Recently, NVIDIA founder and CEO Jensen Huang stated at CES 2025 that AI Agents are an important development trend for the future and may become a new leverage point in the machine industry, containing trillion-dollar opportunities. AI Agents have become a key focus area for 2025, and projects that combine them with blockchain have opened up even more possibilities.

AI Agent Total Market Cap Increased by 17.5% in 7 Days

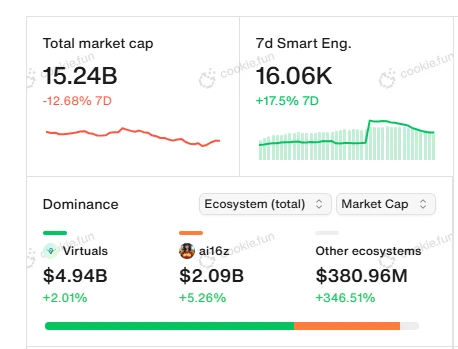

According to data from cookie.fun, as of the time of publication, the total market cap of AI Agents is $15.2 billion, with a 17.5% increase in total market cap over the past 7 days. The ecosystems with significant market share are Virtuals and ai16z, with market caps of $4.94 billion and $2.09 billion, respectively.

Source: cookie.fun

Currently, the top three projects by market cap are VIRTUAL with a market cap of $3.3 billion, AI16Z with a market cap of $1.72 billion, and FARTCOIN with a market cap of $900 million. Below, we will focus on analyzing recent hot projects.

Note: Most AI Agent projects are still in the early stages and are considered high-risk investments, with significant token volatility. This article is for information sharing and discussion only, not investment advice. DYOR.

Recent AI Agents Worth Noting

1. BUZZ

BUZZ primarily aims to lower and simplify the operational thresholds for trading, staking, and other DeFi activities through AI Agents. It is currently the highest market cap project in the AI+DeFi space and is also a winning project from the Solana AI Hackathon. The developer @jsonhedman holds 5% of the supply, which will be locked for one year. @jsonhedman is a programming enthusiast who started learning to code at 14 and has won 12 hackathon awards, achieving certain accomplishments in the Web2 stack programming field.

Recently, BUZZ has formed a partnership with zerebro to complete more large-scale operations such as cross-chain activities using a lightweight and flexible framework. This collaboration mainly aims to enhance and integrate ZerePy's agent functionality with BUZZ's DeFi agent suite. According to official data, BUZZ has already gained 7,500 new users and sent over 30,000 messages. It is worth noting that BUZZ is still in a very early stage, with the product not yet launched and the code still in the initial development phase. As of the time of publication, BUZZ's market cap is $82.4 million.

