The next big move in blockchain is here—will it be MegaETH, Hyperliquid, or Monad? Let's take a look at who will dominate the future!

Author: @threesigmaxyz

Translation: Baihua Blockchain

In the ever-evolving blockchain space, real-time transactions have shifted from a luxury to a necessity. With the continuous breakthroughs of decentralized finance applications, payments, gaming, and high-frequency trading pushing the limits of traditional blockchain capabilities, the demand for real-time performance is more urgent than ever. Among the competitors redefining transaction speed and scalability, MegaETH, Monad, and Hyperliquid stand out as the most notable players.

As we saw in the previous article, MegaETH, as an emerging Layer 2 solution, aims to prioritize real-time performance and has attracted significant attention with its near-instant block times and high transaction throughput.

However, Hyperliquid and Monad present strong competition with their unique blockchain performance optimization solutions. This article will delve into the advantages, architectures, and trade-offs of these solutions to understand who might emerge victorious in the race for instantaneous blockchain transactions.

1. Overview of MegaETH

@megaeth_labs is a Layer 2 scaling solution designed for Ethereum. What sets MegaETH apart is its focus on real-time blockchain performance, providing ultra-low latency and scalability for applications that require instant responsiveness.

1) Project Features

Latency and Speed: MegaETH has a block time ranging from 1 to 10 milliseconds, capable of handling up to 100,000 transactions per second (TPS).

Dedicated Nodes: It employs a model centered around ordering nodes, with node roles including ordering nodes, validating nodes, and full nodes, simplifying the execution process and reducing redundancy.

Integration with EigenDA: MegaETH utilizes EigenDA for data availability, achieving scalability without sacrificing reliability or performance.

2) Advantages

The architecture of MegaETH is designed for speed and efficiency, allowing it to stand out in the competitive Layer 2 space:

Low Latency: Its near-instant transaction processing is ideal for high-frequency trading, gaming, and payment systems.

Scalability: With millisecond-level block processing, MegaETH avoids the congestion issues common to other Layer 2 solutions during peak demand periods.

EVM Compatibility: Fully compatible with the Ethereum ecosystem, it enables seamless integration with existing decentralized applications (dApps) while maintaining security.

2. Hyperliquid and Monad

While MegaETH focuses on real-time performance, it faces fierce competition from Hyperliquid and Monad, both of which adopt different optimization strategies for blockchain transactions.

1) Hyperliquid

@HyperliquidX is a fully on-chain perpetual trading protocol built on its proprietary Layer 1 (L1) blockchain, optimized for low latency and high throughput. By integrating spot, derivatives, and pre-sale markets into its platform, Hyperliquid introduces the HyperBFT high-performance consensus mechanism and plans to launch HyperEVM, aiming to expand its ecosystem through efficient liquidity aggregation.

Vision: Hyperliquid focuses on redefining the trading experience by providing high-speed, decentralized market infrastructure, making it particularly appealing to financial institutions and high-frequency traders.

Market Specialization: Its unique combination of spot and perpetual markets allows for seamless liquidity aggregation and rapid settlement.

Hyperliquid's tech stack encompasses more financial primitives, such as borrowing, governance, and native stablecoins. Based on the HyperBFT consensus, Hyperliquid achieves a block time of 0.2 seconds while maintaining a unified state across all components, ensuring performance, liquidity, and programmability. Hyperliquid currently boasts over 262,000 users and processes 200,000 transactions per second, clearly establishing its leading position in the decentralized market infrastructure space.

To further expand its influence, Hyperliquid has launched the Builder Codes feature, allowing other decentralized applications (dApps) and centralized exchanges (CEX) to easily integrate its liquidity by paying transaction fees. Builder Codes not only extend Hyperliquid's reach but also incentivize external platforms to leverage its high-performance trading infrastructure, thereby enhancing liquidity and expanding network effects.

