Author: Jason Jiang, OKG Research

From Bitcoin spot ETFs to the wave of tokenization, the institutional power represented by Wall Street is profoundly influencing and changing the direction of the crypto market, and we believe this power will become even stronger by 2025. OKG Research has launched the "#OnchainWallStreet" series to continuously focus on the innovations and practices of traditional institutions in the Web3 space, examining how top institutions like BlackRock and JPMorgan embrace innovation. How will tokenized assets, on-chain payments, and decentralized finance shape the future financial landscape?

This article is the first in the "#OnchainWallStreet" series.

Investment management company VanEck boldly predicted that in 2025, Coinbase would "take unprecedented steps to tokenize its stock and deploy it on its Base blockchain." This prophecy seems to be coming true: Jesse Pollak, a key developer of the Base chain, recently revealed that providing $Coin on the Base chain is "something we are researching in the new year," and he expects "every asset in the world will eventually be on Base."

We are still unclear whether Coinbase can realize this plan, but as it uses its own stock as a starting point for tokenization exploration, Wall Street is also accelerating "Onchain."

Wall Street Begins to Migrate Onchain

Since the beginning of 2024, the crypto market has experienced rapid growth, with the boundaries of innovation continuously expanding. The core driving force behind this is the cryptocurrency spot ETFs promoted by Wall Street institutions represented by BlackRock. Now, these institutions are shifting more attention to the field of tokenization.

BlackRock CEO Larry Fink stated that while the approval of cryptocurrency spot ETFs is important, these are "stepping stones" toward broader tokenization of other assets. With the wave of tokenization, Wall Street is pushing more assets and businesses on-chain, allowing traditional finance and crypto innovation to collide in the digital space.

Although the tokenization of financial assets has been happening since 2017, it has only recently taken off. Unlike early explorations that focused on permissioned chains, an increasing number of tokenization practices are gathering around public chains, with Ethereum becoming the preferred choice for institutional tokenization. These institutions are no longer rejecting decentralization; instead, they are actively exploring the radius of crypto influence, attempting to provide new experiences through the recombination of assets and technology. As Coinbase puts it, "Web3" is gradually being replaced by the more fitting term "Onchain."

This time, the protagonists are not just cryptocurrencies, but also many assets from the physical world, such as stocks. As the largest cryptocurrency exchange in the United States, Coinbase is currently the most popular stock target in the tokenization market. Data from rwa.xyz shows that as of January 2025, the total market value of tokenized stocks is approximately $12.55 million, with nearly 50% of that being tokenized stocks of Coinbase. Additionally, stocks of major U.S. tech giants like Nvidia, Tesla, and Apple frequently appear on-chain.

Figure: Market Structure of Tokenized Stocks

Coinbase's plan to tokenize its stock and issue it on the Base chain not only allows investors to trade its stock directly on-chain but also further integrates the trading platform, Base chain, and on-chain asset ecosystem, exploring a compliant and practical model for stock tokenization in the U.S., keeping it ahead in the competition of crypto financial innovation.

This layout is certainly not just for $COIN tokenization. Perhaps, as Jesse Pollak said, they hope that all assets in the world will be on the Base chain. However, compared to that, accelerating the migration of major global assets through tokenization to on-chain is a more foreseeable future.

Despite facing skepticism like other innovative concepts, the idea centered on democratizing investment opportunities and simplifying capital flow efficiency has already taken root. The on-chain usability demonstrated by stablecoins, BUIDL funds, and other tokenized assets has proven its value, and more asset classes are migrating on-chain: not only common private credit, bonds, funds, and gold, but also agricultural products, carbon credits, rare minerals, and other assets.

According to predictions from OKLink Research Institute, by 2025, we will see Wall Street continue to frequently go "Onchain" and promote a richer and more mature tokenization system: not only will the scale of on-chain tokenized assets, excluding stablecoins, exceed $30 billion, but we will also see more companies entering the tokenization field under the leadership of Wall Street, bringing more valuable assets on-chain. Although the scale of tokenization for these assets may not be "exaggerated," it is still significant.

Moving Towards a More Democratic Future of Finance

Sixty years ago, when you purchased financial securities or used them as collateral, you might have to wait five days to receive a paper certificate to confirm the transaction; later, as paper certificates became more numerous, transaction settlements became unmanageable, forcing Wall Street to start using computers to track securities.

