Compiled by: Fairy, ChainCatcher

Performance of Crypto Spot ETFs Last Week

U.S. Bitcoin Spot ETF Net Inflow of $312 Million

Last week, the U.S. Bitcoin spot ETF saw a net inflow of $312 million, bringing the total net asset value to $10.764 billion, with an average daily trading volume of $3.8 billion. On January 6, there was a net inflow of $978 million, setting a record high since November 21.

The inflow mainly came from BlackRock's IBIT, which had a net inflow of $497 million. Five ETFs experienced net outflows, with Ark Invest and 221Shares' ETF ARKB seeing a net outflow of $200 million.

Eleven Bitcoin spot ETFs were officially approved on January 10, 2024, and began trading on January 11, marking their first anniversary. The Bitcoin spot ETFs have accumulated a net inflow of $36.225 billion, with BlackRock's IBIT leading at $37.667 billion, followed by Fidelity's FBTC with a net inflow of $12.156 billion. Grayscale's GBTC had a net outflow of $21.566 billion, making it the only Bitcoin spot ETF with a net outflow.

Source: Farside Investors

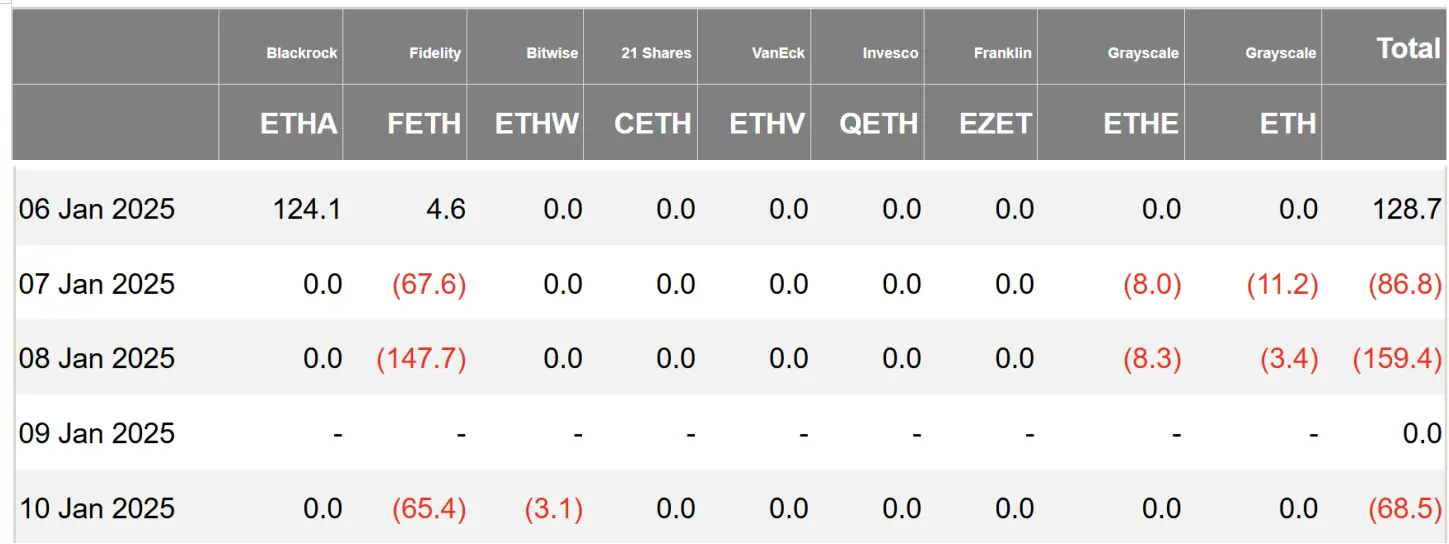

U.S. Ethereum Spot ETF Net Outflow of $186 Million

Last week, the U.S. Ethereum spot ETF experienced a net outflow of $186 million, with a total net asset value of $1.161 billion and an average daily trading volume of $514 million.

The outflow primarily came from Fidelity's FETH, which had a net outflow of $276 million. Additionally, four ETFs had no capital movement.

Note: The U.S. stock market was closed on January 9, so there is no data for that day.

Source: Farside Investors

Hong Kong Bitcoin Spot ETF Net Outflow of 41.29 Bitcoins

Last week, the Hong Kong Bitcoin spot ETF saw a net outflow of 41.29 Bitcoins, with a net asset value of $40.1 million.

The Hong Kong Ethereum spot ETF had a net outflow of 414.71 Ethers, with a net asset value of $6.077 million. On January 10, there was a net outflow of 414.71 Ethers, marking the largest net daily outflow since June 17.

