This column focuses on sharing major mainstream cryptocurrencies such as BTC/ETH/EOS/XRP/ETC/LTC/DOGE. Follow the public account "Yinbi" to avoid getting lost and enjoy more service guidance.

Average financing rate (in %):

When the rate is positive, long positions periodically pay short positions. Conversely, when the rate is negative, short positions periodically pay long positions.

During a bull market, the financing rate for Bitcoin is often positive, as traders believe prices will continue to rise. However, when the market overheats, it often loses momentum, and prices begin to fall, leading to a chain reaction of liquidations.

As of yesterday, the financing rate briefly dropped to a negative -0.001%, marking the first time this year and only a few instances since November. When the financing rate is negative and shorts become overly confident, the risk of liquidation for shorts increases.

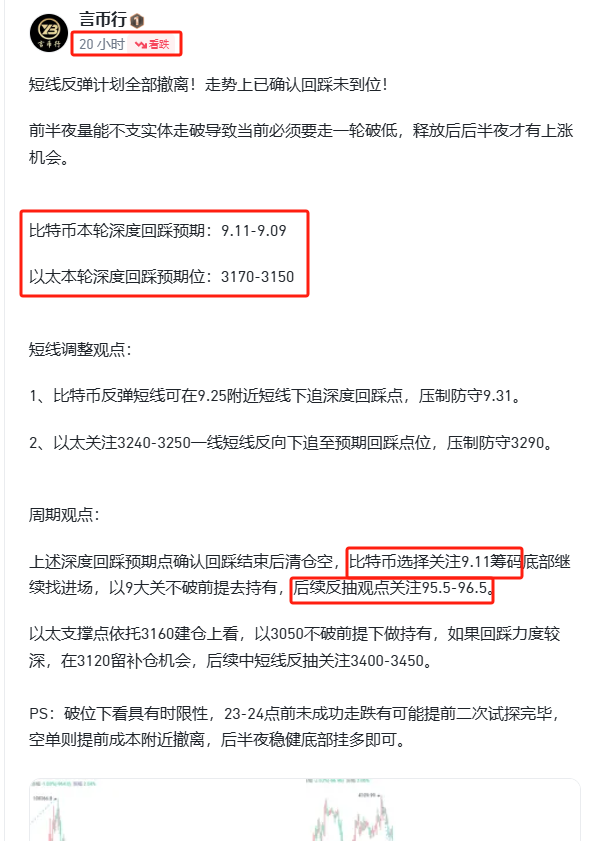

Bitcoin Intraday Evening View:

We are just one step away from the first target point of 9.55.

The layout from 9.11 this morning has gained 4000 points so far.

Long positions must remember to take profits on the first batch, and if there's still room, consider holding a cost position to look at 9.65.

The Labor Department will release non-farm payroll data at 9:30 PM tonight. Do not force a position; if it's time to run, then run.

BCH Layout View:

BCH has shown decent resistance to declines recently.

Although the upward momentum is not very strong, after another adjustment at the bottom, there may be a chance for a rebound with the non-farm data tonight!

If it can confirm a stable position above 435 tonight, it might welcome a rise to 480-510 in the next round.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。