Compiled by: Luan Peng, RootData

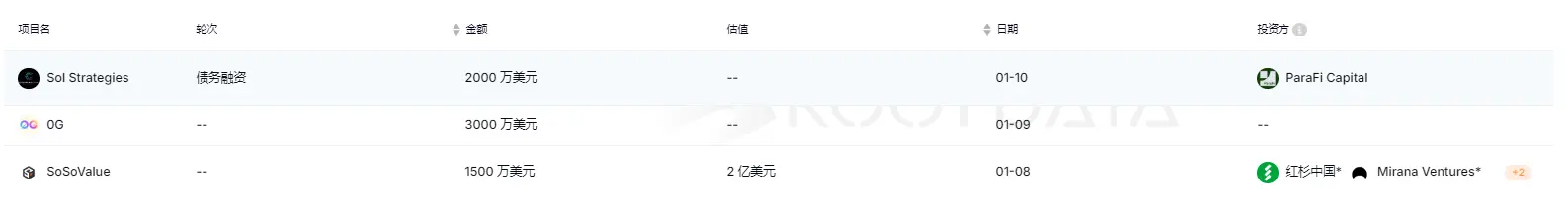

According to incomplete statistics from RootData, during the period from January 6 to January 12, 2024, there were a total of 16 public financing events in the blockchain and cryptocurrency industry, with a cumulative financing of approximately $86.7 million.

From the distribution of sectors, the projects that received financing were mainly concentrated in the infrastructure and DeFi sectors. Popular projects include trusted AI technology company Rena Labs, cryptocurrency data platform SoSoValue, on-chain gaming ecosystem SEED, and DePIN startup Starpower.

In addition, the game-focused L2 blockchain ZKcandy completed a $4 million financing round, with participation from Wemix Pte. Ltd., Animoca Ventures, Spartan Group, Perlone Capital, Presto Labs, Flowdesk, Prometheuz, Lecca Ventures, Efficient Frontier, and angel investors from projects like Stacks, Analog, and Mittaria.

(List of projects with financing greater than $5 million last week, data source:Rootdata)

I. Infrastructure

According to official news, AI + DePIN project Privasea completed Series A financing at a valuation of $180 million, raising a total of $15 million across three rounds, with investors including GSR, Amber, and Echo, and early investors such as Binance Labs, OKX Ventures, Nomura’s Laser Digital, and Gate Labs.

It is reported that Privasea launched the DeepSea testnet Beta on January 6, and this financing will be used to accelerate the deployment of the mainnet DeepSea and the development of related smart agents, promoting the development of human-computer interaction and intelligent agent interaction.

According to Web3 asset data platform RootData, Privasea is an AI + DePIN project focused on building decentralized privacy computing infrastructure. The company's mission is to provide efficient, user-friendly fully homomorphic encryption (FHE) solutions tailored for web2 and web3 environments, with a focus on machine learning (ML) applications.

AI-driven RWA L2 network Novastro completes $1.2 million seed round financing, led by Woodstock

According to Beincrypto, AI-driven RWA Layer 2 network Novastro announced the completion of a $1.2 million seed round financing, led by Woodstock, with participation from Faculty group, Double peak group, Cogitent, X21, and Sam Tapaliya.

Novastro is an AI-driven Layer 2 chain for real-world assets (RWA) that integrates MoveVM and EigenLayer AVS. The network aims to provide Ethereum-level security while leveraging the efficient scalability of the Move language, supporting tokenized yield applications in the RWA and DeFi sectors. Its core framework is built around the RUSD stablecoin, designed specifically for the tokenization and trading of real-world assets.

Aligned Foundation completes $1 million community financing

The decentralized zero-knowledge proof verification layer Aligned Foundation announced via Twitter that it has completed $1 million in community financing.

Aligned Layer is a ZK verification layer developed on top of EigenLayer. This will make the verification of any SNARK proof cost-effective, leveraging the security of Ethereum validators without being constrained by Ethereum. As part of Eigen Layer AVS, it promises affordable verification and multifunctional proof systems for L2 and bridges, addressing key needs in the blockchain ecosystem.

Trusted AI company Rena Labs completes $3.3 million seed round financing, led by Paper Ventures

According to The Block, trusted AI technology company Rena Labs completed $3.3 million in seed round financing, led by Paper Ventures, with participation from Lightspeed Faction, Eterna Capital, Lyrik Ventures, Mapleblock Capital, Selini Capital, and Keyrock.

Rena Labs plans to use this financing to expand its team, attract developers and industry experts, and enhance the development of its abstract middleware Trusted Execution Environment (TEE). This technology aims to build the infrastructure for on-chain trusted AI applications, ensuring that intelligent systems inherently achieve trust and verifiability while safeguarding users' digital sovereignty.

The game-focused L2 blockchain ZKcandy completed $4 million in financing, with participation from Wemix Pte. Ltd., Animoca Ventures, Spartan Group, Perlone Capital, Presto Labs, Flowdesk, Prometheuz, Lecca Ventures, Efficient Frontier, and angel investors from projects like Stacks, Analog, and Mittaria.

These funds will be used to build a Telegram-based EVM gaming ecosystem, collaborate with intellectual property holders, expand the partner network, develop gaming AI agents, and prepare for the mainnet launch in the first half of this year. ZKcandy is developed and operated by iCandy, with Lemon Sky Studios as a subsidiary of iCandy.

According to RootData, ZKcandy is a Layer 2 scaling solution for Ethereum that utilizes zero-knowledge proofs to accelerate transaction speeds and reduce costs. By processing off-chain transactions and leveraging Ethereum's security, ZKcandy enhances scalability, ensuring faster and more cost-effective transactions while maintaining compatibility with the Ethereum ecosystem.

