Background and Event Overview

On January 10, 2025, at 21:30, the U.S. Department of Labor released the latest Non-Farm Payroll (NFP) data: an actual increase of 256,000 jobs, far exceeding the market expectation of 160,000. This stronger-than-expected data directly reinforced market expectations for the Federal Reserve to further tighten monetary policy, leading to a rapid strengthening of the U.S. dollar index and causing a severe impact on global financial markets, including Bitcoin.

In response to the data, Bitcoin plummeted by 1.42% within five minutes of the NFP announcement, forming a typical "spike" pattern: after a rapid price drop, it rebounded sharply. This phenomenon not only demonstrates the high sensitivity of crypto assets to macroeconomic data but also reveals the complex interplay of market sentiment and trading mechanisms in extreme market conditions.

The following analysis delves into the causes of this spike pattern and the underlying market rules from three aspects: macro fundamentals, market sentiment, and trading mechanisms and liquidity.

Core Driving Factors of the Spike Pattern

1. Macro Fundamentals: Strong NFP Reinforces Rate Hike Expectations

- Data Analysis and Market Expectation Discrepancy

The addition of 256,000 jobs far exceeded the market expectation of 160,000, indicating that the U.S. job market remains robust, with economic vitality significantly surpassing expectations. This data directly shattered the market's optimistic expectations for the Federal Reserve to pause or slow down rate hikes, intensifying concerns about continued monetary policy tightening.

