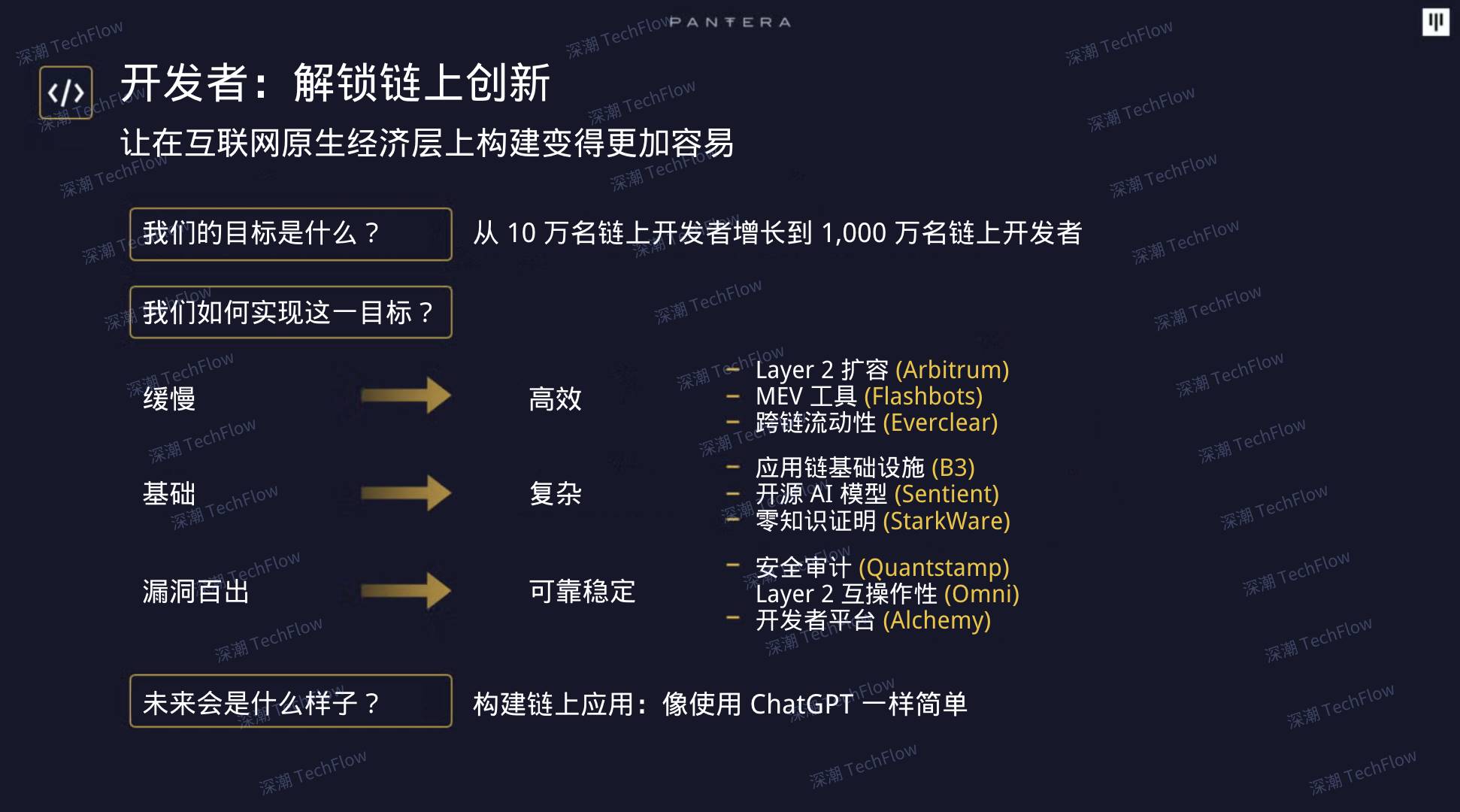

Developers: The Core Driving Force of the Blockchain Ecosystem

Currently, there are about 100,000 active developers in the blockchain space globally, which is only half the number of developers in a large tech company in Silicon Valley. To drive mainstream adoption of blockchain, we need to increase this number to 1 million, a hundredfold growth.

Whether the potential of blockchain technology can be fully realized depends on whether better development tools are available. Just as advancements in mobile development tools unleashed the potential of the Apple App Store, we need to simplify the tools for developing blockchain applications to help developers create more practical products.

By 2025, blockchain development technology will see significant breakthroughs. A key point is to make blockchain itself more developer-friendly. For example, Arbitrum's Optimistic Rollup technology has brought a "broadband era" transformation to the crypto industry. The upcoming Arbitrum Stylus may have even more far-reaching impacts, as it allows developers to write smart contracts using mainstream programming languages like C, C++, and Rust, attracting over 10 million developers globally into the blockchain space.

Zero-Knowledge technology was once considered too complex to be practically applied. However, with the introduction of new tools like StarkWare's development toolkit, implementing zero-knowledge technology has become simpler. Today, zero-knowledge proofs (zk-proofs) have been used in blockchain voting tools like Freedom Tool and Rarimo, which have been deployed in Russia, Georgia, and Iran to enhance democratic participation.

Tools and infrastructure supporting blockchain development play a crucial role in driving technological advancement. For example, the Alchemy platform simplifies the development process, helping developers build and deploy on-chain applications at scale. From decentralized finance (DeFi) protocols to on-chain games, Alchemy has supported multiple projects in achieving success. As the blockchain ecosystem continues to evolve, these development platforms need to iterate continuously to help developers push the boundaries of on-chain applications.

Looking ahead to 2025, the multichain ecosystem will further accelerate its development. In the face of increasingly complex development demands, different blockchains are emerging, each showcasing unique advantages in computational power, execution efficiency, or decentralization. Application-specific infrastructure for certain fields (such as gaming or trading) is also gradually taking shape, such as B3. With the rapid growth of chains, Layer 2, and application chains, cross-chain liquidity solutions (like Everclear) and interoperability protocols (like Omni) will become key, clearing technical barriers for developers and allowing them to focus on building innovative applications.

Just as web development has evolved from hand-coding to no-code tools, blockchain development is undergoing a similar transformation. In the future, as technology advances and development tools improve, building on-chain applications may become as simple as conversing with ChatGPT. This evolution of technology will attract more talent and propel the blockchain ecosystem into a new phase.

