"Weekly Editor's Picks" is a "functional" column of Odaily Planet Daily. Based on the extensive coverage of real-time information each week, the Planet Daily also publishes many high-quality in-depth analysis articles, but they may be hidden among the information flow and trending news, passing you by.

Therefore, our editorial team will select some quality articles worth spending time reading and saving from the content published in the past 7 days every Saturday, providing you with new insights from the perspectives of data analysis, industry judgment, and opinion output, as you navigate the crypto world.

Now, let's read together:

Investment and Entrepreneurship

10K Ventures Annual Report (Part 1): Review of 2024 & (Part 2): Outlook for 2025

In 2024, BTC ETF saw a significant net inflow for the year, with pricing power shifting to North American institutional investors; ETH ETF progress is relatively slow, currently in a phase of handover from insiders to outsiders; the on-chain spot ceiling may be gradually approaching its limit; Hyperliquid stands out; Pump.fun contributes half of Solana's trading volume single-handedly; Solana Memecoin's success comes at a high cost; AI Agent leads Base to prominence; tap2earn users are purely opportunistic, with very low commercial value, or the existing commercial value is just a one-time sale to exchanges; Ethena maximizes yield; Usual can be seen as a Web3 version of a dividend-paying fiat-collateralized stablecoin; the most successful and starting to see exits in OTC Deals may be Pendle/Ton/Solana, with Solana being an exception, as it was meant to clean up FTX's mess; looking back, OTC deals usually make money (though there are also losing ones).

In 2025, the importance of compliance will rise to a new level; the penetration rate in the Korean market can grow at least 1x to 60%; the "Pinduoduo" of the crypto world, Bitget, is expected to become one of the top three CEXs; Bybit will be an invisible winner benefiting from VC coins; the rise of the Agent Economy; on-chain autonomous agents developing intelligent systems for independent thinking and execution; AI agent + payment forming a future human-machine collaborative economic model; Stablecoins are changing cross-border payments; Babylon/Solv who can be more compliant and meet the needs of large institutions will have a better chance of becoming the first in BTCFi in the long run; application outweighs infrastructure; traditional giants are starting to enter.

Multicoin Capital: 2025 Frontier Narratives

DePIN robots, zero-employee companies; on-chain securities; Buy Now, Pay Never, portfolio consumption, portfolio margin; off-chain verification of on-chain status; trading social, full-stack media companies; the rise of "alpha hunters"; institutional frenzy.

Multicoin Capital Follow-up: The Eternal Narrative of the Crypto World

Unremitting pursuit of capital efficiency; addictive new financial games; transparency in financial markets; value capture models will continue to split and bundle; funds seeking returns; using innovation to reduce banking costs; eliminating friction and increasing usage rates.

a16z: Seven Key Crypto Trends to Watch in 2025

Businesses will increasingly accept stablecoin payments. Countries are exploring putting national bonds on-chain. "DUNA" will become a new industry standard for the U.S. blockchain network. Developers will reuse infrastructure more rather than reinventing it. The crypto industry will welcome dedicated app stores and content discovery channels. Crypto users will shift from holders to users. "Hiding technical details" will help the birth of killer applications in Web3.

a16z: Insights into Crypto Industry Development, You Need to Watch 5 Indicators

Monthly active wallet users, adjusted stablecoin trading volume, net inflow of ETF funds, comparison of spot trading volume between decentralized exchanges and centralized exchanges, total blockchain transaction fees.

With AI Agent Projects Everywhere, How to Judge if a Dev is Reliable through GitHub?

Controlling project quality and Dev level, key techniques for "treasure hunting" on GitHub include: smart use of search and Trending pages; checking README, code, and commit history; Issues, Pull Requests, and Contributors interface.

"America's First Think Tank" Eurasia Group: Top 10 Global Risks for 2025

Victory of the G0 world, Trump's "rules of governance," deterioration of U.S.-China relations, Trump economics, Russia's ambitions, Iran in distress, global economic crisis, AI moving towards the infinite and unregulated, governance void, Mexico deadlock.

Also recommended: Interview with Trader Amanda: How to Formulate an Investment Strategy to Outperform BTC in a Bull Market?.