2) Monad

monad_xyz has restructured the EVM architecture through parallel execution, achieving unprecedented throughput. By addressing the limitations of Ethereum's sequential transaction processing, Monad opens a new level of efficiency and scalability, serving as a protocol for Layer 1.

Vision: Monad aims to provide cutting-edge blockchain performance while maintaining decentralization, setting new standards for Layer 1 scalability.

Parallel Execution: Monad's architecture supports concurrent transaction processing across multiple EVM instances, ensuring seamless integration with existing user and developer workflows.

Full Compatibility: Monad maintains complete bytecode compatibility with Ethereum, integrating state-of-the-art internal optimizations without altering the developer experience.

Monad introduces pipelining techniques to optimize transaction execution, consensus processes, and state synchronization, maximizing hardware efficiency and minimizing latency. By leveraging a custom MonadBFT consensus mechanism derived from HotStuff, the protocol supports a robust and decentralized validator cluster while achieving rapid block finality.

Key innovations include MonadDB, a database designed for Ethereum state access, and optimistic parallel execution, ensuring high throughput with minimal overhead. By separating the consensus layer and execution layer, Monad further enhances scalability, enabling developers to build applications with exceptional performance and low latency requirements.

Monad's groundbreaking advancements position it as a powerful enterprise-grade application platform, providing developers with the tools to build high-throughput decentralized applications (dApps) while maintaining compatibility with Ethereum and embracing the future of blockchain innovation.

3. Comparison of the Three

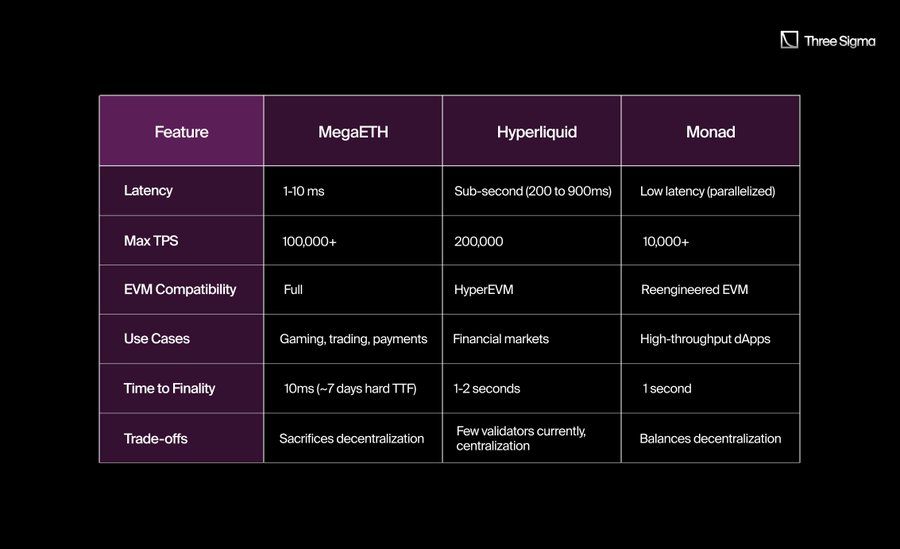

By evaluating MegaETH, Hyperliquid, and Monad on key metrics, we can gain a comprehensive understanding of their unique advantages and trade-offs. In this comparison, we focus on latency, throughput (TPS), EVM compatibility, application scenarios, time to finality (TTF), and the trade-offs of decentralization. These features highlight the fundamental requirements that need to be met when scaling blockchain infrastructure while ensuring its utility and performance in real-world applications.

1) Latency

MegaETH excels in Layer 2 transactions with latencies as low as 1-10 milliseconds, suitable for applications requiring near-instant response times, such as high-frequency trading or competitive gaming.

Hyperliquid's sub-second latency is optimized for financial markets, achieving rapid order execution and a smooth trading experience.

Monad's parallel low-latency execution ensures consistent performance even under high network loads, supporting a variety of decentralized applications (dApps). The team has yet to provide specific timing statements.