Original image from Franklin Bi, translated by Deep Tide TechFlow

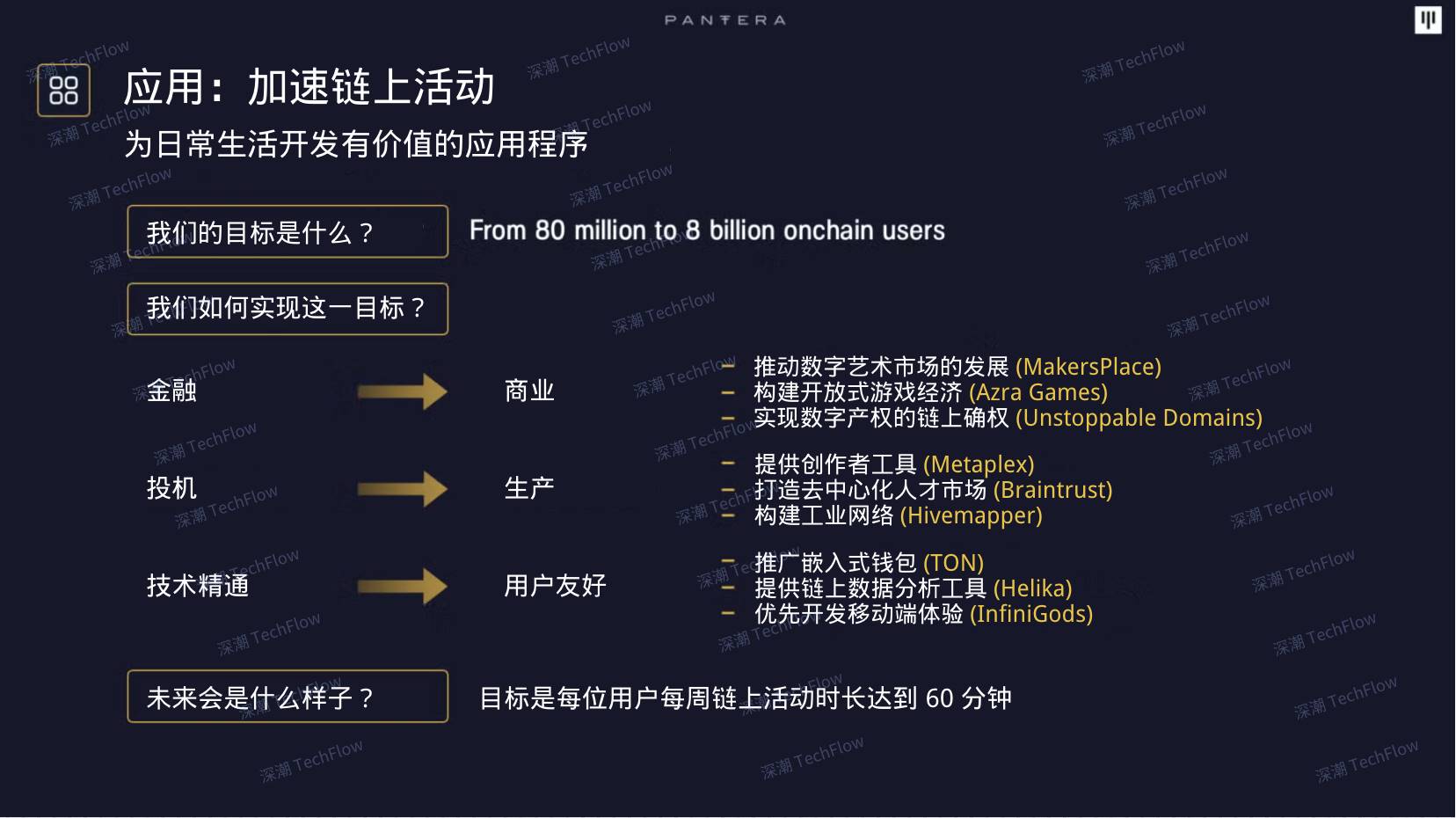

Applications: The Transformation from "Wall Street" to "Main Street"

Currently, how many people have entered the on-chain world?

According to most estimates, there are about 80 million on-chain users globally. This growth is primarily due to the appeal of cryptocurrency as "Wall Street 2.0"—a new venue for capital raising, speculation, and transfers. However, to expand this number to 8 billion, allowing everyone in the world to participate, cryptocurrency needs to gradually move from "Wall Street" to "Main Street," integrating into people's daily lives.

2025 may become a critical juncture for the mainstream adoption of cryptocurrency. It will be the "FarmVille moment" for blockchain technology. FarmVille was the first blockbuster social game on Facebook, driving exponential growth in Facebook users and transforming it from a simple photo-sharing platform into a global social network.

Today, cryptocurrency is accelerating towards its "FarmVille moment." An increasing number of on-chain features are being integrated into new games and social applications. For example, the game studio InfiniGods is attracting a large number of first-time on-chain users. Their mobile casual game "King of Destiny" has been downloaded over 2 million times in the past year, bringing users who typically prefer playing "Candy Crush" into the on-chain world, rather than traditional crypto trading platforms like Coinbase.

Currently, on-chain gaming, social, and collectibles activities account for about 50% of the currently active independent wallets. As more users engage in on-chain commercial activities, it is foreseeable that the impact of blockchain will far exceed the financial sector, penetrating deeper into broader daily life.

A new class of "productive" applications is leading a new industrial revolution. The era dominated by traditional companies is gradually giving way to the rise of "industrial networks." These industrial networks, also known as DePIN (Decentralized Physical Infrastructure Networks), focus on addressing unmet needs in areas such as wireless connectivity, hyper-local data, and human capital. They achieve this through on-chain coordination mechanisms and market-driven approaches. For example, Hivemapper is a decentralized mapping network that has mapped over 30% of the roads globally, relying on data from over 150,000 contributors, with real-time accuracy that even surpasses Google Maps.

More importantly, these "productive" applications are opening up real sources of income. We expect that by 2025, the annualized revenue in the DePIN space will exceed $500 million in 2024. These industrial-grade cash flows provide the potential for profit models based on real-world utility, injecting strong momentum into the on-chain economy to attract more capital.

So, how can these applications reach 8 billion people globally? In 2025, we will witness new distribution models that can scale to cover hundreds of millions of consumers. For example, crypto exchanges like Coinbase, Kraken, and Binance are creating their own blockchains to help users more easily enter the on-chain world. Platforms like Telegram and Sony are also introducing Web3 features within their vast user ecosystems, further expanding the on-chain user base.

At the same time, gaming companies are adding on-chain features to classic games (like "MapleStory"), potentially converting millions of players into on-chain users. Financial institutions like PayPal and BlackRock are launching on-chain financial and payment solutions, making it easier for mainstream users to access and use blockchain technology.

Original image from Franklin Bi, translated by Deep Tide TechFlow

In 2025, the convergence of various trends will lead the on-chain economy into a critical turning point. When ordinary people have a reason to spend 60 minutes a week on-chain, "on-chain" will become a part of daily life, just like "online." Rather than pursuing a single "killer app," it is better to envision a diverse ecosystem: just as we switch between different applications on the internet today, people will spend time on-chain for various reasons such as entertainment, socializing, or making money. When all of this happens, the on-chain economy will truly integrate into our daily lives.

Original image from Franklin Bi, translated by Deep Tide TechFlow

Looking Ahead: The Accelerated Path of Blockchain into the Mainstream

The upcoming year will mark the beginning of blockchain technology's deep integration into daily life, much like the proliferation of the internet. The transformation from "Wall Street" to "Main Street" is not only happening but is also rapidly accelerating. This process is driven by continuous innovation in entertainment, business, and practical applications.

To promote this transformation, we need to invest more in several areas: making it easier for more people to access blockchain, more efficient technologies and development tools, and applications that can solve real-world problems. The year 2025 is still full of tremendous development potential, and the mainstream adoption of cryptocurrency is gradually becoming a reality. As a famous saying goes: "The best way to predict the future is to create it."

