Macroeconomic Interpretation: As 2024 comes to a close, the non-farm payroll report for December, to be released by the U.S. Bureau of Labor Statistics (BLS) tonight at 21:30, has become the focus of market attention. This report not only summarizes the performance of the U.S. job market over the past year but also has significant implications for the future direction of the Federal Reserve's monetary policy. This article will provide an in-depth interpretation of the non-farm employment data, analyze its impact on Federal Reserve policy, and further explore the potential chain reactions this policy change may have on the cryptocurrency market.

Interpretation of Non-Farm Employment Data: According to the general expectations of Wall Street investment banks, the non-farm payrolls for December are expected to show an increase of 165,000 jobs, a decrease from the previous value of 227,000, but still above the six-month average of 143,000. This data reflects a trend of moderate cooling in the U.S. job market after a period of strong growth. Regarding the unemployment rate, the market expects it to remain unchanged at 4.2%, while the Federal Reserve's latest economic forecast indicates that the unemployment rate will rise to 4.3% by the end of 2025, although the long-term forecast remains at 4.2%.

It is noteworthy that financial institutions such as Goldman Sachs and Citigroup have a more pessimistic outlook for the December job market. Goldman Sachs predicts an increase of only 125,000 jobs, with a slight rise in the unemployment rate to 4.3%; Citigroup expects only 120,000 new jobs, with an unemployment rate of 4.4%. These predictions remind the market that, despite the overall robust performance of the job market, there are still risks of a slowdown.

From an industry perspective, the retail and construction sectors are expected to play a larger role in December's employment growth. In November, retail employment decreased by 28,000 due to seasonal adjustments for the holiday season, and construction also slowed due to hurricane impacts. However, the market anticipates a rebound in these sectors in December, which will drive overall employment growth.

Analysis of Federal Reserve Policy Direction: This non-farm payroll report has significant implications for the future direction of the Federal Reserve's monetary policy. The Federal Reserve made a strong hawkish turn at the December FOMC meeting, and the market generally expects a pause in rate cuts in January. Non-farm employment data that aligns closely with consensus expectations will undoubtedly solidify this decision.

Federal Reserve Chairman Powell previously emphasized that as long as the job market and economy remain robust, the Fed can be cautious when considering further rate cuts. Several Federal Reserve officials have also expressed optimism about the job market, believing that its "gradual cooling" trend has not raised concerns. This situation supports expectations for the Fed to "slow down the pace of rate cuts."

Bank of America stated that if the labor market no longer gradually cools, especially if the unemployment rate stabilizes at 4.2% with a healthy number of jobs, then the rate-cutting cycle may have already ended. Nomura also believes that the robust performance of job growth and the stability of the unemployment rate will lead decision-makers to maintain a cautious stance on further rate cuts.

Impact on the Cryptocurrency Market:

Adjustments in the Federal Reserve's monetary policy have significant implications for the cryptocurrency market. On one hand, there is a close correlation between the cryptocurrency market and traditional financial markets. When the Federal Reserve signals a rate cut, market liquidity increases, and investor risk appetite rises, often leading to inflows into the cryptocurrency market, driving prices up. Conversely, when the Federal Reserve tightens monetary policy, market liquidity decreases, and investor risk appetite declines, which may put pressure on the cryptocurrency market, leading to price drops.

On the other hand, the cryptocurrency market has its unique attributes and risk characteristics. Compared to traditional financial markets, the cryptocurrency market is more volatile and unstable. Therefore, in the context of adjustments to the Federal Reserve's monetary policy, the reactions of the cryptocurrency market may be more intense and unpredictable.

From the current market situation, as expectations for the Federal Reserve to pause rate cuts in January gradually strengthen, the cryptocurrency market may face certain pressures. On one hand, market funds may flow into more stable traditional financial markets, leading to outflows from the cryptocurrency market; on the other hand, a decrease in investor risk appetite may exacerbate the volatility and uncertainty of the cryptocurrency market.

However, it is worth noting that the cryptocurrency market also has a certain degree of resilience and rebound capability. After a period of adjustment, some cryptocurrencies with core competitiveness and long-term value may gradually stand out and attract investor attention. Additionally, with the continuous development of the global digital economy and the emergence of innovative technologies, the cryptocurrency market is also expected to welcome new development opportunities and growth points.

Conclusion and Outlook:

In summary, the moderate cooling of December's non-farm employment data provides strong support for the Federal Reserve to pause rate cuts in January. In the context of adjustments to the Federal Reserve's monetary policy, the cryptocurrency market may face certain challenges and opportunities. On one hand, market funds may flow into traditional financial markets, leading to outflows and price declines in the cryptocurrency market; on the other hand, some cryptocurrencies with core competitiveness and long-term value may gradually emerge, attracting investor attention.

BTC Data Analysis:

Yesterday, I joked that the negative news seen during the downturn was overwhelming, first with the U.S. Department of Justice approved to sell nearly 70,000 #BTC from the Silk Road case, and today I saw that Russia has begun selling 1,032 #Bitcoin seized in the Infraud hacker organization case:

Russia has started selling the Bitcoin it confiscated during its investigation of the Infraud hacker organization in 2023. This move indicates that Russia aims to exchange over 1,000 Bitcoins for fiat currency. The Russian state news agency TASS confirmed this development, stating that Moscow will first sell the Bitcoin worth nearly $10 million seized from Marat Tambiev, a former investigator of the Russian Investigative Committee.

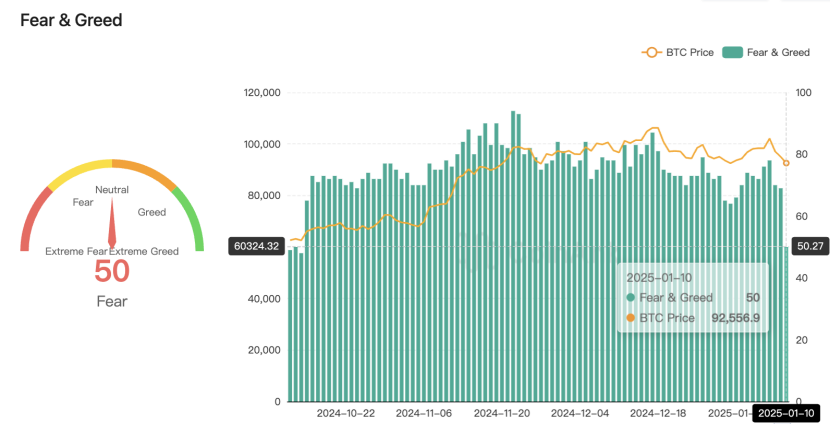

As for my view, although these sales may mostly occur in over-the-counter transactions with minimal impact on the market, and the scale of Russia's sales this time is not large, it may still affect market confidence, leading other short-term speculative funds to follow suit and sell, and some funds may take the opportunity to short hedge and arbitrage, which will impact the prices and volatility of the cryptocurrency market. Additionally, according to the Coinank Fear and Greed Index, it has dropped from a high of 78 (greed) earlier this week to a neutral level of 50, indicating that market confidence has clearly been affected. This is also the first time it has fallen to the 50 level since mid-October last year.

Tonight, the #U.S. non-farm data is about to be released, and in addition to the non-farm employment data, the unemployment rate data will also be released, all of which will affect U.S. monetary policy and the stock market, thereby impacting the #cryptocurrency market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。