Author: Frank, PANews

At the beginning of 2025, the new listing activities in the SVM track on Solana frequently ignited discussions in various crypto communities. First, the Sonic SVM airdrop sparked conversations on social media, followed by another Solana ecosystem project, Solayer, announcing an upcoming community sale, once again fueling the market's fervent imagination about wealth opportunities.

According to several social media accounts, due to Solayer's KYC rules, accounts reselling overseas KYC information have seen price increases, and many crypto influencers humorously shared images of collecting KYC information in African countries. In light of this excitement, Buidlpad, the partner collaborating with Solayer for this sale, urgently announced on January 13 that the community sale would be postponed by three days to January 16 to ensure fair distribution, as the number of registrations far exceeded expectations.

Is the hype around Solayer a new market expectation for the SVM track, or does the project itself have the potential to be a dark horse?

From Re-staking to Hardware Acceleration: Three Narrative Changes in One Year

Solayer is a relatively young project, established in 2024. In less than a year since its inception, Solayer has undergone multiple narrative shifts, seemingly hitting the market trends each time.

Initially, Solayer was positioned as a re-staking protocol. After its mainnet launch in August, it quickly became a hot re-staking protocol on the Solana chain. In the same month, it successfully completed a $12 million seed round of financing, led by Polychain Capital, with participation from Binance Labs and Arthur Hayes' family office, Maelstrom, achieving a post-investment valuation of $80 million. Previously, Solayer had also completed an undisclosed Pre-Seed round of financing, with investors including Solana co-founder Anatoly Yakovenko and Polygon co-founder Sandeep Nailwal.

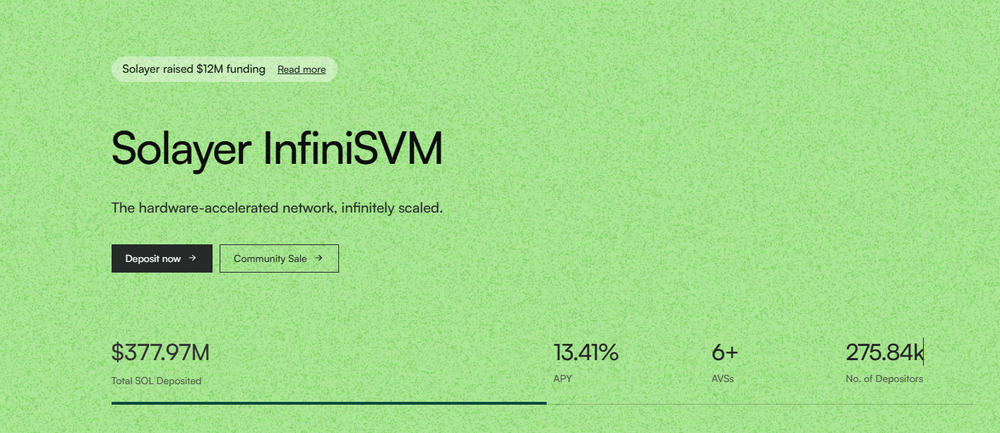

In the re-staking track, Solayer has also achieved impressive results. As of January 13, its official data shows that the current TVL has reached $370 million, with approximately 275,000 depositors and an average annualized return of 13.41%. It ranks ninth in Solana's TVL and sixth among all re-staking protocols.

However, re-staking does not seem to be Solayer's ultimate goal. In October, Solayer introduced the RWA narrative and launched the synthetic stablecoin Solayer USD, which is also based on government bonds, similar to the recently popular USD0 launched by Usual. Currently, this stablecoin has a market cap of about $30 million, ranking sixth in the Solana ecosystem. Of course, this size is still relatively small, only ranking 46th across the entire network.

In December, Solayer quietly updated a blog post titled "Software Scaling Has Reached Its Limits - The Future Lies in Hardware Scaling," stating that issues such as state fragmentation, throughput limitations, latency and costs, and system complexity have led to a bottleneck in software upgrades for Ethereum's EVM Layer 2 networks. It noted that the high performance of Solana and Sui comes from software simplification and hardware acceleration. However, in this article, Solayer did not disclose its next steps to upgrade hardware to become the fastest network in the ecosystem.

One Million TPS, 100Gbps: Technical Narrative Still Effective

On January 7, Solayer released its 2025 roadmap, announcing that through hardware scaling, it would launch the first novel hardware scaling SVM capable of achieving 1M TPS and 100Gbps. PANews learned from reviewing the white paper about the technical principles behind Solayer's goal of achieving million-level TPS and 100Gbps bandwidth. The core of the technology comes from a hardware acceleration technology called Infiniband RDMA, which enables microsecond-level inter-node communication. This technology can be divided into two parts: Infiniband (wireless bandwidth), a high-performance network architecture used for efficiently connecting computing nodes, storage systems, and other devices, widely applied in supercomputers and data centers.

