Last night, news about Movement's upcoming $100 million financing ignited discussions in the crypto community. According to reports, Movement Labs will complete a $100 million Series B financing, with a valuation of approximately $3 billion.

This round of financing is co-led by CoinFund and Nova Fund under Brevan Howard, and is expected to be completed by the end of January. Investors will receive a combination of equity and $MOVE tokens, with a focus on the tokens.

After the news broke, many group members discussed: Is it an OTC discounted sale of tokens? Will it affect the airdrop allocation?

Based on my understanding, let me clarify:

Financing after a crypto project's TGE is a common practice, aimed at bringing in more long-term institutional partners. On the surface, it seems that new institutions receive a lower valuation, but their tokens are locked for the long term, which will not disrupt the original token release rules.

The chips bought by new institutions usually come from the team or foundation, rather than from established community shares. Therefore, Movement's actions will not touch community interests and will not affect airdrop distribution.

In summary, Movement's choice to continue financing after the TGE is likely to bring in more powerful resource partners for the Move ecosystem, indicating a future collaboration rather than a mere opportunistic play.

Currently, the disclosed Series B financing leads are CoinFund and Nova Fund under Brevan Howard. As for how impressive these two institutions are, just look at their backgrounds and investment portfolios:

CoinFund: Established in 2015, it has invested in over 100 companies, including Polygon, Near, L0, Flow, Worldcoin, Ondo, etc. It not only provides funding but also helps them achieve long-term development through strategic guidance and industry resources.

Nova Fund: Part of the digital asset division of hedge fund Brevan Howard, which is one of the world's top hedge funds managing hundreds of billions in assets, covering sovereign wealth funds, corporate and public pension funds, endowments, and more.

In conclusion, Movement's upcoming Series B financing is part of a larger strategy: on one hand, gaining support from resource-oriented institutions like CoinFund to expand the ecosystem, and on the other hand, seeking support from Old Money to prepare for future entry into traditional financial markets.

For us, all of the above is positive news. So, continue to ambush Movement's second airdrop and wait for the rewards:

1. Zero-cost Galaxy Tasks

Although the $MOVE first airdrop did not cover Galaxy points, this is proof of community users' persistence in signing in and participating in various activities. The official has long indicated that it will be useful later, and I guess it will be linked to the second airdrop.

Participation tutorial: https://x.com/wenxue600/status/1870257637667025179

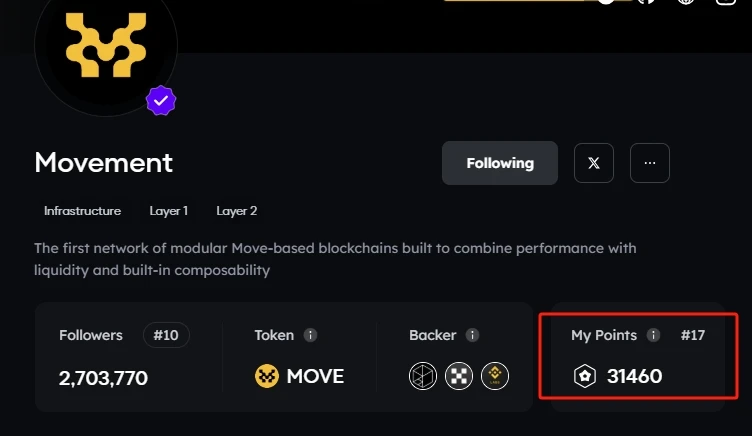

2. Brush Kaito-MOVE Rankings

A few days ago, Movement officially joined Kaito+ and announced an airdrop for Kaito users, with rules to be announced in the coming weeks. If you're interested, get started now.

Key points to grasp: Produce more original Move content + interact more with the official Twitter, founder @rushimanche, and top-ranking teachers on the leaderboard.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。