II. DeFi

Liquidity aggregator Ooga Booga completes $1.5 million strategic round financing, led by Primal

Berachain ecosystem liquidity aggregator Ooga Booga announced the completion of $1.5 million in strategic round financing, which will be used to accelerate its next phase of development in the Berachain ecosystem. This round was led by Primal, with participation from CitizenX, Quantstamp, Rubik, ViaBTC Capital, TempleDAO, and several angel investors, including individual investors from Infinex, GMX, Saison Capital, and Movement Labs.

According to RootData, Ooga Booga is a decentralized exchange aggregator based on Berachain, which finds the cheapest cryptocurrency trades for traders by searching multiple different exchanges.

Cryptocurrency data platform SoSoValue completes $15 million financing, led by Hongshan and others

Cryptocurrency data platform SoSoValue completed $15 million in financing at a valuation of $200 million, led by Hongshan, SmallSpark, Mirana Ventures, and Safepal. This round of financing brings its total funds raised to nearly $20 million.

The company plans to use the new funds to continue launching new investment products as part of its SoSoValue index protocol. This protocol uses smart contracts to automatically purchase digital assets and package them into wrapped tokens.

According to RootData, SoSoValue is a one-stop financial research platform for cryptocurrency investors, providing real, high-quality macro market information to assist investors in more effective investment research. It also offers an AI-based classification system for news and research, connecting macroeconomic data with the cryptocurrency market.

III. Gaming

On-chain gaming ecosystem SEED has received investment from the Sui Foundation

The on-chain gaming ecosystem SEED has received strategic investment from the Sui Foundation, focusing on building the next generation of on-chain gaming ecosystems that combine sustainability, scalability, and innovation.

SEED has transformed from a Telegram mini-program into an on-chain gaming ecosystem based on mass messaging services. With the help of VR, AI, and true on-chain logic, the next version of SEED will provide an immersive gaming experience connected to the blockchain.

IV. Creator Economy

Web3 AI creator platform Oh has completed a $4.5 million seed round financing, with participation from Tangent, Big Brain Holdings, Kosmos Ventures, Tagus Capital, and Bodhi Ventures. The company plans to use these funds to expand its product range and reshape the digital creator economy.

The platform's main product, OhChat, is capable of creating AI-driven "digital twins" for online creators. The platform plans to launch its utility token in the first quarter of 2025, which will be deployed on the Solana blockchain along with all on-chain assets of the protocol.

According to RootData, Oh is an AI infrastructure and product aimed at digital creators, supporting ownership of personalized, interoperable AI characters, thereby unlocking significant profit opportunities both within and outside the ecosystem. Anyone can build and own a supermodel, and creators can have their own digital twin, monetizing through their likeness without the restrictions of other creator platforms (retaining 80% of net income from the character).

V. Others

Canadian publicly listed company Sol Strategies Inc., focused on investing in the Solana ecosystem, announced a CAD 27.5 million private placement financing, fully committed by ParaFi Capital. The funds will be used to expand SOL reserves, grow validator operations, and support daily operations.

This financing includes convertible debenture units, each consisting of a CAD 1,000 convertible debenture and 400 warrants, with an annual interest rate of 2.5%. The conversion price and warrant exercise price are both CAD 2.50 per share. The convertible debentures can be redeemed three years later at 112% of face value plus accrued interest, with settlement expected to be completed on January 16, 2025.

DePIN startup Starpower completes $2.5 million financing, led by Framework Ventures

DePIN startup Starpower announced the completion of $2.5 million in financing, led by Framework Ventures, with participation from Solana Ventures and Bitscale Capital.

Starpower is a decentralized energy network that connects energy devices such as air conditioners, electric vehicle chargers, and batteries. It provides usage-based algorithms to improve energy efficiency, save on electricity costs, and reduce volatility in energy systems by coordinating the charging and discharging of devices.

Solayer announces acquisition of blockchain analytics company Fuzzland

Solana re-staking platform Solayer announced via Twitter that it has acquired blockchain analytics company Fuzzland. The merged team will focus on Solayer infiniSVM (hardware-accelerated SVM chain for Solana scaling), optimizing Solana validators (to improve throughput and maximize returns for sSOL holders), as well as dynamic analysis, formal verification, and real-time protection for SVM.

Fuzzland created the smart contract hybrid fuzzer Ityfuzz, which supports many Web3 security companies today.

Coinbase acquires browser product Roam.xyz

Roam.xyz announced that it will join Coinbase. Members of the Roam founding team, including Xen Baynham-Herd (CEO), Ali Fathalian (CTO), and John Granata (CPO), will join Coinbase to accelerate the company's development in on-chain consumer business.

Roam.xyz is dedicated to building a mobile browser that adapts to the future blockchain internet. The Roam team stated that the browser product they have built has received widespread recognition from the community, and they are very proud to provide users with a brand new on-chain experience. Now, with the addition to Coinbase, the Roam team will focus on creating products that support a new type of open financial system.

TONCASH announces strategic investment from TON Ventures

Telegram cryptocurrency cashback and rewards platform TONCASH has received a strategic investment from TON Ventures. TONCASH is currently actively expanding in the Asia-Pacific region, Europe, the Middle East, and Latin America.

Ben Usinger, CEO and co-founder of TONCASH, stated: "This investment deepens our collaboration with Telegram and The Open Network, enabling us to provide the best online shopping and rewards experience for Web3 users. With the strategic support of TON Ventures, we are driving the adoption of on-chain payments, attracting millions of users through innovative cashback mechanisms, and redefining how brands connect with customers in the Web3 space."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。