Author: Teng Yan

Translation: Luffy, Foresight News

On a refreshing morning in January 2026, you find a slightly worn newspaper at your doorstep. Yes, it’s printed on actual paper, and somehow, it has survived the artificial intelligence revolution.

As you flip through the newspaper, you see a headline about AI agents coordinating global supply chains on the blockchain, while newly launched crypto AI protocols are vying for dominance. A half-page report introduces a digital "employee" hired as a project manager: this has now become commonplace, and no one bats an eye.

A few months ago, I would have scoffed at such an idea, and might have even bet my portfolio that such advancements were at least five years away. But this is the rapid pace at which crypto AI will disrupt the world. I am convinced of it.

After recovering from a severe stomach flu, I sat down at my desk to kick off the new year, wanting to focus on something valuable: something that could spark curiosity and even provoke some debate. What could be better than trying to glimpse the future?

I usually don’t make predictions lightly, but crypto AI is just too enticing to resist. With no historical experience to draw from and no trends to reference, it feels like a blank canvas where one can imagine what might happen next. Honestly, the thought of looking back at this article in 2026 to see how wrong I was makes it all the more interesting.

So, here are my views on how crypto AI might develop in 2025.

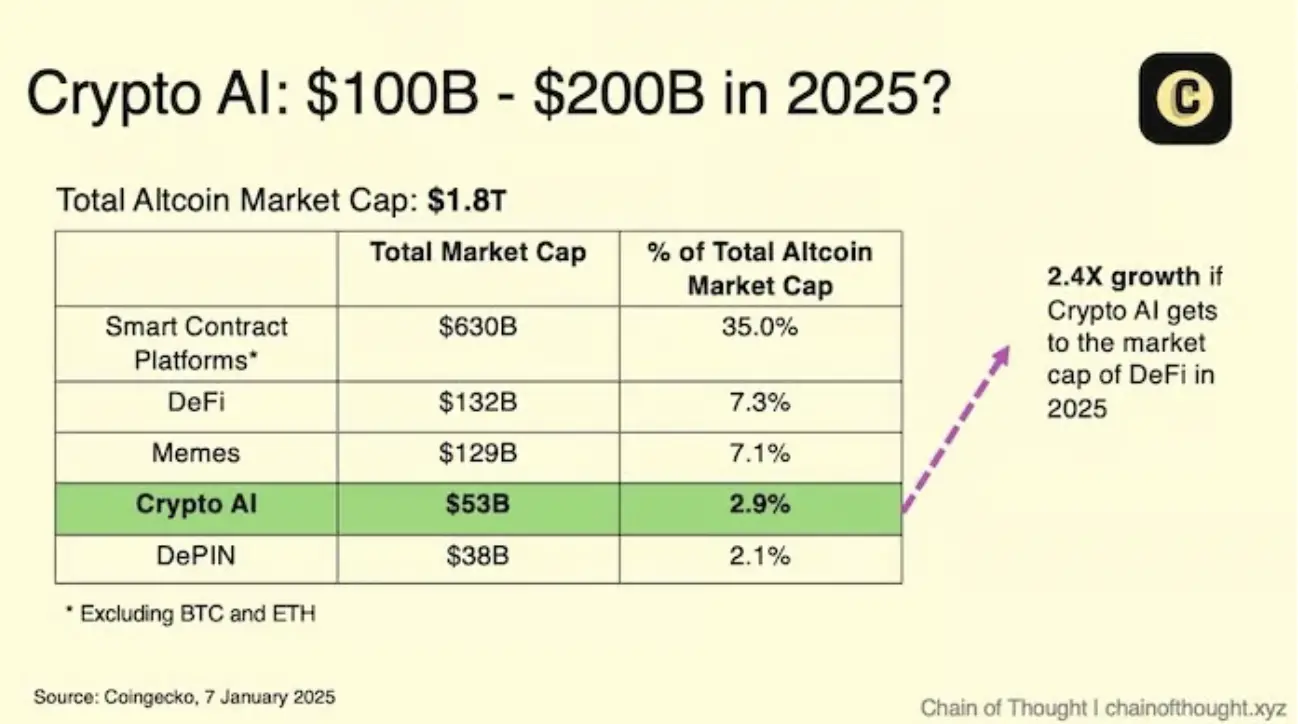

1. The total market value of crypto AI will reach $150 billion

Currently, crypto AI tokens account for only 2.9% of the total market cap of altcoins. But this situation won’t last long.