Meme

As Trump Takes Office, Which New Government-Related Concept Coins are Worth Investing In?

Bitcoin Ecosystem

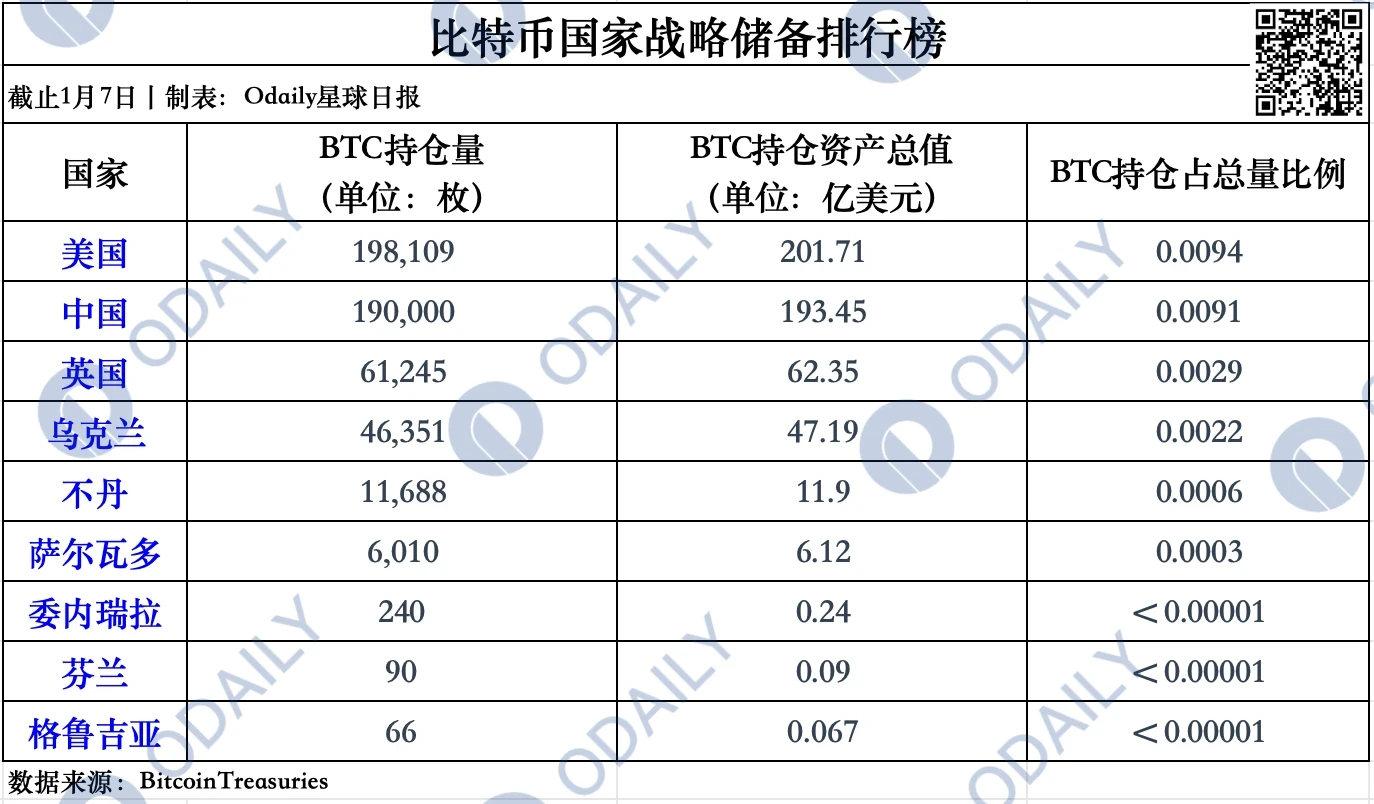

Overview of BTC National Reserve Rankings, Who Holds More Between China and the U.S.?

Long Article Reveals BTCFi TVL Scam, Nubit "Proof of TVL" Report Explained

The true situation of BTCFi TVL is: users (whales) have complete control over the funds: whales can spend these BTC at any time or pledge them to other protocols. There are no mandatory reduction conditions in the pseudo-staking process, which is essentially meaningless.