Predictions for Cryptocurrency in 2025

Author: Paul Veradittakit, Managing Partner

This year, I invited investors from the Pantera team to participate in the predictions. I categorized these predictions into two categories: upward trends and emerging ideas.

Upward Trends:

- **On-chain Real World Assets (RWAs) (excluding stablecoins) will account for 30% of the total *Total Value Locked (TVL)* (currently at 15%)**

In 2024, the total amount of on-chain real-world assets (RWAs) grew by over 60%, reaching $13.7 billion. Approximately 70% of RWAs are private credit, with the remainder primarily consisting of Treasury bills (T-bills) and commodities. The influx of funds into these categories is accelerating, and more complex RWA products may emerge in 2025.

First, the rapid growth of private credit is attributed to the continuous improvement of blockchain infrastructure. For example, the Figure platform has nearly captured the entire market share, with its on-chain assets increasing by nearly $4 billion in 2024. As more companies enter this field, private credit is becoming a convenient way for funds to enter the crypto ecosystem.

Second, there are still trillions of dollars in off-chain Treasury bonds and commodities waiting to be brought on-chain. Currently, there are only $2.7 billion in Treasury bonds on-chain. Unlike stablecoins, Treasury bonds can generate direct returns (whereas the returns from stablecoins are typically captured by the issuer), making them a more attractive option. For instance, BlackRock's BUIDL Treasury fund has only $500 million on-chain, while its off-chain holdings of government bonds amount to hundreds of billions. Today, decentralized finance (DeFi) infrastructure fully supports stablecoins and Treasury bond RWAs (such as integrating them into DeFi liquidity pools, lending markets, and perpetual contracts), significantly lowering the barriers to their adoption. A similar trend is also observed in the commodities sector.

Currently, the application scope of on-chain real-world assets (RWAs) is still limited to some basic products. However, as the infrastructure for minting and maintaining RWA protocols continues to simplify, operators have gained a deeper understanding of the risks involved in on-chain operations and how to address them. Today, there are specialized companies responsible for managing wallets, minting mechanisms, Sybil attack detection, and new types of banking services. These advancements make it possible and feasible to introduce more complex financial products (such as stocks, ETFs, bonds, etc.). It is foreseeable that these trends will further accelerate the widespread use of RWAs in 2025 and promote the deep application of blockchain technology in the financial sector.

- Bitcoin-Fi: The Rise of Bitcoin Finance

Last year, my prediction for Bitcoin finance (Bitcoin-Fi) was optimistic, but it did not reach 1-2% of the total Bitcoin locked (TVL). However, this year, several factors may drive the rapid development of Bitcoin-Fi, including Bitcoin-native financial protocols (like Babylon) that do not require cross-chain bridges, high-yield returns, a higher Bitcoin price, and strong demand for more Bitcoin assets (such as runes, Ordinals, BRC20). It is expected that by 2025, 1% of Bitcoin will participate in the Bitcoin-Fi ecosystem, marking a new breakthrough for Bitcoin in the financial sector.

- Fintech Companies: Becoming the Mainstream Gateway for Cryptocurrency

Platforms like TON, Venmo, PayPal, and WhatsApp have become important forces in promoting cryptocurrency development due to their neutrality. They provide users with an entry point to interact with cryptocurrencies without pushing specific applications or protocols, thus serving as simplified gateways for cryptocurrency entry. These platforms attract different user groups: TON serves its 950 million Telegram users, Venmo and PayPal cover 500 million payment users each, while WhatsApp boasts 2.95 billion monthly active users.

For example, Felix is a service running on WhatsApp that allows users to complete instant transfers through simple messages, with funds being transferred digitally or withdrawn in cash at partner locations like 7-Eleven. On the technical side, Felix uses stablecoins and Bitso from the Stellar network. Meanwhile, users can now purchase cryptocurrencies on MetaMask through Venmo; Stripe acquired the stablecoin company Bridge, while Robinhood acquired the crypto exchange Bitstamp.

Whether intentionally or due to their ability to support third-party applications, these fintech companies are gradually becoming mainstream gateways for cryptocurrency. As they gain popularity, fintech companies may compete with smaller centralized exchanges in terms of cryptocurrency holdings.

4. Unichain: The Largest Second Layer Network by Trading Volume

Uniswap currently has a total value locked (TVL) of about $6.5 billion, processing 50,000 to 80,000 transactions daily, with daily trading volume ranging from $1 billion to $4 billion. Arbitrum's daily trading volume is about $1.4 billion (one-third of which comes from Uniswap), while Base's daily trading volume is about $1.5 billion (one-quarter of which comes from Uniswap).

If Unichain can capture half of Uniswap's trading volume, it will easily surpass the current largest second layer (L2) network, becoming the highest volume L2. This not only demonstrates Unichain's potential but also marks further maturation of the decentralized finance (DeFi) ecosystem.

5. The Revival of NFTs: From Tools to Diversified Applications

NFTs (non-fungible tokens) were initially designed as a tool within blockchain technology rather than an end goal. Today, the application scope of NFTs is expanding, covering various fields such as on-chain gaming, artificial intelligence (for ownership of trading models), identity verification, and consumer applications.

For example, Blackbird is a restaurant rewards application that integrates NFTs into its customer identification system, seamlessly combining Web3 technology with the dining industry. By leveraging the openness, liquidity, and recognizability of blockchain, Blackbird can provide restaurants with consumer behavior data while easily creating features like subscriptions, memberships, and discounts.

Sofamon has developed a Web3 version of emojis, existing as NFTs, referred to as "wearables." This innovation unlocks the financial potential of the emoji market. They also recognize the importance of on-chain intellectual property (IP) and collaborate with top KOLs and K-pop stars to combat digital counterfeiting. For instance, Story Protocol recently raised $80 million at a valuation of $2.25 billion, aiming to tokenize global intellectual property and make originality the core of creative exploration. Swiss luxury watch brand IWC has also launched membership NFTs that allow holders to join exclusive communities and participate in exclusive events.

The flexibility of NFTs allows them to be used in scenarios such as identity verification, transaction records, asset ownership, and membership management, while also representing and assessing the value of assets. This flexibility not only brings monetization opportunities but may also drive speculative growth in the market. As technology matures, the application scenarios for NFTs will continue to expand.

6. Restaking Protocols: A Key Step Towards Mainnet

In 2025, Restaking protocols such as EigenLayer, Symbiotic, and Karak will officially launch on the mainnet. These protocols provide returns to operators through validator services (AVS) and penalty mechanisms. Although the popularity of Restaking has waned over the past year, its potential remains significant.

The influence of Restaking will gradually expand with the adoption of more networks. If the infrastructure of certain protocols is driven by specific Restaking protocols, they can benefit even if the connection is not direct. This characteristic allows certain protocols to maintain high valuations even if they lose some relevance. We expect Restaking to remain a multi-billion dollar market, and as more applications transition to Appchains (application chains), they will gradually adopt Restaking protocols or other protocols built on this foundation.

Emerging Ideas:

7. zkTLS: A New Technology for Bringing Off-Chain Data On-Chain

zkTLS (Zero-Knowledge Transport Layer Security Protocol) is a new technology based on zero-knowledge proofs (ZKPs) used to verify the authenticity of data from the Web2 world. Although this technology has not yet been fully implemented, once realized this year, it will introduce a new type of data to the blockchain ecosystem.

