The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui who talks about coins, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. Welcome the attention and likes from all coin friends, and reject any market smoke screens.

I have talked about many trends and communicated with many friends about the cryptocurrency space. After calming down, I have also looked at many peers' core understandings of blockchain technology and the cryptocurrency space, and I found that there are more or less some misunderstandings in this regard. Perhaps due to many limitations, everyone is unable to express clearly. Today, Lao Cui will discuss with everyone what specific practical value the cryptocurrency space can bring us in reality. Many of Lao Cui's followers have seen Buffett's value investment philosophy, so this investment philosophy is deeply rooted in people's hearts, after all, it is the idea conveyed by the stock god. First of all, Lao Cui extremely agrees with the concept of value investment, but it only belongs to the traditional capital market and cannot cover all financial markets. The most obvious manifestation is our domestic market. This is not to be discussed too much; just look at India to see why value cannot be transformed into real profit investment. The core idea of humanity is to learn to be flexible; we must achieve unity of knowledge and action, as well as transformation of thought.

Let’s bring the concept of value investment into the cryptocurrency space. Who are the real beneficiaries in the cryptocurrency space? Is it the initial dark web to the current gambling platform applications? Or is it the high-level understanding of its untraceability? Everyone should be clear that blockchain technology is not just limited to traditional currencies. Traditional currencies are basically issued by countries; even the US dollar cannot be universally accepted worldwide, as it cannot circulate in North Korea. The concept of Bitcoin is to provide a medium that can circulate globally, which can directly cross national monitoring. This is why there was the incident with Apple phones in the country, where hackers could lock your phone from across the ocean, and you had to pay with Bitcoin to unlock it. Of course, this method is definitely illegal, but isn't the application of this gray industry a form of practical value? Everyone should not only focus on positive assets, always looking at the use of gold and the US dollar, while ignoring more innovative payment methods. The trade war also shows the drawbacks of traditional currencies; the US dollar in hand can turn into worthless paper at any time. This understanding can make it clearer why the so-called foreign trade foreign exchange rate is pegged. These issues can all be resolved through blockchain technology.

If everyone agrees on a cryptocurrency, there will be no exchange rate issues. The current problem is that we cannot buy the semiconductor products we want with US dollars, and Americans cannot buy the rare earths they want with US dollars either. Isn't this also a problem that traditional currencies cannot solve? Looking at the depreciation of the Russian ruble, the core issue is the restriction on Russian trade, which prevents the ruble from settling with Europe. At the same time, holding euros does not allow one to buy the desired weapons, and they do not lack energy themselves. So, can anyone tell Lao Cui what the significance of holding euros is? The significance of currency lies in its ability to reflect the value of purchasing physical goods. When you cannot buy what you want with currency, then it is just a pile of worthless paper. At this time, the value of Bitcoin can be reflected; Germany can use Bitcoin to exchange for Russian energy (this has been confirmed by Italy), and Russia can also receive technical support from Germany. This is a cooperation reached through mutual consensus, and more and more countries and individuals are recognizing this technology, which has already been reflected in practical value transactions. Why can't everyone see the future trend?

