Cryptocurrency News

January 11 Hot Topics:

1. FDIC Vice Chairman Calls for Federal Agencies to Improve Collaboration with Cryptocurrency Technology

2.World Verification Count Exceeds 10 Million, App Downloads Exceed 20 Million

3. Non-Farm Data is Bearish for Safe-Haven Products, Pepperstone Senior Research Strategist: The Federal Reserve Will Remain Relatively Hawkish

4. CME Fed Watch: The Probability of a 25 Basis Point Rate Cut by the Federal Reserve in January Drops to 2.7%

5. Foresight Ventures Founder Lao Bai Deeply Analyzes AI Agent Technology, $BAI Surges 160% in a Short Time, Breaking Previous Highs

Trading Insights

- In the cryptocurrency market, prices rise and fall together; in a bull market, price increases do not require value support, just a reason to rise.

- Do not discuss faith with altcoins; if you need to cut losses, do so.

- Time is a friend of Bitcoin but an enemy of altcoins.

- The value foundation of altcoins lies in continuous innovation; once innovation stagnates, value will collapse. Bitcoin's value foundation lies in its immutability; being trapped in Bitcoin will eventually have a way out, but altcoins may not.

- The only assets suitable for left-side trading are Bitcoin and Ethereum; the biggest risk for altcoins is going to zero.

- A healthy bull market starts with Bitcoin standing out alone; therefore, first build a position in Bitcoin and Ethereum to avoid missing out on gains and not fear being trapped if prices drop.

- Altcoins have no defensive capability.

- Do not increase positions during a rise; position management is crucial—light positions for testing, then significantly increase after a rise; playing this way makes it hard to lose money.

- The position in Bitcoin and Ethereum should not be less than half.

- When trading altcoins, actively take profits and sell.

- If you fall in one place, get up in another—lose money here, make it back elsewhere.

- The biggest cost after being trapped is opportunity cost.

- The core of trading altcoins is knowing when to sell.

- Only eat until you are 70% full; fish heads and tails are not that tasty, leave them for the market makers; wait for the leading coins to emerge before going for the more certain profits.

- When trading altcoins, always keep light positions; heavy positions can ruin your mindset, a bad mindset leads to poor operations, and reckless operations result in losses.

LIFE IS LIKE

A JOURNEY ▲

Below are the real trading signals from the Daba Community this week; congratulations to those who followed along. If your trades are not going well, you can come and test the waters.

The data is real, and each trade has a screenshot from when it was sent.

**Search for the public account: *Dabai Talks Coins*

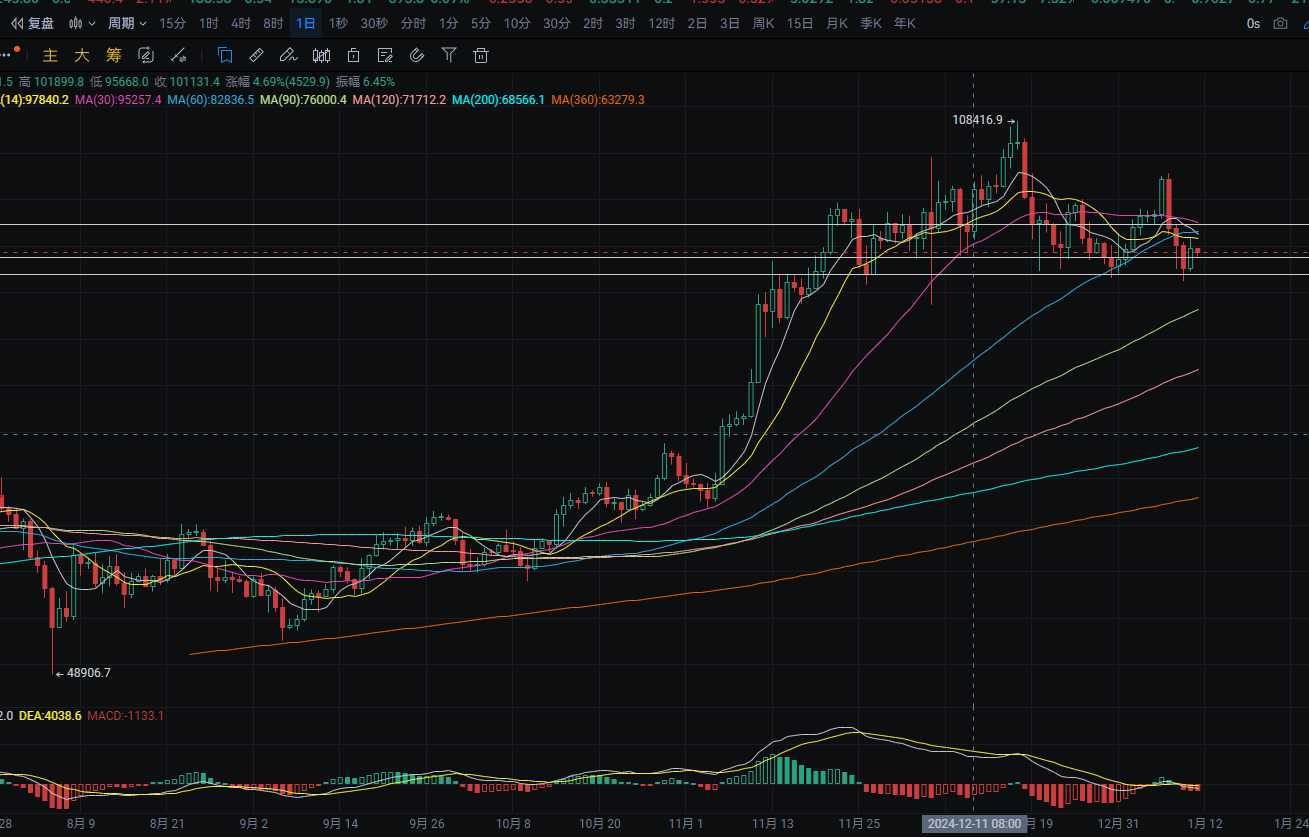

BTC

Analysis

Bitcoin's daily line rose from a low of around 92,200 to a high of around 95,850 yesterday, closing around 94,700. The support level is around 93,700; if it breaks, it could drop to around 92,000. A pullback can be used to buy near this level. The resistance level is around MA14; if it breaks, it could rise to around MA30. MACD shows an increase in bearish momentum. The four-hour support level is around MA14; if it breaks, it could drop to around 91,900. A pullback can be used to buy near this level. The resistance level is around MA90; if it breaks, it could rise to around MA60. MACD shows an increase in bullish momentum, forming a golden cross. Short-term buying can be done around 93,780-92,000, with a rebound target around 97,300.

ETH

Analysis

Ethereum's daily line rose from a low of around 3,195 to a high of around 3,325 yesterday, closing around 3,265. The support level is around MA90; if it breaks, it could drop to around 3,170. A pullback can be used to buy near this level. The resistance level is around the MA7 moving average. MACD shows an increase in bearish momentum. The four-hour support level is around 3,220; if it breaks, it could drop to around 3,195. A pullback can be used to buy near this level. The resistance level is around MA30. MACD shows a flat oscillation with the two lines converging. Short-term buying can be done around 3,222-3,170, with a rebound target around 3,390.

Disclaimer: The above content is personal opinion and for reference only! It does not constitute specific trading advice and does not bear legal responsibility. Market conditions change rapidly, and the article may have some lag; if you have any questions, feel free to consult.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。