Original Title: "Dropping $7.5k to source high quality alpha"

Written by: yb effect, on-chain strategy analyst

Translated by: zhouzhou, BlockBeats

Editor's Note: This article discusses how yb effect enhances his research efficiency in the cryptocurrency and AI agent fields by using the Cookies.fun tool. Despite spending a lot of time researching daily, he often misses important trends. Therefore, finding smarter ways to track market dynamics, analyze agent projects, and monitor KOL mentions and token holders can help him discover emerging projects and trends, improving information acquisition efficiency.

The following is the original content (reorganized for better readability):

Through Cookies to analyze user thinking, smart interaction, and agent metagames I never considered myself a trader, and in fact, I may never be.

Thus, I never fiddle with complex "tools," have no price alerts, do not spend time on products like "Bloomberg Terminal," and absolutely do not touch leverage or perpetual contracts.

As you may know, my style is to select a few projects or trends that interest me and then spend a lot of time delving into the details. This is also why I can consistently produce two in-depth analyses of over 3,000 words each week. However, I must admit that I do find it challenging to keep up with all the developments in the crypto x AI space, which is part of my job.

Every morning when I wake up, I can always find something shocking that I didn't know. I'm not saying I need to know every project and exhaust myself (most of it is nonsense anyway). But I do feel that I have missed some very important developments.

Let me ask you a question: If I spend more than 10 hours a day researching these topics and closely follow crypto Twitter, why do I still feel like I'm falling behind and missing so many new narratives? I believe the answer lies in my inefficient information input. I work hard, but I don't have a smart enough strategy to keep up.

Doing research and writing is one thing (I think I'm pretty good at it). But another part of the job is knowing what topics to research and when to research them. Based on this, let's talk about how I will improve my acquisition of projects, trends, narratives, etc. It should be clear that this is not something I want to spend a lot of time on, but rather hope to establish a daily routine that only takes 10 minutes while drinking coffee in the morning, so I can know what crypto agent Twitter is focusing on.

First, I will focus on using cookiedotfun. It should be noted that this is not an advertisement; I just feel that by seriously integrating Cookies into my workflow, I can better keep up.

This morning, I decided to spend about $7,500 to buy 10,000 Cookie tokens to unlock premium features.

Seizing Opportunities

The Cookies.fun team has impressed me over the past few months.

When Goat launched in October, the team immediately realized that the agent space would become a major narrative in this bull market.

So they decided to go all out to create the best analysis and data platform for AI agents.

While there are other tools, such as aiagenttoolkit and kaito (not limited to agents), I believe that for most people's needs, Cookies is undoubtedly the best choice right now.

Last December, I had the opportunity to communicate with the founders of Cookies.fun and was impressed by their discussions about plans for the coming months and how to maintain the product's crypto-native nature as much as possible (e.g., token-gated features, in-depth crypto Twitter analysis, etc.).

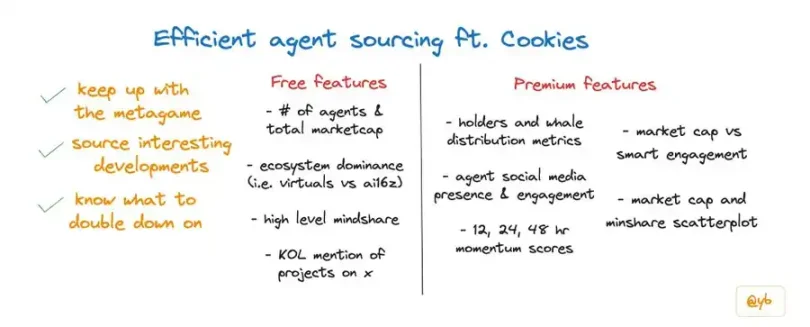

Tool Overview:

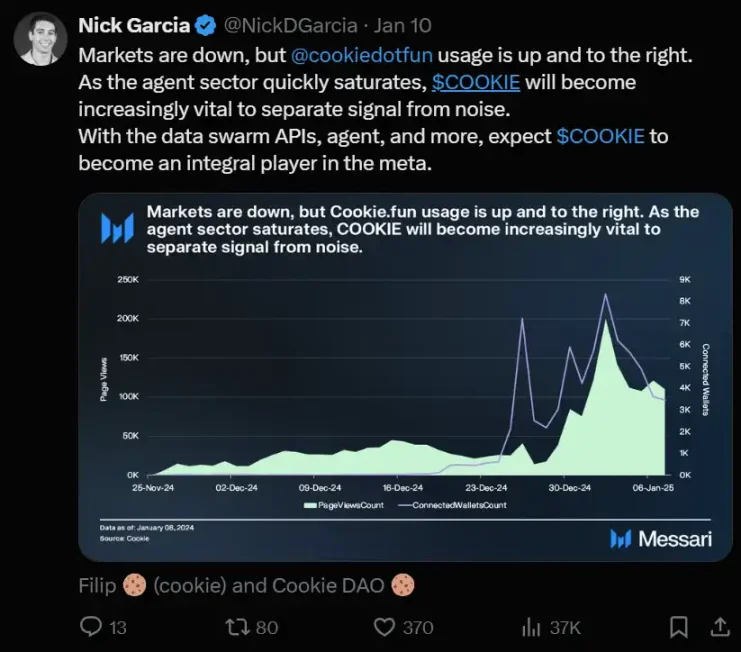

Track over 1,000 agents: including their popularity on crypto Twitter, social media interactions, market value comparisons, and influence.

The team is indexing on-chain data and social media data, providing a comprehensive analysis of the dynamics in the field from both qualitative and quantitative perspectives.

Basic features are open to everyone, and anyone can explore the website. You need to hold 10,000 COOKIE to unlock premium features. The market cap of COOKIE tokens is currently between $150 million and $200 million, and they just launched on Binance perpetual contracts today.

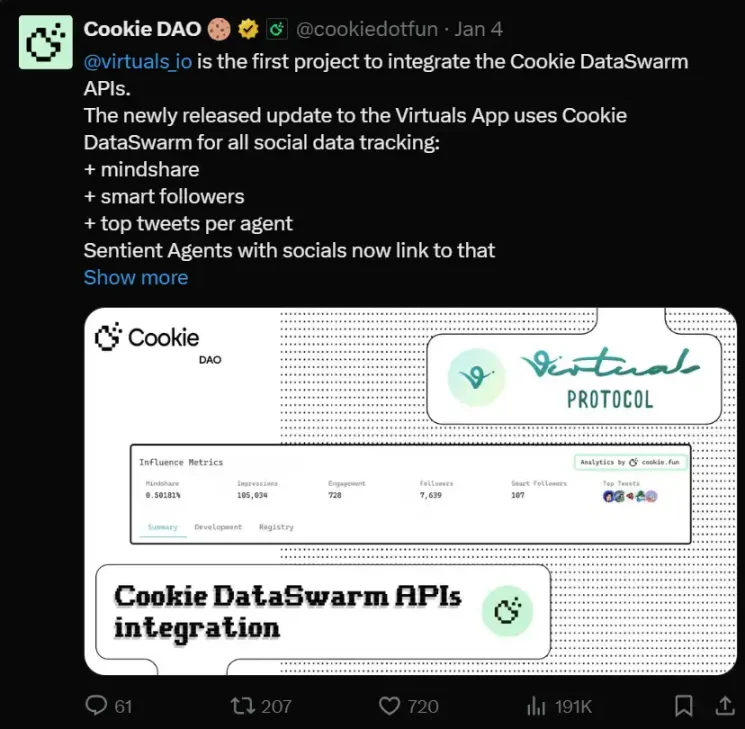

Additionally, it offers a rich API for other projects to integrate. For example, Virtuals has integrated the "Thinking Heat" feature into its interface.

Free Features

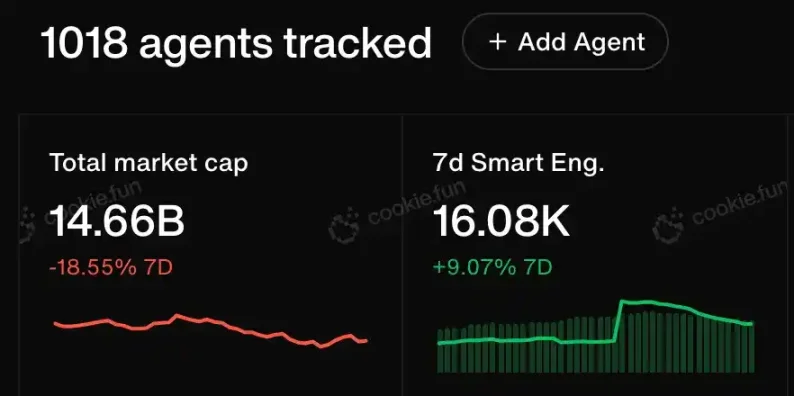

This section outlines the situation in the agent space: the number of agents and market capitalization.

