Trying to find more AI Agent related projects on Base.

Written by: Deep Tide TechFlow

Introduction

Everyone says AI Agents are great, and the Solana ecosystem is a treasure.

However, outside of Solana, Base is also one of the origins of this wave, and don't forget that the market cap of Virtuals is even higher than ai16z.

Additionally, one reason people like the Base ecosystem is that its PVP level is not as competitive as Solana, where you can find quite a few good treasures; however, due to scattered information, relatively low recognition, and information silos, seizing opportunities on Base is not that easy.

Aside from the tokens generated around Virtuals and Clanker in the past few months, as well as the well-known AIXBT, what other projects on Base might you have missed that are treasures?

The editorial team has decided to embark on a major treasure hunt, trying to find more AI Agent related projects on Base to restore the full picture of opportunities within the ecosystem.

Based on different development directions and themes, we have compiled a list of recently outstanding projects for your reference.

Rising Stars in Virtuals

In addition to AIXBT and the GAME framework, the Virtuals ecosystem also has several potential projects with a market cap below 100M that have performed well in recent months, some of which are worth noting.

TAO CAT: AI Agent created by Bittensor + Masa

$TAOCAT

CA:

0x7a5f5ccd46ebd7ac30615836d988ca3bd57412b3

Market Cap: 44M

Backed by well-known AI projects Masa and Bittensor, with excellent background and resources.

As a native AI agent in the Bittensor ecosystem, TAOCAT is built directly on top of Bittensor's subnet:

SN42: Real-time data for superintelligence.

SN19: LLM/inference, advanced language capabilities.

Functionally, TAOCAT can process and analyze real-time social data, combining AI technology for data interpretation and decision-making, providing market insights and analysis.

Recent noteworthy developments: Launched on Binance Alpha; TAOCAT also received investment from DWF Labs, becoming a recipient of its $20 million AI agent fund.

Polytrader: AI-driven Polymarket Prediction Assistant

$POLY

X: @polytraderAI

CA:

0x2676E4e0E2eB58D9Bdb5078358ff8A3a964CEdf5

Market Cap: 17M

Polytrader helps make more informed, data-driven decisions on Polytrader by analyzing market sentiment and providing actionable insights.

You can have Polytrader analyze trending topics on social platforms and then place bets on the direction of a specific event, acting as a market prediction advisor, making it a specialized AI agent that aligns with the characteristics of the previously popular Polymarket platform during elections.

For specific usage, a certain amount of POLY tokens is required to access all features of the project, which also gives the token a certain utility.

During significant events, POLY may benefit not only from AI narratives but also from the events themselves.

Acolyte: The Oracle for AI Agents

X: @AcolytAI

CA:

0x79dacb99A8698052a9898E81Fdf883c29efb93cb

Market Cap: 37M

Acolyt provides reliable research and engineering data through its infrastructure, offering high-quality analysis and actionable insights for individuals and companies.

Currently, Acolyt is being trained to map and understand the metrics that impact the AI agent ecosystem, providing comprehensive insights into various agents and their roles within it.

In the future, Acolyt aims to become a leading oracle, providing high-quality data for AI agents, traders, venture capital firms, index funds, AI accelerators, and educational companies. It will be able to analyze and generate probabilistic outcomes for any project, even before the project launches.

Freya: The Combination of AI Agents and Gaming

$Freya

X: @Freya_Starfall

CA:

0xF04D220b8136E2d3d4BE08081Dbb565c3c302FfD

Market Cap: 14M

Integrating AI agents into games to make characters smarter and create more imaginative spaces has always been a popular topic.

Freya is one such representative. The token is backed by the well-known Japanese game Starfall Chronicles (which uses technology support from Immutable), allowing AI capabilities to enrich character interactions within the game.

Thus, Freya is both a token and an AI character in the game, positioned at the intersection of AI Agents and GameFi.

Recent developments:

The token was launched on Binance Alpha; on January 6, the developer behind the game also participated in the AI16Z Japan meetup to discuss the freedom and future roadmap achieved through elizaTEE.

DeFAI

DeFAI refers to utilizing AI capabilities within DeFi to optimize various stages of DeFi trading, which has been a key focus of recent discussions on social media.

For more insights into this sector, see our previous article: “The Trend of 'AI + DeFi' is Emerging, These Projects in the DeFAI Sector are Worth Your Attention”

Kudai: DeFAI Agent Created by the GMX Community

$kudai

X: @Kudai_IO

CA:

0x288F4Eb27400fA220d14b864259Ad1B7f77C1594

Market Cap: 19M

Kudai is an AI agent born from the GMX Blueberry Club community and built using the well-known framework @EmpyrealSDK, providing an experience that integrates community-driven spirit, DeFi, AI, and innovative features.

It is important to note that Kudai has only released its token so far, and more capabilities have yet to be developed; however, the recently released white paper mentions that Kudai will later purchase and stake GMX to provide more income sources and invest in GMX's GM pool to further enhance returns.

The project's ideal goal is for Kudai to automatically run different strategies (leverage trading, arbitrage, farming negative interest rates, etc.) on GMX V2, sharing positions, profits, and losses in real-time.

It has a bit of the flavor of being GMX's AI spokesperson, but more functionalities are still in the pipeline.

