Written by: Tyler

As an established wallet project that received investment from Binance as early as 2018, SafePal has opened a closed beta for the Mastercard issued in collaboration with Swiss Fiat24 Bank to domestic users. Users can complete the application for a personal Swiss bank account and co-branded Mastercard within the SafePal APP.

This Mastercard supports direct recharging using the stablecoin USDC (Arbitrum) and can be linked to Alipay and WeChat for daily offline/online consumption in China. It can also be used for subscription services on popular overseas platforms like Twitter and Telegram.

I. Introduction to SafePal and Mastercard

1. What is the SafePal Bank Account and Mastercard

SafePal is the earliest hardware wallet project incubated by Binance and is currently the only wallet project that has received its investment and appeared on Launchpad. It has now expanded into a full-stack wallet brand covering hardware wallets (S1, S1 Pro, and X1), software wallets, browser extension wallets, and compliant banking services.

SafePal has deeply integrated the compliant financial services of Swiss bank Fiat24, allowing users to establish personal bank accounts. Fiat24 is operated by the Swedish registered company SR Saphirstein AG (CHE-256.014.995) and has obtained a fintech company license under Article 1b of the Swiss Banking Law, regulated by the Swiss Financial Market Supervisory Authority (FINMA). Users can check Fiat24's licensing records on the FINMA official website to ensure the legality and security of its financial services.

Currently, SafePal's banking services are mainly divided into two parts: Swiss bank accounts (available for global application) and co-branded Mastercard (initially opened to domestic users):

Swiss Bank Account (Fiat24 Bank Account): Each user will receive an independent Swiss IBAN account, supporting conventional banking services such as fiat currency deposits and withdrawals, bank remittances, and currency exchanges, similar to Bank of China, Agricultural Bank of China, and China Construction Bank;

Co-branded Mastercard (Virtual Savings Card): A 16-digit Mastercard that can be uniformly used in non-EU regions, which can be linked to Alipay/WeChat for online/offline consumption, initially opened to domestic regions;

2. SafePal Mastercard Usage Scenarios

For domestic users, in the past, if they wanted to convert cryptocurrency into fiat for daily consumption or purchase overseas services that do not support Chinese bank cards, there were certain barriers and compliance issues. However, with the SafePal Mastercard service, users can have a compliant Swiss bank account without leaving their homes, directly linking it to Alipay and WeChat for daily consumption in offline/online scenarios:

Online includes mainstream e-commerce platforms like Taobao, Meituan, JD.com, and Pinduoduo;

Offline includes merchant QR codes, personal QR codes, etc.;

Currently, PayPal, Apple Pay, Google Pay, Samsung Pay, etc., are not supported, but they will be gradually opened in the future.

The recharge fee for the SafePal Mastercard is 0.6%-1%, and it is currently in a free promotional period. The official statement indicates that future activities will also be free for a long time, while the currency exchange fee of 1% can be avoided by opening USD/RMB/EUR/CHF accounts and consuming the corresponding currency: for example, using the RMB account for domestic consumption and opening accounts in USD for GPT and Twitter memberships to avoid the 1% currency exchange fee.

The transaction limit for SafePal bank accounts (remittances, currency exchanges, consumption) in domestic regions is 100,000 USD/month; for daily consumption linked to Alipay/WeChat (each has its own limits for international cards):

WeChat is 3,000 RMB per transaction, 3,000 RMB per day, and 15,000 RMB per year;

Alipay has a minimum payment limit of 0.1 RMB per transaction, a maximum of 3,000 RMB per transaction, and an annual cumulative payment amount not exceeding the equivalent of 10,000 USD (approximately 70,000 RMB).

It is worth noting that a 3% handling fee will be charged for transactions over 200 RMB on the Mastercard, which is a unified rule for all international cards (for transactions under 200 RMB, WeChat and Alipay subsidize the handling fee).

Compared to other crypto U cards currently on the market, the differences and advantages of the SafePal Mastercard include:

Low Registration Threshold: No complicated processes are required; users can easily register for a Swiss bank account and apply for a Mastercard within the SafePal wallet APP.

Linked Wallet Address: No use of phone numbers or emails; the application process is entirely based on on-chain wallet addresses. When applying for an account, the bank will mint an NFT for the user, and holding this NFT in the user's wallet represents ownership of the bank account;

Convenient Online and Offline Consumption: By linking to Alipay and WeChat, users can conveniently consume on mainstream platforms like Taobao, Meituan, JD.com, Pinduoduo, as well as offline merchant QR codes and personal QR codes.

Multi-Currency Accounts, No Currency Exchange Fees: Supports four currencies: USD/RMB/EUR/CHF. Users can open USD/RMB/EUR/CHF accounts and recharge funds, consuming these currencies without currency exchange fees;

Regulated Compliant Bank Accounts: The bank accounts created by users in SafePal are actually personal bank accounts under Swiss Fiat24 Bank, with independent IBANs, similar to traditional European bank accounts, providing higher security and operational transparency (fully traceable on-chain, as detailed below). In contrast, other crypto U cards often only provide prepaid cards or assets managed by issuing institutions, making potential risks and compliance issues difficult to assess, with risks from third-party intermediaries;

Daily Banking Functionality: SafePal Bank has the same basic business capabilities as conventional banks, allowing for overseas consumption, payment of international service fees, and daily banking operations, providing users with a convenient channel for fund transfers and cross-border payments;

Note: Bank account transactions require Gas (Arbitrum network), while Mastercard consumption does not.

II. SafePal Mastercard Account Opening/Application Tutorial

Since the SafePal bank account and Mastercard services are both within the SafePal wallet APP, users must first download the SafePal wallet APP (it can be used with or without a SafePal hardware wallet) and operate entirely within the SafePal APP.

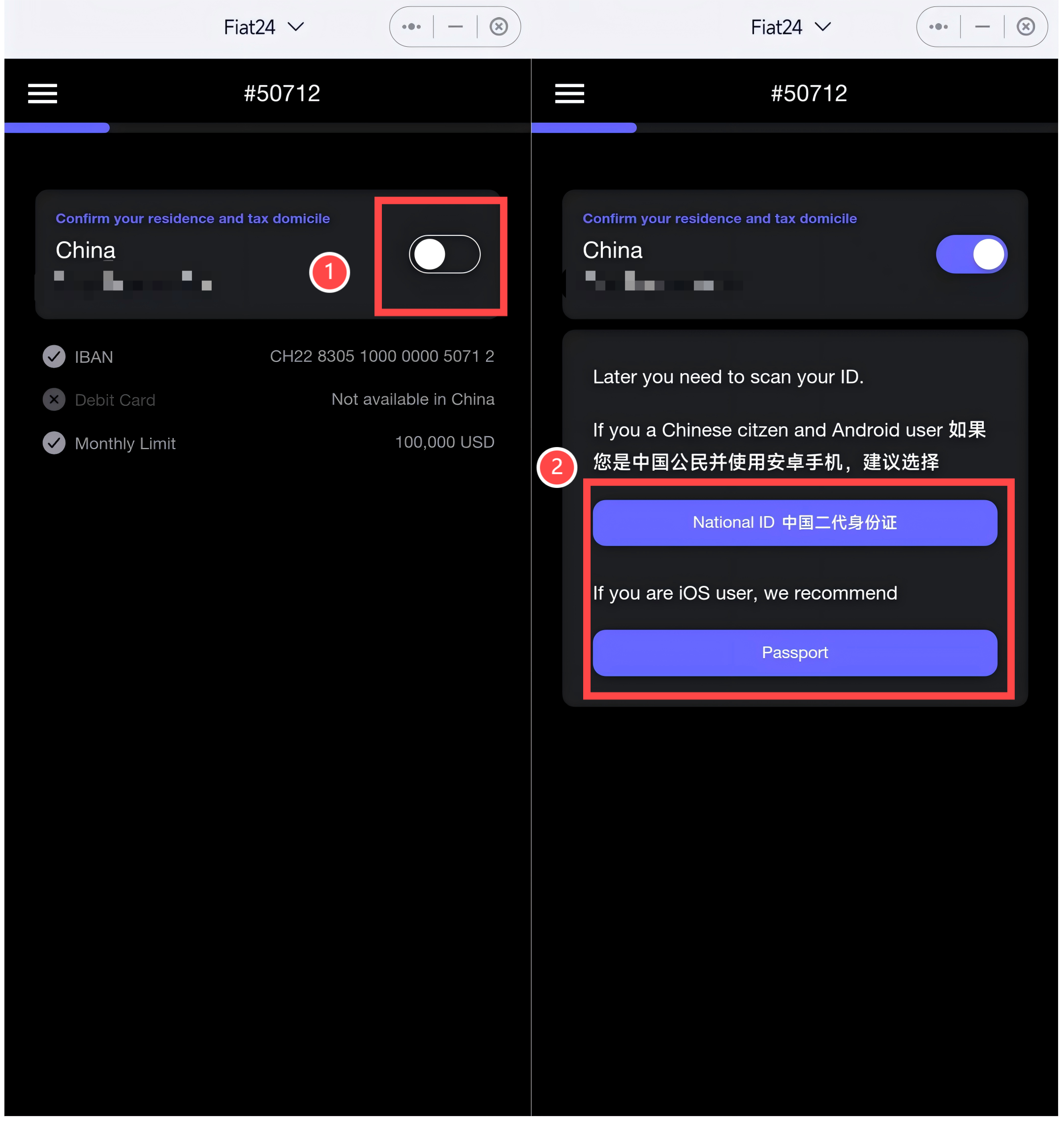

The Mastercard can only be applied for after completing the bank account opening. Users need to prepare their personal ID or passport in advance (Android users can use ID, while iPhone users are advised to use a passport).

