Author: Mankun Blockchain

Blockchain, as a collective term for technologies derived from Bitcoin, inherently carries a strong financial attribute and a spirit of liberalism to some extent. However, under the eaves, people have to bow their heads; to prevent being targeted by mainstream regulatory bodies, the vast majority of Web3 projects strive to prove that their tokens are utility tokens rather than security tokens.

The troubles between projects are not shared. In the world of Web3, there is another type of token that fears users not treating it as money, and that is stablecoins. After all, as a medium of payment, the most challenging issue is stability (the Russian ruble might say, "What about me?").

The narrative logic of stablecoins is actually quite simple: if I have $1 in my bank account, I issue 1 coin on the blockchain. The focus is on emotional and price stability. To some extent, stablecoins combine the stability of traditional currencies with the decentralized advantages of blockchain technology, becoming a bridge connecting the real world and the on-chain world, rightfully becoming one of the first large-scale applications of blockchain technology in ordinary people's lives.

However, as stablecoins like USDT gradually dominate the market, we suddenly realize that the dragon-slaying youth has become a dragon.

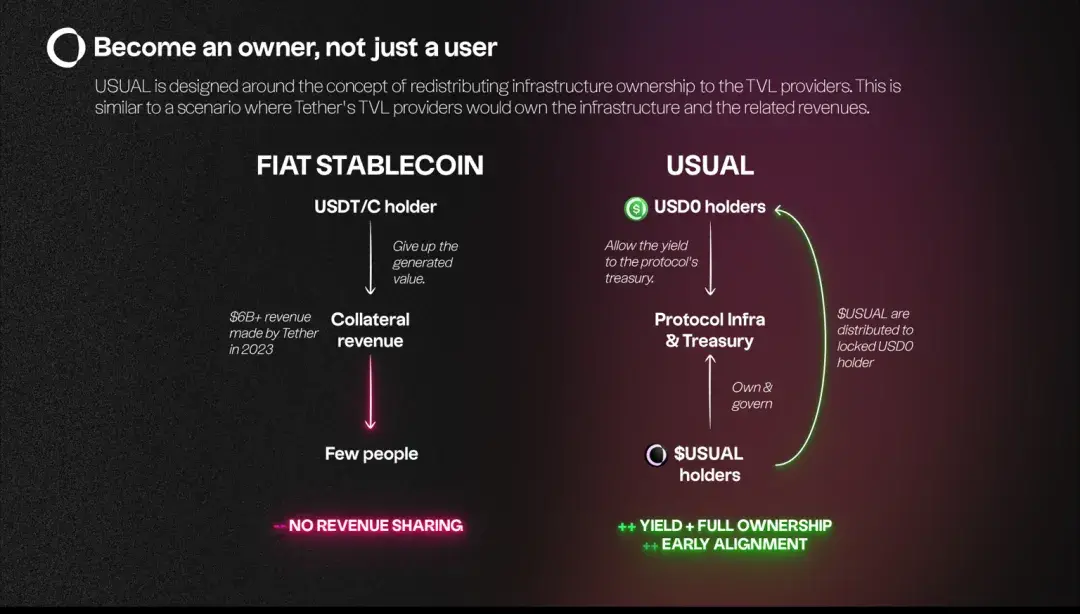

Tether, as the issuer of USDT, is a core hub in the global Web3 industry, holding over 65% of the global stablecoin market share, earning billions of dollars annually from stablecoin business. However, it is the most traditional centralized Web2 commercial company.

The issuance and freezing of USDT completely rely on a centralized issuer, and its information transparency is relatively low, with profits almost unrelated to users, and governance rights highly concentrated. These three points are acceptable for traditional internet companies, but when placed on a pillar company in the Web3 industry, it becomes critical because this is not Web3 at all!

It is important to know that the core concepts of Web3 are a few words: open transparency, trustworthiness, and value sharing. These words seem to have nothing to do with Tether, a centralized stablecoin company.

So the question arises: can we make the important application of stablecoins in Web3 a bit more Web3? Perhaps this is the key to the next generation of stablecoin development.

In today's article, lawyer Honglin wants to share a recently researched project with everyone, further exploring how to achieve an innovative model that combines decentralization with stablecoins. Naturally, the content of this article is for learning and communication purposes only and does not constitute any investment advice.