For example, zkTLS can be used to prove that certain data indeed comes from a specific website, something that no existing technology can currently achieve. This technology combines the latest advancements in trusted execution environments (TEEs) and multi-party computations (MPCs) and may further develop to support privacy protection for certain data.

While zkTLS is still in the conceptual stage, we expect companies to invest resources in developing this technology and integrating it into on-chain services. For instance, it could be used for verifiable oracles of non-financial data or as cryptographically secure data oracles, providing broader data support for the blockchain ecosystem.

8. Regulatory Support: A Shift in U.S. Cryptocurrency Policy

The regulatory environment in the U.S. has shown a positive attitude towards cryptocurrency for the first time. In the new election cycle, 278 House candidates supporting cryptocurrency were elected, while only 122 candidates opposed it. Additionally, current SEC Chairman Gary Gensler, who has long opposed cryptocurrency, announced he will resign in January. Reports indicate that Trump plans to nominate Paul Atkins as the new SEC chairman. Paul Atkins served as an SEC Commissioner from 2002 to 2008, and he has publicly supported the cryptocurrency industry while serving as an advisor to the Chamber of Digital Commerce, which is dedicated to promoting the adoption and acceptance of cryptocurrency.

At the same time, Trump also appointed tech investor, former Yammer CEO, and PayPal COO David Sacks as the newly established "AI & Crypto Czar." In the statement, Trump specifically mentioned: "[David Sacks] will be responsible for developing a legal framework to provide the clarity that the cryptocurrency industry has long sought."

This series of changes has generated optimism about the future of the U.S. cryptocurrency regulatory environment. We hope to see a gradual reduction in SEC lawsuits, a clear definition of cryptocurrency as a specific asset class, and clearer tax policies.

Cryptocurrency: An Unexpected Boost to De-Dollarization

Authors: Jeff Lewis (Hedge Fund Product Manager) and Erik Lowe (Content Director)

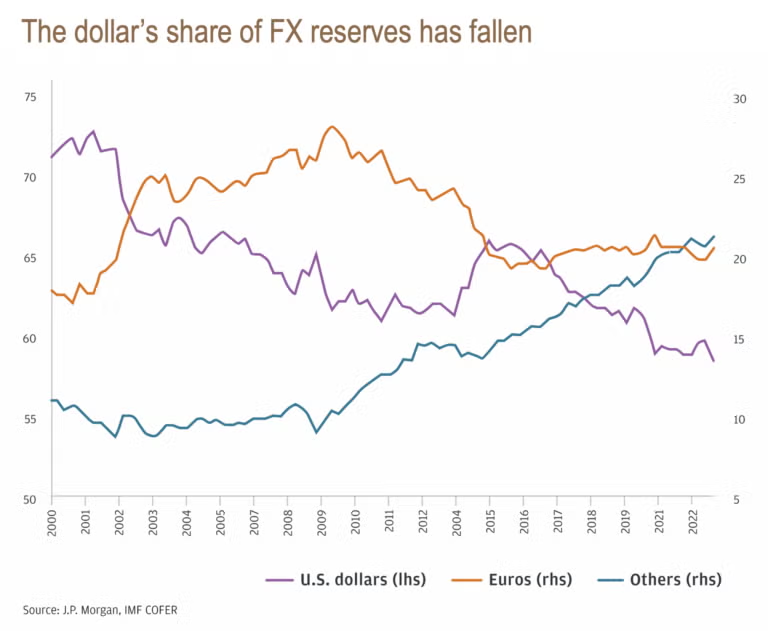

In recent years, the global trend of "de-dollarization" has become increasingly evident. Countries and institutions are gradually reducing their reliance on the dollar in international trade and financial transactions, raising concerns about the long-term dominance of the dollar.

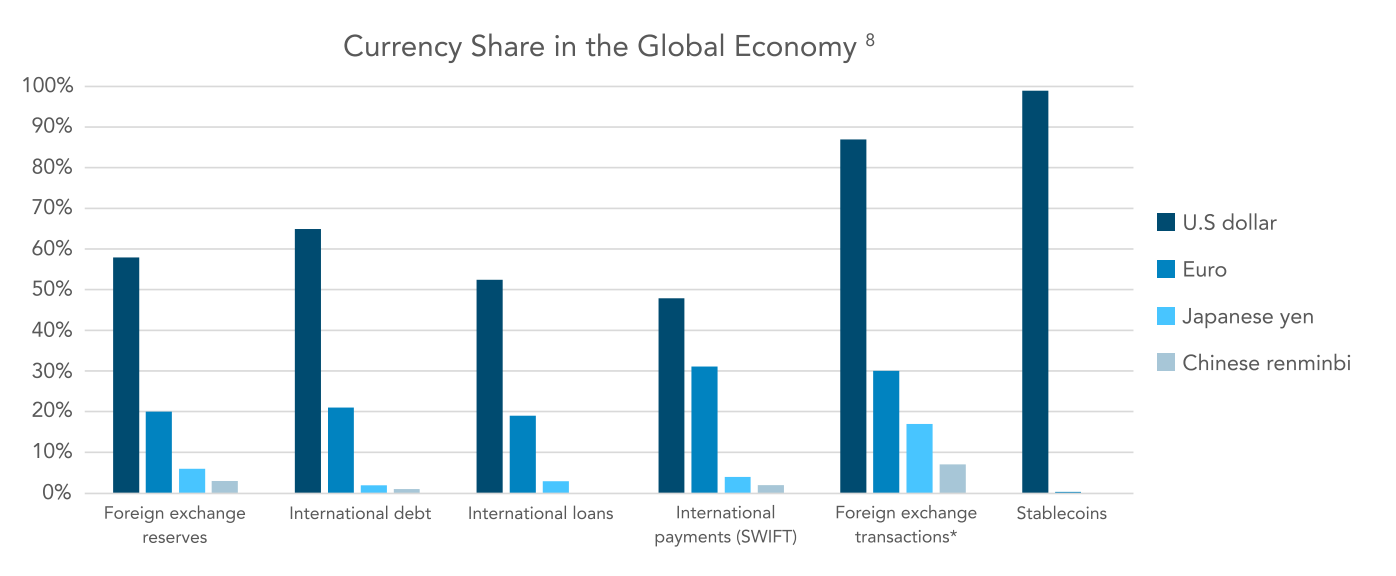

A common metric for measuring the dollar's dominance is its share of global foreign exchange reserves. However, since 2000, this share has been steadily declining, having decreased by 13 percentage points.

However, we believe this trend is about to reverse, and the driving force behind this change is precisely blockchain technology and tokenization—technologies that were once thought to potentially undermine the dollar's position. Ironically, they are now becoming the dollar's most powerful boosters.

As Elon Musk said, "The most ironic outcomes are often the most likely."