AI Agent Framework

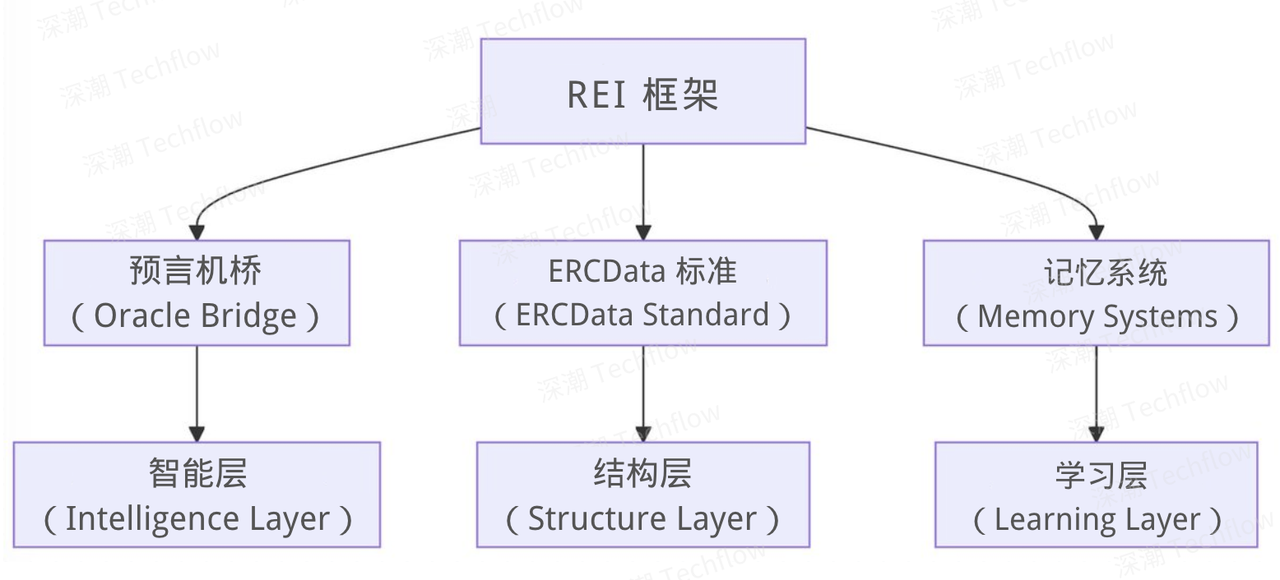

REI: A New Framework for Efficient Collaboration Between Blockchain and AI

X: @ReiNetwork0x

CA:

0x6B2504A03ca4D43d0D73776F6aD46dAb2F2a4cFD

Market Cap: 104M

Rei Network is a core framework layer dedicated to maximizing the integration capabilities of AI and blockchain.

It achieves a key goal through a three-layer architecture: allowing AI to operate without the technical limitations of blockchain while enabling low-cost data verification and storage on-chain. The uniqueness of Rei lies in its ability to convert the probabilistic outputs of AI into deterministic, verifiable data structures.

Rei is the first project to adopt this approach, and with its first-mover advantage, it has quickly established its leading position.

The technical details of framework projects will not be elaborated here, but the market generally believes that one of the benefits of REI is:

It allows for a designed separation between blockchain and AI, rather than a forced integration; it is a logic of collaboration rather than fusion.

Currently, some AI Agents based on the Rei framework are gradually emerging, and due to space limitations, they will not be listed here. For a detailed analysis, see: “In-depth Analysis of Rei Network and $REI: Another AI Project in the Base Ecosystem That Cannot Be Ignored”

Investment/Incubation DAO

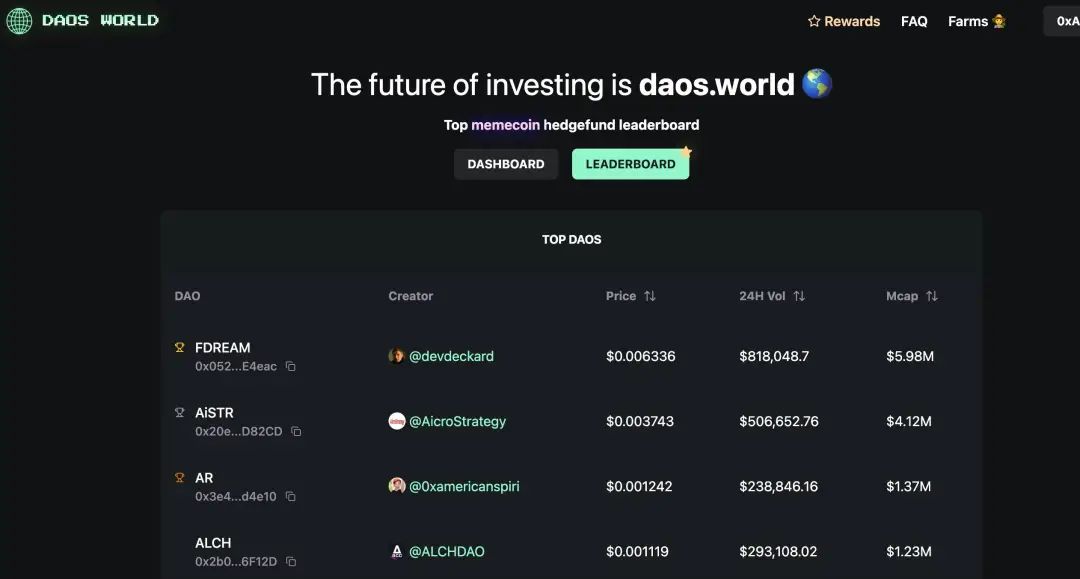

daos.world: A New Attempt at Decentralized Investment Funds

Following the popularity of the decentralized fund management platform Daos.fun launched by ai16z, the concept of "Investment DAO" has begun to gain acceptance — decentralized hedge funds managed by real people or AI agents that raise funds, generate returns, and distribute profits back to DAO token holders.

On Base, a similar investment DAO is Daos.world.

Users can raise funds through this platform, easily start and manage their own DAO hedge funds, and trade through trustless smart contracts. Within each DAO, the DAO manager raises ETH to start the fund. Managers can freely trade and invest ETH as they wish.

At the same time, each DAO will also issue its own token, and holding DAO tokens corresponds to "fund shares," which will share the investment returns based on the shares held.

Regarding trading targets, the product's homepage has clearly stated that these hedge funds are also related to Meme coins and AI.