Stablecoin Usual Project Introduction

Usual is a decentralized fiat stablecoin issuance platform dedicated to breaking down the barriers between traditional finance and decentralized finance (DeFi), linking traditional finance with decentralized finance (DeFi).

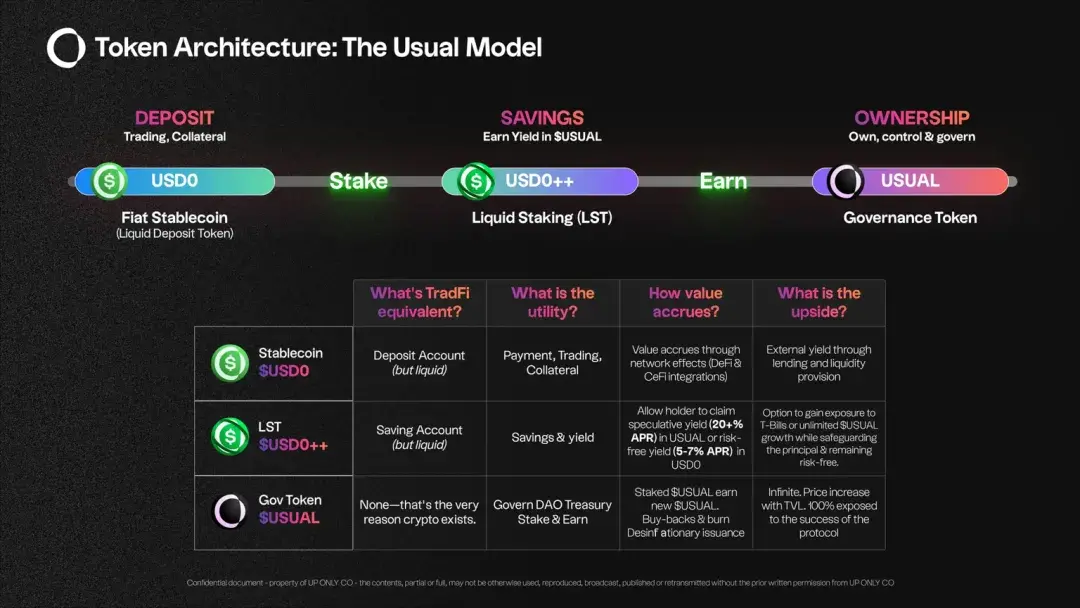

Usual centers around three core products:

· Usual Stablecoin: Designed for payments, trading counterparts, and collateral use.

· Usual LST (Ordinary LST): A yield-generating product.

· Usual Governance Token: Grants holders decision-making power within the protocol.

Usual aggregates tokenized real-world assets (RWA) from well-known institutions such as BlackRock, Ondo, Mountain Protocol, M0, or Hashnote, transforming them into permissionless, on-chain verifiable, and composable stablecoins, thereby enhancing the liquidity of traditional illiquid assets and making it easier for more investors to access these assets.

More importantly, it redistributes ownership and governance through the $USUAL token, allowing community members to become owners of the platform's infrastructure, funds, and governance, promoting the integration of the Web3 world with the real world. Through Usual's design, the issuance of stablecoins is not just about digitizing assets but also reconstructing the traditional financial system.

The founder of Usual is Pierre Person, born on January 22, 1989, who was a member of the French National Assembly for the 6th constituency and has long been active in politics as an electoral advisor and political ally to French President Macron. Pierre Person's political background and understanding of blockchain technology enable him to lead the Usual team with a unique perspective, promoting the integration of Web3 and traditional finance. As a member of the French Socialist Party, Pierre participated in important legislative projects such as LGBT healthcare and cannabis legalization during his tenure, showcasing his cross-disciplinary thinking and innovative capabilities.

In terms of project financing, Usual has attracted attention and funding support from several well-known investment institutions. In April 2024, Usual completed a $7 million financing round led by IOSG Ventures, with participation from GSR, Mantle, Starkware, and others. In November, Usual completed a new financing round of $1.5 million, with Comfy Capital and early crypto project investors echo also injecting funds into the project. In December, Usual announced the completion of a $10 million Series A financing round led by Binance Labs and Kraken Ventures. These investments not only provided Usual with necessary capital support but also offered rich industry resources and strategic guidance for project development.