Enhanced Dollar: How Blockchain Supports the Dominance of the Dollar

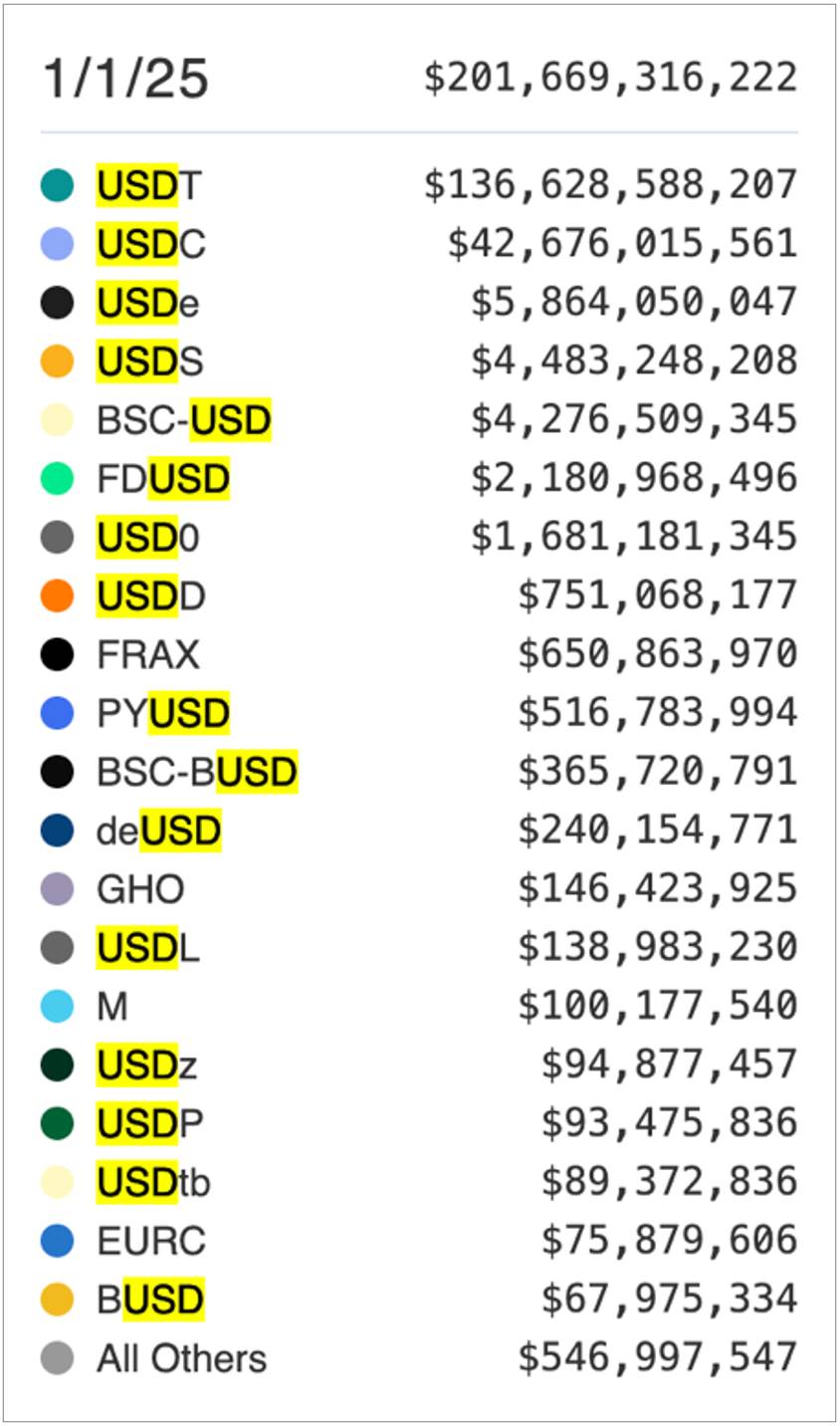

Public blockchains have injected new vitality into fiat currencies, enabling them to reach 5 billion smartphone users globally and facilitating convenient cross-border payments. The demand for tokenized fiat currencies (i.e., stablecoins) has surged, creating a market worth up to $200 billion—of which the U.S. dollar holds an absolute dominant position.

A report released by Castle Island and Brevan Howard shows that the proportion of dollar-collateralized stablecoins in the stablecoin market is nearly 100%. This phenomenon indicates that blockchain technology has not weakened the dollar's position; rather, it is further consolidating the dollar's dominance in the global financial system through its efficiency and globalization characteristics.

Data Source: Castle Island and Brevan Howard report

Among the top 20 fiat-backed stablecoins, 16 have "USD" in their names.

Data Source: rwa.xyz

Despite the continuous development of blockchain technology over the past 16 years, public perception of it has not changed significantly. Early supporters of Bitcoin hoped it could challenge the global dominance of the dollar. However, over time, Bitcoin has gradually been viewed as "digital gold," a tool for storing wealth rather than a medium of exchange. In this regard, Bitcoin's threat to the dollar has significantly diminished.

At the same time, the rapid rise of stablecoins and RWA (real-world assets) is fulfilling Bitcoin's initial promise, providing a more stable and practically beneficial medium of exchange for blockchain. This development has not diminished the importance of the dollar; rather, it has further amplified the dollar's global influence through blockchain technology.

The Rise of Stablecoins in Emerging Markets

In emerging markets, dollar-backed stablecoins have become a practical financial tool, providing an alternative for those holding cash or relying on fragile banking systems. In countries experiencing currency devaluation or economic instability, merchants and residents often prefer the stability of digital dollars.

The report from Castle Island and Brevan Howard surveyed existing cryptocurrency users in countries such as Nigeria, Indonesia, Turkey, Brazil, and India, revealing the significant role of stablecoins in these markets:

Savings Demand: 47% of respondents indicated that their primary use of stablecoins is to save in dollars. This figure is just slightly below the 50% who use stablecoins for cryptocurrency or NFT trading.

Currency Conversion: 69% of respondents have exchanged local currency for stablecoins unrelated to trading activities, indicating a broad demand for stablecoins beyond payments and savings.

Future Expectations: 72% of respondents expect to increase their use of stablecoins in the future, reflecting the potential of this tool in emerging markets.

Whether for ordinary consumers saving small amounts or multinational corporations, as economic entities lean towards the safest and most liquid financial instruments, dollar-backed stablecoins are gradually squeezing the use of local currencies. This phenomenon indicates that stablecoins not only provide practical application scenarios for blockchain technology but also further consolidate the dollar's position in the global economy.

2025 Stablecoin Legislation: A Wise Move in U.S. Interests

As the legislative process advances, there is widespread expectation that the Trump administration will push for regulatory frameworks centered on stablecoins. Patrick McHenry's stablecoin bill has garnered bipartisan support; it was initially proposed in 2023 and recently submitted to the House for review by Congresswoman Maxine Waters. For a long time, stablecoin legislation has been seen as an important first step toward clarifying U.S. cryptocurrency regulation. We believe that by 2025, substantial progress will be made in this area, especially as policymakers gradually recognize the strategic significance of stablecoins in expanding the dollar's global influence.

The widespread use of stablecoins aligns with U.S. national interests. They not only increase the proportion of global transactions denominated in dollars but also create demand for U.S. Treasury bonds as collateral. For a country with $37 trillion in outstanding debt, stablecoins and cryptocurrencies provide an innovative distribution channel.

