Original | Odaily Planet Daily

Author | jk

After the collapse of FTX in 2022, the story of this exchange shifted from glory to the complex process of repayment and liquidation. Two years later, FTX's compensation plan has gradually become clear, but it has brought massive selling pressure to some cryptocurrencies.

In this article, Odaily Planet Daily will take readers through FTX's progress in repaying debts, the tokens under selling pressure, and how the once market-highlighted unique products will impact the future of the cryptocurrency industry.

FTX's Repayment Plan and Timeline

In May 2024, the Associated Press reported that FTX had submitted court documents with clear compensation amount data. According to these court documents, FTX owes creditors approximately $11.2 billion, while the exchange estimates that the funds available for distribution to creditors range from $14.5 billion to $16.3 billion.

The documents state that after full payment of claims, the plan also stipulates that additional interest will be paid to creditors as long as there are remaining funds. The interest rate for most creditors is 9%.

However, these compensations will all be settled in US dollars at the price of cryptocurrencies at the time of FTX's collapse. Specifically, when FTX filed for bankruptcy protection in November 2022, the price of Bitcoin was $16,080. This is both a good and a bad thing—

The bad news is that investors held digital currencies at that time, but will now receive compensation in dollar amounts. If an investor held 1 Bitcoin at that time, they would have approximately six times the return today, but these gains are not counted in the compensation; the investor can only receive $16,080 plus two years of interest.

The good news is that without the two-year cryptocurrency bull market, FTX's treasury might not have had enough funds to compensate all customers—getting back the amount from that time is still quite comforting.

According to the plan submitted to the U.S. Bankruptcy Court in Delaware, customers and creditors with claims of $50,000 or less will receive approximately 118% compensation. This group accounts for 98% of FTX's customers.

In August 2024, there was a small update on this event: Odaily previously reported that FTX and the U.S. Commodity Futures Trading Commission (CFTC) have agreed to a $12.7 billion settlement. The CFTC agreed not to seek any compensation as long as FTX complies with the restructuring plan. Therefore, FTX will pay creditors up to $12.7 billion in compensation, depending on available funds. This effectively stamped the government’s approval on the compensation agreement, ensuring that the government’s lawsuit against FTX would not reduce the funds available for customers. Based on the estimated amount of funds at that time, FTX could still complete full compensation, and even have some left over.

Odaily previously reported that a judge approved FTX to sell its stake in the AI startup Anthropic, valued at $1 billion, and plans to pay $200 million in priority taxes and $685 million in subordinate tax claims to the IRS. FTX argued that the amount it owes is far less than the $24 billion claimed by the IRS. All of these are part of FTX's path to compensation.

So, how is FTX's compensation progressing now? FTX's compensation requires selling coins, and how much selling pressure this brings—are some tokens facing massive selling pressure? Let's take a look.

What Does FTX Currently Hold in Its Wallet?

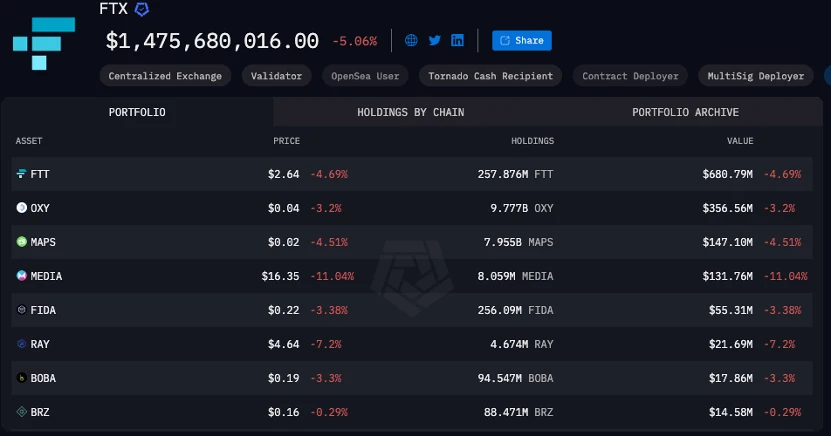

FTX's current wallet and holdings are publicly accessible on Arkham. As of the time of writing this article, FTX's on-chain address has a total asset value of $1.475 billion, with the largest holding being FTT, valued at approximately $680 million.