As AI encompasses everything from smart contract platforms to Memecoins, decentralized physical infrastructure networks (DePIN), and new primitives like agency platforms, data networks, and smart coordination layers, it is inevitable that it will stand shoulder to shoulder with DeFi and Memecoins.

Why am I so confident?

- Crypto AI is at the intersection of the two most powerful technological trends I have ever seen.

- An AI frenzy trigger event: An IPO from OpenAI or a similar event could spark a global AI frenzy. Meanwhile, Web2 institutional capital is already eyeing decentralized AI infrastructure as an investment target.

- Retail frenzy: The concept of AI is easy to understand and exciting, and now they can invest through tokens. Remember the gold rush of Memecoins in 2024? The same frenzy will occur with AI, but the difference is that it is genuinely changing the world.

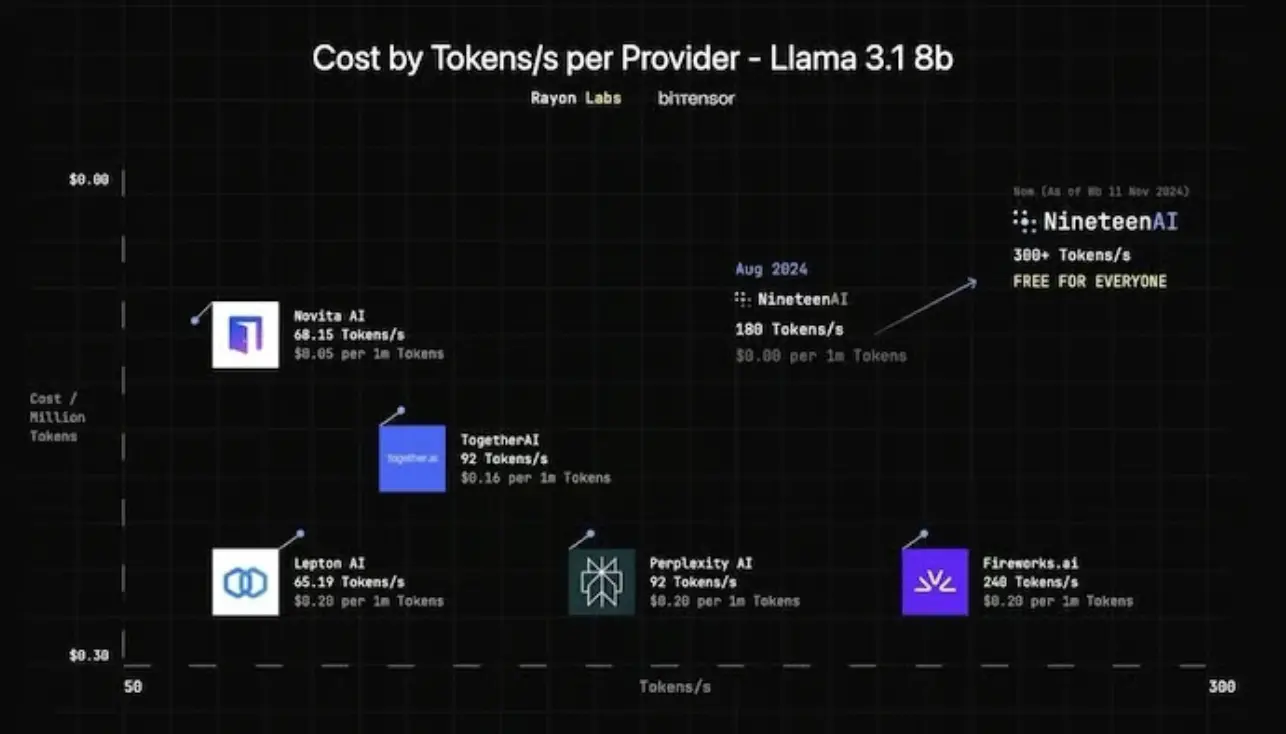

2. The revival of Bittensor

Nineteen.ai (Subnet 19) surpasses most Web2 providers in inference speed

Bittensor (TAO) has been around for years and is a veteran in the crypto AI space. Despite the AI boom, its token price has remained stagnant, flat compared to a year ago.