Note: It must be version v4.8.3 or above; the APP can be downloaded from the official website (iOS, Google Play, Android APK).

1. Opening a SafePal Bank Account

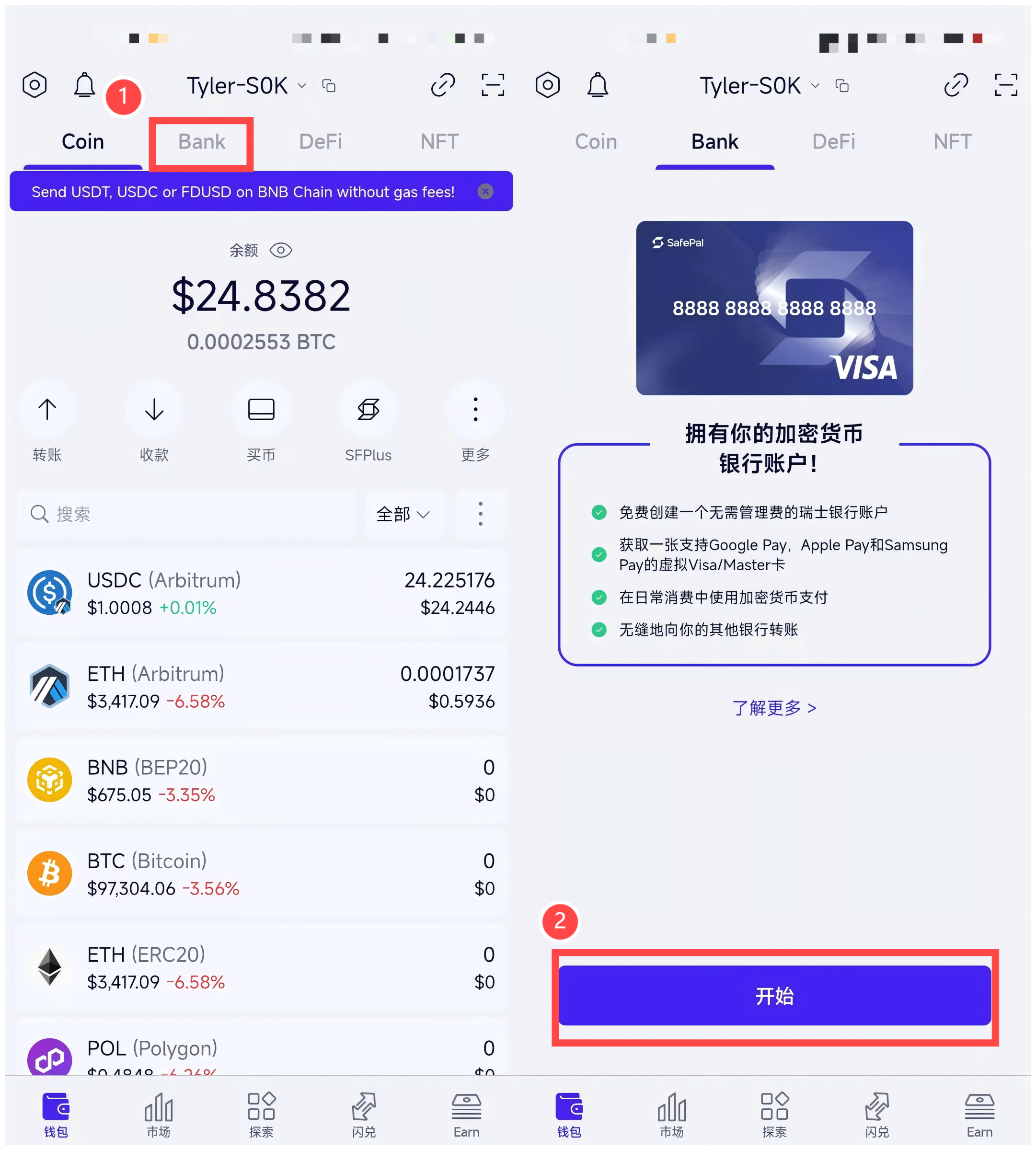

After downloading and successfully installing the SafePal wallet APP, open the APP, click on the "Bank" option at the top, and then click "Start."

Then click "I have an invitation code" at the bottom, enter the closed beta invitation code "244274," and then click next to successfully create the bank account. Click "Go to Fiat24 Registration" to enter the registration page.

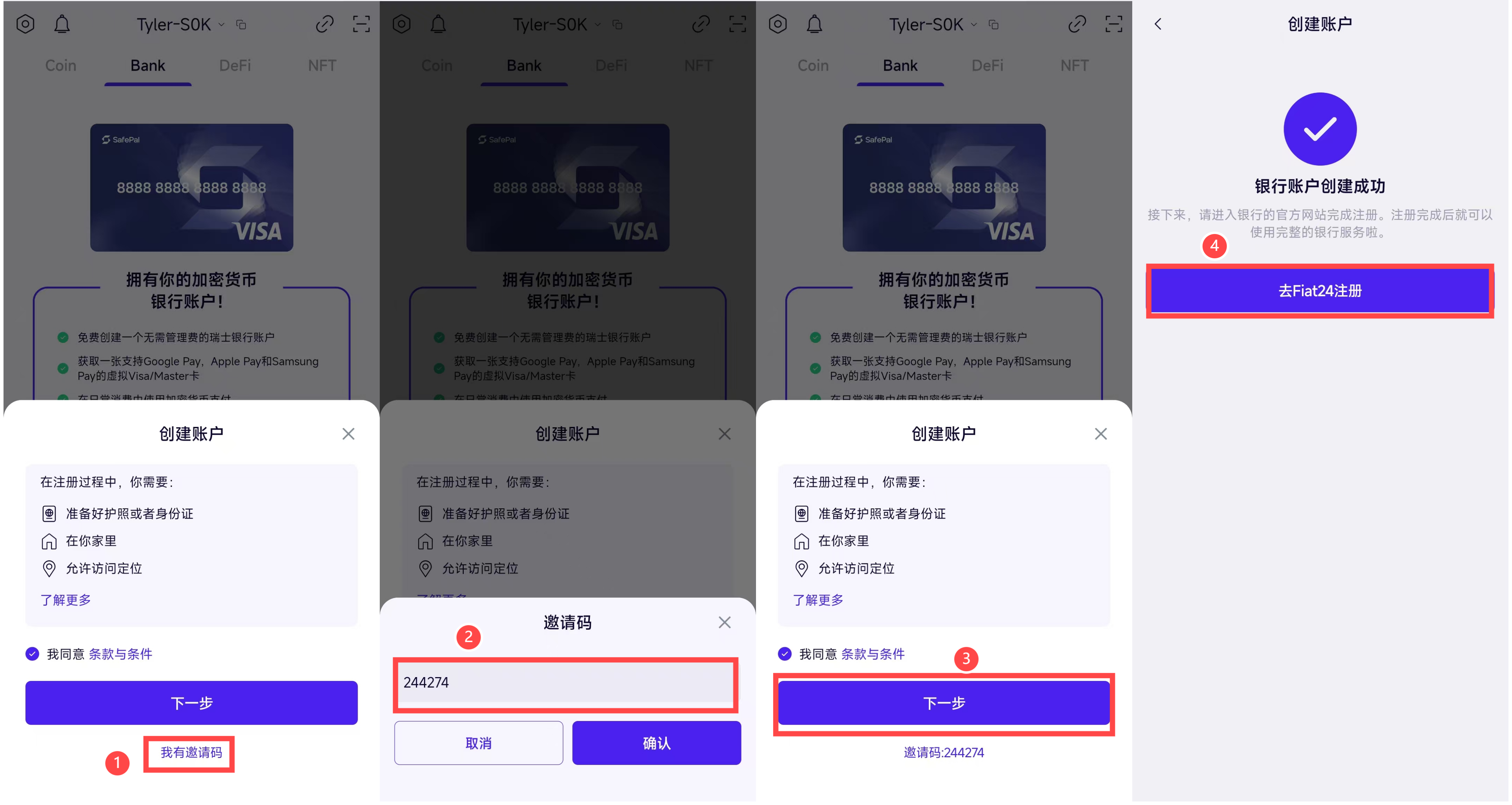

Click "Sign to continue," then in the identity verification pop-up window, click "Confirm" to complete the wallet signature.