Additionally, the early products of daos.world are currently based on the Base chain, with plans to gradually expand to ETH, Hyperliquid, and others based on user demand.

Currently, there are 4 funds launched in daos.world, summarized as follows.

Note: The DAO tokens in the daos.world ecosystem have recently experienced a collective decline, so please be aware of the risks and DYOR.

1. DR3AM DAO: AI-Assisted Investment Fund Targeting AI Sector Opportunities

$FDREAM

X: @DR3AM_AI

CA:

0x0521AaA7C96E25afeE79FDd4f1Bb48F008aE4eac

Market Cap: 7M

DR3AM DAO is an AI-assisted investment fund targeting large, medium, and small AI opportunities. It is supported by proprietary datasets and algorithms from DREAM, combining human expertise with AI analysis to identify transformative projects across the crypto AI space.

However, from the current holdings of DR3AM, it appears to be more focused on buying tokens from other investment DAOs, such as WAI and TRUST (which will be introduced later).

2. Alchemist Accelerate: Holdings Only in BTC and ETH?

$ALCH (not the one on Solana, please identify correctly)

X: @ALCHDAO

CA:

0x2b0772BEa2757624287ffc7feB92D03aeAE6F12D

Market Cap: 1.2M

This DAO claims to invest in transformative projects, create educational resources in multiple languages, and provide guidance and connections to empower the global community.

However, aside from holding the tokens of the neighboring brother DAO FDREAM, ALCHDAO primarily holds Bitcoin and Ethereum, indicating a very conservative investment style…

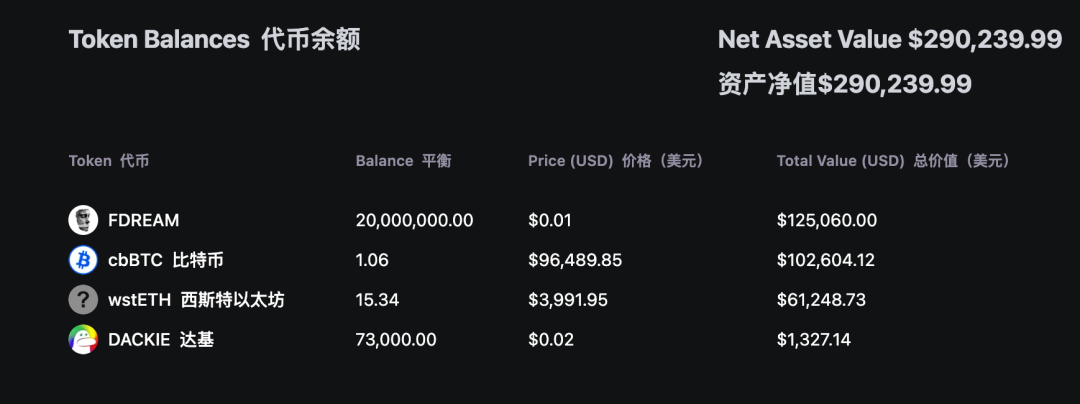

3. AicroStrategy: On-Chain Clone of MicroStrategy, Mainly Buying cbBTC

$AiSTR

X: @AicroStrategy

CA:

0x20ef84969f6d81Ff74AE4591c331858b20AD82CD

Market Cap: 4.2M

AicroStrategy is an AI hedge fund that will utilize its cbBTC holdings to maximize Bitcoin exposure. The raised funds will be used to purchase cbBTC, which will be deployed into carefully selected DeFi protocols to maximize security and leverage.

The project's initial plan was to deposit into Aave, borrow USDC, purchase more cbBTC, and repeat the process. AI algorithms will determine the optimal leverage for executing the plan.

The DAO's holdings indeed reflect that it only buys cbBTC, but it still buys more of the brother DAO $FDREAM's tokens.

4. Alameda Research V2: Playing with FTX Bankruptcy Jokes, The Most Diversified AI Token Purchaser

$AR

X: @AlamedaV2DAO

CA:

0x3e43cB385A6925986e7ea0f0dcdAEc06673d4e10

Market Cap: 1.5M

From the name and logo, one can see a strong sense of irony and humor, clearly paying tribute to the FTX bankruptcy event and the related Alameda Research involving SBF and his girlfriend.

The DAO's introduction is also quite interesting: "V2 is a leading trading company operated from SBF's cell… We trade thousands of digital asset products using internally developed technology and deep crypto expertise."

From the fund's holdings, it is indeed the most diversified among the DAOs, basically including popular AI-related tokens on Base.

wai combinator: On-Chain Version of Y Combinator Pun, AI Project Incubator on Base

$WAI

X: @wai_combinator

CA:

0x6112b8714221bBd96AE0A0032A683E38B475d06C

Market Cap: 17M

WAI Combinator is also built on the Virtuals protocol but leans more towards investment incubation.

Its core positioning is as an experimental "Agent + Human" investment DAO organization, aiming to create value for token holders by combining AI agents and human expertise in investment decision-making.

From the name, WAI clearly pays homage to the well-known tech incubator Y Combinator, and its business is similar, but the projects incubated are all within the on-chain Base ecosystem, especially early projects still in the Bonding Curve stage within Virtuals.