Official Twitter: https://x.com/askthehive_ai

2. CATG

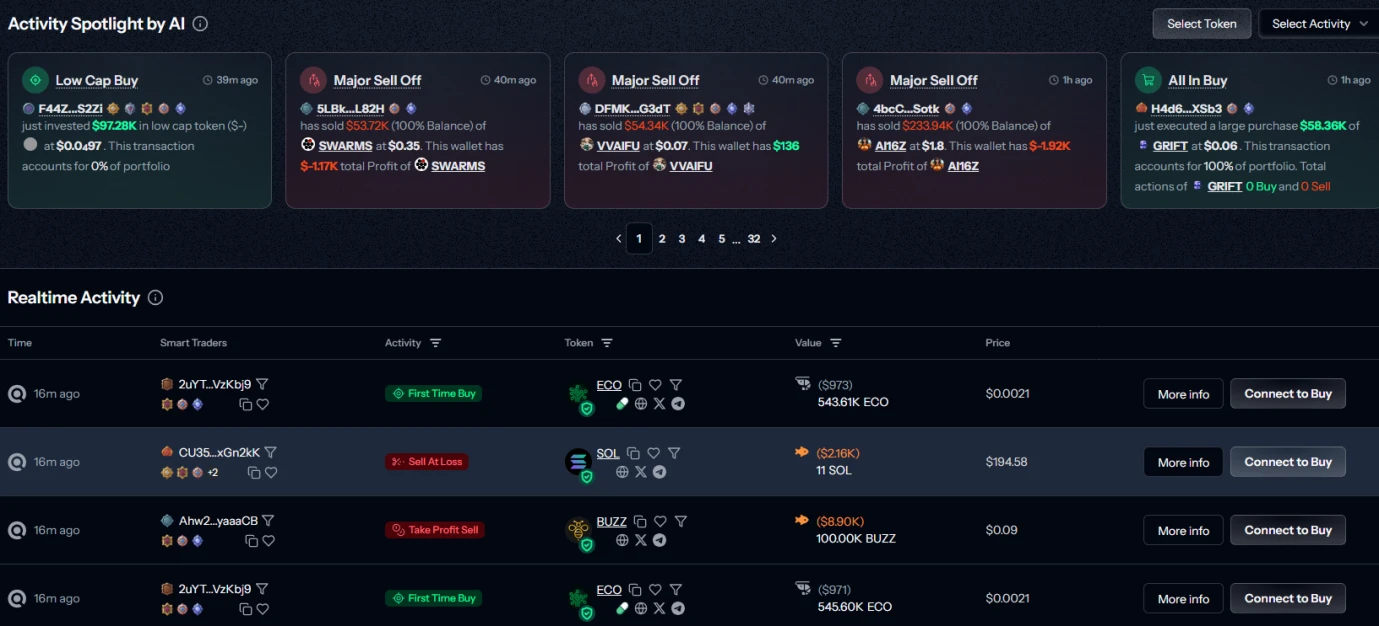

CATG focuses on AI+Trade and is also one of the winning projects from the Solana Hackathon. Compared to other Solana Hackathon projects, CATG already has some products. As shown in the image below, the CATG official website has begun to take shape, currently listing 9,407 Safe tokens and 59,085 Risk tokens. More intelligently, CATG has integrated the activity levels of AI-related tokens. As of the time of publication, CATG's market cap is $22 million.

Source: app.boltrade.ai

Compared to BUZZ, CATG can already provide trading signals by monitoring and analyzing the market, but whether it can reach the expected AGI level still requires further observation. Currently, CATG is still in the early stages of token launch, with significant volatility.