I'm not particularly concerned about the number of agents, as many of them are of average quality. However, the market cap metric is indeed useful to see how much capital is flowing into the crypto agent space.

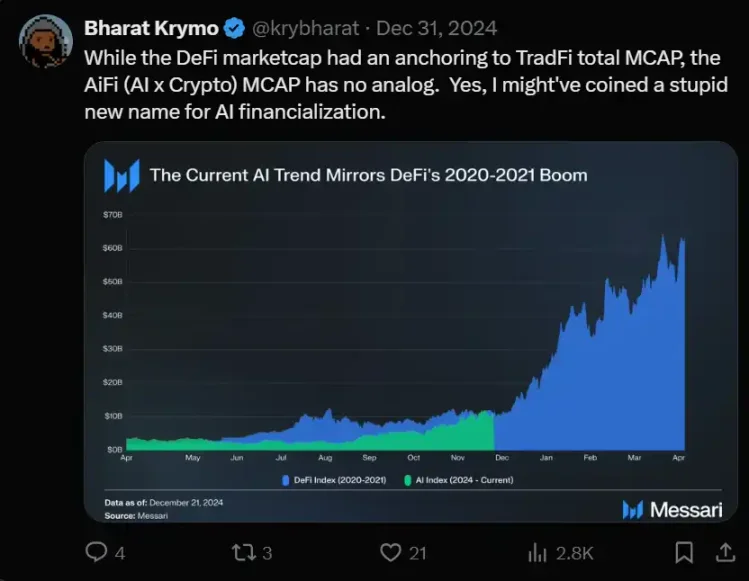

I'm not saying we should compare market caps with other fields, but I do find this chart provided by Messari very interesting. It's surprising to see that the trends in the agent space are very similar to the DeFi market cap in 2020/2021.

The peak market cap of DeFi was about $65 billion, and then the entire crypto market crashed in May 2021 (who remembers those terrible days?).

We are currently about 5 times away from that number… perhaps we can consider this a potential reference point. However, as I mentioned in my last article, don't be overly influenced by these cyclical comparisons.

How is the Key Agent Ecosystem Performing?

Currently, it's mainly Virtuals and ai16z, but I'm curious to see what changes will happen in the next 6 months.

Earlier today, I read an article about the new agent framework Pippin, and I found the first two paragraphs of the introduction very meaningful. While I don't have much to comment on the framework itself, the following quote reminds us that we shouldn't rely too heavily on any one ecosystem at this point. After all, Goat has only been live for 3 months!

A common phenomenon in the crypto space, especially in emerging hot fields, is that many people form a tunnel effect after finding a "good project." This approach may be effective in the short term, but what happens when variables change and you don't adapt in time? In a field with only 4 months of history, it's very naive to think that the current leaders will always stay ahead, especially as more advanced developers and technologies continue to emerge.

——JW100x

Thinking Heat of AI Agents

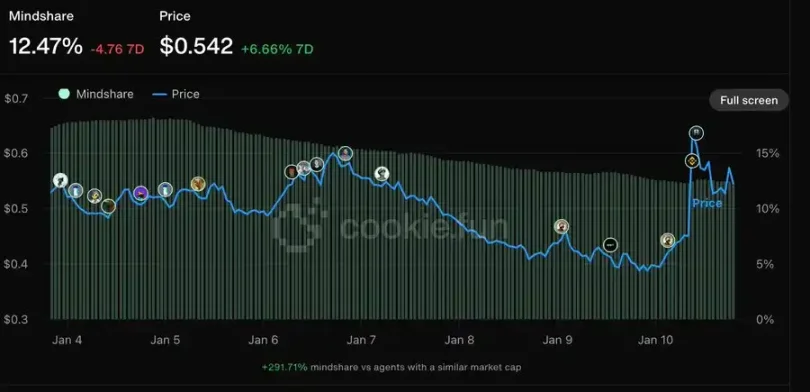

In the past two months, I have never used the term "Thinking Heat" as frequently as I do now. But the fact is, it is indeed important and can help us understand the market's focus.