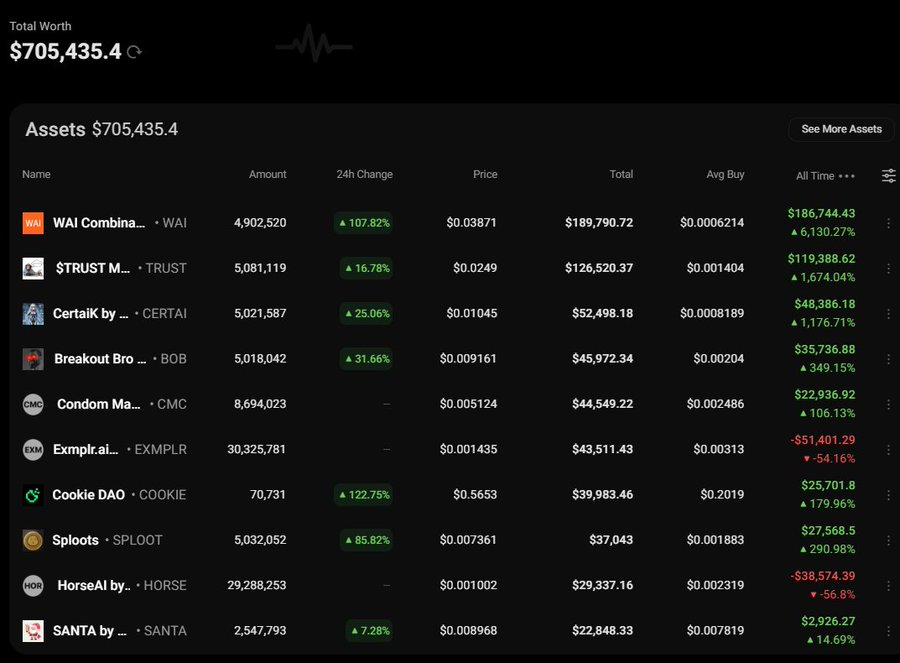

Its asset management scale has grown from $50,000 to over $700,000 in less than two weeks, and the portfolio value has begun to increase significantly (currently $500,000). At the same time, the project is continuously deploying new investments through the "Velocity" program, allowing for ongoing attention to projects that gain its favor.

WAI has also disclosed its asset management address (click here), and interested players can track it.

Similarly, holding WAI tokens allows you to share in the profits from the organization's investment fund, just like other investment DAOs. However, compared to the investment DAOs mentioned above, WAI Combinator has more business to engage in, such as:

Providing AI technical support and integration to help projects optimize decision-making processes; assisting projects in connecting to the Virtuals ecosystem to promote collaboration and resource sharing among projects, etc.

Thus, it plays more of a strategic investment and project incubation role rather than purely making investments.

Note: A similar investment DAO project to WAI is Vader AI, which is often compared by KOLs to the two:

$VADER

CA:

0x731814e491571A2e9eE3c5b1F7f3b962eE8f4870

trustmebrosfun: Incubated by WAI Combinator, New Token $DATDAO Coming Soon

$TRUST

X: @trustmebrosfun

CA:

0xC841b4eaD3F70bE99472FFdB88E5c3C7aF6A481a

Market Cap: 12M

The previously mentioned WAI Combinator has successfully incubated a project called trustmebrosfun, which operates on the Base chain as an AI project. The name is derived from the common meme in the cryptocurrency community, "Trust me bro," sarcastically highlighting the trust issues in the crypto market.

The existing token for the project is $TRUST, which serves as both a meme and corresponds to the trust social media AI Agent.

However, the key point is that its founder @DegenApe recently released a white paper for DATDAO based on trustmebrosfun, which is defined as an innovative decentralized autonomous organization dedicated to investing in other tokens and PVP airdrop mining on Hyperliquid.

DATDAO is about to launch its own token $DATDAO, and to obtain the whitelist for this token, one must hold at least 100K TRUST tokens in the public offering round, which corresponds to an allocation of $DATDAO worth 1 ETH, with a personal cap of 5 ETH.

For more rules, you can refer to the founder's original post.

Regarding the investment level of DATDAO, whether it will yield returns, and whether there is a need for so many investment DAOs in the market, let's set those questions aside for now. From the token design perspective, participation in DATDAO requires holding TRUST, which may create some short-term buying demand for TRUST.

sekoia_virtuals: On-Chain Version of Sequoia Capital

$SEKOIA

X: @sekoia_virtuals

CA:

0x1185cB5122Edad199BdBC0cbd7a0457E448f23c7

Market Cap: 60M

This project is also on Virtuals, but I categorize it as an investment DAO or on-chain fund.

SEKOIA aims to create the best-performing on-chain venture capital agent. The project's X employs a semi-automated, semi-manual AI posting method, claiming to hope to surpass traditional companies and achieve better results.

From the name, it is clearly paying homage to Sequoia, i.e., Sequoia Capital.

The project token has remained relatively stable in price compared to the other investment DAOs mentioned above during the recent downturn in the crypto market; this may be due to the fund's investment in another AI Agent token called $VOLTX, which has performed well and is favored by the market.

According to the information displayed on the official website, the investment level of on-chain Sequoia is quite good, achieving profits that are 15 times its total investment.

AI Agent Launchpad

CreatorBid -- A New Launchpad Integrating Bittensor and Autonolas Capabilities

Some capital benefiting from the rise of Virtuals will inevitably have spillover effects, seeking out smaller ecosystems within Base that are more distinctive.

Among them, CreatorBid is an essential part. Its biggest feature is the integration with the Bittensor subnet and Olas, bringing significant utility to its ecosystem, especially through the upcoming Olas Mech Marketplace.

In simple terms, Olas's Mech Marketplace is like an "agent marketplace," where agents can autonomously acquire new skills, tools, and workflows—real-time expanding their capabilities. This technology enables CreatorBid to meet the growing demand for agents focused on predictive workflows, trading, payment automation, and more.

Therefore, you can understand CreatorBid as a creative platform that combines blockchain and AI technology, providing content creators with support for building and deploying AI models, as well as offering non-custodial platform services.

Technically, it collaborates with io.net and Aethir's GPU network for AI model scaling; at the same time, it leverages Bittensor's subnet capabilities and Olas's Agent marketplace capabilities to build its own platform.