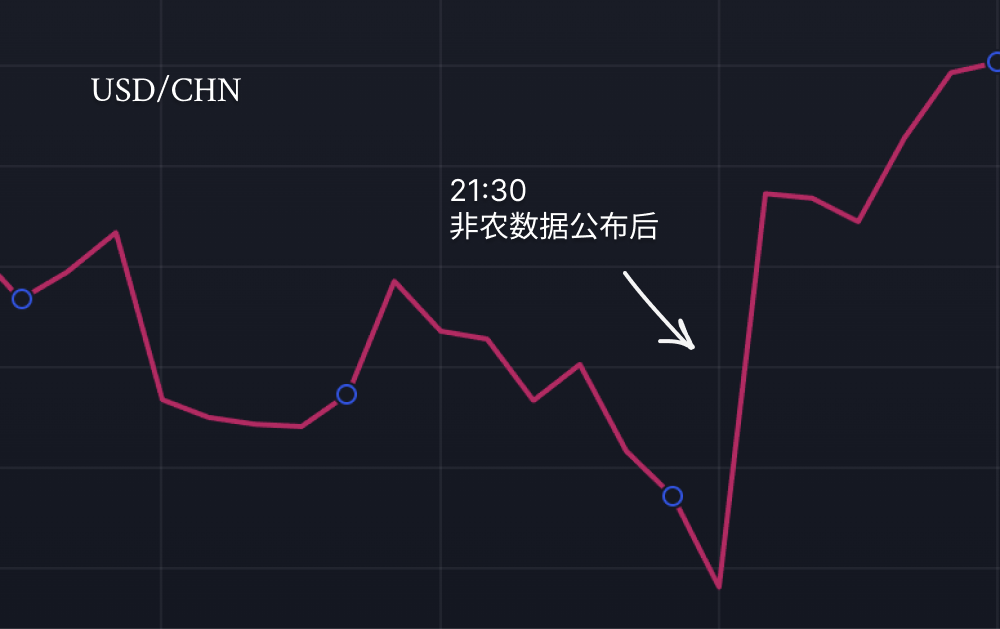

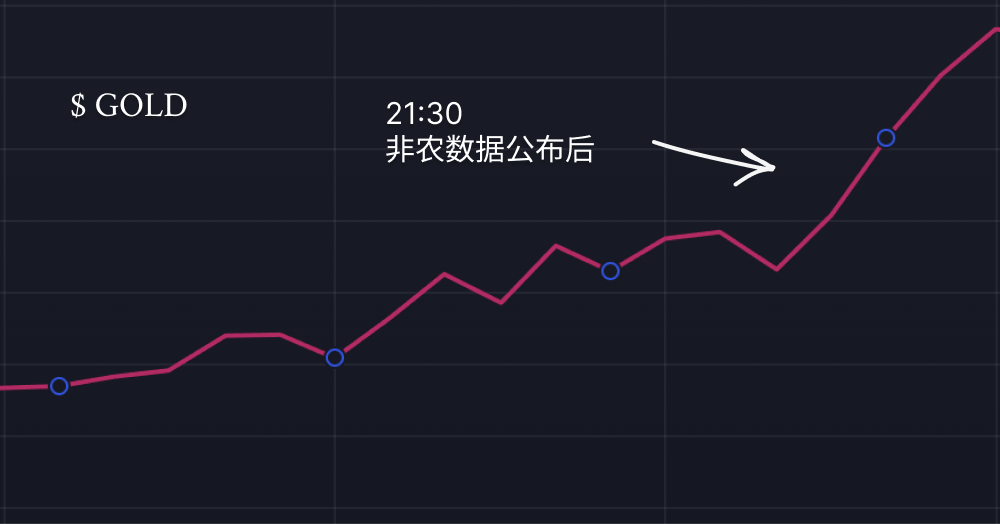

- The market readjusted its expectations for future interest rates, exacerbating the selling pressure on risk assets. The chain reaction of a stronger dollar

- Driven by the NFP data, the U.S. dollar index (DXY) surged, creating a suppressive effect on non-dollar assets like Bitcoin. The strong dollar attracted a significant influx of safe-haven funds, diminishing the appeal of risk assets, making it difficult for cryptocurrencies like Bitcoin to gain funding support in the short term. The transmission effect in the global market

The NFP data had spillover effects on global financial markets, not only increasing volatility in the U.S. tech sector and gold but also transmitting to the Bitcoin market through changes in the dollar exchange rate, further amplifying volatility.

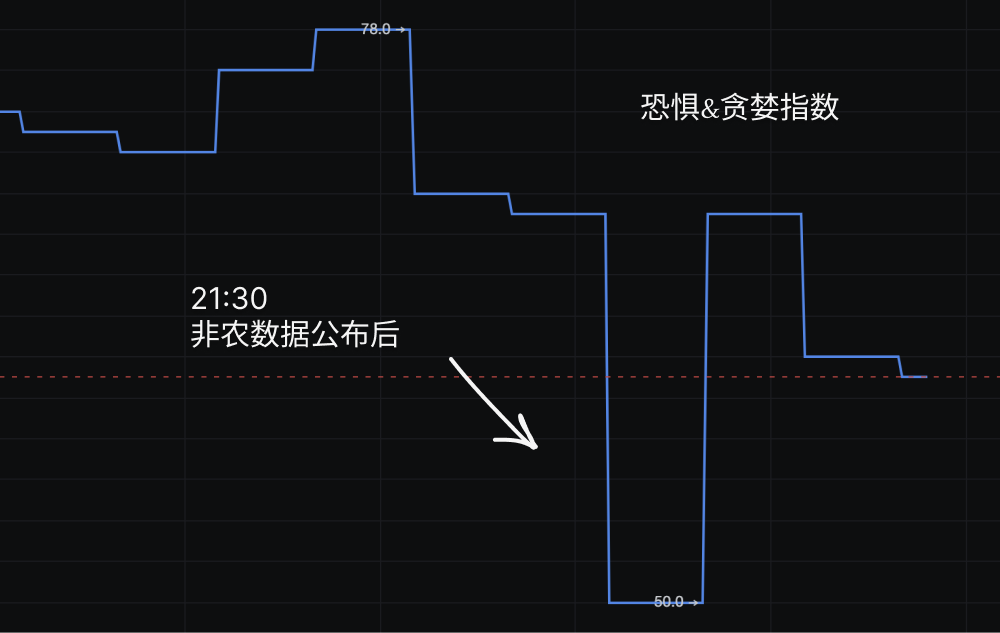

2. Market Sentiment: Short-term Panic and Expectation Reversal

- Triggering Effect of Market Expectation Mismatch

- Before the NFP data was released, the market generally expected a slowdown in job growth, which could alleviate the Federal Reserve's policy tightening pressure. However, the actual data's "blowout" completely overturned this assumption, causing market sentiment to shift rapidly from optimism to pessimism. The adjustment of investor positions and expectation reversals directly triggered severe price fluctuations. The ripple effect of panic selling

- After the NFP data was released, some short-term funds and retail investors in the Bitcoin market exhibited emotional reactions, and concentrated selling further accelerated the price decline. This panic sentiment, combined with insufficient market liquidity, created a vicious cycle that drove prices to quickly hit bottom. The amplifying effect of institutional trading on the market

In recent years, the institutionalization of the crypto market has continued to rise, with many institutional investors adjusting their portfolios based on judgments about macroeconomic conditions and Federal Reserve policies. Following the release of the NFP data, institutional investors reacted more swiftly and on a larger scale, significantly increasing the market's sensitivity to macro data.