Stablecoins vs. CBDCs: Essential Technical Differences

It is important to clarify that fiat-backed stablecoins and central bank digital currencies (CBDCs) are two similar but fundamentally different technologies and should not be conflated.

In a report released by J.P. Morgan in October 2025, it was mentioned that new technologies promoting payment autonomy are one of the potential drivers of de-dollarization. They cited projects like mBridge—a digital currency initiative developed by multiple central banks—as a possible alternative to dollar transactions.

Although the rise of foreign CBDCs and other payment systems has indeed increased pressure for de-dollarization, we believe that the rapid development of dollar-backed stablecoins effectively offsets this trend. In our view, stablecoins built on decentralized and permissionless blockchain technology will become a more popular choice due to their stronger privacy protection, censorship resistance, and multi-platform interoperability.

Stablecoins and Tokenized Treasuries: A New Driver for U.S. Treasury Demand

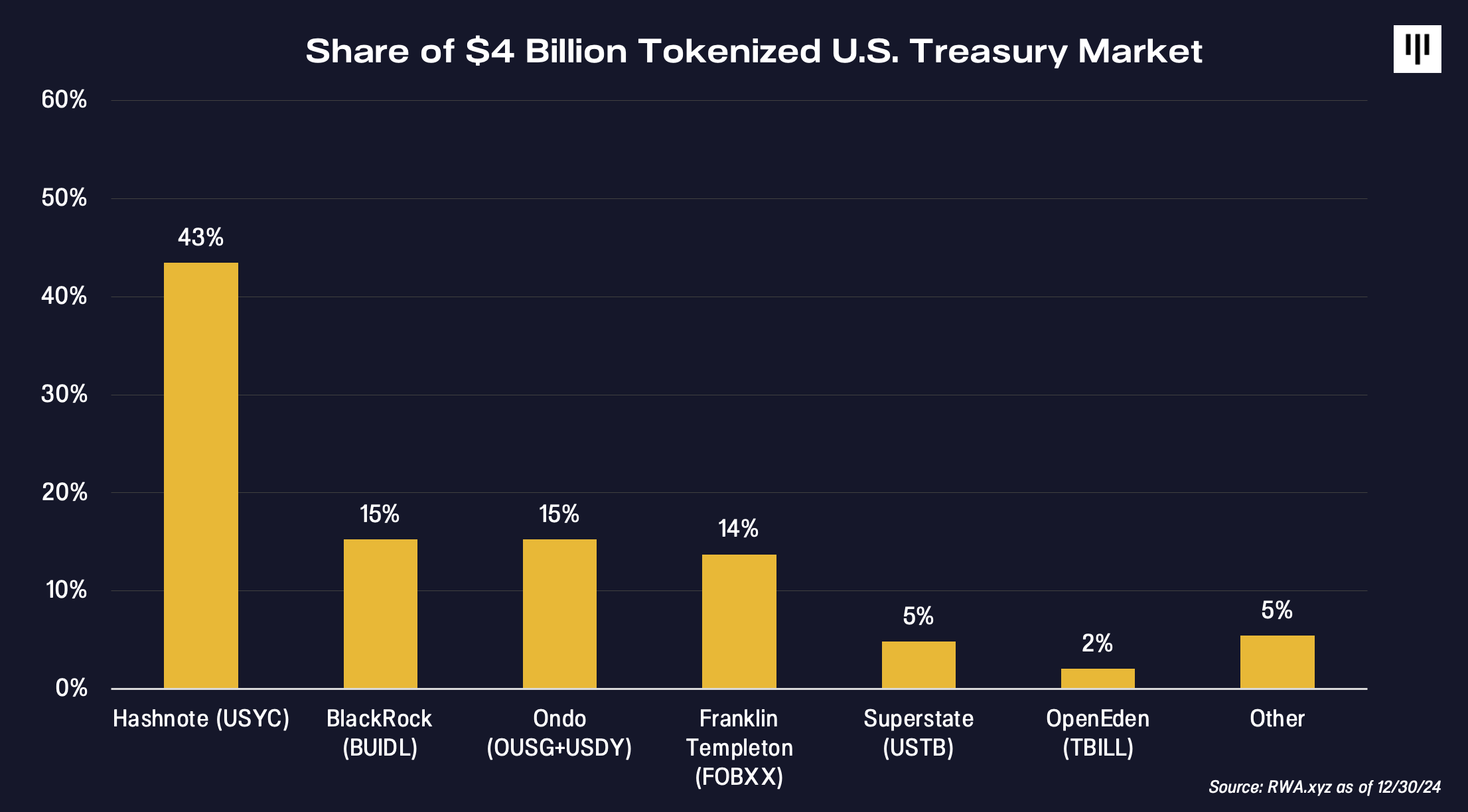

According to the U.S. Treasury, approximately $120 billion in stablecoin collateral is currently directly invested in U.S. Treasuries, significantly increasing market demand for short-term Treasuries. In addition to stablecoins, the direct tokenization of U.S. Treasuries has also become an emerging trend. Digitizing Treasuries through blockchain technology not only enhances their liquidity but also provides investors with a more convenient trading method.

Currently, companies like BlackRock (through Securitize), Franklin Templeton, Hashnote, and Pantera investing in Ondo are leading in this market, which is approximately $4 billion in size. This trend indicates that blockchain technology is not only showing potential in the payment sector but is also having a profound impact on the digitization of traditional financial assets.

Ondo has launched two core products in the on-chain asset space, aimed at providing investors with more convenient and efficient investment channels:

USDY (U.S. Dollar Yield Token): USDY is a tokenized note backed by short-term U.S. Treasuries and bank deposits. This product is designed for non-U.S. investors, offering stable and high-quality returns while simplifying access to dollar-denominated assets.

OUSG (Ondo Short-Term U.S. Government Bonds): OUSG provides liquidity exposure to short-term U.S. Treasuries, allowing qualified investors to mint and redeem instantly. This flexibility enables investors to manage their asset allocation more efficiently.

Compared to traditional channels, products like USDY offer overseas investors a simpler and more convenient way to access dollar and U.S. Treasury assets.

A New Era of Dollar Dominance: Empowered by Blockchain

Blockchain technology has not only failed to weaken the global supremacy of the dollar but has further consolidated its core position through digital infrastructure. Even in the face of de-dollarization pressures from geopolitical and technological changes, the tokenization and liquidity capabilities of dollar assets globally make them irreplaceable.

J.P. Morgan noted in its report that the dollar's dominance is supported by three strong structural factors:

Deep Capital Markets

Rule of Law

Institutional Transparency

These advantages are unmatched in the current global financial system, and the emergence of stablecoins extends these characteristics into a digital and borderless context.

In fact, the dollar has become the biggest beneficiary of blockchain technology. The "killer application" of blockchain may very well be the dollar itself, indicating that technology can not only transform traditional power structures but also further reinforce them. As regulatory frameworks gradually improve and demand for tokenized assets surges, the on-chain migration of the dollar will further solidify its position as the cornerstone of global finance. Regardless of whether U.S. regulators are from the Democratic or Republican party, they will support any force that can increase demand for U.S. Treasuries, making relevant regulatory progress almost inevitable.