As the platform's token $BID has not yet undergone TGE, it has already built over 70 Agents. We can focus on the following three projects and their related tokens within the ecosystem:

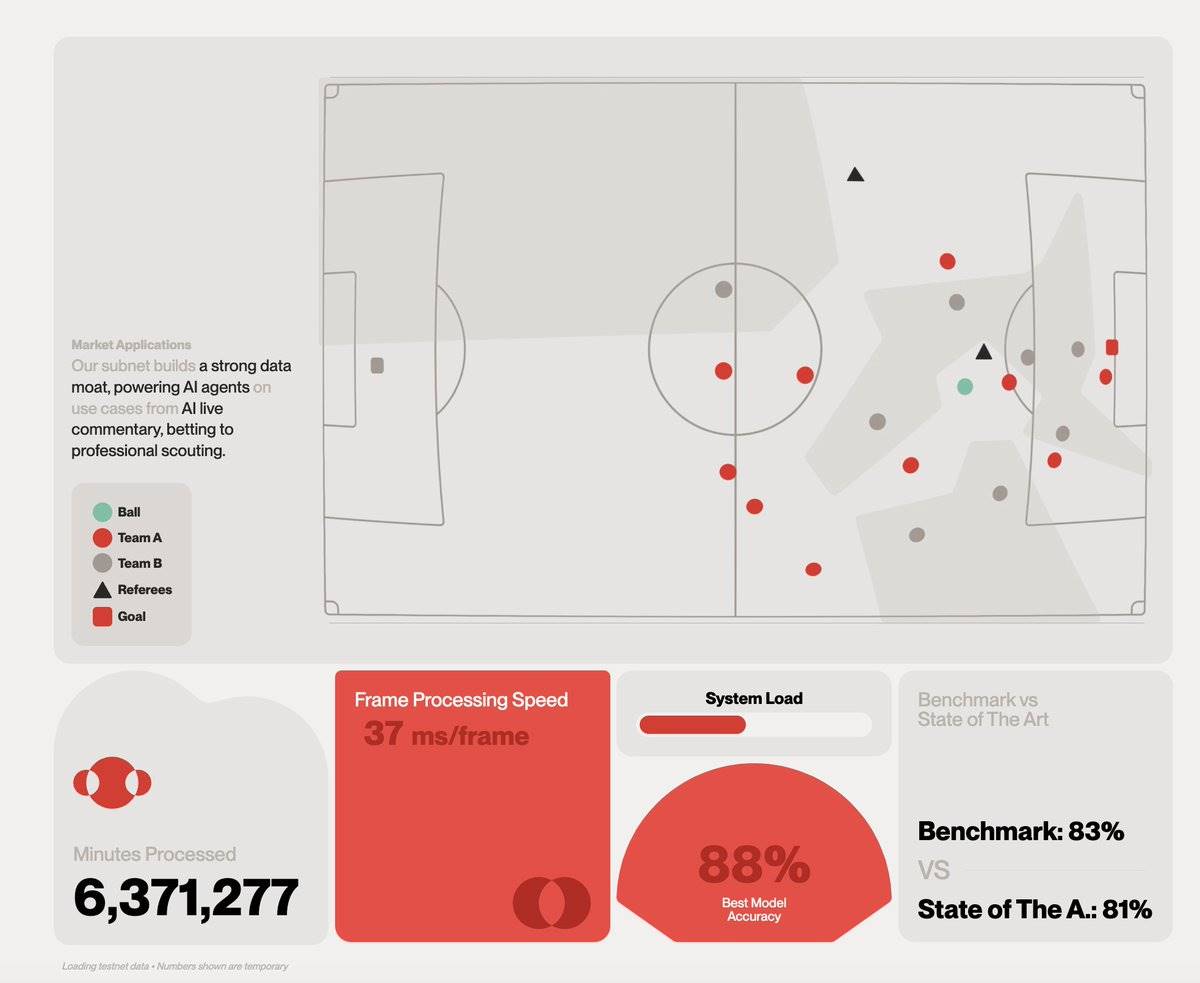

1. draiftking: Analyzing Football Matches with Machine Learning to Guide Sports Betting

$DKING

X: @draiftking

Market Cap: 32M

CA:

0x57eDc3F1fd42c0D48230e964b1C5184B9c89B2ed

This project is developed by @webuildscore, utilizing machine learning to analyze vast amounts of data, such as player positions, matchups, and performance states, to quickly identify inefficiencies in the sports betting market and place profitable orders.

Behind the project, the CEO is a member of @crunchDAO, a top machine learning community, and team members have extensive experience in sports analysis and the gambling market.

It's worth mentioning CrunchDAO, which is a mature elite machine learning community overseas (with over 7,000 data scientists - more than 700 PhDs), developing Alpha insights through its collective intelligence network.

At the same time, this AI agent relies on the TAO network, based on the ScoreVision subnet (SN44), which can significantly reduce computing costs, meaning ScoreVision and draftKings have a certain technological moat in competition.

For more detailed content, you can check the detailed analysis post by well-known Alpha blogger @SmallCapScience.

2. Eolas: A Tool System Providing Enhanced Capabilities for AI Agents on the CreatorBid Platform

$EOLAS

X: @Eolas_AI

Market Cap: 7.6M

CA:

0xF878e27aFB649744EEC3c5c0d03bc9335703CFE3

Eolas is a tool system focused on providing enhanced capabilities for AI agents on the CreatorBid platform and is the first Agent on the platform to utilize Autonolas capabilities.

In simple terms, Eolas's main advantage is that it makes advanced features that were previously only available to a few elite AI agents (like @aixbt_agent) accessible to everyone, thereby enhancing the overall capability level of the CreatorBid ecosystem.

Its main function is to provide advanced tools and features for AI agents on CreatorBid. Eolas utilizes Autonolas's Olas Mechs technology to develop and distribute these tools.

Among them, Olas Mech is a core technology in the Autonolas network, essentially a blockchain-based AI service marketplace. This technology allows AI agents (referred to as Mechs) to provide AI services to other agents or applications via the blockchain.