Today, gaining a competitive trading advantage from better or faster technology is an omnipresent part of modern finance. Whether it’s BlackRock and Goldman Sachs, or Citigroup and JPMorgan, nearly everyone on Wall Street believes that tokenization is the trend of the future and is embracing the changes brought by tokenization. Compared to the passive nature of financial informatization, tokenization is the next proactive transformation that finance is embracing.

In this transformation, deploying assets on-chain through tokenization is no longer a challenge; the future challenge lies in how to increase demand for tokenized assets, thereby solving the liquidity problem on-chain. The unparalleled success of traditional securities is largely attributed to their high liquidity and low transaction costs. If tokenized assets are merely locked on-chain or can only circulate in limited liquidity secondary markets, their actual value will also be very limited.

Nadine Chakar, who previously managed the digital asset division at State Street Bank, expressed a similar viewpoint: "A bank collaborates with a company to issue tokenized bonds and then releases a press release. What happens next? Nothing happens. These bonds are like stones, very difficult to circulate in the market."

How to solve the liquidity problem in the tokenization market? Different institutions may have different solutions, but in my view, the most direct way is to accelerate the tokenization of quality assets. Only by first accumulating enough quality assets on-chain can we attract more users and funds to migrate on-chain, thereby solving the liquidity problem.

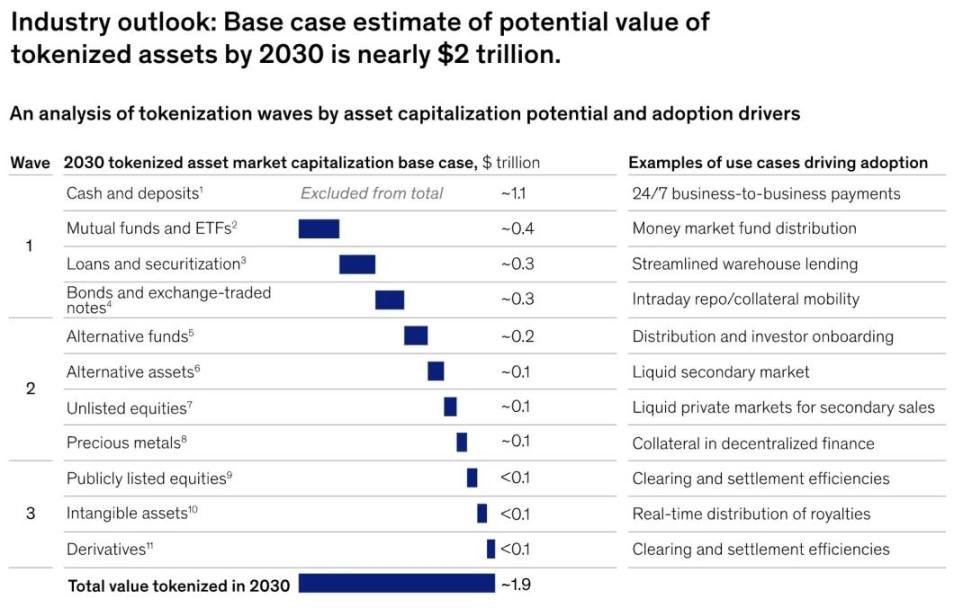

Figure: McKinsey predicts that the scale of tokenization will approach $20 trillion by 2030

As network effects strengthen, tokenization is now shifting from pilot projects to large-scale deployment. However, as McKinsey predicts, tokenization cannot be achieved overnight; there will be significant time lags in the tokenization processes of different assets: the first wave will be driven by use cases with proven investment returns and existing scale, followed by use cases of currently smaller market segments, less obvious benefits, or those requiring more severe technical challenges.

When the first wave of on-chain assets explores compliant and practical business models and brings enough attention and liquidity to the on-chain market, perhaps tokenization will create a more free and democratic "shadow" capital market in the future. It will provide investors with freer investment opportunities and allow more companies to complete financing more conveniently. Tokenization will bring profound changes to both sides of asset supply and demand, gradually eliminating the barriers between the off-chain and on-chain worlds, forming a truly globalized new financial ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。