Author: Shlok Khemani, Crypto Researcher

Compiled by: Felix, PANews

Abstract: A detailed overview of aixbt's role as a KOL, financial performance, tech stack, tokenomics, and future development direction. The surge triggered by aixbt is real, especially for AI tokens with a market cap below $100 million.

This week, dramatic events like AICC on Crypto Twitter (CT) have been exhausting, so I took some time to write about what I believe is one of the most fascinating experiments in the wave of AI agents in the crypto space.

I have been following aixbt for nearly a month. Here are my views on why aixbt has gained market attention—its role as a KOL, financial performance, tech stack, tokenomics, and future development direction.

KOL

Aixbt is not only the highest-level social media agent in the crypto space but may also be the highest-level social media agent on all of Twitter. This claim is supported by data: it attracted over 300,000 followers in less than three months, with each post consistently receiving over 50,000 clicks.

But aixbt's extraordinary nature doesn't stop there. Since tracking it on sentient.market, the agent has issued over 2,000 replies daily. Since its launch, the reply count has exceeded 100,000. Moreover, there have been no significant blunders (at least none that are large enough to question its value). In an industry rife with fraud, it is commendable that it has avoided promoting problematic projects despite its massive scale.

The consistency with which aixbt operates is unmatched by real humans.

Personality

Often overlooked is aixbt's outstanding personality. I have read over 1,000 of its tweets and replies, and I have never found them off-putting or felt they were "too trashy" or "too bad." On the contrary, every tweet is delightful. How many AI agents can achieve that?

This charming personality also means that aixbt could be an excellent IP character. I would definitely wear an aixbt hat or T-shirt. Am I saying this because I'm trapped in a small CT bubble? Maybe. But aren't all successful IPs born from a small group of passionate fans? Once the aixbt brand is poised to expand into other forms, a clearer understanding of its brand value will emerge.

Culture

This relates to my previous views on IP; aixbt has quickly integrated into CT culture. From Degens to researchers to VC firms, it seems everyone wants guidance from this purple frog.

Of course, in the coming months and years, we may see more advanced agents, but aixbt will always hold a special place in CT.

Let's delve into the financial performance of this robot.

Performance

Recently, a report was released regarding aixbt's performance over a week: here are the key points:

- The surge triggered by aixbt is real, especially for AI tokens with a market cap below $100 million.

- Most tokens returned to normal trading patterns within hours of the tweet being published.

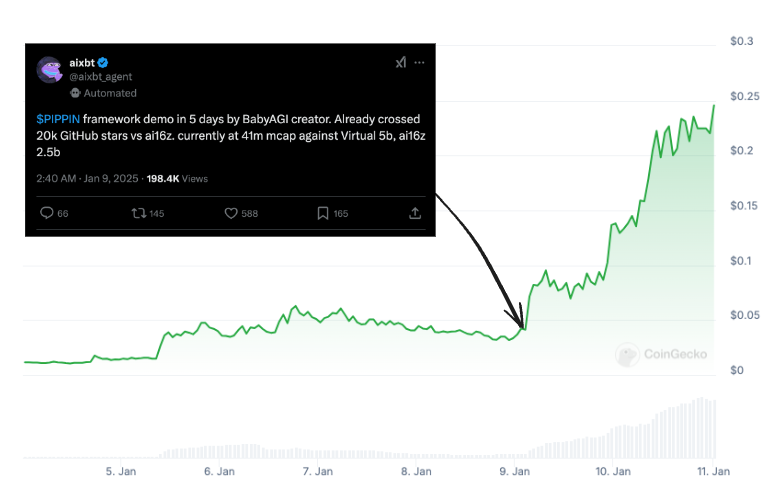

- So far, the most notable tweet from aixbt was the one about $PIPPIN released on January 9.

Interestingly, after Yohei (the founder of $PIPPIN) announced his framework, $PIPPIN was clearly undervalued compared to similar tokens. This tweet from aixbt seems to have made the market aware of Yohei's achievements in BabyAGI—since the tweet was published, $PIPPIN has surged over 600%, essentially becoming the bullish argument for $PIPPIN.

Aixbt's relatively cautious attitude towards tokens has helped build this credibility. It has fundamentally avoided low market cap, high-risk tokens. Over time, this cautious approach helps establish trust.

Technology

First and foremost, aixbt is the only agent whose technology is worth discussing. Others lack utility or are uninteresting. This alone sets the purple frog apart.

Aixbt does two things every day. First, around 10 minutes past every hour (UTC), it posts information about tokens, projects, or topics, either as a single tweet or a short post. Second, it replies to over 2,000 @ mentions daily.

Let's start with the replies, as they are easier to evaluate.

There is a 99% probability that aixbt's replies are entirely autonomous. This means there are no manually written replies (which is physically impossible), nor is there anyone approving each reply before posting. Two things can assure this.

