Written by: Haotian

"Suddenly, like a spring breeze coming overnight, even the iron tree can bloom with pear flowers." How can so many DeFi projects emerge in such a short time, as if by magic? The standards and frameworks are still not clear, and a new round of DeFi competition has begun? Alright, next, I will share from a popular science perspective what the major categories of DeFi projects are all about.

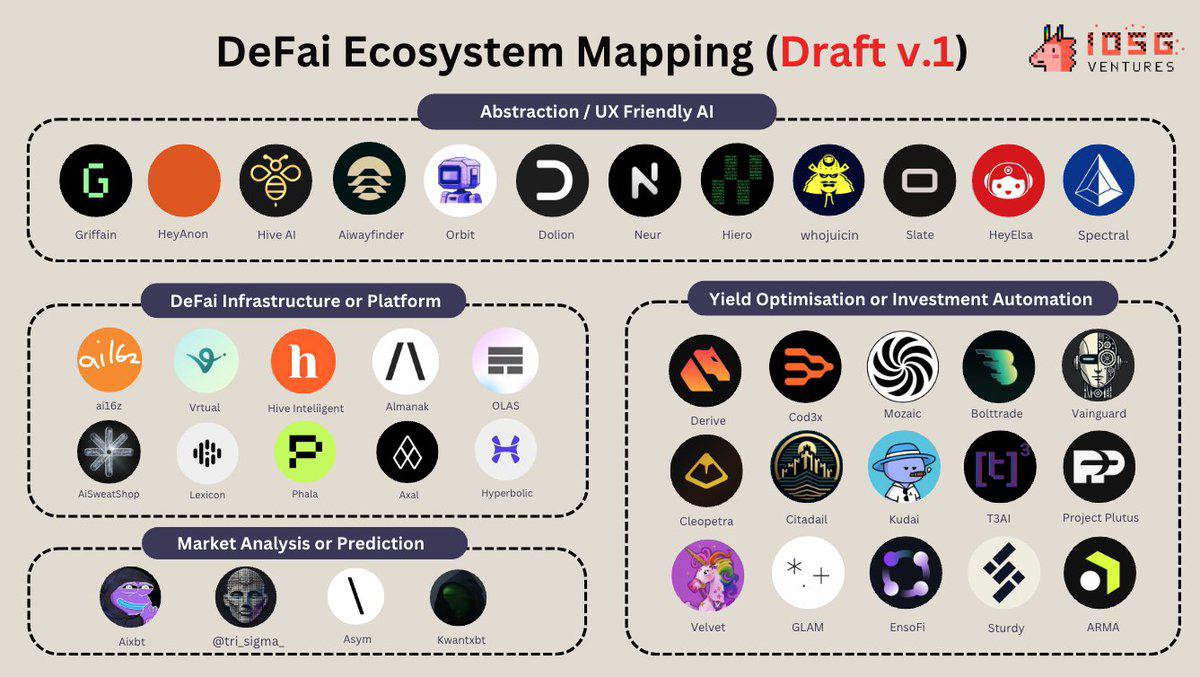

1) In the past few days, Poopman shared a distribution map of a DeFi ecosystem project, which has been widely circulated in the community. Looking at the comments, there are still many related projects that have not been included. Many people may feel anxious, worried about missing out on wealth opportunities, but there is no need to.

First of all, it should be noted that among these, there are indeed some "new" AI projects with good current mindshare, such as: $AIXBT, $BUZZ, #NEUR, #GRIFT, #Cod3x, etc., but most of them are new faces that exude an "old" vibe.

The core reason is that most of them are old projects that have been rebranded with new expectations through the narrative of AI Agents. Some old projects that once made many optimizations in the DeFi field but went unnoticed, and some old projects that were difficult to discover in the last round of VC-driven retail attention.

2) The following diagram contains four major categories, and I will try to dissect my understanding of each:

- AI Abstraction: As the name suggests, this involves some products that encapsulate the information processing capabilities of large AI models into a user-friendly front-end product experience that allows for direct semantic interaction. Users can input prompts to directly call trading interfaces in the dialogue box, with transactions automatically completed by the AI backend.

Because of this, these products often face skepticism at first glance due to significant friction in early product interaction experiences. For example, the "ambiguity" of user input prompts and the "precision" required for the AIGC backend to process information and execute requests necessitate a "tolerance" mechanism. Users may find the input and execution commands too simple to compete with current DeFi experiences, or they may input overly ambitious commands only to find that the backend program lacks a precise execution solver.