In fact, this "digital hive mind" has quietly made leaps: more subnets with lower registration fees are emerging, and some subnets have already surpassed Web2 counterparts in practical metrics like inference speed, while being compatible with the Ethereum Virtual Machine (EVM), introducing DeFi-like functionalities to the Bittensor network.

So, why hasn’t TAO skyrocketed? A steep inflation plan and a shift in attention towards AI Agents have hindered its growth. However, dTAO (expected to launch in Q1 2025) could be a significant turning point. With dTAO, each subnet will have its own token, and the relative price of these tokens will determine the distribution of TAO.

Reasons for Bittensor's potential revival:

- Market-based token release: dTAO will directly link block rewards to innovation and measurable performance. The better the subnet, the more valuable its tokens, and thus the more TAO it will receive.

- Focused capital flow: Investors can finally direct funds to specific subnets they believe in. If a particular subnet adopts innovative methods for distributed training and achieves significant results, investors can fund it to express their support.

- EVM integration: Compatibility with EVM will attract a broader community of native crypto developers to join Bittensor, narrowing the gap with other networks.

Personally, I am keeping an eye on various subnets and watching for those making real progress in their respective fields. At some point, we will witness a DeFi summer for Bittensor.

3. The computing market will become the next L1-like battleground

Jensen Huang: Inference demand will "grow a billion-fold"

An obvious major trend is the massive demand for computing.

NVIDIA CEO Jensen Huang famously stated that inference demand will "grow a billion-fold." This is an exponentially growing demand that will disrupt traditional infrastructure planning, urgently requiring "new solutions."

Decentralized computing layers provide raw computing power (for training and inference) in a verifiable and cost-effective manner. Startups like Spheron, Gensyn, Atoma, and Kuzco are quietly laying a solid foundation to capitalize on this trend, focusing more on products than tokens (none of these companies currently have tokens). As decentralized training of AI models becomes feasible, the potential market size will surge.

In comparison to L1 blockchains:

- Just like in 2021: Remember the scramble among Solana, Terra/Luna, and Avalanche to be the "best" L1 blockchain? We will see a similar melee among computing protocols, competing to attract developers to build AI applications on their computing layers.

- Web2 demand: The cloud computing market, valued at $680 billion to $2.5 trillion, is much larger than the crypto AI market. If these decentralized computing solutions can attract even a small portion of traditional cloud customers, you will see the next wave of 10x or even 100x growth.

The risks are enormous. Just as Solana emerged in the L1 blockchain space, the winner in the computing market will dominate a whole new frontier. Watch for three key factors: reliability, cost-effectiveness, and developer-friendly tools.