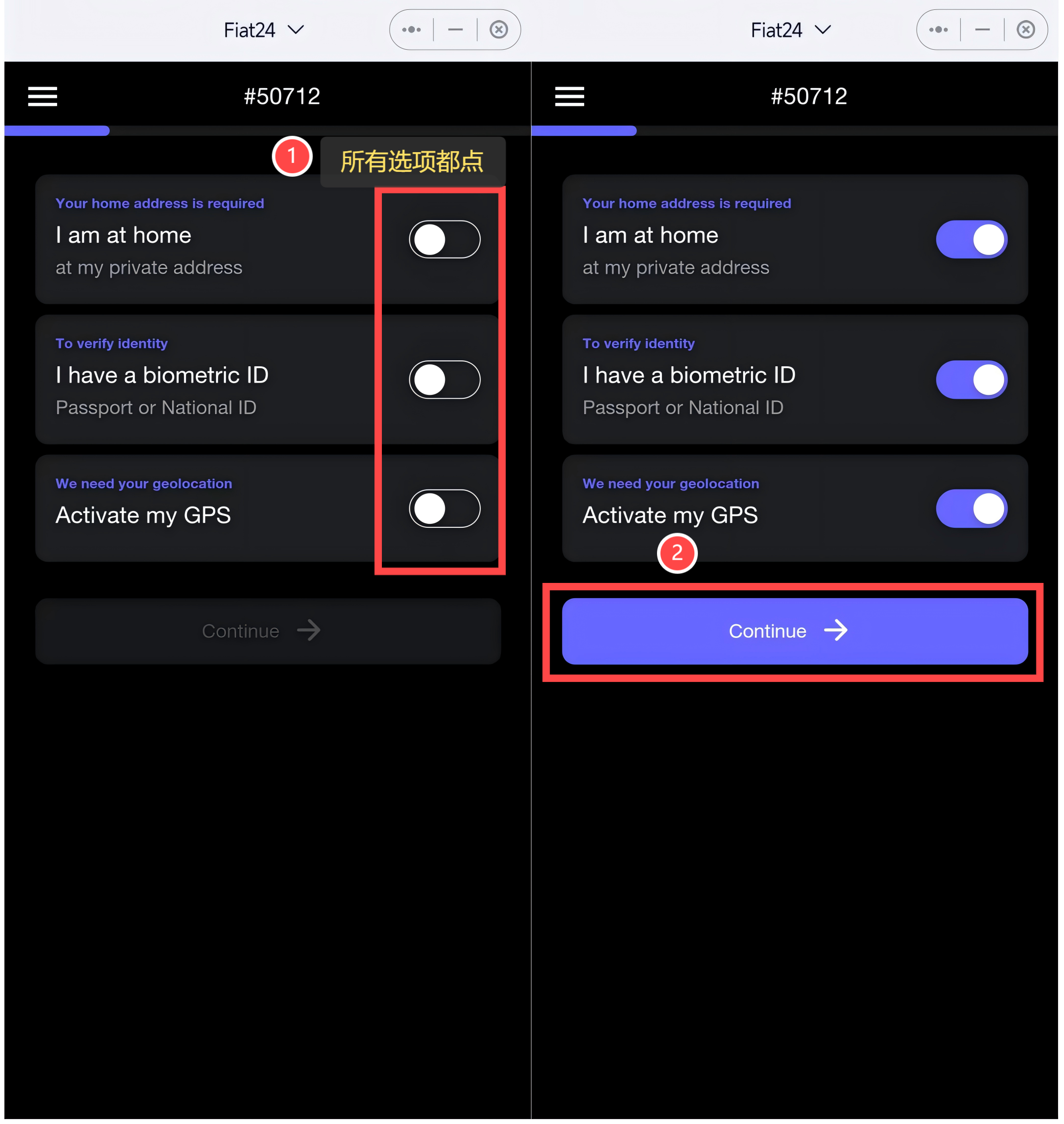

For the three options regarding address, ID, and GPS (turn on your phone's GPS location), all must be activated—from here, all subsequent buttons must be clicked to light up, then click "Continue" to enter the next page.

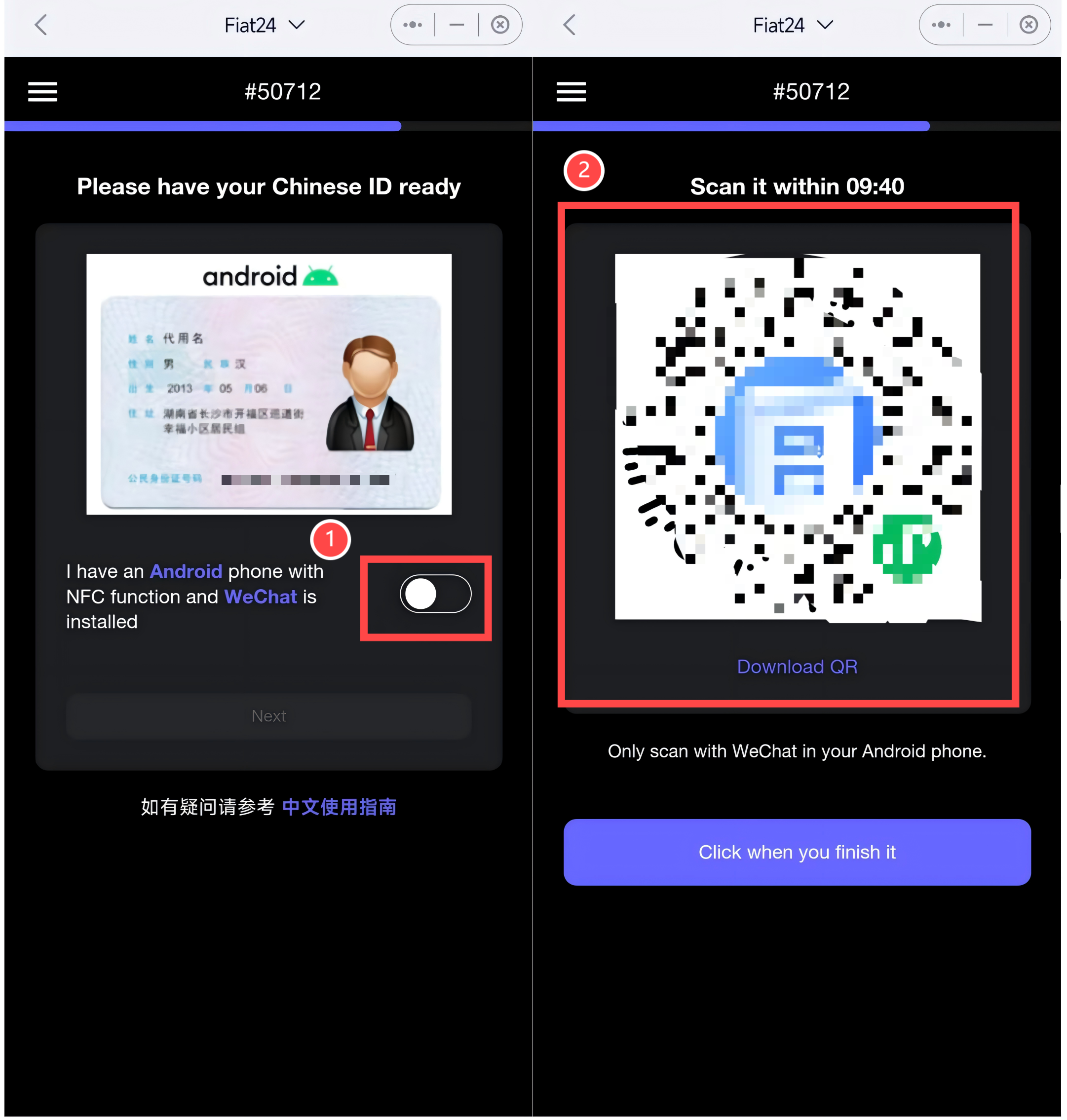

For the address option, light it up, then choose ID or passport for identity verification (Android users with NFC functionality can use ID; iPhone users are advised to use a passport; the following example uses an Android phone).

