Recently, the homework pressure during the holidays has been quite heavy, especially when the BTC price is declining. The market sentiment is visibly poor, and many pessimistic comments about the future have appeared in the comment section. Although the price is similar to what it was during Christmas, the bearish sentiment is clearly much stronger than it was then. I can understand; this is just a torment. But if we look back to three months ago today.

It was exactly October 10, 2024. On that day, the sentiment was also terrible. The price of #BTC even fell below $59,000, and the sentiment in the comments was much worse than now, with everyone predicting a drop to the $40,000 range. Some even thought it could drop to the $20,000 range. But in reality, just a month later, it broke above $80,000, and a little over a month later, the price doubled. Who could have imagined that at the time?

Even though I firmly believe that the election will help with sentiment and prices, I didn't expect it to reach $100,000 so quickly. I even lost a jar of wine to my neighbor over it, but his Moutai is vintage, so I’m not too upset about losing.

Compared to October 10 back then, the current price has risen by 57%. In this situation, if someone insists on telling me that the bull market is over and the bear market has arrived, I find it a bit hard to accept. If we really have returned to a bear market, at least it should drop back to $59,000. Especially after eight months of fluctuations around $65,000, and now it’s only been two months. Back then, I was holding on because of the U.S. election, and now I’m holding on because of the power transition.

I may not be right, just like I always say, you don’t have to believe me. Today, jokingly, I said that American analysts love to carve the boat to seek the sword. My obsession with the election and power transition is just another form of carving the boat to seek the sword. The boat still needs to be carved, after all, it has never capsized. It’s actually quite interesting; I suddenly want to laugh. I wonder what the friends in 2028 will say before the next halving?

I believe the halving cycle will definitely have a positive effect on #Bitcoin. If you look back at history, you’ll know that during the 2024 halving, the price fell terribly, but just six months later, it soared directly, breaking through $100,000. So I firmly believe that halving is not wrong; at least history has never been wrong.

I hope this tweet can be saved until that time, and then I can bring it up again. How interesting that would be.

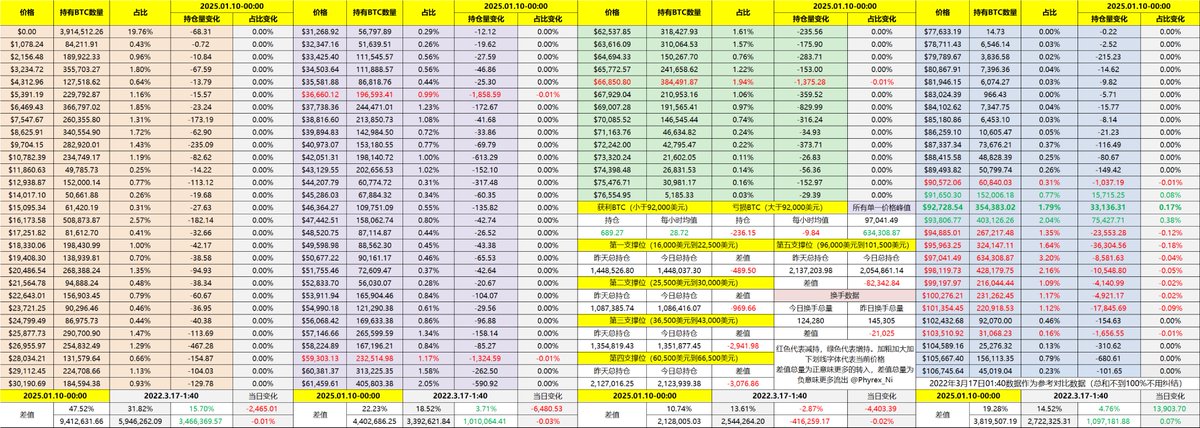

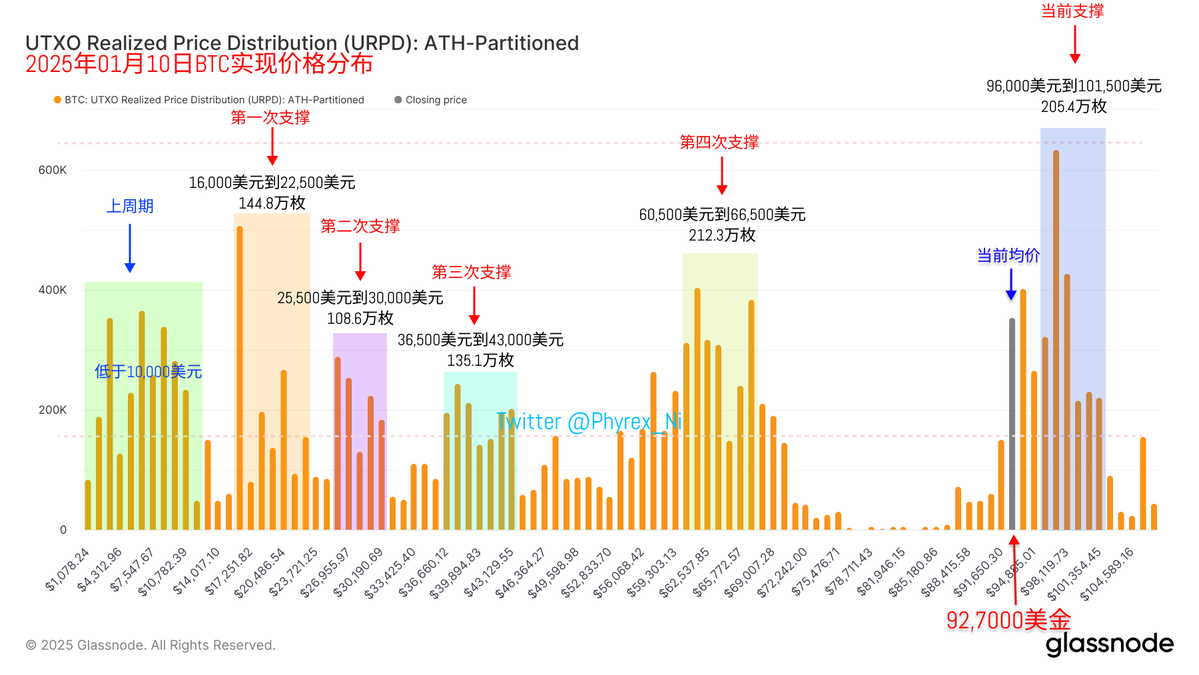

Today's data is still of limited help, after all, it’s a holiday. Even if there is some panic, it’s due to a lack of liquidity. However, there has indeed been some panic or risk-averse selling, which is normal, especially since the non-farm payroll data is coming out tomorrow. Just one job vacancy data caused #BTC to drop by 10%, so it’s normal to be a bit fearful before the bigger non-farm data.

I don’t know how tomorrow’s non-farm data will be, but I don’t think it’s anything significant. It won’t affect the overall trend because the current trends are twofold: one is the transition from monetary tightening to monetary easing, which is already in progress, just a matter of timing; the other is the power transition of the U.S. president. Unless there is an economic recession, I believe the power transition is a positive factor. If Trump says a few words in support of cryptocurrency during the transition, it will probably go up.

Looking back, what were we worried about every month in 2022 and 2023 regarding the Federal Reserve's interest rate meetings? What does that matter? The $16,000 in 2022 didn’t make me give up my holdings, and the $39,000 in 2023 didn’t make me give up my holdings either. In 2024, facing countless FUD, I can still hold onto my assets. If I’m wrong, I’ll pay for my own understanding.

Support will be revised next week; the chances of revision are quite high.

Data has been updated, address: https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。