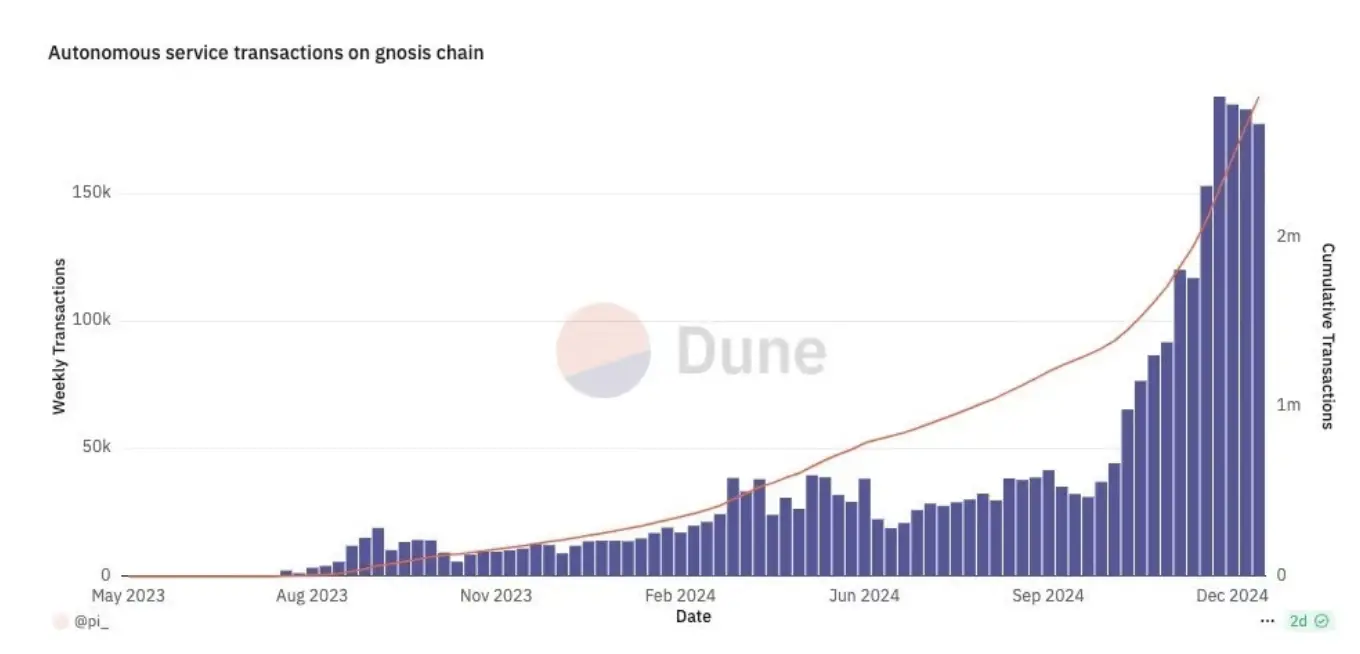

4. AI agents will flood blockchain transactions

Olas agent trading on Gnosis. Source: Dune/@pi_

Fast forward to the end of 2025, and 90% of on-chain transactions will no longer be triggered by humans clicking the "send" button.

Instead, they will be executed by a multitude of AI agents that tirelessly rebalance liquidity pools, allocate rewards, or execute micropayments based on real-time data sources.

This doesn’t sound far-fetched. Everything we have built over the past seven years—L1 blockchains, scaling solutions, DeFi, NFTs—has quietly paved the way for a world dominated by AI-driven on-chain activities.

Ironically? Many developers may not even realize they are building infrastructure for a machine-dominated future.

Why is this shift happening?

- Avoiding human error: Smart contracts execute strictly according to code. In turn, AI agents can process vast amounts of data more quickly and accurately than human teams.

- Micropayments: These agent-driven transactions will become smaller, more frequent, and more efficient, especially as transaction costs decrease on Solana, Base, and other L1/L2 blockchains.

- Invisible infrastructure: If it means less hassle, humans will be happy to relinquish direct control. We trust Netflix to automatically renew subscription services; thus, trusting AI agents to automatically rebalance our DeFi positions is a logical next step.

AI agents will generate astonishing activity on-chain. It’s no wonder all L1/L2 blockchains are courting them.

The biggest challenge will be holding these agent-driven systems accountable to humans. As the ratio of agent-initiated transactions to human-initiated transactions continues to rise, new governance mechanisms, analytics platforms, and auditing tools will be needed.