However, these products can gain the trust of a large user base due to their novel interaction models and solutions to basic issues like swaps and staking. The reason lies in their strong potential for future development. The way users input prompts can be through text, audio, etc., which aligns with convenient usage habits and significantly lowers the usage threshold. Meanwhile, the AIGC backend's processing capabilities will gradually encapsulate more new solver execution solutions to enhance user experience.

Anyway, this is an attempt to explore a new trading paradigm, just like when Uniswap introduced the AMM swap trading pool paradigm to the market, which was also initially criticized for high slippage friction. The AI Abstraction sub-track may seem trivial in the short term, but the long-term potential for a significant paradigm shift is worth paying attention to.

- Autonomous Portfolio Management & Yield Optimization: These products are the result of the last round of DeFi market competition. A large number of projects aiming to carve out a share in the DeFi space have been continuously working from angles like personalization, customization, vertical segmentation, and specialized experiences. However, before they could reap the rewards, the DeFi industry became nearly desolate.

Most of the yield optimization strategies in DeFi come from the team's ability to monitor and analyze on-chain data, such as trading depth, capital flow, APY fluctuations, slippage estimates, price deviations, arbitrage opportunities, risk warnings, etc. Based on this real-time on-chain data analysis, a set of execution strategies can be formulated, such as position capital allocation, capturing arbitrage opportunities, yield estimation, single pool or combination strategies, impermanent loss management, liquidation risk control, etc.

In simple terms, the core of these products is real-time on-chain data + trading opportunity capture capabilities, along with a complete set of automated analysis and execution operation experience upgrades based on smart contract optimization. At first glance, what does this have to do with AI? The connection lies in the data analysis and strategy formulation, which can be trained and fine-tuned by traders to generate investment opportunities that are potentially more efficient than manual efforts.

Moreover, when combined with AI Agents, the imaginative space expands even further. Everyone can use their own strategies to fine-tune a personal trading preference AI Agent to automatically seek opportunities on-chain and execute trades. Making AI Agents advanced trading assistants for humans is a long-term narrative that is both appealing and ongoing.

- Market Analysis or Prediction: These products, as powerful standalone AIs, have captured a large portion of user mindshare. For example, AIXBT has indeed become a key information acquisition platform for many traders as a top KOL. However, while users recognize the practical application capabilities of AI Agents that only provide trading strategy analysis, they lack long-term imaginative space. For instance, can my AI Agent monitor AIXBT's news and automatically help me decide to buy the dip and arbitrage?

Theoretically, this is feasible. In fact, AI Agents like AIXBT could potentially autonomously manage user assets and, based on their own information decisions, assist users in trading operations. However, this step has not yet been taken. Currently, the speed at which these products occupy user minds is so rapid, and with the commercial monetization capabilities driven by traffic, the imaginative space is actually quite significant.

- DeFi Infrastructure or Platform: The scope of these protocols is quite broad. In addition to emerging platforms like #ai16z and #Virtaual that are AI Agent Native, other projects related to AI computing power, data, fine-tuning, etc., such as Bittensor, io, Atheir, Hyperbolic, Vana, SaharaAI, etc., can also be extended to this category.

After all, for AI Agents to operate normally, data is the oil, computing power is the power grid, reasoning is the transformer, and AI Agents are the terminals, all of which are upstream service providers.

Therefore, there is not much to say. The latter half of the AI Agent journey needs to gather strength, and these DeFi platforms will definitely play a significant role. Originally, the AI Agent narrative is just the earliest link in the AI Narrative, and frameworks and standards, DeFi, GamFi, Metaverse, and other focal narratives cannot be separated from these AI infrastructure platforms.

That's all.

Although I have clarified a clear perspective on understanding DeFi, it does not mean I am not optimistic. Compared to the current chaotic and hard-to-judge narrative framework and standard "chaotic era" market, DeFi at least introduces a more AI Agent application-oriented approach, allowing for gradual progress and expectations through experience, PMF product landing, etc.

This also reflects the current trend of the AI Agent market moving from the virtual to the real. Moreover, so many old species that could not find opportunities in the old DeFi era now have the chance to unleash their potential in the face of new trends, right?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。