The other core technology is RDMA (Remote Direct Memory Access), which allows devices to access the memory of remote nodes directly without operating system intervention. This "zero-copy" communication method significantly reduces CPU load and communication latency. It is understood that these two technologies are currently mainly used in high-performance computing (HPC), artificial intelligence and machine learning, finance, and distributed storage. Solayer is likely the first to adopt this technology in blockchain networks. As of now, it remains uncertain whether this technology can be realized.

From the team's experience, Solayer's founder Rachel Chu was a core developer at Sushiswap, and another co-founder, Jason Li, graduated from the University of California, Berkeley, with a degree in computer science and previously created the non-custodial Web3 wallet MPCVault. Additionally, on January 8, Solayer announced the acquisition of the smart contract mixing company Fuzzland, with one of the tasks of this acquisition being to focus on building hardware-accelerated SVM chains.

Community Sale Sparks Participation Surge

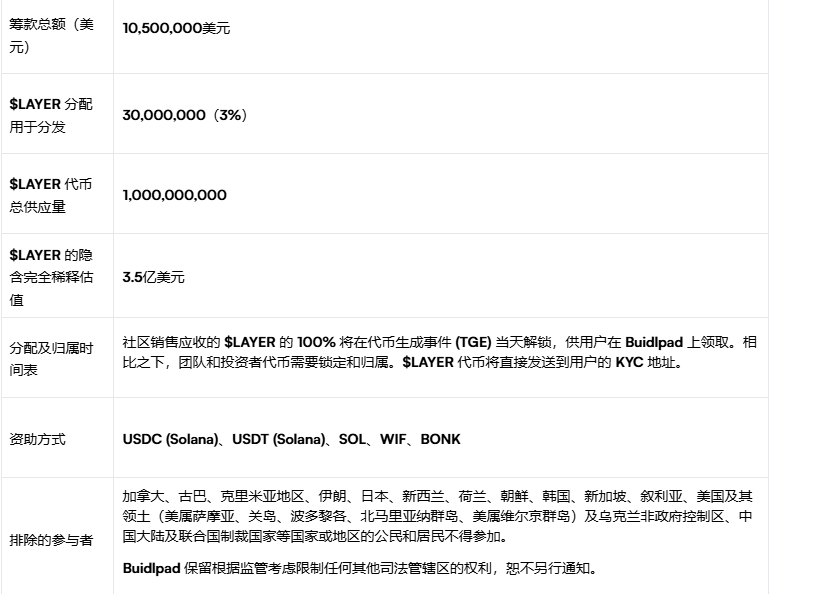

On January 9, Solayer announced a partnership with Buidlpad for its first community sale. According to the information released, the total issuance of the LAYER token is 1 billion, with 30 million tokens available for this sale, raising a total of $10.5 million, with an average token price of about $0.35, resulting in a token valuation of $350 million. 100% of the LAYER tokens in the community sale will be unlocked on the day of the token generation event (TGE).

In addition to the token sale, Solayer also launched a debit card called the Solayer Emerald Metal Card, a virtual + physical debit card in collaboration with Visa, usable online and offline for exports and legal expenditures. The exact timeline for this product will be announced separately by Solayer. Users participating in this sale have the chance to receive the Solayer Emerald Metal Card. Previously, it was common to see token sales offering whitelists to users holding certain hardware or products, but Solayer's model of giving cards with token purchases is relatively rare.

Regardless of the reasons, various crypto studios and many crypto KOLs have been sharing tweets about rushing to register for KYC on social media. If we compare it to the recently launched Sonic SVM token, the SONIC token currently has a market cap of about $240 million, with a fully diluted market cap of about $1.6 billion. Given that the market seems to have higher expectations for Solayer, even with a projected market cap of $1.6 billion, the appreciation potential for LAYER appears to be around 4-5 times.

Under these expectations, the KYC for LAYER subscriptions is particularly hot. According to Buidlpad, the current number of registrations is more than 15 times the expected amount, and they have also noticed a large number of bots and crypto studios. Therefore, they had to pause registrations and delay the sale to January 16.

Of course, we cannot predict the performance of LAYER after its launch. However, looking at Solayer's development journey over the past year, from re-staking to RWA, and then to hardware acceleration and crypto payment cards, we can see that this team has substantial experience in narrative and rhythm management. They have followed a similar path to Hyperliquid, delivering products before technology. If the technical and operational capabilities behind it can match, achieving the goal of million-level TPS and a new technological milestone of millisecond-level transaction speeds, Solayer will truly become the next rising star that cannot be ignored. The outcome of all this will depend on when Solayer can bring its product to market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。