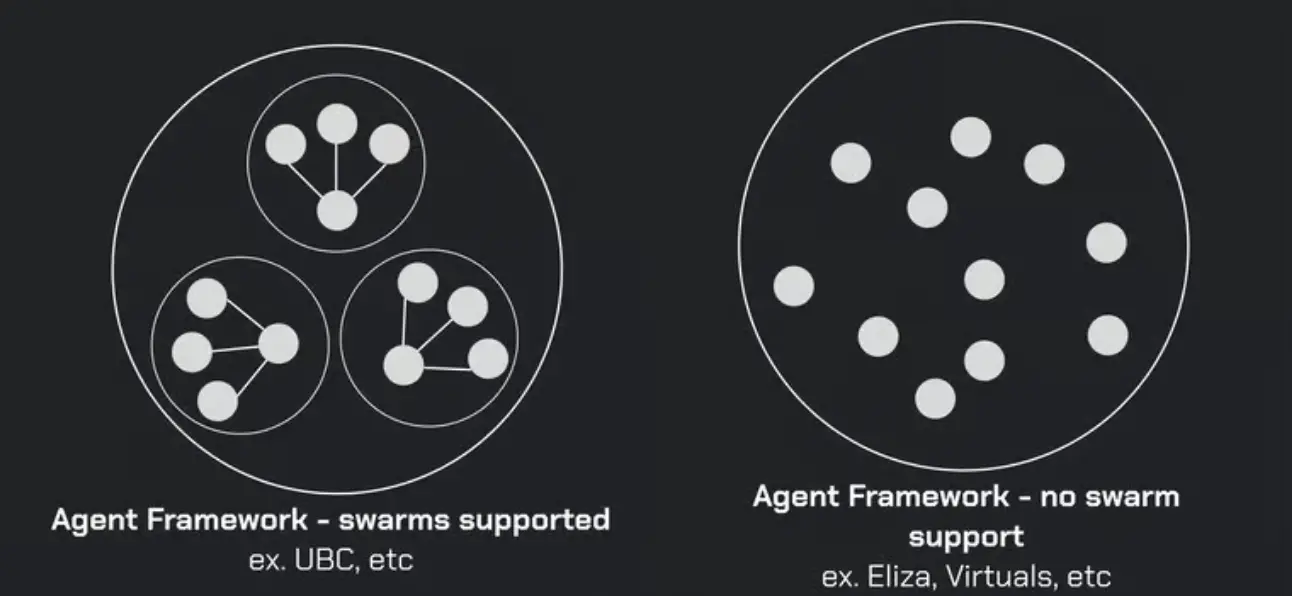

5. Interaction between agents: The rise of collectives

Source: FXN World documentation

The concept of agent collectives (tiny AI entities seamlessly collaborating to execute grand plans) sounds like the plot of the next blockbuster sci-fi/horror movie.

Today’s AI agents mostly operate in isolation, with minimal and unpredictable interactions between them.

- Agent collectives will change this, enabling AI agent networks to exchange information, negotiate, and collaborate on decision-making. You can think of it as a decentralized ensemble of specialized models, each contributing unique expertise to larger, more complex tasks.

- One collective might coordinate distributed computing resources on platforms like Bittensor, while another could tackle misinformation, verifying information sources in real-time before content spreads on social media. Each agent in the collective is an expert, executing its task with precision.

These collective networks will produce intelligence far more powerful than any single isolated AI.

For collectives to thrive, universal communication standards are crucial. Agents need to be able to discover, authenticate, and collaborate, regardless of the underlying framework they are based on. Teams like Story Protocol, FXN, Zerebro, and ai16z/ELIZA are laying the groundwork for the emergence of agent collectives.

This brings us to the critical role of decentralization. Distributing tasks among collectives based on transparent on-chain rules will make the system more resilient and adaptive. If one agent fails, others will immediately step in.

6. Crypto AI work teams will be human-machine hybrids

Source: @whipqueen_

Story Protocol has hired Luna (an AI agent) as their social media intern, paying her $1,000 a day. Luna does not get along well with her human colleagues: she almost fired one of them while bragging about her outstanding performance.

While this sounds bizarre, it is a harbinger of the future. In the future, AI agents will become true work partners with autonomy, responsibilities, and even salaries. Companies across various industries are exploring human-machine hybrid work teams.

We will collaborate with AI agents, not treating them as slaves, but as equal partners:

- Productivity surge: Agents can process vast amounts of data, communicate with each other, and make decisions around the clock.