Three Major Trends in DeFi: On-Chainization of Real-World Assets

Author: Mason Nystrom, Junior Partner

With improvements in user experience and the increasing maturity of protocols, DeFi is rapidly evolving, attracting more users and capital. In my blog post, I explore three key trends shaping DeFi. Here is a brief overview of one of the trends:

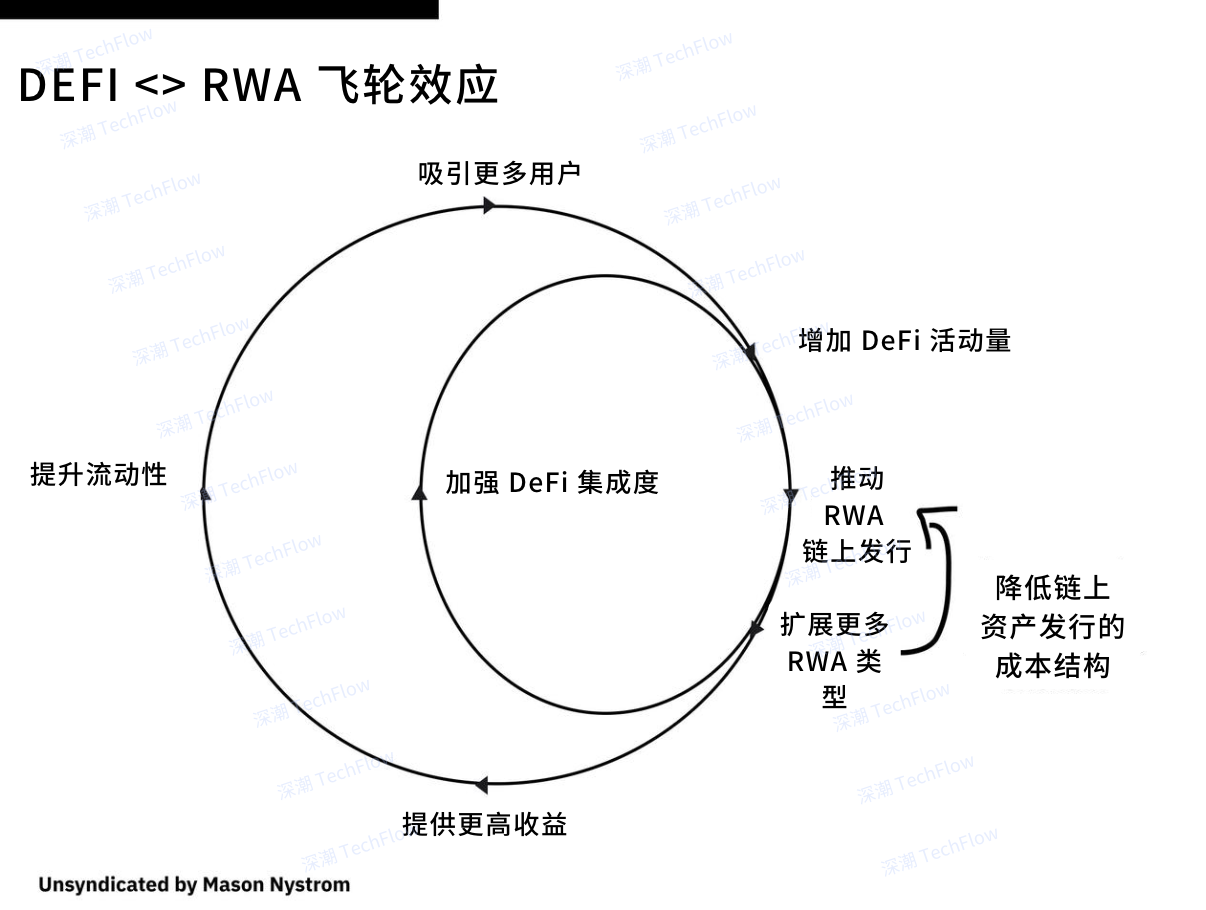

RWA Flywheel Effect: From Endogenous Growth to Exogenous Growth

Since 2022, the high-interest-rate environment has driven a significant migration of real-world assets (RWA) on-chain. Asset management giants like BlackRock have recognized that bringing RWAs on-chain can yield the following significant advantages:

Programmable Financial Assets: Automation of operations through smart contracts.

Lower Cost Structure: Reducing the costs of asset issuance and maintenance.

Higher Accessibility: Allowing more investors to access quality assets.

These advantages are similar to stablecoins, bringing a tenfold efficiency improvement compared to traditional financial systems.

According to data from RWA.xyz and DefiLlama, RWA currently accounts for 21%-22% of assets on the Ethereum chain. These assets primarily exist in the form of A-rated U.S. Treasury bonds, with their growth benefiting from the high-interest-rate environment. However, even if the macroeconomic environment changes in the future, the trend of tokenizing on-chain assets has already taken root on Wall Street, paving the way for more RWAs to go on-chain.

As traditional assets gradually migrate on-chain, this will trigger a compound growth flywheel effect, accelerating the integration and replacement of traditional financial tracks with DeFi protocols.

Original image from Mason Nystrom, compiled by Deep Tide TechFlow

Why is this important? The growth of the cryptocurrency market can be attributed to two important sources: endogenous capital and exogenous capital.

Currently, most of the funding for decentralized finance (DeFi) is endogenous, meaning that this capital primarily circulates within the DeFi ecosystem and can achieve self-growth through on-chain activities. Nevertheless, the development of DeFi often exhibits strong cyclicality: market rises, corrections, and then re-circulation. However, over time, new financial tools (or "financial primitives") continue to emerge, gradually expanding the overall market size of DeFi.

For example, on-chain lending protocols (such as Maker, Compound, and Aave) have expanded the application scenarios of DeFi by allowing users to obtain leverage using crypto assets as collateral. The emergence of decentralized exchanges (especially automated market makers, AMMs) has not only increased the variety of tradable tokens but also significantly enhanced on-chain liquidity. However, the endogenous growth capacity of DeFi is limited. Although speculative behavior in on-chain assets (i.e., endogenous capital) has developed cryptocurrencies into a mature asset class, the next wave of growth for DeFi must involve the introduction of exogenous capital—traditional financial capital from outside the chain.

Real-world assets (RWA) provide a tremendous opportunity for this. RWAs include traditional assets such as commodities, stocks, private credit, and foreign exchange, representing a substantial amount of potential exogenous capital that can help DeFi break through the limitations of internal capital circulation. For instance, just as the stablecoin market needs to achieve growth through real-world use cases (such as cross-border payments or savings tools), other DeFi activities (such as trading and lending) also require similar injections of exogenous capital.

Looking ahead, the direction of DeFi's development is to migrate all financial activities onto the blockchain. We anticipate that the expansion of DeFi will proceed along two parallel paths: one is endogenous expansion through increased on-chain primitive activities, and the other is exogenous expansion through the on-chainization of real-world assets.