2) Throughput (TPS)

MegaETH's throughput exceeds 100,000 TPS, emphasizing scalability for large-scale applications.

Hyperliquid achieves a maximum of 200,000 TPS through its unique HyperBFT consensus and Layer 1 optimizations.

Monad's throughput is 10,000 TPS, focusing on maintaining a balance between high performance and decentralization.

3) EVM Compatibility

MegaETH is fully EVM compatible, ensuring seamless access for developers and existing dApps.

Hyperliquid integrates a HyperEVM version customized for financial market use cases.

Monad's redesigned EVM supports high-performance execution while maintaining compatibility with Ethereum tools and standards.

4) Application Scenarios

MegaETH focuses on gaming, trading, and payment systems, emphasizing real-time interaction and high scalability.

Hyperliquid targets financial markets, providing robust infrastructure for derivatives, spot trading, and market making.

Monad's versatility supports a wide range of dApps, especially those requiring high throughput and low latency.

5) Time to Finality (TTF)

MegaETH's Layer 2 transactions achieve near-instant finality (10 milliseconds), but full settlement on Ethereum L1 takes about 7 days.

Hyperliquid's TTF is 1-2 seconds, balancing low latency with a strong consensus mechanism.

Monad completes transaction confirmations within 1 second, providing a good balance of speed and security.

6) Trade-offs of Decentralization

The centralized ordering node design of MegaETH sacrifices some decentralization at the Layer 2 level to achieve real-time performance.

Hyperliquid's market-oriented architecture prioritizes low latency and high throughput over decentralization.

Monad's design strives to maintain a balance between decentralization and performance, optimizing both through parallel execution and delayed state updates.

4. Summary

MegaETH, Hyperliquid, and Monad each bring unique innovations to the blockchain ecosystem, catering to different needs:

MegaETH: Excels in latency and throughput (TPS), making it suitable for real-time applications, but its centralized ordering node design raises some concerns regarding decentralization.

Hyperliquid: Performs exceptionally well in financial markets with its HyperEVM and liquidity integration, but its versatility in other categories of decentralized applications (dApps) is not as strong as MegaETH.

Monad: Achieves a balance between decentralization and performance through parallel execution, increasing throughput and supporting a variety of applications.

Who will lead? The answer depends on the specific application scenarios:

In trading and liquidity, Hyperliquid is a strong competitor due to its focus on the financial sector.

In terms of scalability for general decentralized applications, MegaETH holds a leading position with its real-time performance and broader application range.

For decentralized high-throughput applications, Monad's parallel EVM offers a compelling choice for developers prioritizing decentralization.

Trade-offs of MegaETH: By sacrificing decentralization, MegaETH achieves unparalleled speed, making it highly suitable for real-time systems like trading and gaming. However, while MegaETH relies on Ethereum Layer 1 (L1) for settlement (ensuring trust and security), it inherits Ethereum's final confirmation delays. In contrast, Monad and Hyperliquid achieve faster local finality through their independent consensus mechanisms, prioritizing instant performance but sacrificing Ethereum's shared security.

Specialization of Hyperliquid: Hyperliquid excels in financial markets with its unmatched speed, liquidity aggregation, and seamless trading infrastructure. However, its focus on trading limits its versatility in the broader decentralized application ecosystem, making it less attractive for general applications. Additionally, its centralized HyperBFT consensus mechanism raises concerns about decentralization and trust, and it heavily relies on external liquidity to maintain performance and ecosystem growth.

Balance of Monad: Monad strikes a balance between scalability and decentralization through its parallel execution model, providing developers with high throughput without sacrificing EVM compatibility. However, reliance on powerful hardware (such as 32 GB of memory and high bandwidth) limits accessibility for smaller operators, potentially leading to network centralization. Its independent Layer 1 consensus offers autonomy but sacrifices Ethereum's security, which may deter developers who prioritize trust and shared security.

Article link: https://www.hellobtc.com/kp/du/01/5632.html

Source: https://x.com/threesigmaxyz/status/1877349944014622824

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。