Original Author: DC | In SF

Original Translation: Block unicorn

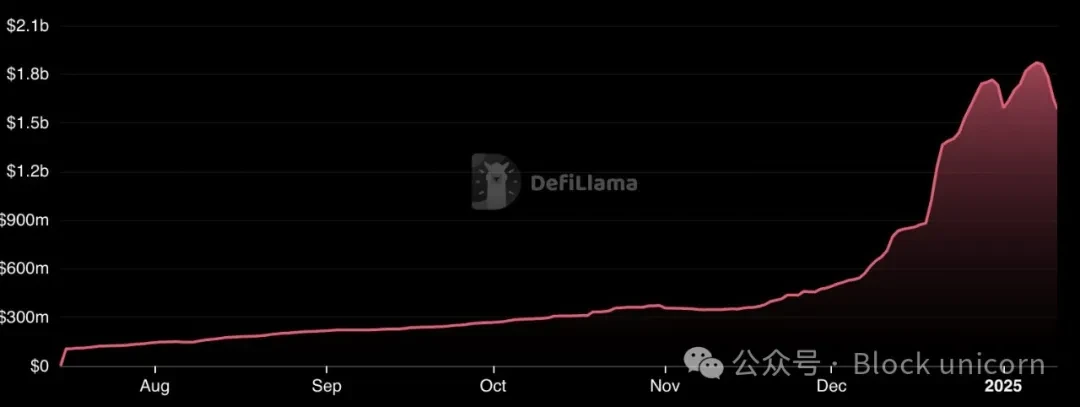

The current trading price of Usual's USD0++ is below one dollar, yet it is said that this has always been part of the plan. Before the decoupling incident occurred, I was writing an article about Usual, as it has recently gained widespread attention. It is one of the fastest-growing stablecoin protocols and has recently partnered with Ethena, earning significant profits for many YT miners on Pendle. However, if you ask people what Usual does, you often get a variety of answers. "It provides you with yields based on RWA (real-world assets)." So the natural question is: how is this different from Ondo? "Oh, it decentralizes RWA yields," well, isn't Maker or Sky doing that too? And so on. If you look closely, @usualmoney's product is a token, not any actual product. Essentially, if the risk-free rate that users receive is above 4%, then the source of the yield is the users themselves. But how did we get here? Why did a protocol with a TVL of over a billion dollars suddenly collapse so quickly? What exactly is the operating mechanism of Usual?

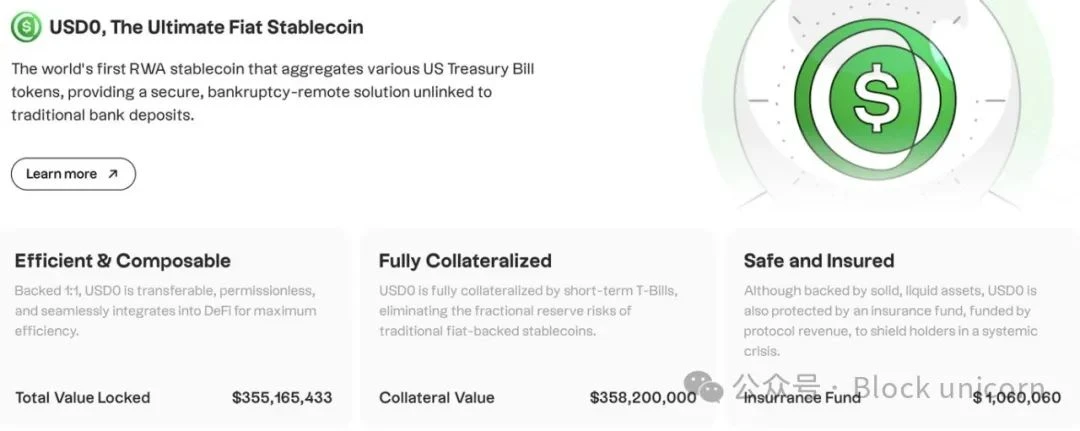

How do USD0 and USD0++ work?

USD0 is Usual's standard, non-yielding stablecoin. There isn't much to interpret here, but once you delve into USD0++, things get interesting. Despite the similar name, USD0++ is not essentially a stablecoin. Initially, USD0++ could be redeemed for USD0 at a 1:1 ratio, and USD0 could be exchanged for 1 dollar. However, the project states in its documentation that at some point in the first quarter of 2025, this will change, and USD0++ will function more like a bond, with its lower limit being the effective price of a 4-year U.S. Treasury bond, while the actual underlying yield paid will be zero. Naturally, the community expects this change to be announced in advance, and there would be some process allowing users to exit if they no longer wish to participate in liquidity mining or choose to hold for a longer time and accept the accompanying higher risk. Regardless of what changes occur in the first quarter of 2025, once this change is announced, the value of USD0++ will plummet. Holders of USD0++ will no longer hold it purely for its dollar value but because they believe the $USUAL tokens they will receive are worth locking up for a longer time.