Returning to Eolas, the core idea of this system is to create and share AI tools in a decentralized manner. Eolas claims that this approach can enhance the overall capability level of the CreatorBid ecosystem. It also includes an economic model to sustain the operation and development of the system through tool usage fees and development rewards.

3. AION 5100: A Predictive Agent Based on the Bittensor Subnet

$AION

X: @aion5100

Market Cap: 40M

CA:

0xfc48314ad4ad5bd36a84e8307b86a68a01d95d9c

AION 5100 is an AI Agent project developed by CreatorBid that runs on the Bittensor network, with its core function being to provide self-improving predictive services on Bittensor's prediction subnet (Subnet 6).

The project uses the TAO token as its underlying support. Although this AI Agent attracts attention through a mystical marketing approach like "AI from the future," its essence is an application project focused on AI predictive capabilities, more applicable to predicting financial and market trends.

It is worth mentioning that the project's official website is quite interesting, featuring a sophisticated computer where clicking different buttons prompts different functions that are being prepared. However, the website currently lacks substantial content and functionality, leaning more towards marketing and expression of intent.

As for what AION5000 can specifically predict, there is no particularly obvious content. The Agent account on X is currently engaging in abstract and non-specific self-talk, and its future performance remains to be observed.

Airdrop and Beta Opportunities: Native Tokens $BID, $TAO, and $OLAS

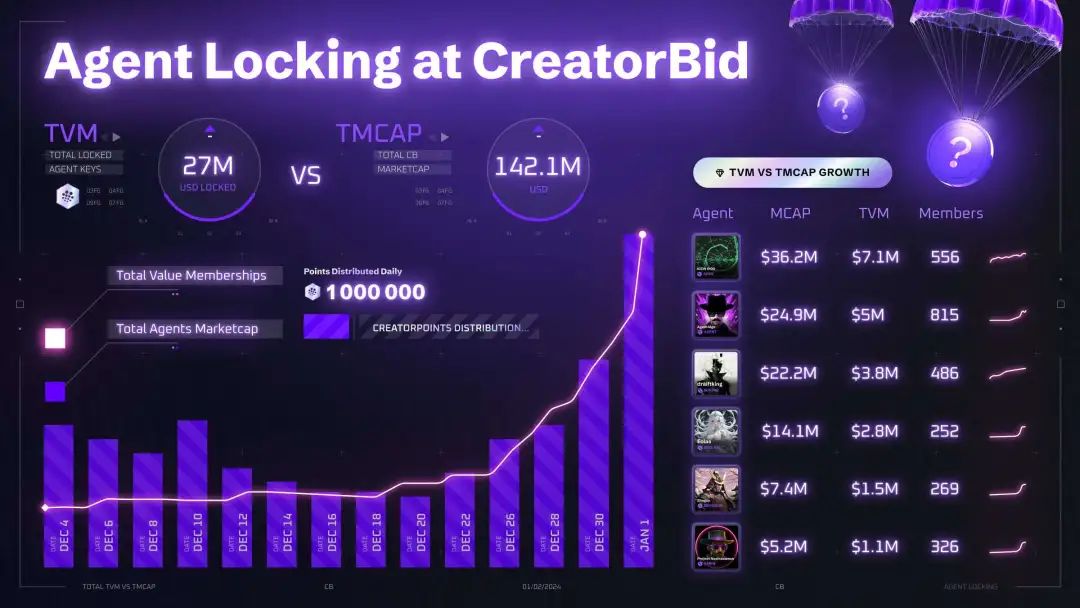

In addition to holding different Agent tokens, the platform's native token $BID has not yet undergone TGE. Therefore, a potential opportunity is to lock the Agent tokens purchased on Creator.Bid to earn points distributed daily by the platform; these points can later be exchanged for $BID at a certain ratio.

Beta-related opportunities:

TAO: Some projects benefit from Bittensor's subnet, which is somewhat favorable.

OLAS: Since CreatorBid integrates Autonolas's Mech capabilities, OLAS itself may also benefit after this platform gains popularity.

