Every weekend, the homework is quite simple, and today is no exception. The price of BTC is still fluctuating slightly as expected. This level of price change will intensify as we get closer to the opening of the U.S. stock market on Monday. On Friday, the U.S. stock market dropped significantly, and the dollar index is also rising. The new non-farm payroll data basically indicates that the Federal Reserve is not expected to cut rates too many times, at least not too many from the current perspective.

This is also the reason why the market is feeling uneasy. The yield on 10-year U.S. Treasuries has started to rise, and the dollar is about to break through 110. This is mainly because the probability of a black swan event and recession has greatly increased under the condition of maintaining high interest rates, and next week's inflation data is also going to be unpleasant.

Why do I say this? Because the Federal Reserve has already anticipated that inflation will be quite stubborn. Does the market know this? The market knows, but as long as inflation rises, the market will worry that the Federal Reserve will not only refrain from cutting rates but may even continue to raise them. Although Powell has stated that he is not likely to consider raising rates, the market will panic, and even if things are bad, it will perform similarly to the non-farm payroll data.

Of course, there is also the core CPI data. Currently, the hope is that even if the broad CPI increases, it would be good if the core CPI could decrease a bit. This would still be somewhat beneficial for the market. In fact, this has nothing to do with being bullish; after all, who would want to face an economic recession?

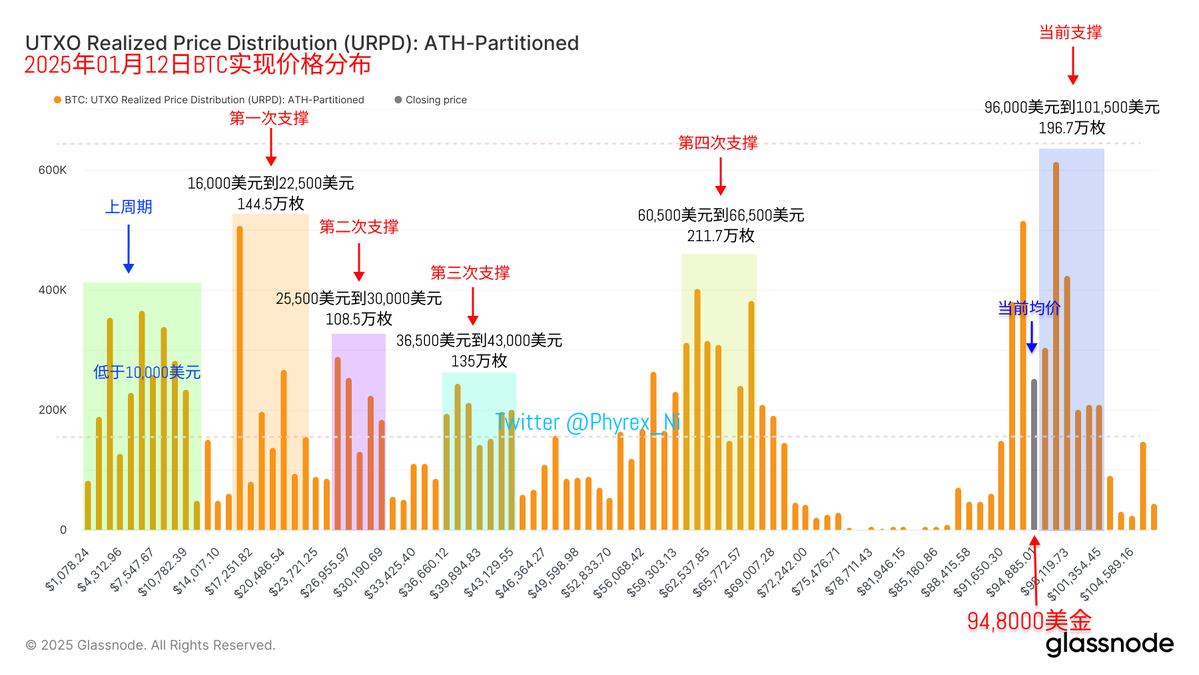

Next Wednesday's data will likely lead to risk aversion starting as early as Tuesday. This could pose a small problem for the price trend of #BTC. If investor sentiment remains poor after the U.S. stock market opens on Monday and returns to around $92,000, then risk aversion on Tuesday could potentially push it below $90,000. Of course, I still remain optimistic about the positive impact of the power transition on #Bitcoin, and the third BTC accumulation is still at $89,000.

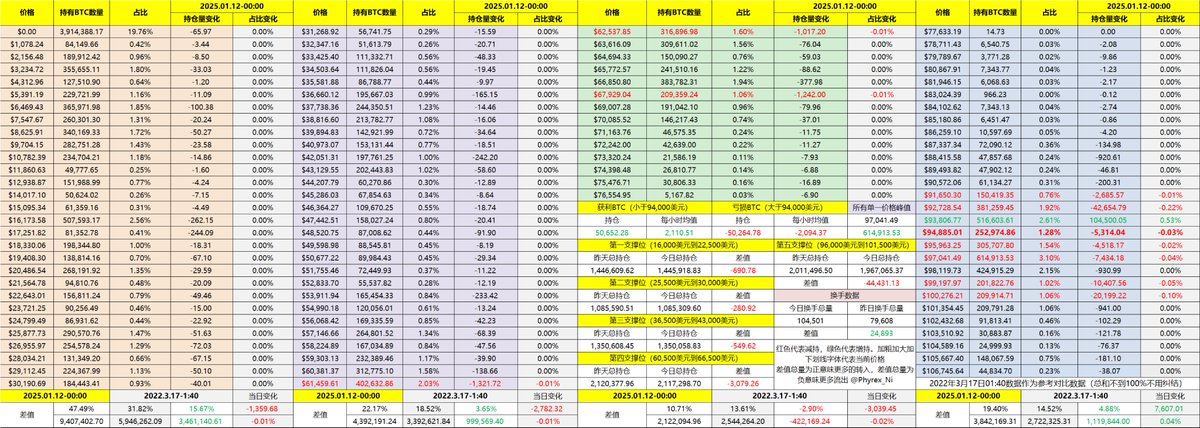

From the data, as sentiment intermittently improves, the short-term profit-takers and short-term losers have almost reached a balance today. Tomorrow's liquidity should be worse, and the turnover rate may be lower. Support remains the same; let's start to lower it a bit on Monday.

The data has been updated, address: https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。