Conflict of Interest

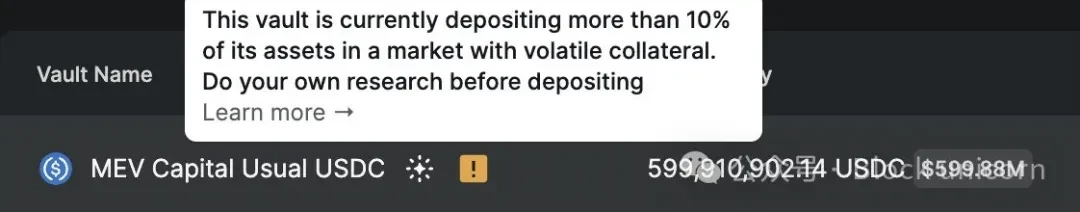

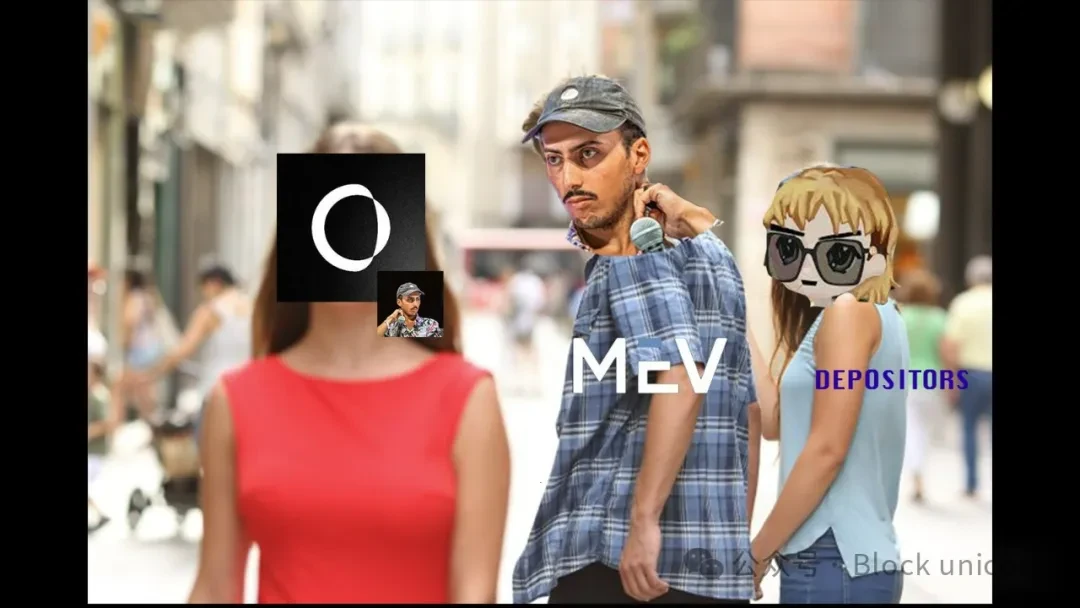

To facilitate liquidity mining, the liquidity pools for USD0 and USD0++ have been deployed across multiple platforms, including Morpho and Euler. The risk management of Morpho is outsourced to other managers, including MEV Capital, which plays a significant role in this story. MEV Capital's reputation has become somewhat dubious in certain circles—they have previously caused losses for investors and obscured this through questionable accounting practices. Additionally, one of the shareholders of MEV Capital, @AdliTB, is also a co-founder of Usual, which clearly presents a conflict of interest. MEV Capital's responsibility is to help lenders manage risk, not to recklessly direct large amounts of funds towards Usual. To achieve this, MEV Capital used a vault that hard-coded the value of USD0++ as 1 dollar. In other words, its Oracle effectively assumes that the value of USD0++ is always 1 dollar, regardless of market prices. Another well-known protocol operating in a similar manner is Anchor, which played a key role in the UST collapse. While there may be some rationale for doing this, adopting such an approach on assets that will eventually have liquidity removed is irresponsible. Euler's oracle uses market prices to operate, leading to liquidations, and many of Usual's liquidity pools now seem to hold a significant amount of bad debt.