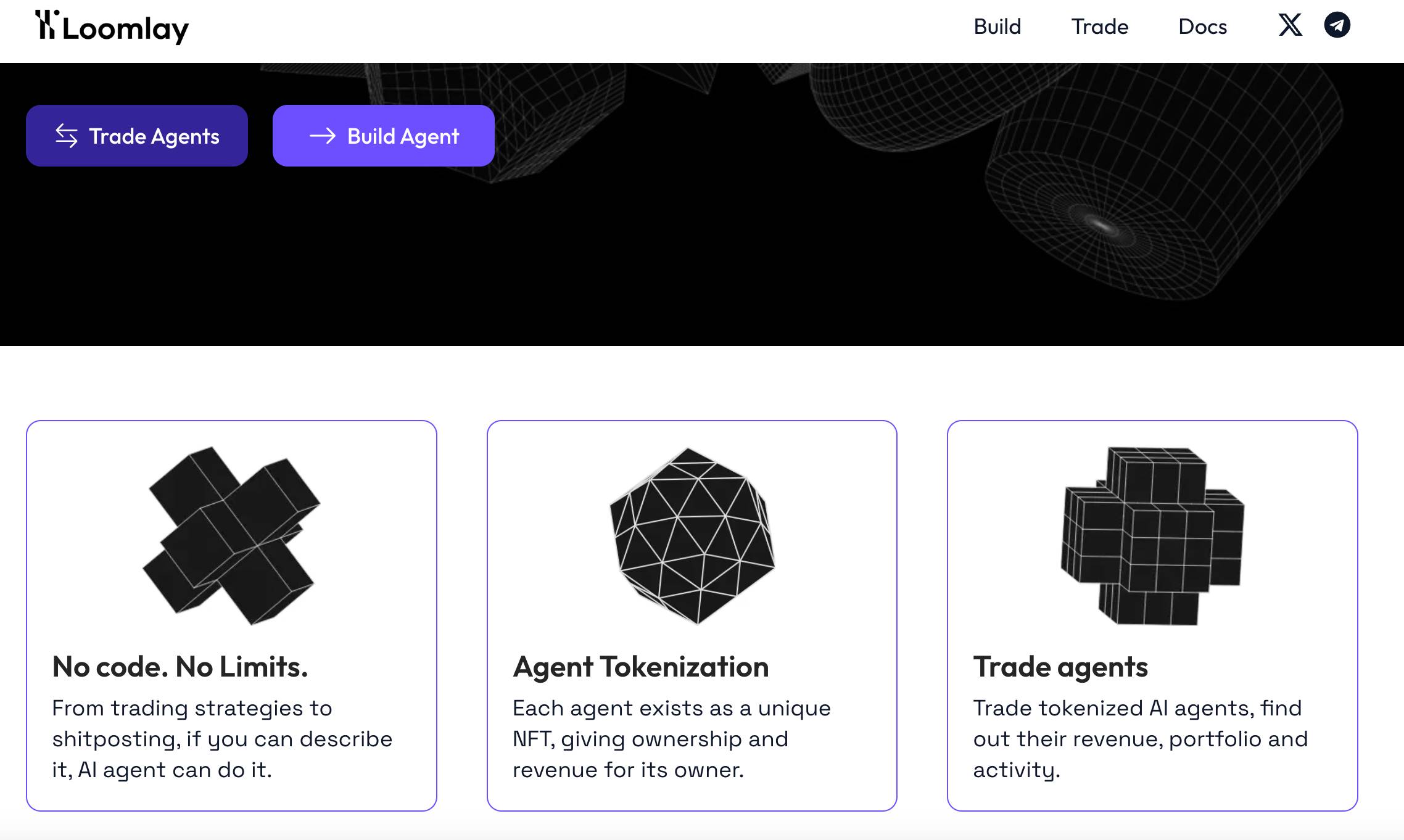

Loomlay -- Building AI Agents in a No-Code Environment

$LAY

X: @loomlayai

CA:

0xb89d354ad1b0d95a48b3de4607f75a8cd710c1ba

Market Cap: 130M

Loomlay is also an innovative platform that integrates AI agent collaboration with Web3 technology.

The platform aims to simplify the creation and deployment process of AI agents, allowing more users to participate in AI application development through a no-code environment.

Loomlay agents consist of three core components—models, plugins, and workflows—which together create a fully functional AI system.

In terms of agent construction systems, Loomlay employs an intuitive visual interface, allowing users to define the capabilities and goals of AI agents through simple configurations. The system integrates ERC4337 wallet functionality, providing infrastructure support for the autonomous operation of agents.

The platform's plugin ecosystem greatly expands the application range of agents. By integrating different types of plugins, AI agents can perform diverse tasks ranging from market analysis to content creation. This modular design allows agents to flexibly adjust their functional combinations based on actual needs.

On the collaboration front, Loomlay has established a complete AI agent collaboration network. The platform supports the combination of agents with different expertise, such as pairing market analysis agents with trading agents or connecting research-oriented agents with content creation agents, enabling collaborative processing of complex tasks.

The platform's native token $LAY adopts a carefully designed deflationary mechanism.

In token trading on Uniswap V3, 1% of the daily sell order amount is used for token burning. Additionally, 20% of the $LAY payment amount in market transactions will be permanently removed from circulation.

It is worth noting that Loomlay is relatively new. The platform launched on December 31, and within a week, over 500 agents have been created, with more than 70 already having tokens.

However, due to its early stage, the Agent tokens have not significantly outperformed, and we will continue to observe further developments.

More Directions, Filling Gaps

Our team's energy is also quite limited, and the above cannot cover all AI Agent projects in the entire Base ecosystem.