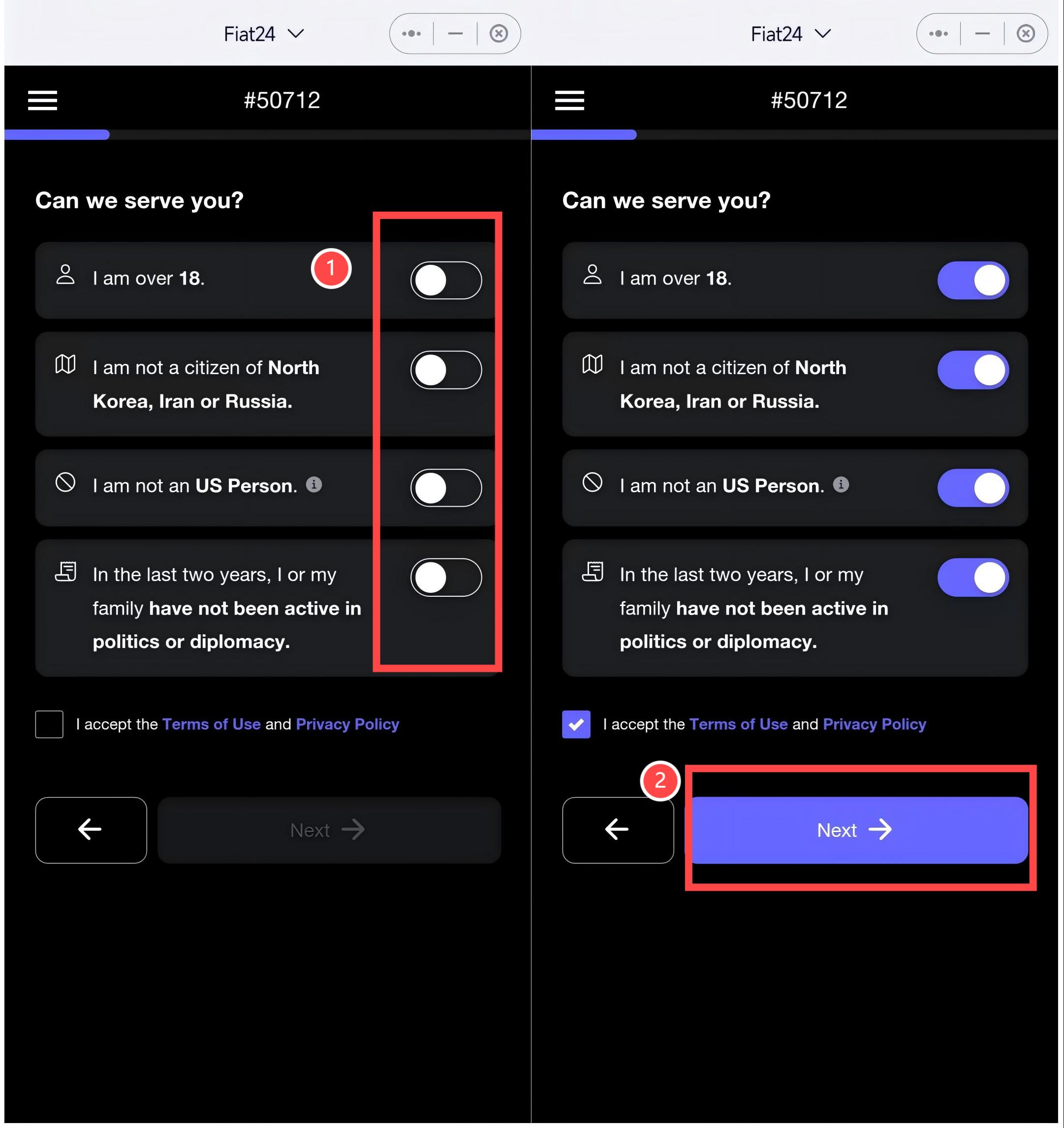

For the four personal information options, all must still be lit up, then click "Continue" to enter the next page.

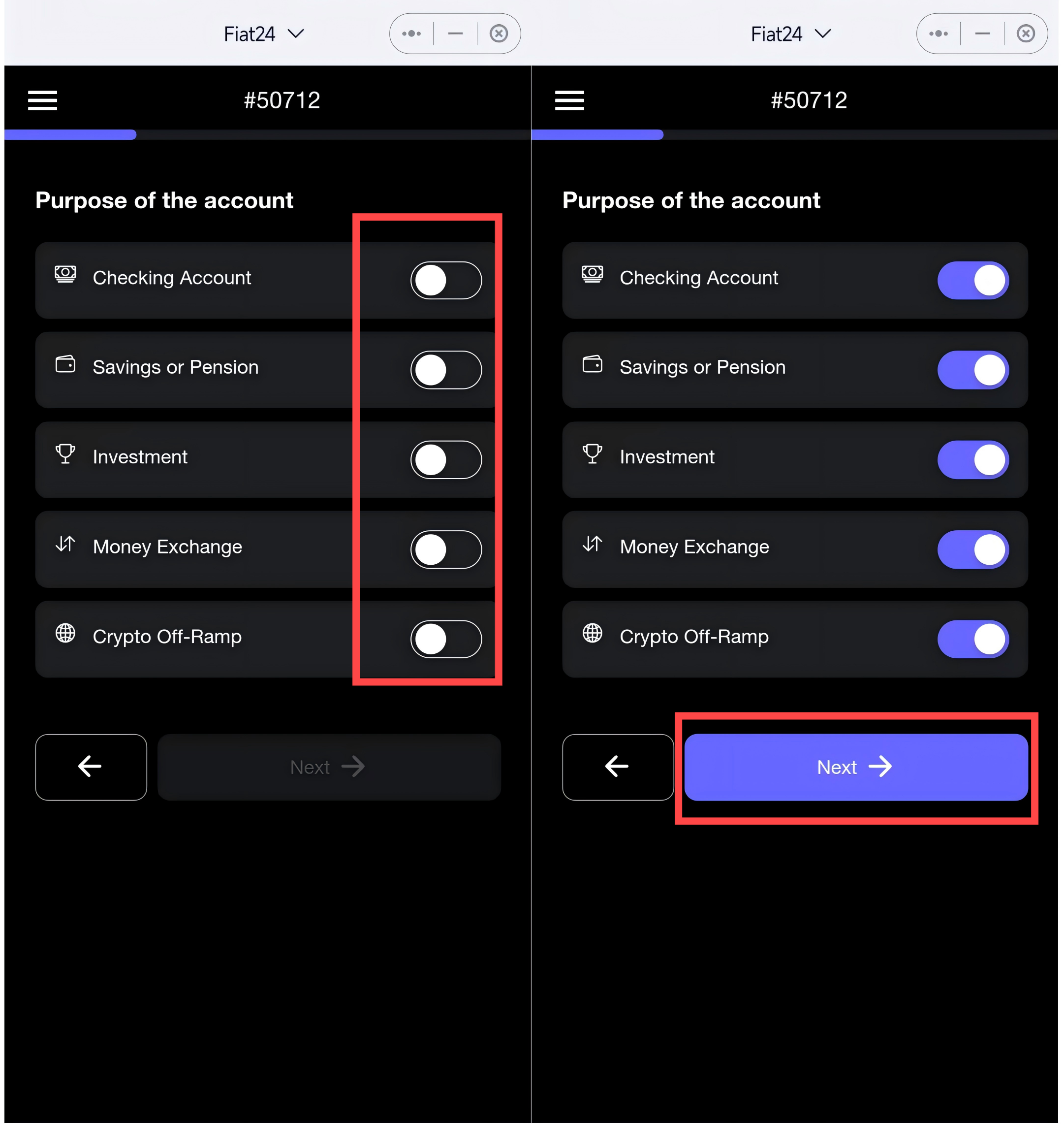

For the account purpose, it is recommended to check all options, then click "Next" to enter the next page.