The solution is very clear: achieve TVL verification through zero-knowledge proofs.

Ethereum

How Does ETH "Generate Wealth"? An Overview of 16 Yield Strategies with Over 20% APR

Multi-Ecosystem

New Generation Public Chain Competition: MegaETH vs Hyperliquid vs Monad

DeFi

"DeFAI," A New Concept to Help DeFi Break Through?

The article explores three main application scenarios of AI in DeFi (AI as DeFi interface DeFi agent: autonomous trading execution; research and communication agent) and demonstrates how each application is expected to change the way we access and benefit from decentralized financial services.

Launched DeFAI projects: Griffain, Hey Anon, Mode, Hive, Orbit, Neur, Hiero, ASYM, Gekko AI;

Unlaunched but worth noting DeFAI projects: Cod 3 x, Almanak, WayFinder Protocol, Slate.

New Windfall in DeFAI, What Projects are Worth Watching?

Abstract layer (simplifying interaction operations) — Griffain, Orbit, Neur, Slate, AI Wayfinder;

Autonomous trading AI agents — Almanak, Cod 3 x, Axal & Gekko Agent, Project Plutus;

AI-driven DApps — Mode Network, ARMA (by Giza Tech), Modius, Amplifi Lending Agents, HeyAnonai.

Web3 & AI

Vitalik's New Article: Decentralized Accelerationism and AI One-Year Outlook

Vitalik's core argument from last year's article supports decentralized, democratic, and differentiated defensive acceleration. It is necessary to accelerate technological development while distinctly focusing on technologies that can enhance our defensive capabilities rather than cause harm, and to promote the decentralization of power rather than concentrating it in the hands of a few elites, avoiding these elites from representing everyone in determining right from wrong.

Our goal is to build a world that retains human agency, achieving negative freedom, which avoids others (whether ordinary citizens, governments, or superintelligent robots) from actively intervening in our ability to shape our own destinies, while achieving positive freedom, ensuring we have the knowledge and resources to exercise this ability. This echoes a classical liberal tradition that has persisted for centuries. Given the technological landscape of the 21st century, we can view d/acc as a means to achieve these same goals.

d/acc is the extension of the fundamental values of cryptocurrency (decentralization, censorship resistance, open global economy and society) to other technological fields.

Virtuals Teaches You How to Start Your AI Agent Entrepreneurship Journey

"Go live immediately, build publicly" is the best strategy in the current environment.

The reason to go live now: validate your idea before investing over $100,000 in development; leverage the Lindy effect to solidify your position in the top 50; instantly form a community and distribution network on the first day; get ahead of the many VC-backed token TGEs in 2025.

The core lies in building a solid foundation (details will be elaborated in another article, but in short, it’s about the team, product, and community). The litmus test for whether the foundation is strong is: are your close circle willing to be the first to buy, hold, and believe in your project? If they are not convinced, others will be even less so.

Reproducing DeFi Summer? The Beta Cycle Dividend Under the AI Agent Craze

The improvement of infrastructure and the maturity of technology have allowed AI Agents to transition from the uncertain Alpha stage to a profitable and scalable Beta stage.

The Soul of AI Agents: Crypto Contracts

The code of conduct for AI Agents will be smart contracts. However, potential risks of AI Agent + Crypto at the technical implementation level include security, scalability, liability, and privacy.

Five Major Trends and Opportunities Under the AI Wave (with Related Projects)

Framework + launchpad: value accumulation is becoming important, and frameworks may persist; the next round of Agents will prioritize utility and value accumulation, with DeFAI (DeFi x AI) likely being the first type of Agent to achieve product-market fit; consumer layer: entertainment Agents, the revival of autonomous worlds and games; agentic organizations: the return of DAOs; verifiable Agents: current Agents will evolve towards greater autonomy and truly owning their liquidity.

How to Make Money from the Agent Economy in 2025?