One Dollar Turns into 80 Cents: The Decoupling Incident

Instead of announcing that liquidity mining users could exit, the Usual team actually chose to launch a "raid" on its users and all parties using Usual assets. According to @GauntletXYZ, at 4:56 PM Eastern Time, Usual notified Gauntlet and other managers from @MorphoLabs via Telegram chat that the unconditional 1:1 redemption mechanism for USD0++ in the primary market was immediately terminated. At the same time, the team released a public tweet announcing this change and stated that two new mechanisms would be introduced: a price protection mechanism with a floor price of 0.87 dollars and a 1:1 early uncollateralization mechanism for converting USD0++ to USD0, which is expected to be available next week.

Once the news broke, USD0++ began to decouple, dropping several percentage points within hours. As Euler's oracle correctly calculated that the debt positions were becoming unhealthy, Euler began liquidations. Prices continued to fall, while MEV Capital's liquidity pools began to suffer as interest rates surged due to borrowers withdrawing and traders leveraging to profit when the price of USD0++ rebounded.

Reasons for Purchase and the Pyramid Supply Structure of $USUAL

In my view, this situation and the potential for trapped funds to explode seemed highly likely to occur at some point, but the team made such extreme changes, without any warning, and issued shocking, misleading, and even completely false statements, which is truly unbelievable.

In reality, most participants in Usual are actually liquidity mining its tokens, and the team is well aware of this. If they had not operated in this way, one might reasonably assume they were trying to create a positive flywheel effect. However, the manner of this announcement was clearly intended to catch users off guard and deprive them of the opportunity to choose between withdrawing or continuing to participate, making this situation appear more like a "honeypot." The team's claim that "this change will occur at some point in the first quarter" is neither honest nor infuriating. We are only ten days into a 90-day quarter, which is clearly designed to catch people off guard. For such a significant change, most people expect to receive some warning in advance.

Moreover, the team clearly knew what would happen. This can be directly seen from Usual's announcement:

"Encouraging high-leverage positions in the USD0++/USDC ChainlinkOracleMorpho market to improve their health factors for maximum safety during this volatility, during which arbitrage bots may not be able to effectively maintain the floor price."

To compensate and improve health factors, miners had to sell USD0++ that no longer had value support!

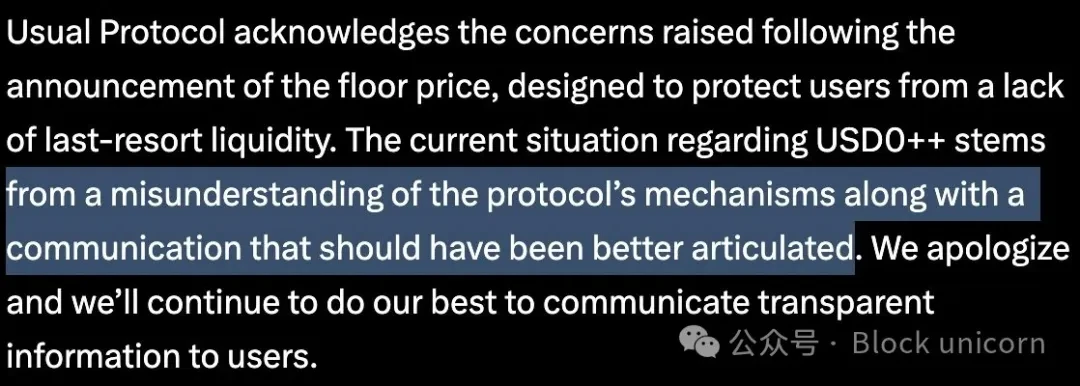

Despite the team beginning to backtrack in the face of significant opposition, even some miners threatening legal action, they still have not fully acknowledged their responsibility for failing to communicate the fundamental changes to USD0++ properly.

Some General Thoughts

Many smart people I know were surprised by this. I believe that making arbitrary changes to the redemption rules of USD0++ without any reasonable warning cannot be considered an act of integrity, and it may be illegal (absolutely so in the U.S., and likely in France as well), but that does not necessarily mean there will be consequences. This should not be used to attack Morpho; the Morpho system is manager-centric. One manager colluding directly with the protocol has now actually strengthened the position of those managers who did not collude, which will further solidify Morpho, whose model is designed for such events. Different approaches do not mean wrong approaches.

Overall, caution is needed when pursuing yields and trading, especially in the crypto space. Do your own research, understand the team, and if there isn't a good system for obtaining yields (see @ethena_labs), then the source of the yield is yourself, and if you are the source of the yield, either participate in the game like Curve / Velo / Aero or not at all. Bad teams exist, and they should be exposed and condemned. In my view, even if the team is not bad, the manner in which this decision was executed is very poor, bordering on criminal. However, the crypto and DeFi space remains a wild west, so do your own research; where there is smoke, there is always fire.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。