Data: SoSoValue

Crypto Spot ETF Options Performance

As of January 10, the nominal total trading volume of U.S. Bitcoin spot ETF options was $1.98 billion, with a nominal total long-short ratio of 1.59, indicating a relatively balanced trading volume between bulls and bears. As of January 8, the nominal total open interest for U.S. Bitcoin spot ETF options reached $9.81 billion, with a nominal total open interest long-short ratio of 1.68.

Additionally, the implied volatility was 59.27%.

Data: SoSoValue

Overview of Crypto ETF Developments Last Week

Ninepoint Announces Update of Web3 Innovation Fund to ETF

Ninepoint Partners LP announced that it will update its Web3 Innovation Fund, the Ninepoint Web3 Innovators Fund, to an exchange-traded fund, with the new product name being “Ninepoint Crypto and AI Leaders ETF.”

Currently, the investment objectives and strategies of this ETF will remain unchanged, and it will continue to be listed on the Toronto Stock Exchange.

Nasdaq Applies to Increase BlackRock Bitcoin Spot ETF Position Limit to 250,000 Shares

According to a public regulatory filing, Nasdaq has submitted an application to the U.S. Securities and Exchange Commission (SEC) to increase the position limit for BlackRock's Bitcoin spot ETF (IBIT) from 25,000 shares to 250,000 shares. It is important to note that this application still requires SEC approval to take effect, and the position limit refers to the maximum number of shares that a single investor or institution can hold in the ETF.

Bitwise Alpha Strategies' director commented: “Given the continuous increase in trading volume for this ETF, it would be reasonable to raise the position limit to at least 400,000 shares. Nasdaq and BlackRock's request is justified and supported by facts.”

Views and Analysis on Crypto ETFs

The ETF Store President Releases 10 Crypto-Related ETF Predictions for 2025

The ETF Store President Nate Geraci released 10 crypto-related ETF predictions for 2025, believing that the Trump administration will adopt significantly different policies towards cryptocurrencies compared to the Biden administration, potentially making 2025 the "Year of Crypto ETFs." The main predictions are as follows:

- The asset size of spot Bitcoin ETFs will surpass that of physical gold ETFs (this is obvious unless Bitcoin prices plummet);

- Approval for spot Ethereum ETF options trading;

- Spot Bitcoin and Ethereum ETFs will allow for physical creation/redemption;

- Spot Ethereum ETF staking will be approved;

- Bitwise Bitcoin Standard Company ETF will launch, with assets under management exceeding $1 billion;

- At least 50 other crypto-related ETFs will be listed, including options-based products (covered call ETFs, outcome-based ETFs, etc.), stock ETFs priced in Bitcoin, and "Bitcoin bond" ETFs;

- Approval for spot Solana ETF;

- Approval for spot XRP ETF;

- Approval for Bitwise and Grayscale crypto index ETFs;

- Vanguard will allow clients to invest in Bitcoin and Ethereum spot ETFs through brokerage accounts.

Ripple President: XRP May Be the Next Crypto Spot ETF

Ripple President Monica Long stated in an interview on Tuesday that an XRP ETF may be realized soon, as favorable U.S. cryptocurrency legislation would greatly benefit domestic companies.

Long said: “I believe we will see more spot ETFs launched in the U.S. this year, and XRP is likely to be the next crypto spot ETF after Bitcoin and Ethereum. Especially with the change in government, the approval of these applications will accelerate.”

21.co Strategy Analyst: Data Shows ETH ETF Still Has Significant Growth Potential, May Catch Up in 2025

21.co strategy analyst Tom Wan stated that the current market cap ratio of BTC to ETH is 4.5:1, while the AUM ratio for ETFs is as high as 9:1. BTC ETFs hold 5.9% of the total supply, while ETH ETFs only hold 2.9%, indicating that ETH ETFs still have significant growth potential and may catch up in 2025, potentially driving up ETH prices.

The ETF Store President: Calamos to Launch First Bitcoin ETF with 100% Downside Protection

The ETF Store President Nate Geraci stated on X: “Calamos will launch the first Bitcoin ETF CBOJ that offers 100% downside protection. If Bitcoin is held during the outcome period, full downside protection will be provided, but the upside is capped.”

It is reported that CBOJ is expected to be listed on CBOE on January 22, 2025. CBOJ will combine U.S. Treasury bonds and options on the CBOE Bitcoin U.S. ETF Index. This actively managed ETF provides a regulated way to gain exposure to Bitcoin within a risk control framework.

Previous news reported that asset management company Calamos submitted an application for a Bitcoin buffered ETF.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。