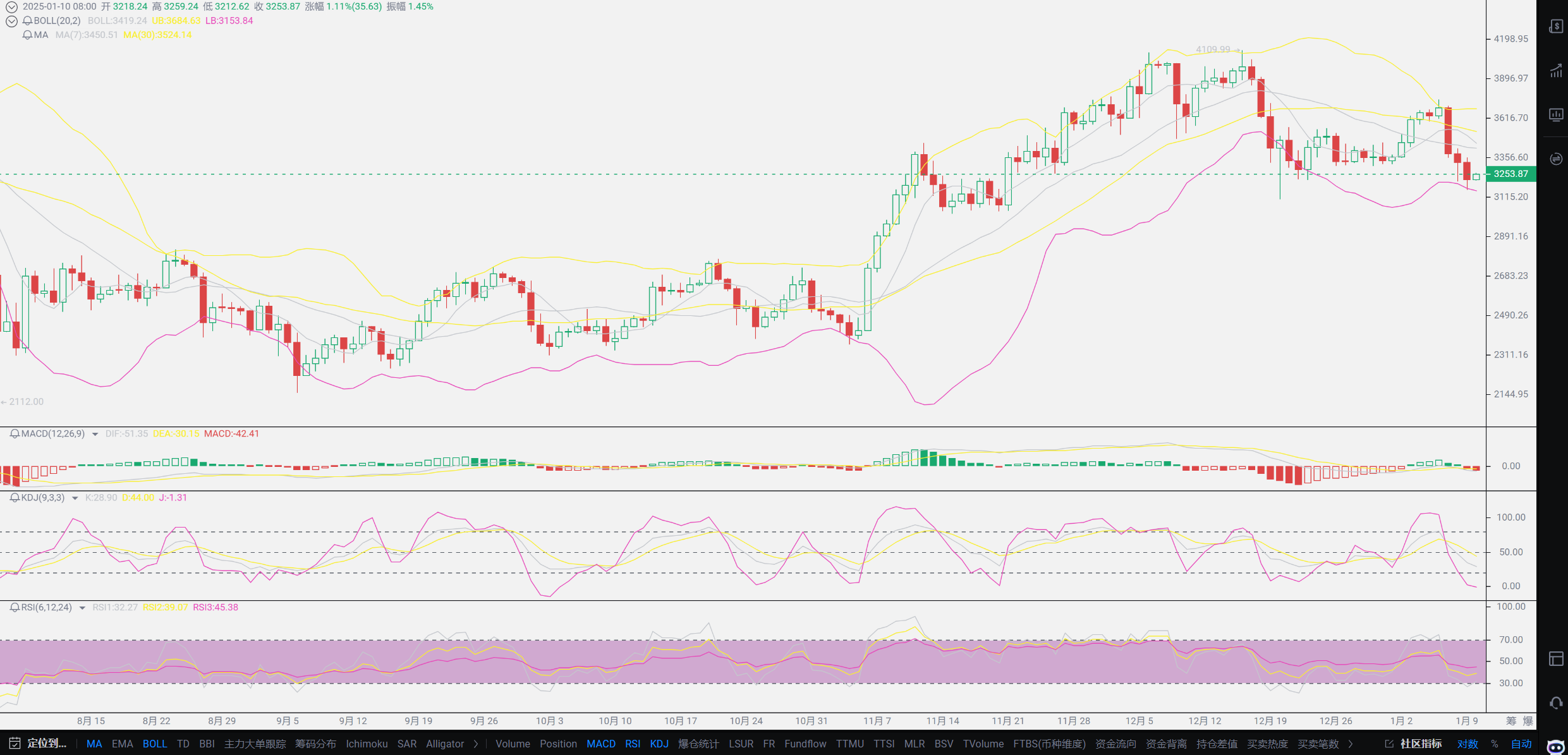

It's a simple logic. If everyone insists on starting from the market trends, they will find it completely irregular. This has always been a common tactic of capital; the entire market trend fluctuates, sometimes increasing by thousands of points, and sometimes decreasing by thousands of points. Blindly focusing on market trends will lead to confusion, completely falling into a capital trap. The point Lao Cui has always mentioned is the level of capital. Currently, the capital aggregation in the cryptocurrency space has actually reached around 110,000 to 120,000, and the reason for the stagnation in growth is definitely there. Judging from the current capital level, this wave of decline basically announces the end of the washout. The market fluctuations in the week before Trump takes office are extremely important, and there are likely two possibilities. The pull before taking office reaches a new high, and the market will decline when he takes office, which will first clean up the bulls before rising again. If the market is in a downward trend before taking office, and it continues to decline on that day, then the timing for the market to start will likely be around two days after he takes office. The fluctuations in growth on that day may be larger, but these are all issues that capital needs to consider. Our response measures should be to lay low around 90,000; every wave of decline provides an entry opportunity for everyone. Capital will definitely release more smoke screens around this area, making it difficult for everyone to clarify their thoughts. At this time, a clear mind is even more needed; just confirm that the bullish trend has not changed, and the biggest good news is about to arrive. The year 2025 belongs to the cryptocurrency market, and Bitcoin's new high will definitely come again.

To survive in the cryptocurrency space, it is especially necessary to abandon the peculiar perspective of traditional finance. The traditional capital market cannot solve the current problems in the cryptocurrency space. This is why traditional American capital does not look favorably upon the cryptocurrency market; they know that once cryptocurrencies are recognized by the world, their interests will be infringed upon. The relationship between traditional capital and the cryptocurrency market is a historical process of new and old alternation, and in this process, there will definitely be candidates for elimination, with traditional currencies being among them. The US dollar is the credit endorsement of the Americans; in the future, Bitcoin may be the endorsement of the whole world. The ultimate vision is certainly greater than the concept of the US dollar. Once this vision is realized, it means that Bitcoin may surpass the status of the US dollar. The point that everyone is always confused about is the confrontation between the Federal Reserve and the US government. The different mechanisms create opposition between the two. This opposition will indeed bring some uncertainty. Everyone needs to pay attention to Trump's victory, which is different from other presidents; he holds legislative power, executive power, and the power to amend the constitution. As of now, he still holds the upper hand, and the opposition still gives Trump a higher chance of winning. What Powell said about not considering constitutional amendments is not something he can prevent by personal will.

Looking at the entire cryptocurrency market from this perspective, you will find it very easy to understand. The rise will only be the main theme of Bitcoin; there is no second path to take. The US stock market once struggled to regain control from the cryptocurrency space, but it is too difficult for the US stock market to stabilize at historically high levels. However, this level of capital volume is completely insignificant in the cryptocurrency space; the growth space in the cryptocurrency space is still very large, and this space is completely beyond Lao Cui's expectations. At this stage, Lao Cui cannot even estimate the peak. How could it stop at the 100,000 mark? For the year 2025, 100,000 is just the starting point, especially since the situation of interest rate cuts has not truly brought large capital into the cryptocurrency space. This delayed satisfaction of waiting for the capital wave to arrive will still lead to some growth in the cryptocurrency space. Everyone needs to pay attention to the data from the first half of the year in the US. From January to May, there is no need to think; the data will be very good. However, attention should be paid to the data in June, as both the unemployment rate and non-farm payrolls, as well as the overall performance of the US stock market, are crucial. Currently, the data in the US has also learned to be fabricated; only at the last moment can we truly understand the real data. The data from June to September will basically indicate the number of interest rate cuts in 2025. If the data falls short, three to four interest rate cuts will still come. At this stage, there is no need to predict that far ahead; everyone just needs to remember to buy low. The closer it gets to the 90,000 mark, the safer it is. Regarding other issues, including the choice of entry positions, if you cannot judge, you can directly ask Lao Cui. At this stage, Lao Cui will maintain the subsequent users and will not expand the user base for 2024; the idea of bringing in new users is temporarily halted. This month, the new year is approaching, and Lao Cui still wants to have a peaceful New Year. I hope everyone can understand. Of course, if there are questions, Lao Cui will definitely reply to everyone. Thank you all for your trust and understanding!

Original creation by WeChat Official Account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's Message: Investing is like playing chess; a master can see five, seven, or even more than ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation and the big trend, not focusing on one piece or one territory, aiming for the ultimate victory. The novice, on the other hand, fights for every inch of land, frequently switching between long and short positions, only competing for short-term gains, and often finds themselves trapped.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。