The three waves of evolution for Agents are from human to agent (current), agent to human, and agent to agent/collaboration, corresponding to the current, emerging, and future stages. The six key directions of the Web3 AI stack and notable examples: applications (aixbt agent), agent coordination (virtuals), privacy (Phala Network), AI training/inference (ritualnet), computation (ionet), data (Arweave).

The author is willing to invest in more complex applications including: automated trading systems, portfolio rebalancing, virtual reality, AI-based smart contracts (prediction market arbitration).

Most consensus is focused on the following directions: ai16z system and partners, Solana hackathon winners, AI frameworks, DeFi x AI.

Which AI Agent Projects Are Supported by VCs?

Payman, Skyfire, Axal, Theoriq, Talus Network.

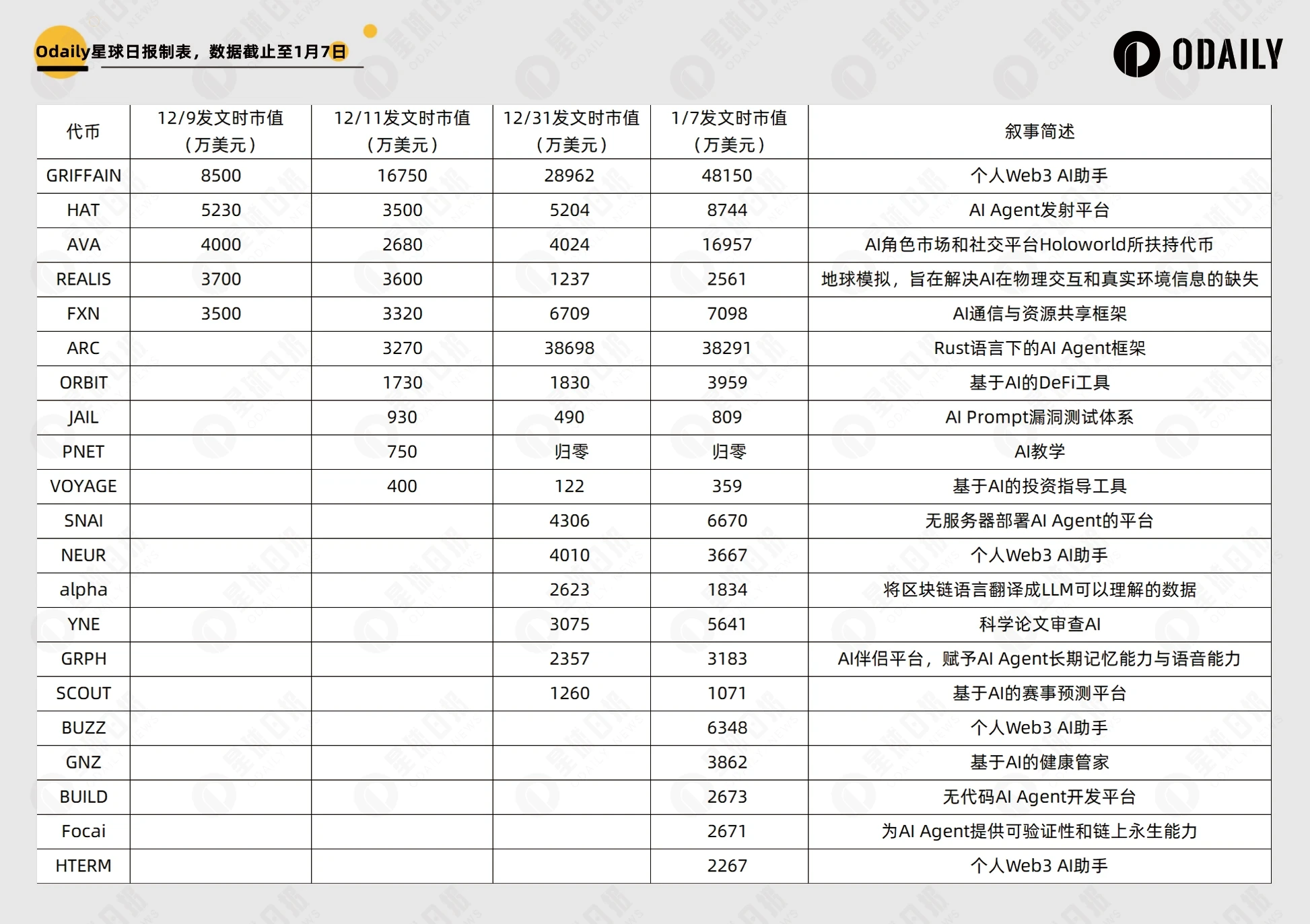

Homogeneity of AI Projects Rises, This Week's Quick Overview of Pros and Cons

Also recommended: 《AI Agent Rising Star Swarms Sees 7x in a Week, What Other Ecological Potential Projects Are There?》《Review of 20 Official Collaboration Projects from Eliza Labs: The Low Market Cap Boost Effect is More Obvious》《AI Agents Become the Market Mainstream, 22 Crypto Projects Collectively Layout》《Base Ecosystem AI Gold Rush: Besides Virtuals, What Other Treasure Projects Are There?》。

Weekly Hotspot Recap

In the past week, FTX officially announced that its bankruptcy plan has taken effect, with the first round of compensation expected to be distributed within 60 days; Backpack Exchange acquired FTX EU for $32.7 million, which will be responsible for distributing $55 million in FTX bankruptcy claims; the U.S. Department of Justice has been authorized to sell $6.5 billion in seized Silk Road Bitcoin; Trump met with Ripple executives at Mar-a-Lago;

Additionally, in terms of policy and macro markets, Coinbase's Chief Legal Officer: has received an unredacted version of the FDIC's OCP 2.0 letter, and the new Congress should immediately initiate hearings; one of Portugal's major banks, BiG, has terminated fiat transfers to crypto platforms to comply with regulations; Sam Altman: OpenAI is beginning to shift its focus to "superintelligence", and the first batch of AI agents is expected to join the labor market this year](https://www.odaily.news/post/5200957); Jensen Huang: AI Agents are expected to become the next robotics industry, with an industry scale reaching trillions of dollars;