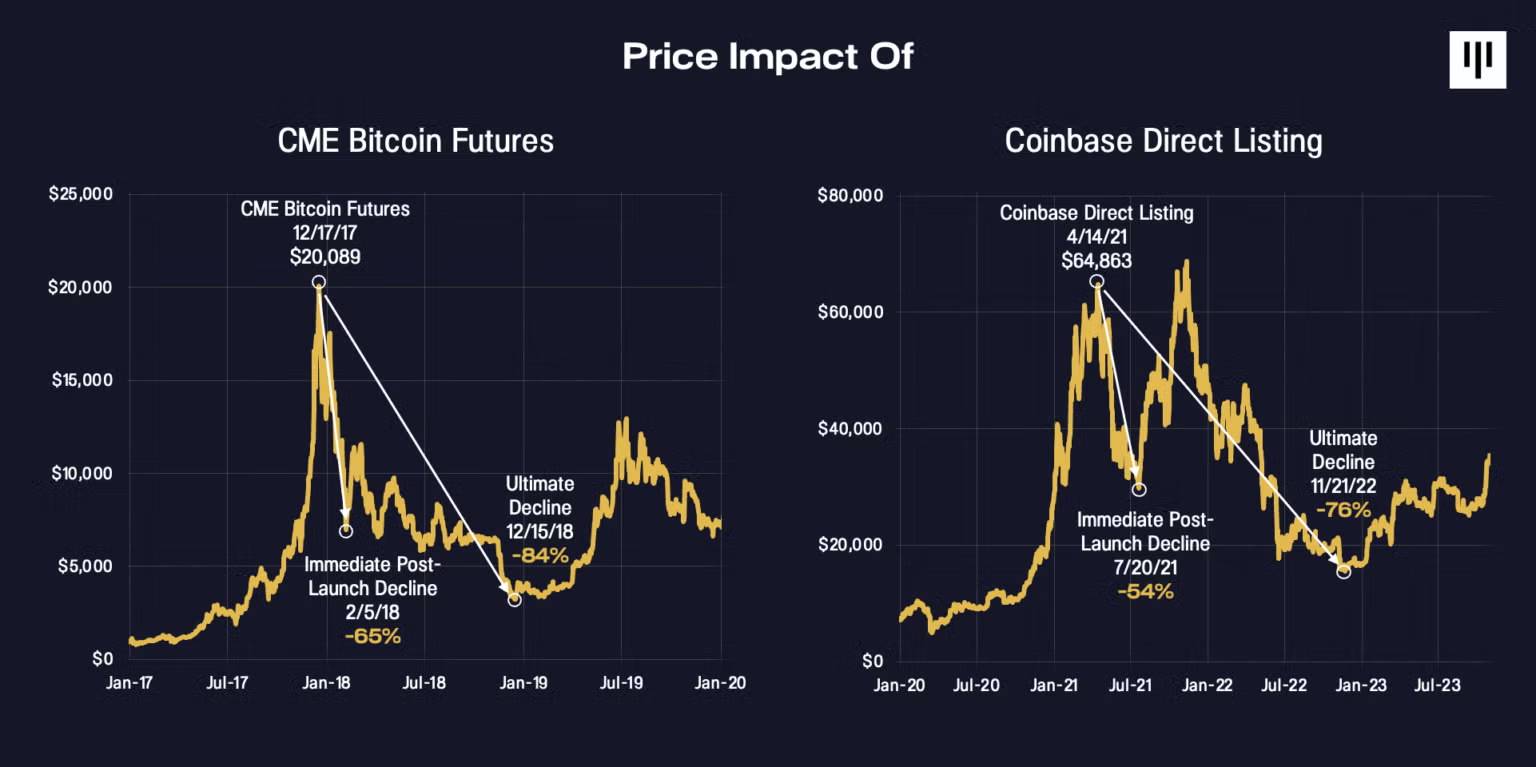

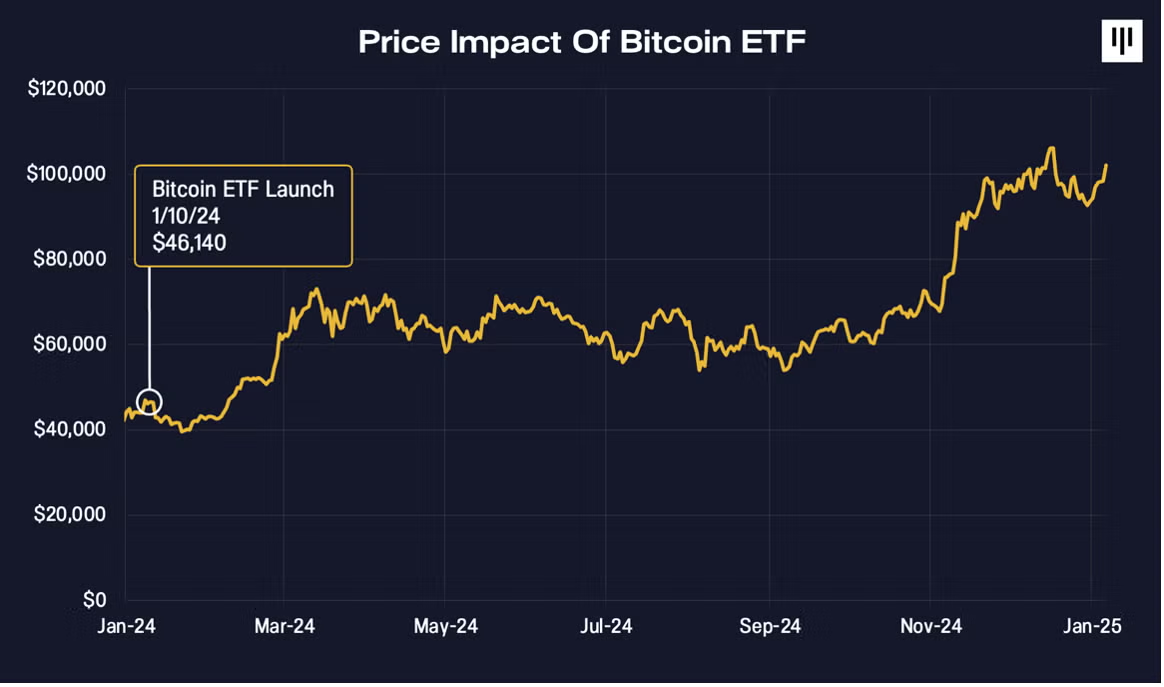

“BUY THE RUMOR, BUY THE NEWS”: The Success Case of Bitcoin ETF

A year ago, we published an article in the November blockchain letter titled "The Upcoming Bitcoin ETF: BUY THE RUMOR, BUY THE NEWS."

We put forth the viewpoint: Although "BUY THE RUMOR, SELL THE NEWS" is a classic operational logic on Wall Street, this rule may not apply to the launch of spot Bitcoin ETFs. In fact, this prediction has been validated.

Since the launch of the Bitcoin ETF, the price of Bitcoin has risen by 103%.

BlackRock's Bitcoin ETF surpassed the total asset size of its gold ETF launched 20 years ago just 11 months after its launch. This achievement is regarded as "the most successful launch in ETF history," with its asset size surpassing $50 billion at a speed five times that of the second-fastest ETF.

Next month, I will delve into why the impact of the U.S. elections has not yet been fully understood by the market and has not been reflected in Bitcoin's price. I believe the U.S. elections will become another typical case of "buy the rumor, buy the news."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。