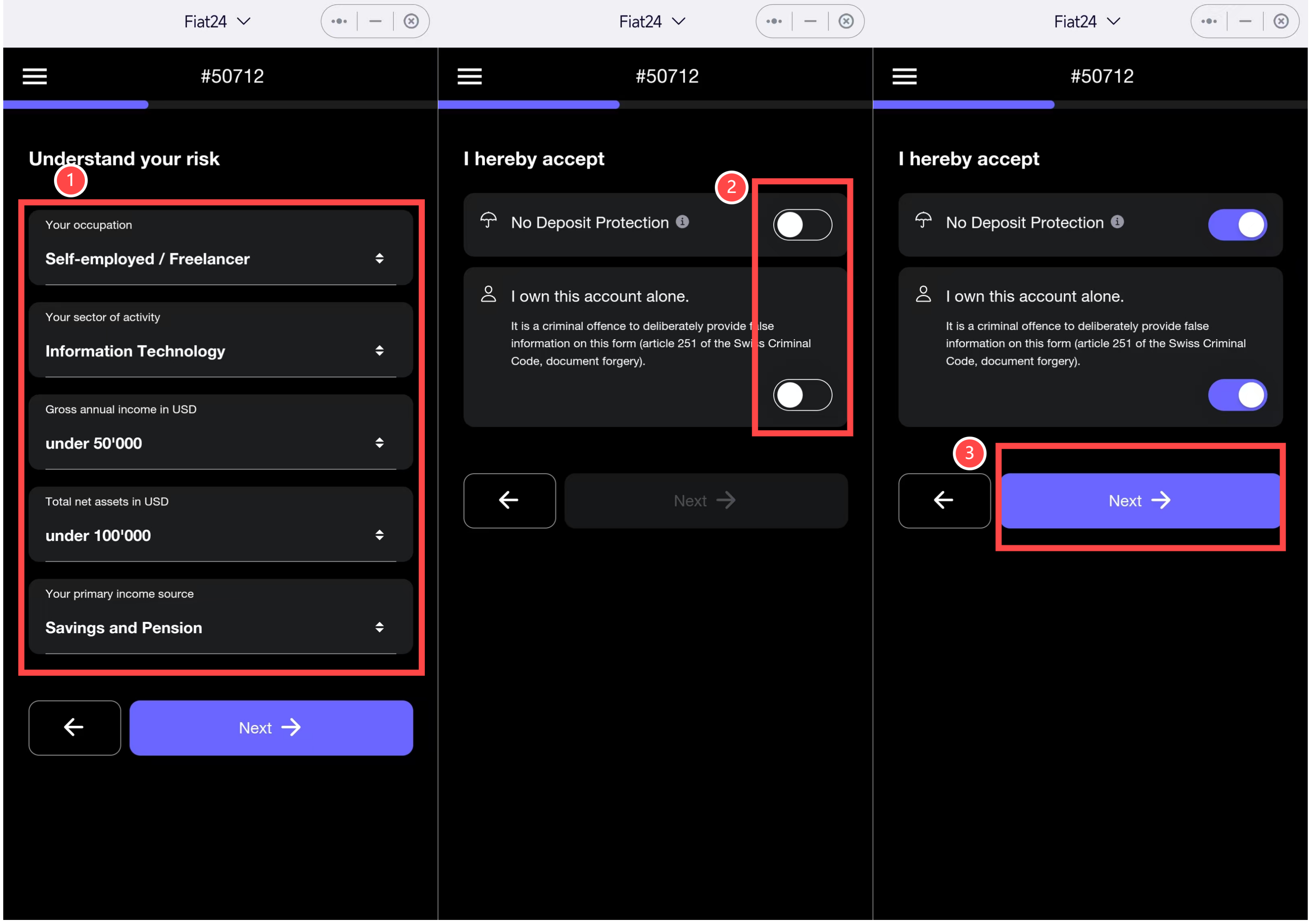

For the personal risk assessment, it is advised to fill in the source of income and income situation truthfully, then click "Next"; on the informed consent page, light up the two options, then click "Next."

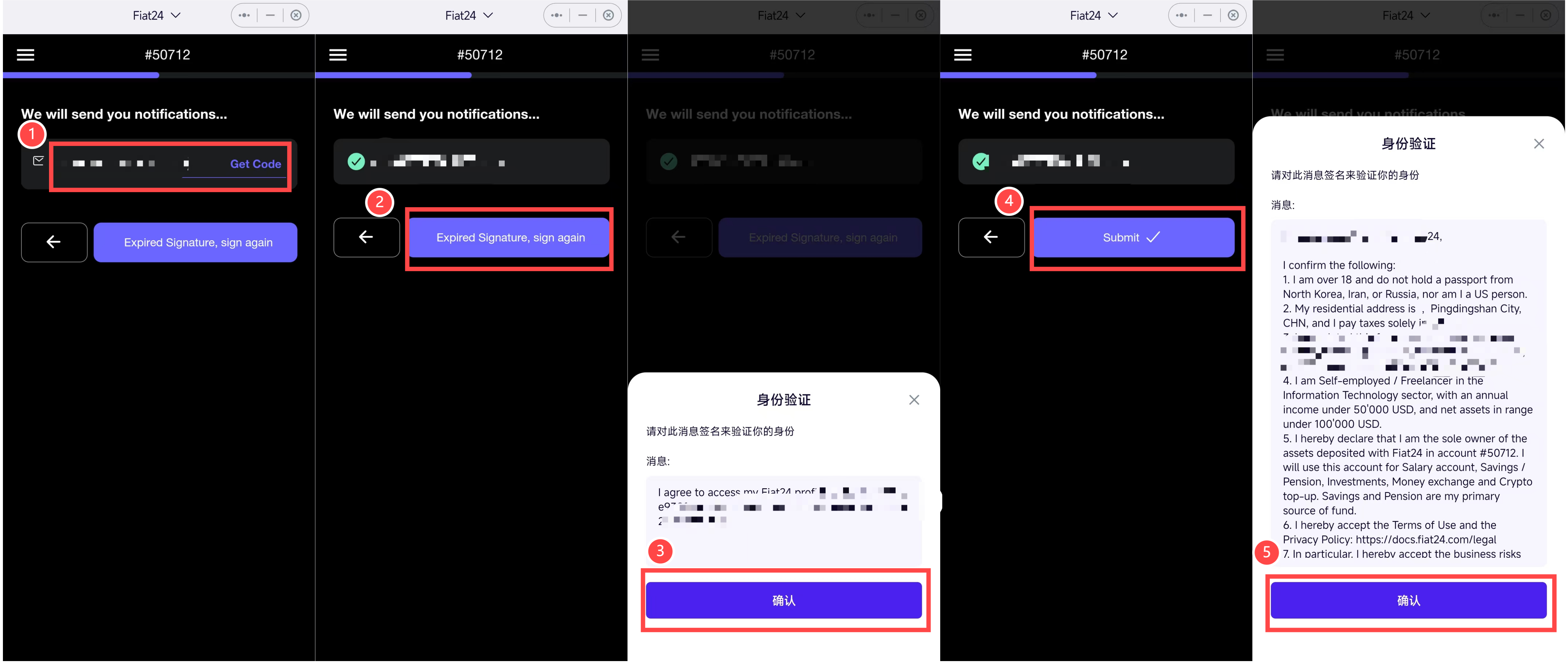

Next, you need to accept the email verification code to bind your email and make the final signature confirmation:

First, enter your email address and click "Get Code" to receive the verification code;

After receiving the verification code, fill it in and click "Expired Signature, sign again";

Then, in the identity verification pop-up window, click "Confirm" to complete the wallet signature;

After the signature is completed, click "Submit";

In the identity verification pop-up window, click "Confirm" to complete the wallet signature;

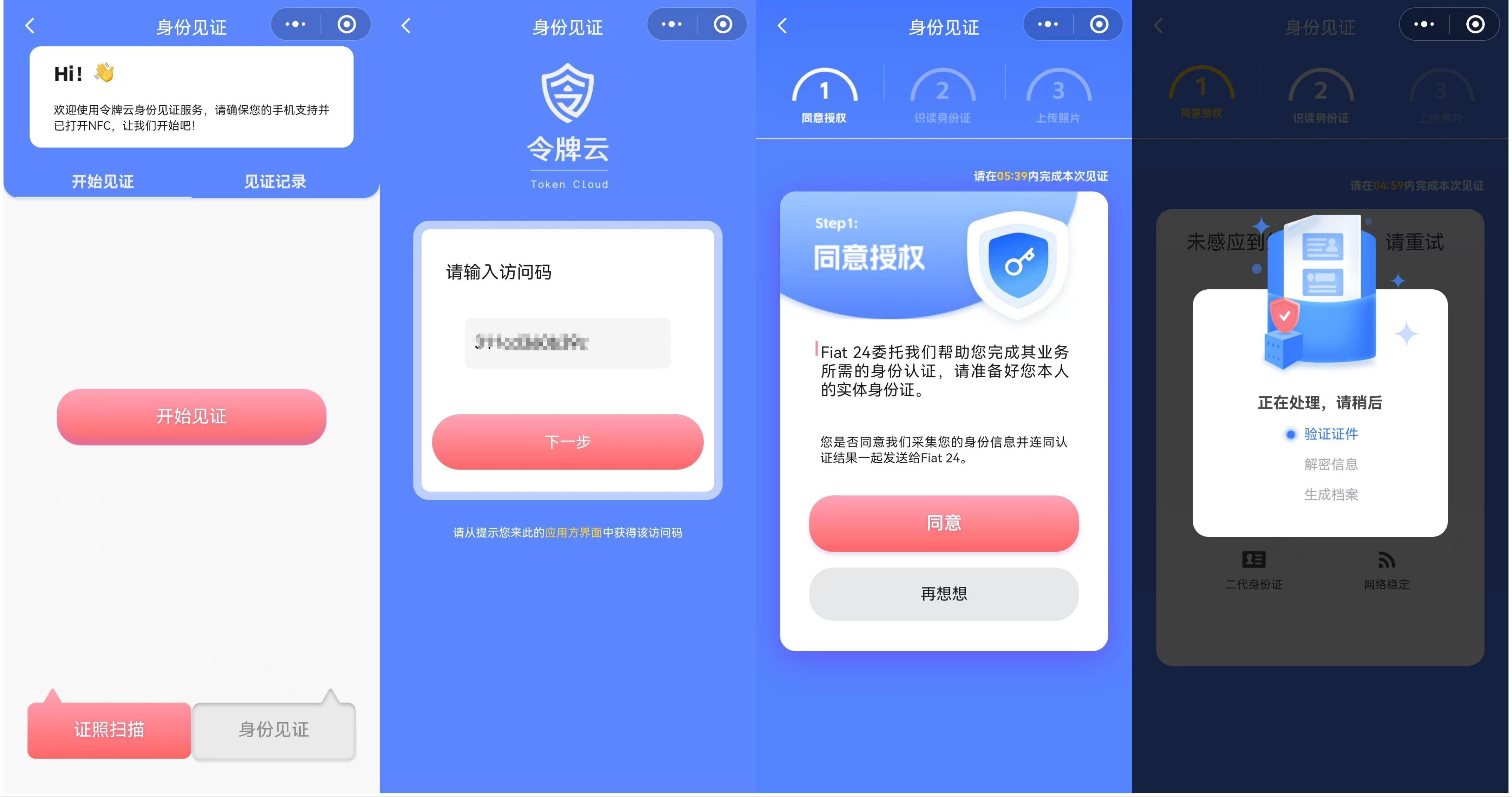

Enter the ID verification page, light up the options, and then use an Android phone with NFC functionality to scan the QR code in WeChat to enter the verification mini-program.