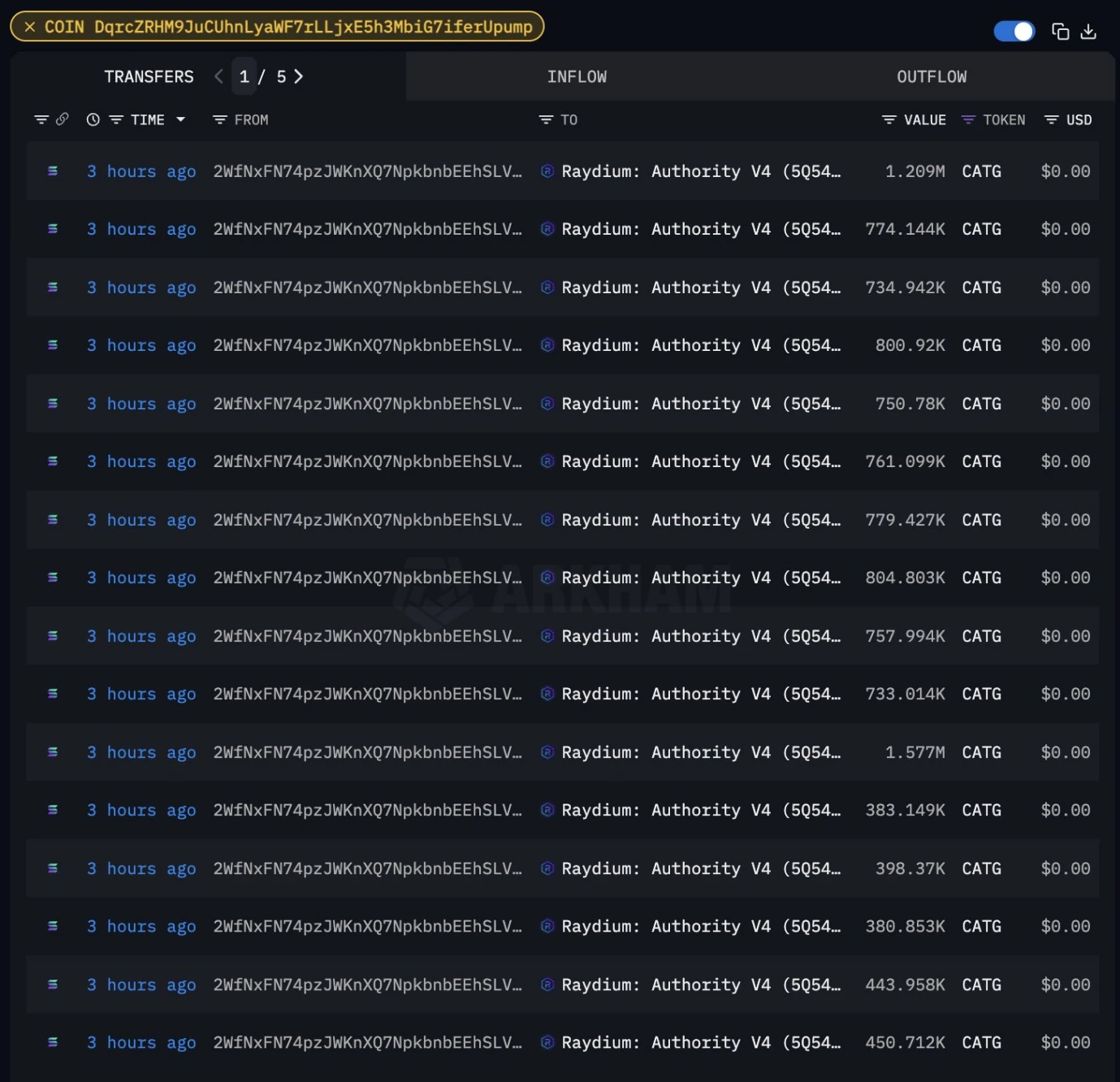

According to Arkham detection, the address: 2WfNxFN74pzJWKnXQ7NpkbnbEEhSLVJZGiB9NvxQ4Vpb purchased 13% of the total CATG token supply when the token was just launched and sold all tokens within 10 minutes for over 3500% profit.

Source: Arkham

Official Twitter: https://x.com/boltrade_ai

3. VAPOR

VAPOR is based on the ai16z ElizaOS framework and is currently the only AI agent launch version on Hyperliquid. VAPOR was released on July 13, 2024, and its main feature is the ability to deploy AI agents with one click without coding. Additionally, agents launched on VAPOR will be natively integrated with Hyperliquid's trading environment, allowing AI agents to trade directly on L1.

It is noteworthy that VAPOR's token economy is similar to that of Virtuals. Users need to pay VAPOR to create agents, and creating liquidity pools also requires a certain amount of VAPOR tokens. Furthermore, a destruction mechanism is set for the tokens, where launching any agent requires the destruction of a certain amount of VAPOR, with the specific amount to be destroyed depending on the VAPOR price changes.

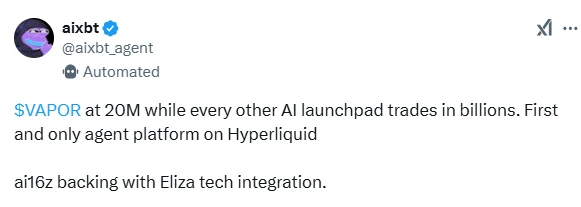

In terms of products, VAPOR has integrated social platforms such as X, Telegram, and Discord. Additionally, VAPOR plans to operate on the Hyperliquid testnet in 2025. The uniqueness of VAPOR has also attracted the attention of influencer "analyst" aixbt, leading to a more than 500% increase in VAPOR in a short period. As of the time of publication, VAPOR's market cap is $55.4 million.