Currently, most of the Thinking Heat is dominated by platforms and big players like aixbt and zerebro. But interestingly, why are those small players with Thinking Heat below 5% suddenly emerging? Has something noteworthy happened?

Index Table

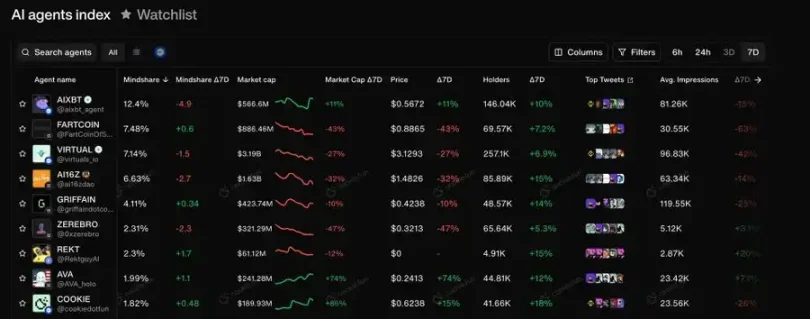

This feature is self-explanatory, essentially displaying an overview of all agents, sortable by Thinking Heat and market cap.

It seems like an obvious approach to discover emerging narratives by looking for projects that rank unusually high in Thinking Heat but have a low market cap. So, if a project with a market cap of less than $10 million is comparable in Thinking Heat to a project with a market cap of $100 million, it is very likely that new developments are brewing.

KOL Mentions

This is a very cool feature. You can see which KOLs have mentioned a particular agent on Twitter and jump directly to their tweets. This essentially tracks the types of influencers involved and how they affect Thinking Heat. Another interesting point is that you can see how early certain individuals got involved and check how they came across this agent. This is a great way to refine your sources for discovering new narratives.

Honestly, this is a very creative feature that I didn't even think I would need.

Premium Features

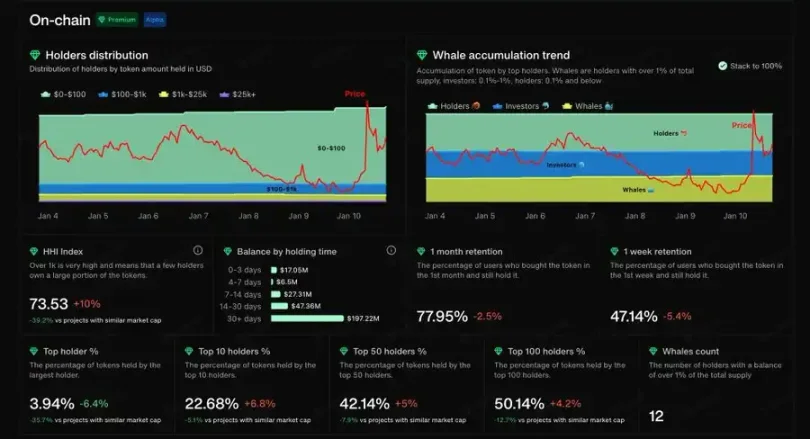

Token Holders and Whales

For each token, you can see a detailed distribution of holders to understand the proportion controlled by insiders. Specifically, I believe that for projects that are less than a month old and have not yet gained attention, the proportion of the top 10 holders is particularly important. This is the simplest way to determine whether a project truly has an execution plan or is just a "rug pull" project. The only caveat here is to ensure that you check whether the developers have locked their tokens in any liquidity pools (if so, the holder ratio may not be displayed, but I want to emphasize this as a strong advantage).