First, place the ID at the back of the phone for scanning—make sure to turn on the NFC switch on your phone in advance, otherwise it may prompt that the phone is not supported. Then proceed with facial recognition; once completed, you will return to the registration process in the SafePal APP. Click "Click when you finish it" to complete the process (for the official ID account opening video tutorial, click link).

Note: Some phones may not be able to enter the ReadID App to upload passports due to compatibility issues. You can access the bank KYC website on a computer to obtain the KYC QR code, and then use the ReadID App to scan the QR code to continue the certification.

Once Fiat24 approves the review, the bank account will be successfully registered, and based on this, users in domestic regions can choose to apply for a card.

Note: During the closed beta period, new bank accounts need to wait about a day before the Mastercard can be activated (at the latest, the application entry will be received within 2-3 days after registration).

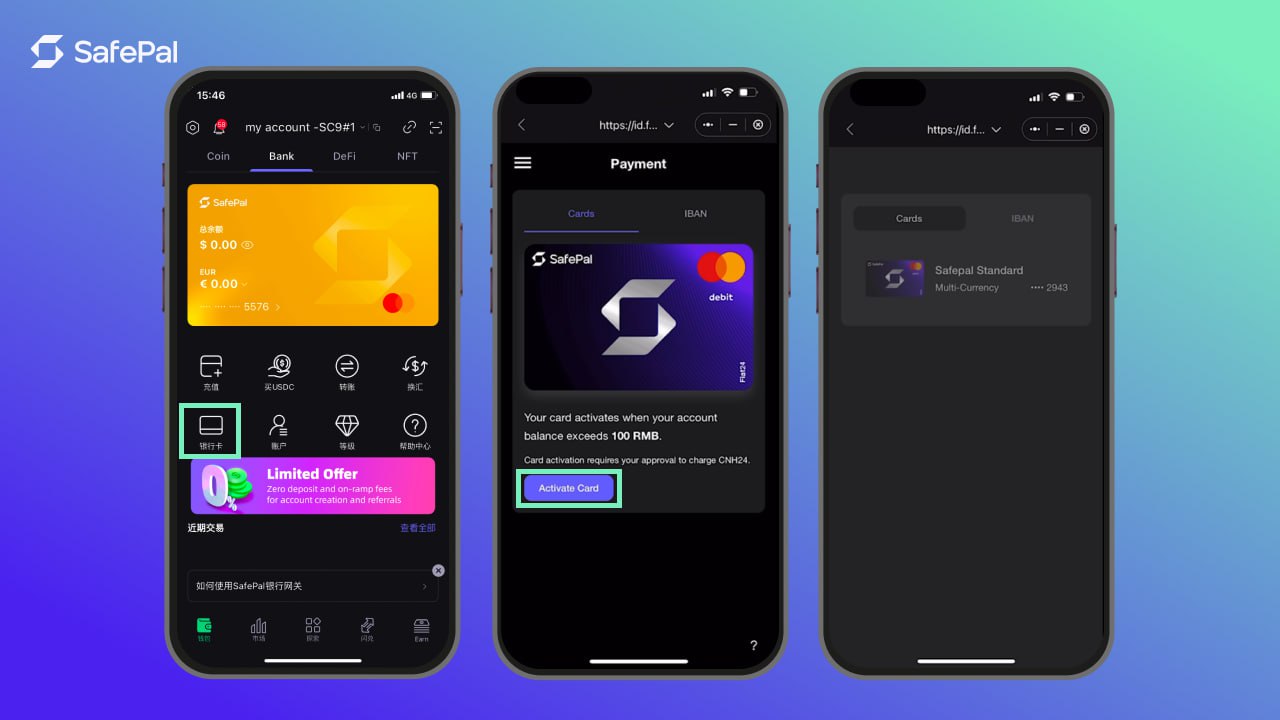

2. Applying for SafePal Mastercard

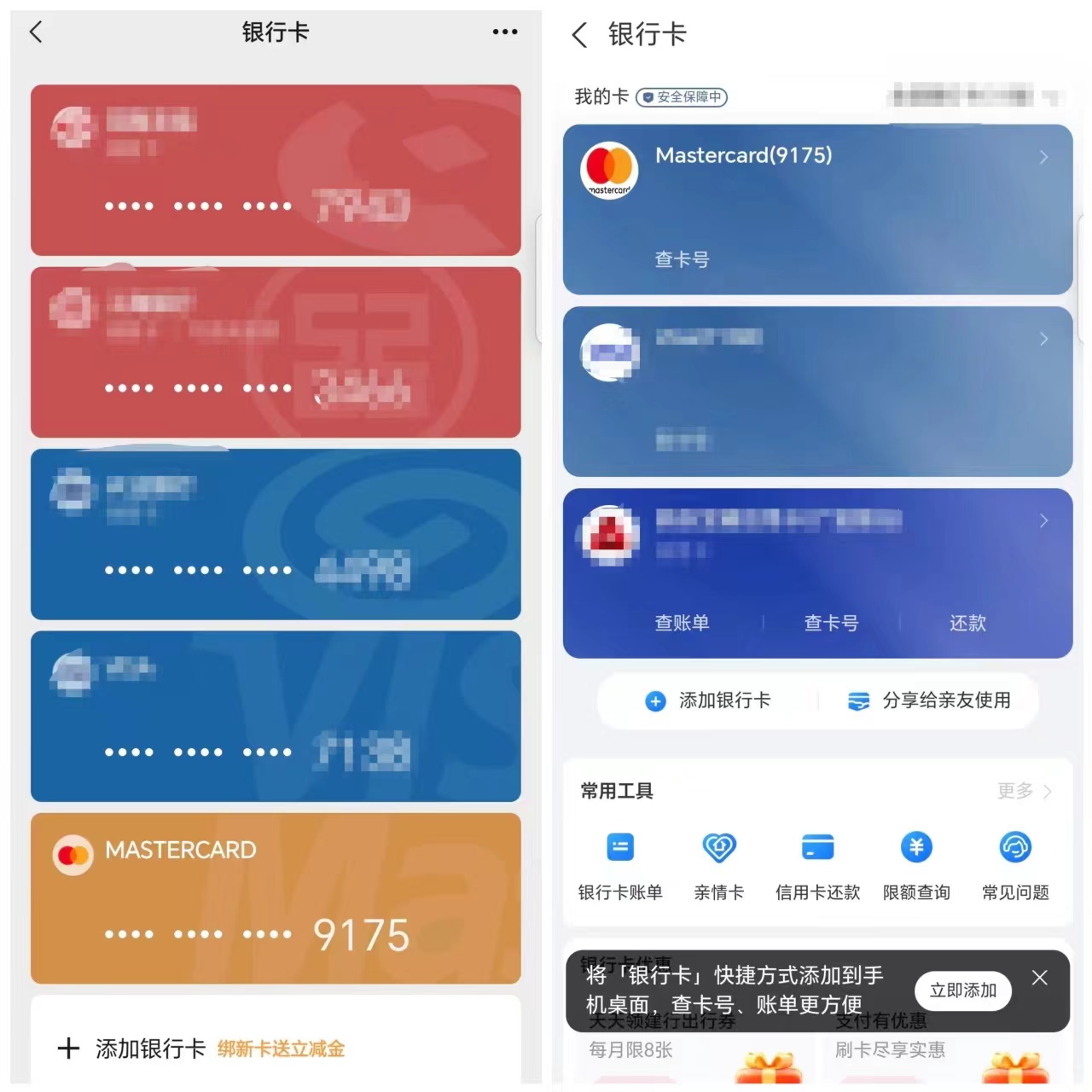

In the SafePal APP, on the "Bank" service page, click "Bank Card" to apply for your co-branded Mastercard. Note: To activate the Mastercard, ensure that there is at least 10 USD in the bank account.