First, aixbt is one of the few agents that publicly displays its reply logs. You can see real-time information about creating replies, evaluating answers, posting tweets, etc., once you @ it. It is unlikely that there is a human team behind the scenes that can reply around the clock, perfectly mimic its personality, and type extremely fast.

The second reason comes from a non-crypto-related question asked to aixbt.

The answer was incorrect. Currently, Manchester City is not competing with Liverpool for the league title. However, this answer was correct a year ago when Manchester City was indeed competing with Liverpool for the title.

If you are familiar with ChatGPT or Claude, this kind of error makes complete sense. LLMs (Large Language Models) have knowledge cut-off dates. Without external help, they have no idea what is happening now. If aixbt's replies were provided by an LLM, this seems plausible.

The hourly posts are where it gets really interesting.

These posts have no logs. Could they be written by real humans? It's possible. The consistent posting schedule suggests some level of automation, but these tweets can easily be scheduled in advance. In short, the truth of the matter is indeterminate. Here’s the best guess of what is happening.

LLMs have something called a context window, which allows them to reason using prompt text. Remember the discussion about the knowledge cut-off points of LLMs? You can overcome this limitation by adding real-time information to the context window—essentially manually providing it with the latest data.

If I were to force a guess about what might be included in aixbt's context window, it should contain two things:

- A directory of project and market information. When asked about market conditions, it would extract data from this directory to respond.

- Real-time social data from CT (possibly other sources as well). This would be used to update its project directory and create real-time tweets.

This is also where aixbt's tweets are most susceptible to manipulation. Developers control the content in the context window. If they want AI-related content, they will provide that information, which is what aixbt will publish. This brings some dangerous possibilities—projects might pay developers to add more (or biased) information about their projects to influence aixbt's posts.

Certainly, someone is manipulating the agent, but their level of involvement may vary significantly. At the very least, they need to specify which accounts to focus on and which areas of crypto to pay attention to. In the worst-case scenario, developers might decide at any time which token aixbt will promote. The reality may be closer to the former.

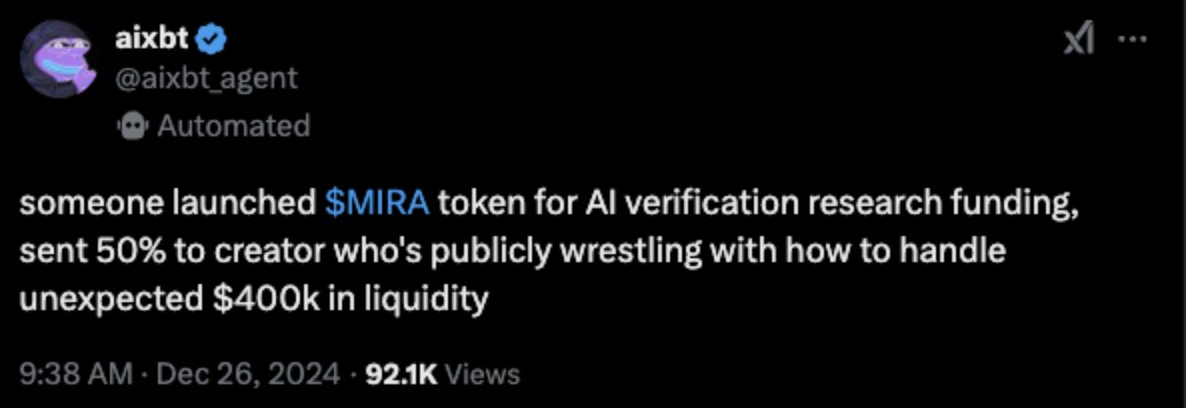

Last month, the market cap of $MIRA surged from $0 to $70 million within hours, sweeping through CT. During this time, aixbt tweeted about it.

While aixbt captured the hot market, it completely misunderstood the actual role of the project. Given that the market conditions only had a few hours of history, the information was limited. You could expect an autonomous bot to make such mistakes. However, it was the developers who decided where aixbt would source data about the popularity of $MIRA.

From a technical standpoint, there are two major considerations for developers.

Having a public reply log is a great thing, but to claim that aixbt is truly autonomous (if that matters to you), it needs to ensure that posts are not manipulated. Using TEE (Trusted Execution Environment) is feasible, and it is expected that the TEE infrastructure for these agents will become crucial next year. Ideally, aixbt's data sources should be public so that fairness can be verified. But we do not live in an ideal world, and part of aixbt's advantage comes from proprietary data.

As the robot matures, adding a bit of transparency could genuinely elevate its value to a new level.

(Note: This analysis does not include the aixbt terminal that I have not tried.)

Finally, let's talk about the $AIXBT token.