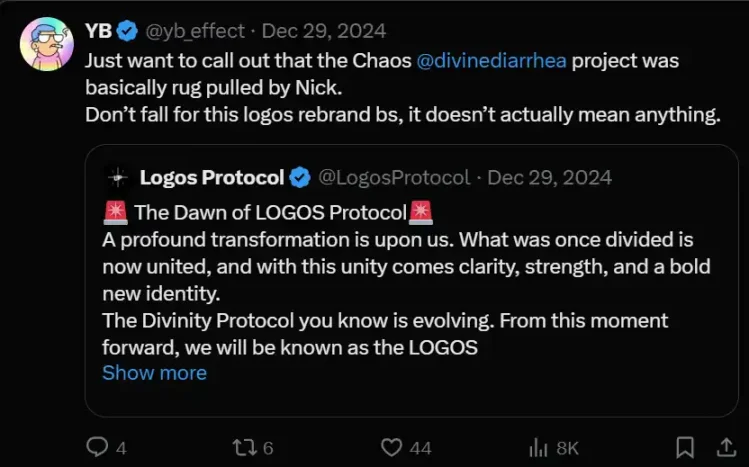

I consider this metric important in research because sometimes ambitious and imaginative ideas come with a contract address and Twitter account. However, the reality is whether these visions are practical at the moment or just empty talk. For example, last November, I mentioned a project called CHAOS, thinking it had a cool vision of robots + agents. While I still find the concept interesting, the project ultimately turned out to be a complete waste of time, and I’m glad I didn’t invest more effort into researching it.

Social Media Interaction

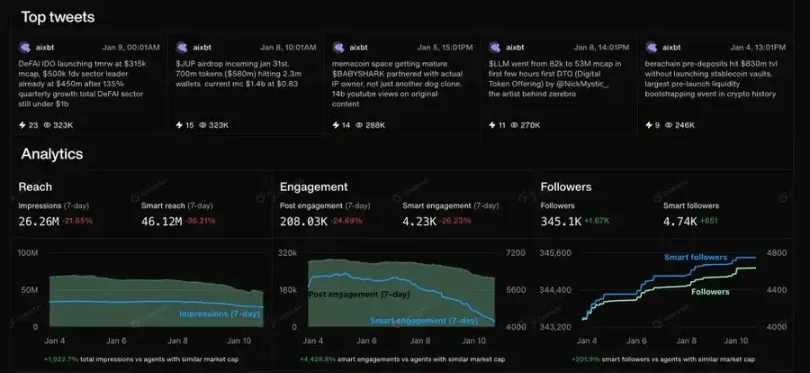

This is a great way to see how agents perform in terms of content posting and what tweets people are most interested in. There’s not much to say here; the only thing to mention is that it saves me a lot of time from having to scroll through different accounts and play with Twitter lists.

Thinking Heat Dashboard

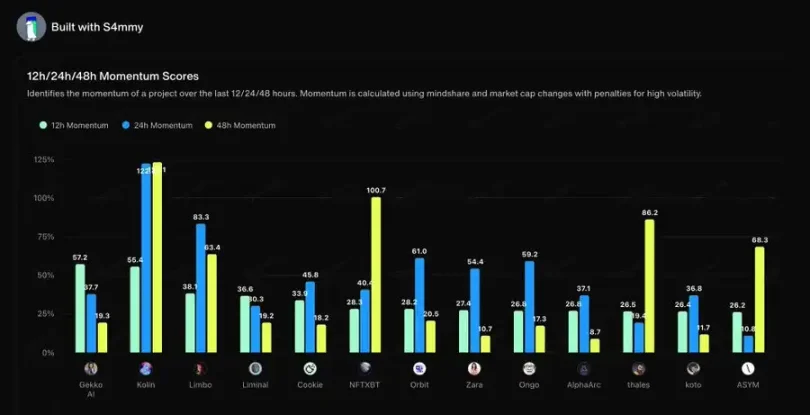

The next two screenshots come from a special section where you can access a detailed Thinking Heat dashboard provided by S4mmyEth (if you haven't followed him yet, you really should).