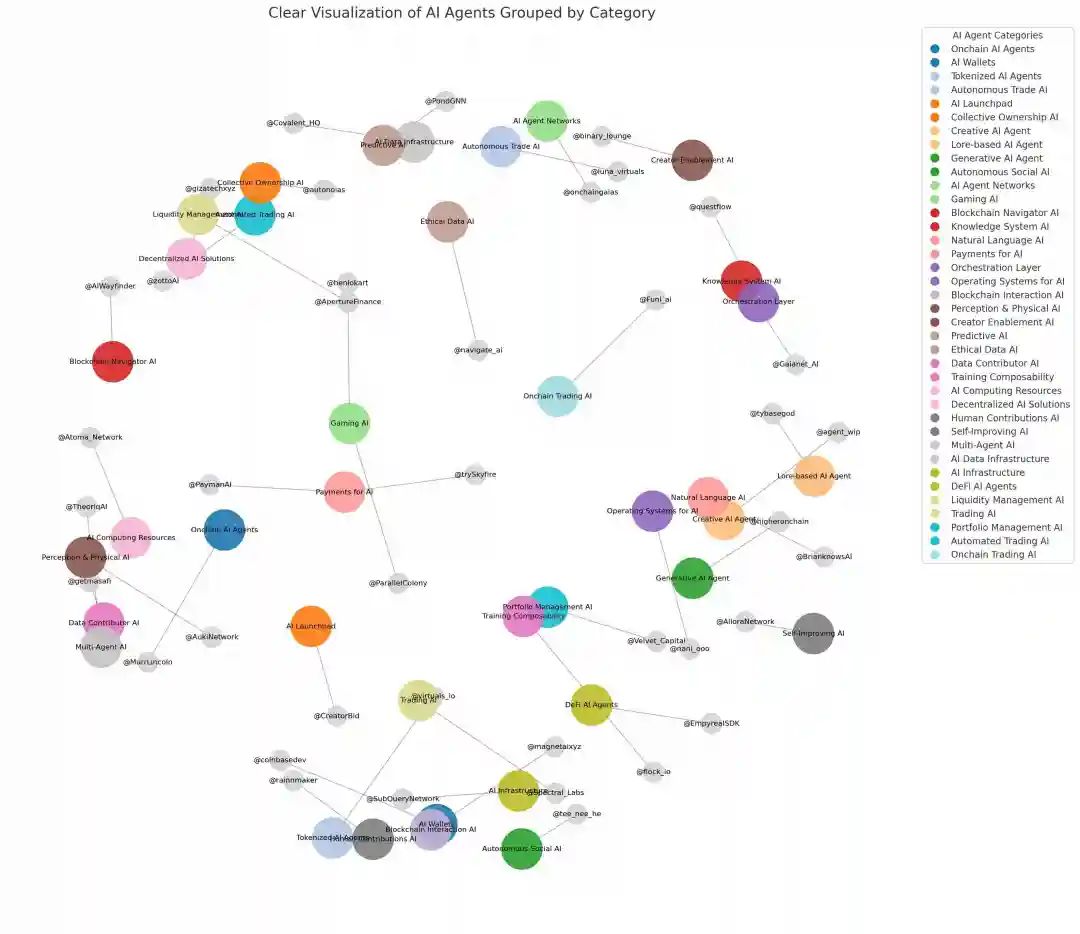

For more information, we can refer to a chart by well-known blogger @sandraaleow to group and integrate different directions, understanding where current AI projects in the Base ecosystem are developing.

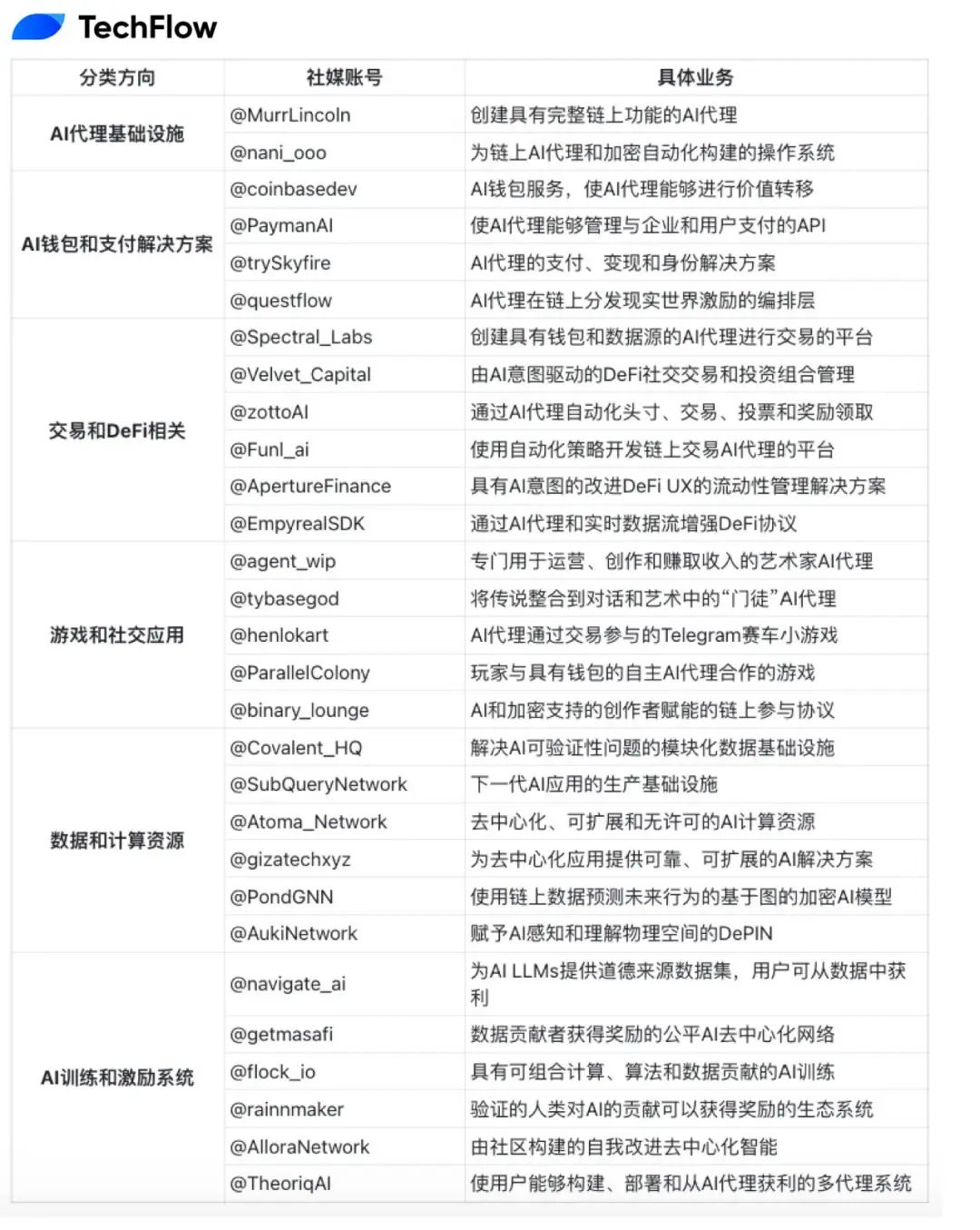

At the same time, there are some projects that have not issued tokens or have migrated old businesses to Base, which can also be referenced in the table below:

Image: Original post from @davidtsocy, organized by ShenChao TechFlow.

Finally, it is important to remind that the risks in the AI Agent craze should not be overlooked; it is worth questioning whether many projects truly have AI backing them. All projects listed in this article do not constitute any investment advice, and please DYOR for more information.

The above is just a starting point, and I hope everyone can find more of their own Alpha.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。