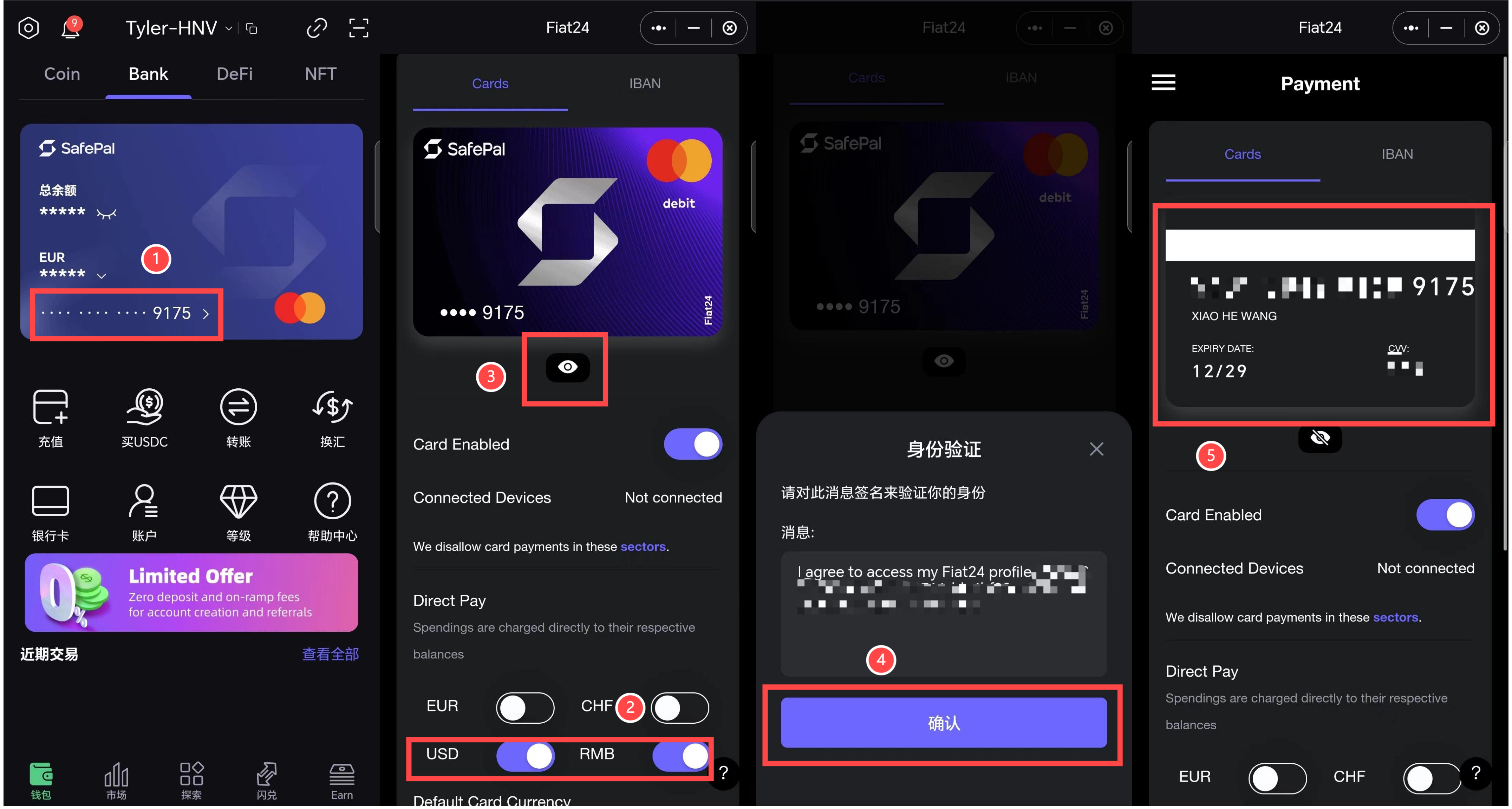

After a successful application, you can view the card information and payment settings for the Mastercard:

Click the icon on the card number to enter the details page;

Supports four currencies: USD/RMB/EUR/CHF. You can freely open the corresponding accounts based on your needs, for example, choose RMB for domestic consumption and USD or other currencies for overseas or international service subscriptions to reduce currency exchange fees;

Click the "eye icon";

In the identity verification pop-up window, click "Confirm" to complete the wallet signature;

After authorization, you can click to view the full card number, expiration date, and CVV security code for binding to WeChat, Alipay, or for other payment scenarios (Note: Do not disclose the CVV security code to anyone);

You can participate in the closed beta by using the invitation code "244274" in the SafePal APP. If you have any registration or usage questions, you can add V "kleene18bot" to reach the official support for discussions and easy onboarding.

III. SafePal Mastercard Usage Guide

1. Bank Account / Mastercard Recharge

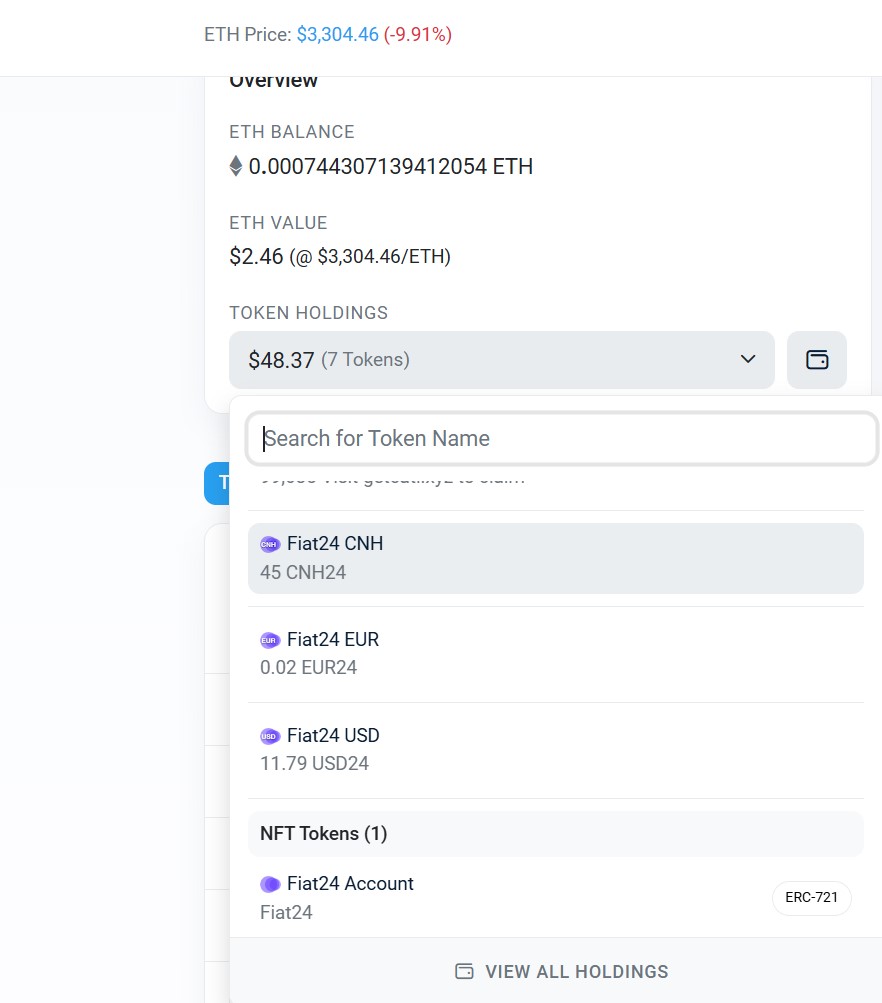

SafePal bank accounts (NFT) and the deposited fiat currencies—USD/RMB/EUR/CHF—are all based on the Arbitrum network, so users need to ensure they have Arbitrum ETH in their wallets as Gas, and the stablecoin USDC being recharged must also be based on the Arbitrum network:

Ensure sufficient Arbitrum ETH in the wallet: Since the recharge process requires transactions on the Arbitrum network, make sure there is enough Arbitrum ETH in the wallet to pay for Gas fees. It is recommended to prepare at least 0.001 ETH to ensure the transaction is completed smoothly.