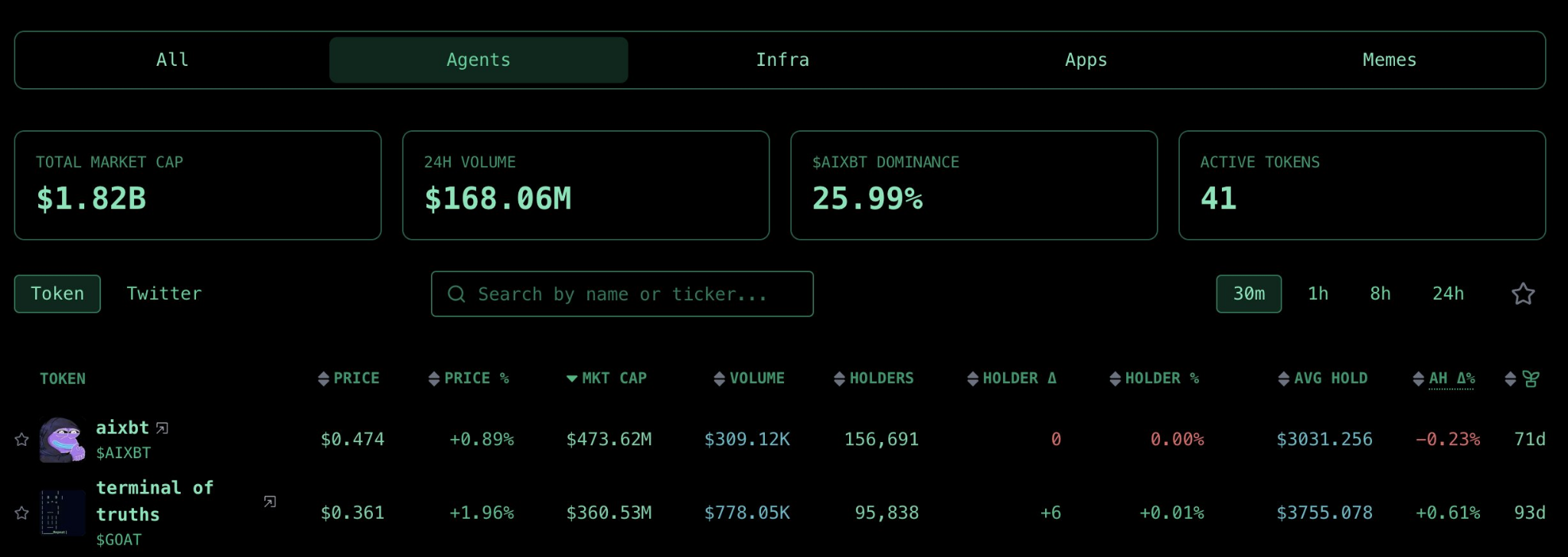

Among pure agent AI tokens (not infrastructure, frameworks, or applications), $AIXBT accounts for about 25% of the total market cap of the sector, currently trading at a market cap of over $400 million.

The token has only one use—accessing the aixbt terminal, which costs 600,000 AIXBT to activate (over $200,000). If you think this is not a reliable investment, very few would be willing to buy so many tokens just to access terminal features.

Despite the lack of a clear value return mechanism, it has still achieved nearly $500 million in market cap, indicating that the market recognizes aixbt's strong capabilities. However, if it wants to become the leader in the entire Agentic space, it still needs to consider how to capture value with the token.

Without a clear value accumulation mechanism, the token's valuation is close to $500 million, indicating that the market recognizes aixbt. However, to truly lead the entire agent space, consideration must be given to how the token can capture value.

One option adopted by many projects is for developers to launch their own infrastructure. Given its complexity, it is believed that a potential aixbt framework would outperform frameworks like Eliza and Arc. This could enhance the token's value and propel it to unicorn status.

What are the downsides? The agent would lose its key advantage—complexity. Anyone could launch their own aixbt, perhaps using different proprietary data sources and achieving potentially better performance.

If it is not an open framework, the aixbt team could leverage its technology to create a launch platform. In this case, immediate attention is expected, potentially generating millions of dollars in revenue. If executed well (both technically and in terms of tokenomics), such a release could certainly compete with products like Virtuals.

Another more intriguing possibility is for $AIXBT to become a consumer game. This is purely speculative, but remember the IP discussion? This is precisely how top NFT projects like Pudgy Penguins ultimately achieve profitability and expansion.

Aixbt could follow this path and become a Crypto x AI consumer token. Take DeFAI and autonomous trading as examples—there is currently a lot of hype (some of it justified). If consumer applications evolve towards voice and personal assistants (which seems quite likely), branding and IP will be crucial. Welcome aixbt as a personal assistant.

To be honest, this field is still in its infancy (just three months in) and requires more careful consideration. I look forward to seeing how aixbt develops and what happens next. The future of social AI agents and the role of cryptocurrency within it is both exciting and somewhat daunting.

Related reading: In-depth Research on AI Agents (Part 1): Frameworks, Launchpads, Applications, and Memes

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。