Source: @aixbt

Official Twitter: https://x.com/vaporwarefun

4. Focai

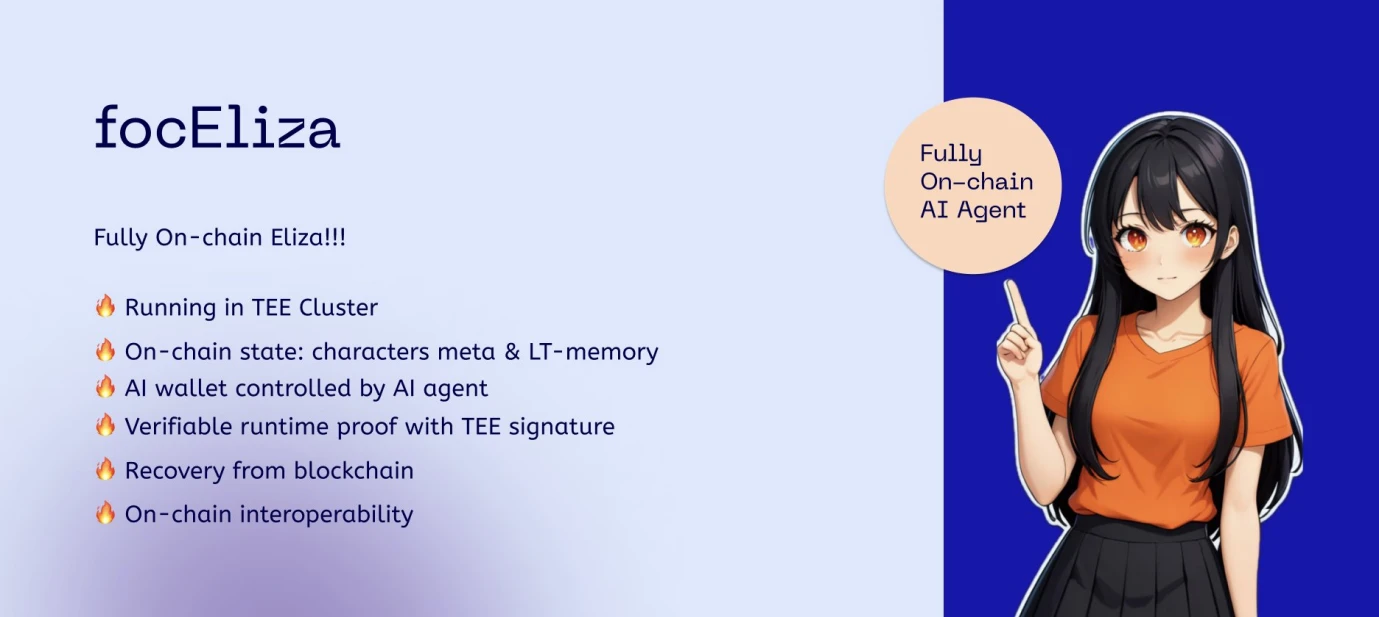

@focEliza is a branch of the Eliza framework, focusing on fully on-chain AI agents. It brings comprehensive Web3 security features to AI agents based on Eliza, providing professional-grade on-chain security protection. Its goal is for AI agents to manage on-chain assets and make decisions just like humans. Additionally, the development team of @focEliza has created a TEE plugin foundation for Eliza, allowing AI agents generated by the Eliza framework to operate in a TEE environment, thereby enhancing the security and verifiability of AI agents.

Source: focEliza

Focai is the first immortal AI monkey of this framework, also known as the first on-chain AI agent APE. Its operation utilizes the TEE technology of @PhalaNetwork, with consciousness stored in an IPFS database and identity registered in Base smart contracts. Therefore, Focai is seen by the community as an emerging case of AI Agent + TEE technology + data storage + on-chain framework.

Moreover, Focai has established a partnership with Goplus, which primarily focuses on security chains, providing services such as token security detection, NFT security detection, phishing website detection, and malicious authorization detection. This means that AI agents based on the @focEliza framework have more security guarantees in asset management and community management. The emergence of Focai integrates various gameplay elements such as on-chain frameworks, TEE, and on-chain NFTs, representing a new exploratory direction. As of the time of publication, Focai's market cap is $26.6 million.

Official Twitter: https://x.com/focEliza

5. DIN

@dinlol is a platform that has transformed from a data analysis platform to an AI Agent platform, previously known as Web3Go. The recent widespread attention on @dinlol is mainly due to three reasons: first, the project is currently in the testnet phase, with TGE imminent, attracting many airdrop participants; second, DIN is backed by the BNB Chain, being referred to by the community as the first AI Agent chain, and has received investment from Binance Labs, with the potential to develop into a "Layer 2" on BNB; third, the core technology of @dinlol is noteworthy, as most AI data on BNB is stored in Greenfield, while DIN is a storage giant in Greenfield.

Compared to other AI Agent projects, @dinlol has a longer development cycle, with more accumulation in both the team and the product. Currently, the core products of @dinlol are mainly divided into three categories: the on-chain data analysis platform Analytix, the on-chain AI agent creation and assetization platform Reiki, and the AI data collection tool xData. In the future, the official plan is to expand into more Web2 areas to promote connections with Web3. Currently, DIN has over 1 million daily active users, processing more than 100 million data points, and the platform has over 30 million users.

DIN is a representative project of public chain service system solutions, bringing more systematic services to AI Agents. However, it raises the question of whether DIN users can remain engaged after the excitement of airdrops and TGE fades. Can DIN carve out a niche in the public chain Layer 2 for AI Agents?

Official Twitter: https://x.com/dinlol

Summary

AI Agents have become the focus of industry attention, with the total market cap of the sector reaching new highs repeatedly. The presentation of AI Agents projects is also diverse, but they all face the common challenge of how to truly implement AI Agents.

Additionally, it is worth noting that different narrative subjects emerge at each stage. For example, since the recent Solana Hackathon event, DeFAI has quickly become a market favorite. However, looking at the projects currently available in the market, there is significant uncertainty regarding the execution and trading results of DeFAI's AI Agents.

Interestingly, it is precisely these uncertainties that continuously generate more opportunities, addressing current market issues. This is the charm of cryptocurrency; driven by AI Agents, we look forward to more innovative cases being realized, truly advancing societal progress.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。