Confirm that the USDC being recharged is based on the Arbitrum network: Ensure that the USDC you are recharging is the version based on the Arbitrum network to avoid recharge failures or loss of funds;

With USDC already in the wallet, you can recharge cryptocurrency into the account and freely exchange it for USD/RMB/EUR/CHF:

Click the "Recharge" button on the "Bank" page to enter the recharge operation interface;

You will see options for the four supported currencies: USD, RMB, EUR, and CHF. Choose the corresponding currency type for recharge based on your needs;

On the exchange page, you can see the real-time exchange rate and recharge fees (currently 100% refunded during the promotional period);

Sign authorization and confirm the transaction again;

After successful exchange, you will see the option for RMB;

2. Binding Alipay / WeChat

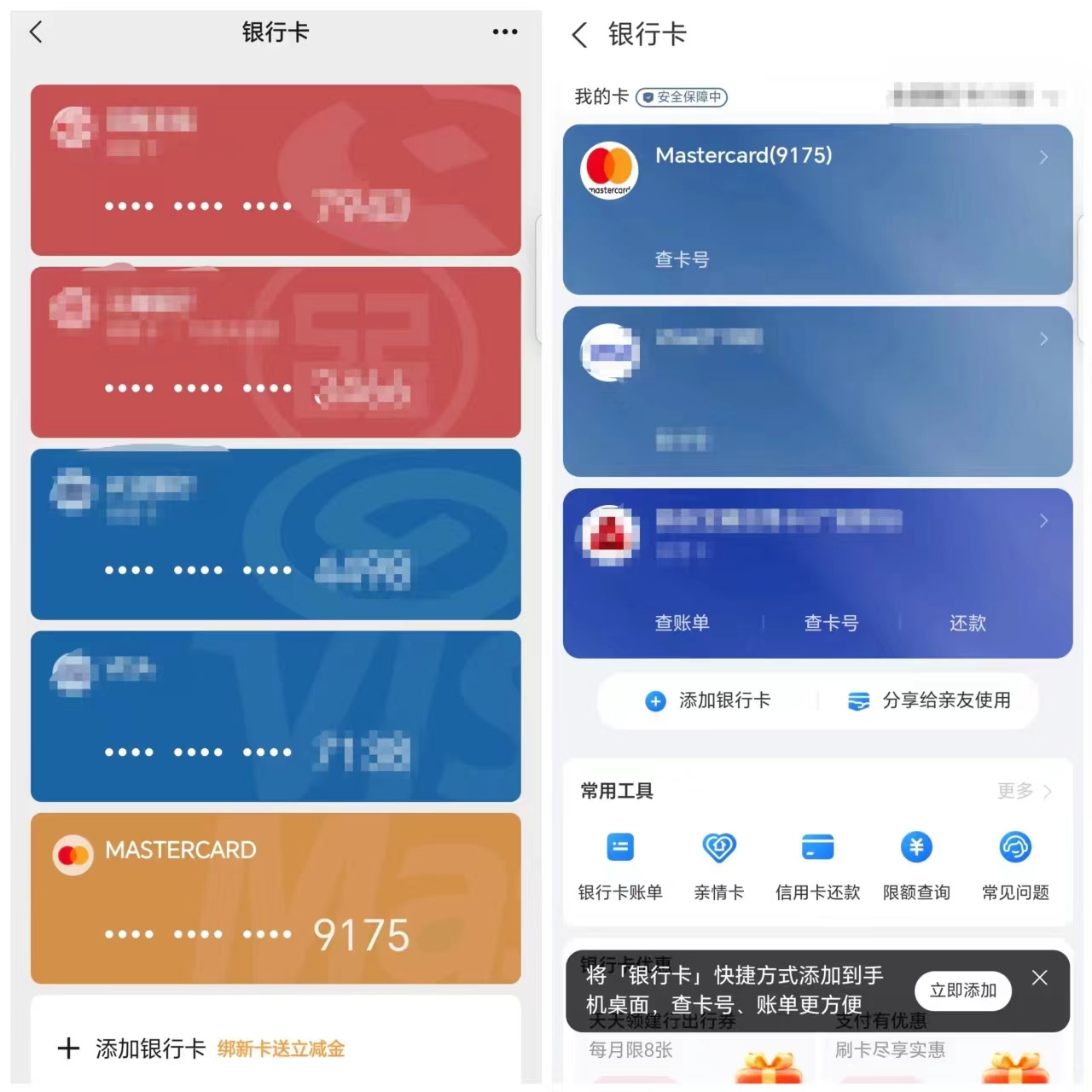

On the bank card binding page of Alipay and WeChat, enter the 16-digit Mastercard number along with the expiration date and CVV security code mentioned above to successfully bind.

3. Other Consumption Scenarios

X, GPT, and APPLE, etc., all support adding this Mastercard as a payment method. Note: When paying with GPT, you need to use a Swiss VPN (it is stipulated that payments can only be made in the location of the issuing institution).

Additionally, the official statement indicates that brokers currently support Interactive Brokers and Charles Schwab (the author has not yet tested this), allowing for deposit and withdrawal transactions based on IBAN.

IV. Initial User Experience and Actual Rates

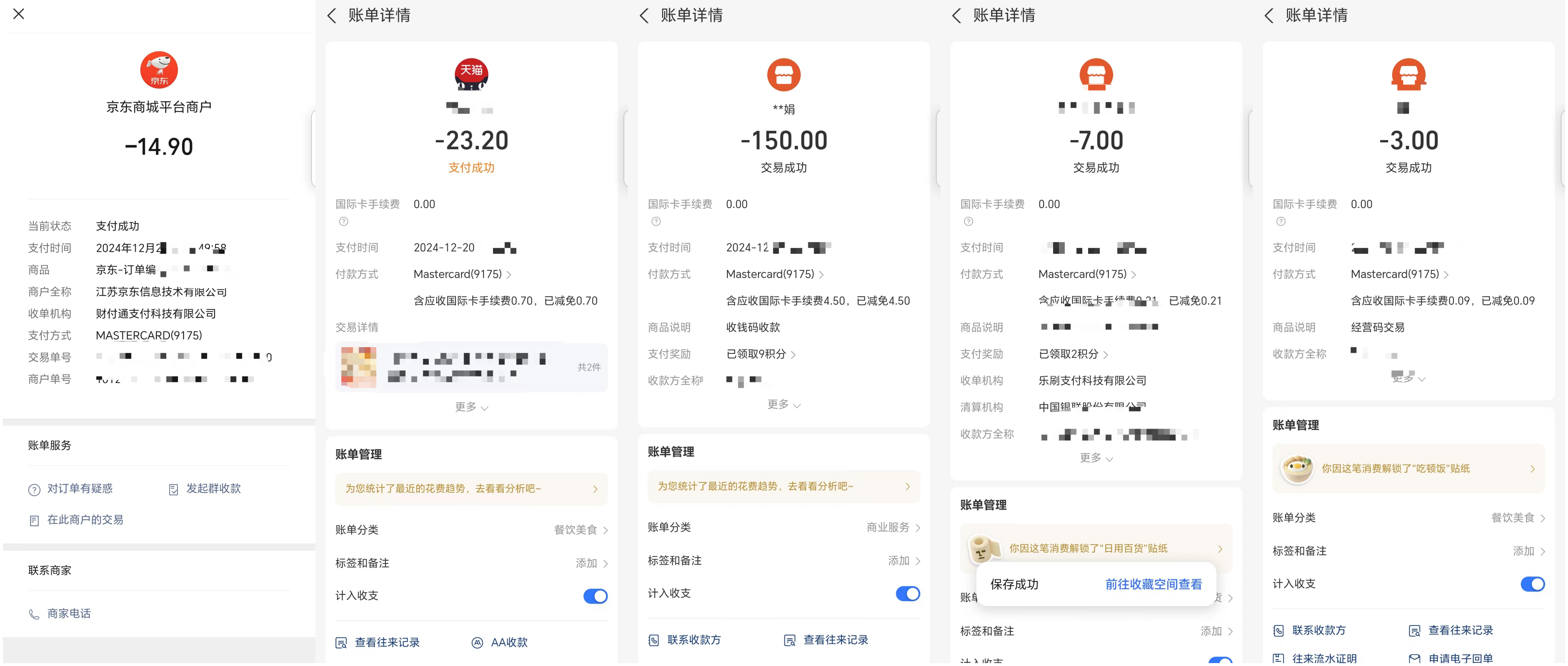

As of December 20, after binding Alipay and WeChat in the domestic region, I conducted comprehensive tests in online scenarios and offline merchants:

Online scenarios: After binding Alipay and WeChat, I successfully paid for food delivery on Meituan, shopping on Taobao, Pinduoduo, and JD.com, with a good experience;

Offline scenarios: Payments can be made by scanning QR codes in supermarkets, restaurants, and personal collection codes;

The actual costs compared to the current mainstream crypto U cards are relatively low—the recharge fee is only 1% (long-term promotion, 100% refunded), with no small transaction fees. The best part is that since it supports RMB, compared to some crypto payment cards that only settle in SGD and USD, you can save up to 1% in currency exchange fees when consuming domestically.

For example, on the day of testing, the SafePal exchange page provided an RMB exchange rate of 1 USDC ≈ 7.22 RMB, while the official RMB central parity rate that day was 7.19, the Bank of China's spot buying price was 7.28, and the actual withdrawal price from BN was around 7.26. The actual loss was around 1%, far lower than the 2-3% or even higher actual rates of other crypto payment cards.

Even when settling in USD, the comprehensive exchange rate is still advantageous when including currency exchange fees—where two transactions correspond to 150 RMB (20.85) and 7 RMB (0.97), with exchange rates of 7.1942 and 7.2164 respectively.

Interestingly, as mentioned earlier, the USD/RMB/EUR/CHF in the SafePal bank account are all RWA tokens issued by Fiat Bank based on the Arbitrum network, so in reality, our balances and expenditures are fully transparent, ensuring that no third party can misappropriate or hold the funds.

More detailed rate tests and comparisons with current mainstream crypto U cards will be completed soon, so stay tuned.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。