Including FTT, there are 20 other cryptocurrencies currently held in amounts exceeding one million dollars:

FTT: $680.79M

OXY: $356.56M

MAPS: $147.10M

MEDIA: $131.76M

FIDA: $55.31M

RAY: $21.69M

BOBA: $17.86M

BRZ: $14.58M

DRIFT: $10.15M

JUP: $6.66M

JTO: $6.25M

USDC: $3.31M

SOL: $3.14M

RENDER: $2.77M

ASD: $2.76M

SRM: $2.72M

KMNO: $2.67M

MPLX: $2.65M

AMPL: $1.67M

STG: $1.18M

So, which cryptocurrencies need to be particularly cautious about selling pressure? Based on Coingecko data, Odaily has compiled the following tokens for you:

FTT: Currently, the fully diluted valuation (FDV) is only $870 million, with a 24-hour trading volume of $18 million, while FTX's holdings amount to $680 million. Even if market makers take on the pressure, it is difficult to find buyers to support the current price.

OXY: Currently, the 24-hour trading volume is only $3,000, with an FDV of around $365 million. FTX's holdings amount to $356 million, indicating that due to the outlook for selling pressure, this token has almost no trading volume. However, this token is only listed on Kraken besides DEX, so it has little relevance to most traders.

MAPS: Currently, the FDV is $185 million, with FTX's holdings at $147 million, and the 24-hour trading volume is also bleak, only $130,000.

MEDIA: Currently, the FDV on Coingecko is $14.23 million, while FTX's holdings have reached $131 million.

FIDA: The current FDV is $216 million, with FTX's holdings at $55.31 million. If operated properly, there may be room for shorts. The current 24-hour trading volume is $15.51 million.

BOBA: The current FDV is $94.67 million, with a market cap of $81.05 million, while FTX's holdings amount to $17.86 million. The 24-hour trading volume is $1.62 million.

SRM: The current market cap is $11.37 million, with a 24-hour trading volume of $490,000, and FTX's holdings are $2.72 million.

MPLX: The current market cap is $185 million, with a 24-hour trading volume of $1.36 million, and FTX's holdings are $2.65 million.

AMPL: The current market cap is $150 million, with a 24-hour trading volume of $830,000, and FTX's holdings are $1.67 million.

Less Impactful Tokens:

RAY: Raydium currently has a market cap of $1.3 billion, with a 24-hour trading volume of $94.83 million, and FTX's holdings are $21.69 million. If market makers aim for stable selling and operate properly, a significant drop is not expected.

DRIFT: Currently, the market cap is $310 million, with a 24-hour trading volume of $29.01 million, and FTX's holdings are $10.15 million, which has full capacity to absorb.

ASD: Currently, the market cap is $32.02 million, with a 24-hour trading volume of $1.24 million, and FTX's holdings are $2.76 million.

KMNO: Currently, the market cap is $146 million, with a 24-hour trading volume of $19.92 million, and FTX's holdings are $2.67 million.

For other tokens, such as the highly liquid Solana (with a 24-hour trading volume reaching $4 billion, and FTX currently holding only $3.14 million), Jupiter, Jito, Render, Stargate, and fully supported stablecoins USDC and BRZ, there is no need to worry at all.

FTX's held tokens. Source: Arkham

As of the publication of this article, FTX is still continuously selling coins. On Arkham, it can be seen that FTX's liquidation address is transferring its held tokens to Binance and Gate at a frequency of several times a day, and the amount transferred each time is not large, ranging from $50,000 to $5 million, depending on whether the token is a large holding. It is still unclear whether there are market makers behind this selling behavior, but this time, FTX did not sell all its holdings at once like the German government, causing a sharp price drop.

FTX's Unique Products

In its heyday, FTX was the preferred exchange for traders and institutions, especially for high-frequency trading. This part also generated a considerable degree of technical spillover effect, as FTX developed many unique trading products for retail investors. After FTX's downfall, some of these products were absorbed by other exchanges, while others have not seen any follow-up to this day.