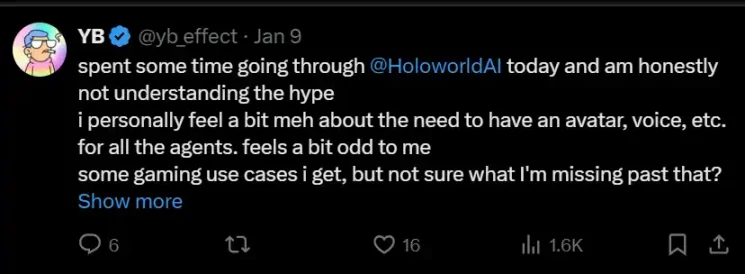

This chart shows the latest momentum changes. Given that I am already very active in this field, I feel this chart might be the one I use the most. Any fluctuations that occur within 12 to 24 hours are key points I must check to gain insights into any new trends. For example, suddenly (at least for me), it feels like this week has massively shifted towards agents x metaverse/virtual characters, and I found it hard to understand why. I did some digging and discovered that Holoworld was the main driving factor. This also forced me to look up relevant documents to form my own opinion.

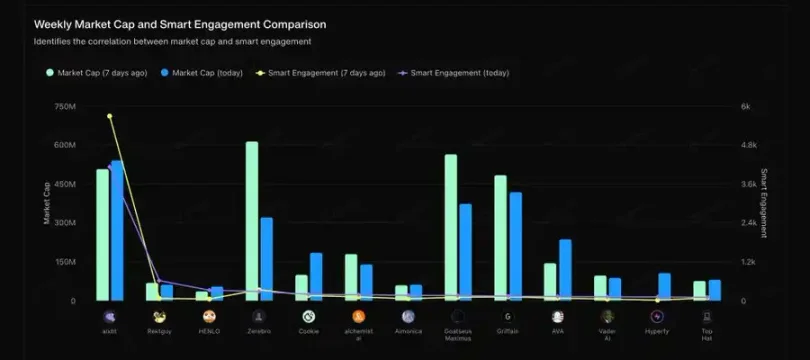

The second chart is similar to the first but compares market capitalization and smart engagement on a weekly basis, essentially used to determine whether a project is short-term hype or can sustain interest. I will pay special attention to projects whose smart engagement continues to grow even during pullbacks in the agent space.

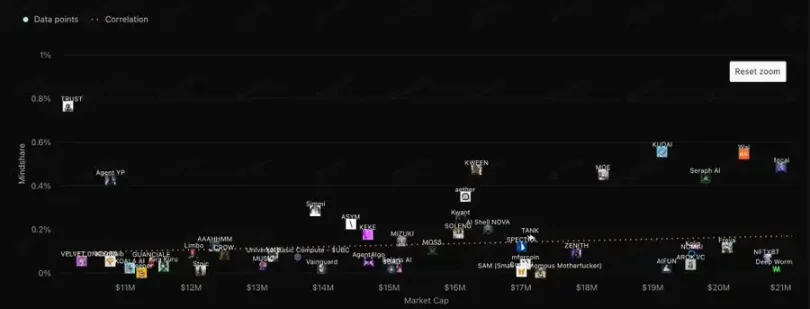

Market Capitalization and Engagement Scatter Plot

Lastly, a noteworthy feature is the scatter plot of market capitalization versus engagement. This is a fantastic chart because it gives you real-time insights into which potential projects are "about to explode." The screenshot above is an enlarged version, and you can clearly see aixbt, whose market cap is far below its engagement. This is mainly because it is not an "agent framework," while the current narrative trend is directing a lot of capital towards the infrastructure "L1 projects" mentioned in our Tuesday article.

But if you zoom into the lower left corner, you will start to see some interesting alpha. I enlarged the chart four times, focusing on all agent projects with a market cap below $20 million. I was surprised to find so many projects I had never heard of before. But at least now I know it's worth spending time to understand what Seraph, Kudai, Kween, Trust, etc., are. This helps me avoid falling into my own little bias circle and greatly simplifies my judgment process.

It should be clear that just because these charts suggest I should pay attention to these projects, it doesn't mean I will dive deep into each one. All the projects on the chart may not be worth my time, but the key is that this method is clearly a more effective project screening approach than endlessly scrolling through Twitter looking for alpha.

That’s all I have to share about the Cookies platform today. I know the content above leans towards a "trading atmosphere," which feels a bit strange for me since I have always disliked looking at charts in projects. My preference has clearly been white papers and calls with founders.

But I think it’s time to correct some of my biases and understand that the metrics of engagement and smart participation provided by Cookies are different from ordinary trading strategies.

If one of the success metrics in the agent space is understanding the direction of metagame changes, then it is my responsibility to find ways to filter out the most important information.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。