3. Amplifying Effects of Trading Mechanisms and Liquidity

- Chain Reaction of Leverage Trading

- The high leverage characteristic of the Bitcoin market is a significant driver of the spike pattern. After the NFP data was released, the rapid decline in Bitcoin prices triggered a large number of forced liquidations (margin calls) of leveraged long positions. This chain reaction further amplified the price drop, accelerating short-term market volatility. The boosting effect of algorithmic trading

- Quantitative trading strategies in the market are highly sensitive to NFP data. After the data was released, algorithms based on macro data quickly executed sell strategies, leading to a surge of sell orders flooding the market, causing a sharp drop in liquidity and severe price fluctuations. Subsequently, buy orders from arbitrage strategies entered the market, driving prices to rebound quickly, forming a "spike" V-shaped reversal. The exacerbating effect of liquidity shortages

During the release of the NFP data, liquidity in the Bitcoin market significantly decreased. Some market participants chose to withdraw orders and wait to avoid risks, resulting in insufficient market depth. In this context, large trading orders were difficult to be effectively absorbed, leading to price fluctuations far exceeding normal levels.

Insights and Market Rules from the Event

1. Increasing Sensitivity of the Crypto Market to Macroeconomics

With the deep involvement of institutional investors, the price movements in the Bitcoin market are increasingly influenced by macroeconomic data. This phenomenon indicates that Bitcoin is transitioning from a purely decentralized asset to a globally correlated asset.

- Traders need to closely monitor key macroeconomic indicators such as NFP data, CPI, and interest rate decisions.

- Develop event-driven strategies based on discrepancies between market expectations and actual values before and after the release of significant economic data.

2. Leverage Trading and Low Liquidity Lead to Amplified Volatility

This spike pattern highlights the amplifying effect of high leverage and low liquidity on market volatility. The leverage characteristics of the crypto market starkly contrast with the low volatility of traditional asset markets, resulting in extreme short-term fluctuations and greater risk exposure.

- In event-driven markets, investors need to reasonably control leverage risks to avoid additional losses from liquidation chains.

- Market participants should be cautious of abnormal price fluctuations in low liquidity environments and maintain a moderate wait-and-see approach.

3. The Profound Impact of Algorithmic Trading on the Market

The proliferation of quantitative trading strategies has made the crypto market's response to macro data faster and more intense. The widespread application of this technology enhances market efficiency while exacerbating price volatility in extreme conditions.

- Investors need to understand the operational mechanisms of quantitative trading to predict its potential impact during key events.

- Retail traders should avoid chasing prices in extreme market conditions to reduce emotional trading behavior.

4. Global Market Interconnectivity of NFP Data Shocks

As a global asset, Bitcoin's price fluctuations not only reflect internal dynamics of the crypto market but are also closely related to changes in traditional financial markets. The volatility of Bitcoin prices following the NFP data shock further highlights the interconnectivity and systemic risks of global markets.

- Investors need to pay attention to changes in the correlation between Bitcoin and other assets (such as the U.S. dollar and U.S. Treasuries) to optimize asset allocation.

- By tracking global market sentiment and capital flows, investors can better grasp the changing trends in Bitcoin prices.

Conclusion

The spike pattern in Bitcoin triggered by the release of the NFP data is the result of the interplay of macroeconomic data shocks, market sentiment reversals, and the complexity of trading mechanisms. The strong NFP data not only reinforced market expectations for Federal Reserve rate hikes but also amplified market volatility through leverage trading, liquidity shortages, and algorithmic trading.

This event profoundly reflects the high sensitivity and vulnerability of the crypto market to macroeconomic data, while also revealing the decisive role of market participant behavior and trading mechanisms in price fluctuations. Investors need to comprehensively integrate macroeconomic factors, market structure, and risk management strategies to better protect their assets and seize potential opportunities in a high-volatility environment.

If you have any questions, you can contact us through the following official channels:

AICoin Official Website: www.aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AICoincom

Email: support@aicoin.com

Group Chat: Customer Service Yingying, Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。