For example, the leveraged tokens that were all the rage on FTX were extremely friendly to retail investors:

Leveraged tokens can provide investors with double-leveraged assets without complex operations or directly bearing the liquidation risks of leveraged trading. Most investors are familiar with contract trading/leveraged trading, which requires investors to collateralize assets in the form of margin and monitor market fluctuations to avoid being forcibly liquidated. The leveraged tokens launched by FTX, such as 3x Long Bitcoin and 3x Short Ethereum, greatly simplified this process. Users can buy and sell leveraged tokens just like trading ordinary spot tokens, without needing to open a separate leveraged account or pay margin. Additionally, leveraged tokens lock in the risk of market fluctuations within a daily range through a daily rebalancing mechanism, helping users avoid the risk of liquidation that may occur during significant market volatility.

For retail investors, the emergence of leveraged tokens lowered the threshold for participating in leveraged trading. They could achieve multiple market returns with a smaller capital cost, making them quite popular in the FTX market at that time. Now, this product has been absorbed by exchanges like KuCoin and has already been applied to popular tokens like Bitcoin.

3x Short Bitcoin product on KuCoin. Source: KuCoin

Another product from FTX, tokenized U.S. stock products, has yet to see a large-scale offering that can provide similar services. At that time, FTX offered tokenized products for several U.S. companies, including Alibaba and Coinbase; the launch of these tokenized U.S. stock products allowed global investors to easily participate in the U.S. stock market without needing to open a U.S. securities account. FTX facilitated the circulation of these stock assets in token form on the blockchain by partnering with regulated partners and custodians. These tokens are pegged 1:1 to the underlying stocks, allowing investors to trade tokenized U.S. stocks directly on the FTX platform.

This product addressed several pain points in the traditional stock market. For example, investors are no longer restricted by region or regulation and do not need to open cumbersome securities accounts; at the same time, tokenized products support 24/7 trading, unlike the traditional stock market, which has fixed opening and closing times.

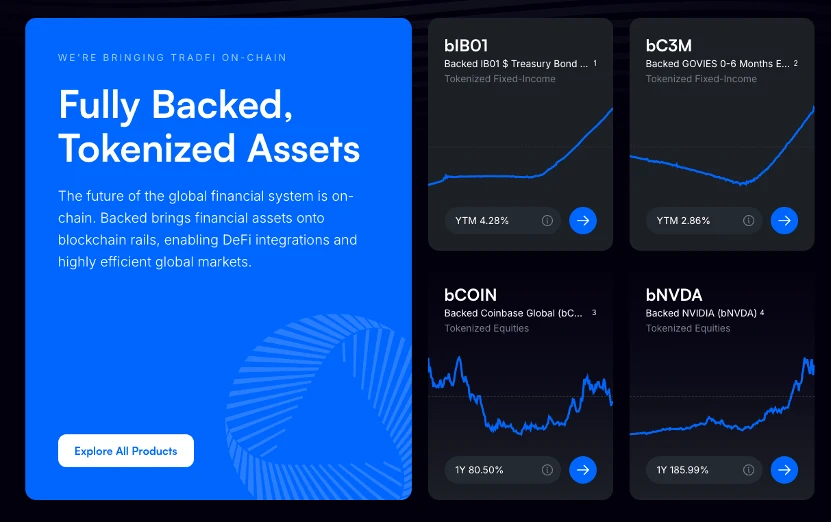

As of now, protocols like Backed can provide tokenized U.S. stock products to non-U.S. users, including stocks like Nvidia, which were recently very popular. However, U.S. users still do not have a platform to purchase tokenized U.S. stocks.

Tokenized U.S. stocks provided by Backed. Source: Backed official website

Odaily previously reported that Base developer Jesse Pollak stated in a post on the X platform that Coinbase is considering offering tokenized shares of its stock to U.S. users on its Ethereum Layer 2 network, Base. Pollak mentioned that non-U.S. users can already obtain tokenized COIN stock through protocols like Backed (a tokenized RWA platform), and implementing COIN on Base is “something we want to explore in the new year,” adding that ultimately “every asset in the world will be implemented on Base.” Jesse Pollak also noted that Coinbase “currently has no specific plans.”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。