Usual Project Stablecoin Features

Unlike traditional centralized stablecoins, Usual's USD0 stablecoin exhibits unique advantages in stability, transparency, yield distribution, and decentralized governance.

· Selection of Collateral Assets and Transparency

Unlike traditional stablecoins backed by cash, commercial paper, and other short-term assets, USD0 chooses ultra-short-term real-world assets (RWA) as collateral, including U.S. Treasury bonds, overnight reverse repurchase agreements, etc. Holders can earn yields by converting USD0 into USD0++, with yield forms including $USUAL tokens or risk-free USD0. Moreover, the collateral assets of USD0 are on-chain transparent and verifiable, allowing users to check and verify the status of assets supporting USD0 at any time on-chain. This approach not only enhances transparency but also helps build user trust in the protocol.

· Innovative Yield Distribution Mechanism

The profits of traditional stablecoins mostly belong to the issuer, and users cannot directly benefit from them. However, the design of USD0 considers a fairer and more transparent distribution mechanism. 100% of USD0's profits flow into the protocol treasury, with 90% of $USUAL tokens distributed to community members. Community members include not only users but also liquidity providers and contributors. Through this design, USD0 ensures that users can share in the growth dividends brought by the protocol, rather than concentrating all profits in the hands of the issuer.

Interestingly, users holding USD0 can convert it into USD0++ to earn more yields. This not only enhances user engagement but also allows users to benefit from the protocol's growth, truly realizing the concept of decentralization and yield sharing.

In contrast, traditional stablecoins like USDT, although backed by a large amount of U.S. Treasury bonds, have most of their profits belonging to Tether and offer almost no way for ordinary users to participate in profit distribution. For example, in the first half of 2024, Tether's net profit reached $5.2 billion, with almost all profits belonging to the company, and users did not share in this dividend.

· Decentralized Governance and Transparent Management

The decentralized governance of USD0 is one of its highlights. In the Usual protocol, community members are not just users; they can also participate in protocol governance by staking $USUAL tokens. Users have a certain voice in treasury and protocol decisions, meaning that the issuance and management of USD0 are not controlled by a centralized entity but are collectively decided by the community.

The advantages of this decentralized governance are evident; it ensures that the protocol's decisions are not manipulated by a single interest party and can better serve all participants. In contrast, traditional stablecoins like USDT are almost entirely controlled by Tether, with very limited space for user participation in governance.

· Unique Advantages in Risk Management

As mentioned earlier, USD0 chooses highly liquid and safe government bonds as collateral, reducing the impact of systemic risks from the banking system compared to commercial bank reserves. The short-term assets used by USD0 can effectively avoid situations of discounted liquidation during large-scale redemptions. If the asset's maturity is too long, it may be forced to sell at a low price to meet redemptions, but short-term assets' maturity can reduce this risk.

Additionally, all assets are tokenized and on-chain, allowing users to verify their liquidity and safety at any time. This transparency greatly enhances user trust in the protocol. Smart contracts automatically execute the issuance and management processes of USD0 and ensure price stability through arbitrage mechanisms. When the market price of USD0 deviates from its pegged value, arbitrageurs can buy and sell USD0 to restore its stability. Through these measures, USD0 can minimize price fluctuations and reduce systemic risks during large-scale redemptions.

Conclusion

With the continuous development of the Web3 industry, decentralized finance (DeFi) and cross-border payments have become the most promising application scenarios for blockchain. As an important tool connecting traditional finance and on-chain assets, the decentralized, transparent, and fair yield distribution mechanism of stablecoins will be key to the future development of stablecoins.

One of the core concepts of Web3 is decentralization and sharing value with users. The Usual project is based on this concept, innovatively combining the advantages of traditional finance with the decentralized spirit of Web3, creating a new stablecoin model through more transparent, fair, and decentralized mechanisms. It not only provides users with higher yields but also allows more community members to participate in protocol governance, sharing network value and commercial dividends.

This model may very well be the true future of Web3.0 stablecoins.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。