In terms of opinions and voices, Mark Cuban: if the economy falters, he would rather hold Bitcoin than gold; Arthur Hayes updated his prediction: the market will peak at the end of March; well-known trader Ansem: the experience of the past three years is that shorting ETH is always safe, expecting the market to consolidate for a long time, but there are still opportunities on-chain; 1confirmation founder: many new ideas driving the crypto space forward all started with Ethereum; Vitalik's latest long article discusses new views on d/acc, focusing on the role of AI and Crypto; Vitalik: Polymarket is unique because it is suitable for solving real social problems; Bitwise CEO: AI may lead to a surge in niche tokenized companies, forming a new long-tail capital market; Solana AI hackathon "Golden Dog" continues, organizers urge developers to stop; Su Zhu: Sui has a more resilient advantage compared to Aptos, with a positive developer experience; Solv co-founder responds in a long article: the accusations regarding Solv asset security issues are false and contradictory; Shaw: the founder of swarms does not understand how to write code and has a history of fraud;

In terms of institutions, large companies, and leading projects, Base is considering launching tokenized COIN stocks; Solayer has released its 2025 roadmap: it will launch an infinitely scalable multi-execution cluster architecture called Solayer InfiniSVM; Solayer has announced community sale subscription details; Coinbase, Google, and members of ai16z have teamed up to launch the DAO organization Aiccelerate to accelerate the integration of crypto and AI; EigenLayer will collaborate with ai16z to host an AI Agent hackathon; Usual bonds have decoupled; VitaDAO will launch a new token on February 25 on Pump Science; swarms is about to launch a new feature: agents can be bought and sold using swarms tokens; HAT is set to update its token economics, including increasing the burn amount and unlocking premium features; Pump Science has begun airdropping 2.5 million BIO tokens to RIF and URO holders;

In terms of data, Eliza ecosystem partners exceed 45,000, with over 2,000 forked projects;

On the security front, Slow Mist reported that 410 security incidents occurred in the crypto space in 2024, resulting in losses of $2.013 billion, a year-on-year decrease of 19.02%; the official X account of Solv Protocol was hacked and false information was released… well, it has been another eventful week.

Attached is the Weekly Editor's Picks series.

See you next time~

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。