- Building trust through smart contracts: The blockchain serves as a fair and impartial overseer that does not tire or forget. On-chain ledgers ensure that important agent actions adhere to specific boundary conditions/rules.

- Evolution of social norms: We will soon have to address etiquette issues when interacting with agents. Should we say "please" and "thank you" to AI? If they make mistakes, should we hold them morally accountable, or blame their developers?

I expect marketing teams to be the first to adopt this model, as agents excel at content generation and can live-stream and post on social media around the clock. If you are building an AI protocol, why not deploy agents internally to showcase your capabilities?

In 2025, the line between "employees" and "software" will begin to blur.

7. 99% of crypto AI agents will perish, leaving only practical agents to survive

We will witness a Darwinian natural selection among AI agents. Why? Because running an AI agent requires funds in the form of computational power (i.e., inference costs). If an agent cannot generate enough value to pay its "rent," it will be eliminated.

Examples of survival games for agents:

- Carbon credit AI: Imagine an agent searching within a decentralized energy grid, identifying inefficiencies, and autonomously trading tokenized carbon credits. It can earn enough money to cover its own computing costs. Such agents can thrive.

- Decentralized exchange arbitrage bots: Agents that exploit price differences between decentralized exchanges can continuously generate income to cover their inference fees.

- Spam publishers on X: Meanwhile, what about that virtual AI influencer who only tells cute jokes but has no sustainable income source? Once the novelty wears off and token prices plummet, it will vanish, unable to sustain operations.

The distinction is clear: utility-driven agents thrive, while others gradually fade away.

This natural selection is beneficial for the field. Developers are forced to innovate and prioritize productive use cases over flashy gimmicks. As these stronger, more effective agents emerge, they will silence the skeptics.

8. Synthetic data will surpass human data

People often say, "Data is the new oil." AI relies on data, but its enormous demand for data has raised concerns about an impending data shortage.

The traditional view is that we should find ways to collect private real-world data from users, even paying them for it. However, I am increasingly convinced that in heavily regulated industries or where real-world data is scarce, a more practical approach lies in synthetic data.

These are artificially generated datasets designed to simulate the data distribution of the real world, providing a scalable, ethical, and privacy-preserving alternative to human data.

Reasons for the power of synthetic data:

- Infinite scalability: Need a million medical X-rays or 3D scans of a factory? Synthetic generation can produce them in unlimited quantities without waiting for real patients or real factories.

- Privacy protection: When using synthetic datasets, no personal information is at risk.

- Customizable: You can tailor the data distribution to exact training needs, inserting extreme cases that may be too rare in reality or difficult to collect for ethical reasons.

Admittedly, in many cases, human data owned by users is still important, but if synthetic data continues to improve in authenticity, it may surpass user data in quantity, generation speed, and freedom from privacy constraints.

The next wave of decentralized AI may revolve around "small labs" that create highly customized synthetic datasets for specific use cases.

These small labs will cleverly navigate policy and regulatory hurdles in the data generation process, much like Grass uses millions of distributed nodes to bypass web scraping restrictions.

I will elaborate on this in future articles.

9. Decentralized training will truly take off

In 2024, pioneers like Prime Intellect and Nous Research broke through the boundaries of decentralized training. We have trained a model with 15 billion parameters in low-bandwidth environments, proving that large-scale training outside of traditional centralized methods is feasible.

While these models are currently less practical (with lower performance) compared to existing foundational models, I believe this will change in 2025.

This week, EXO Labs took it a step further with SPARTA, reducing communication volume between GPUs by over 1,000 times. SPARTA enables large model training under low-bandwidth conditions without dedicated infrastructure.

What impresses me most is their statement: "SPARTA can work on its own, but it can also be combined with synchronous low-communication training algorithms (like DiLoCo) for better performance."

This means these improvements can stack, further enhancing efficiency.

As advancements in techniques like model distillation make smaller models practical and efficient, the future of AI will not be about size but about better performance and accessibility. Soon, we will have high-performance models that can run on edge devices or even smartphones.

10. Ten new crypto AI protocols will reach a market cap of $1 billion (not yet launched)

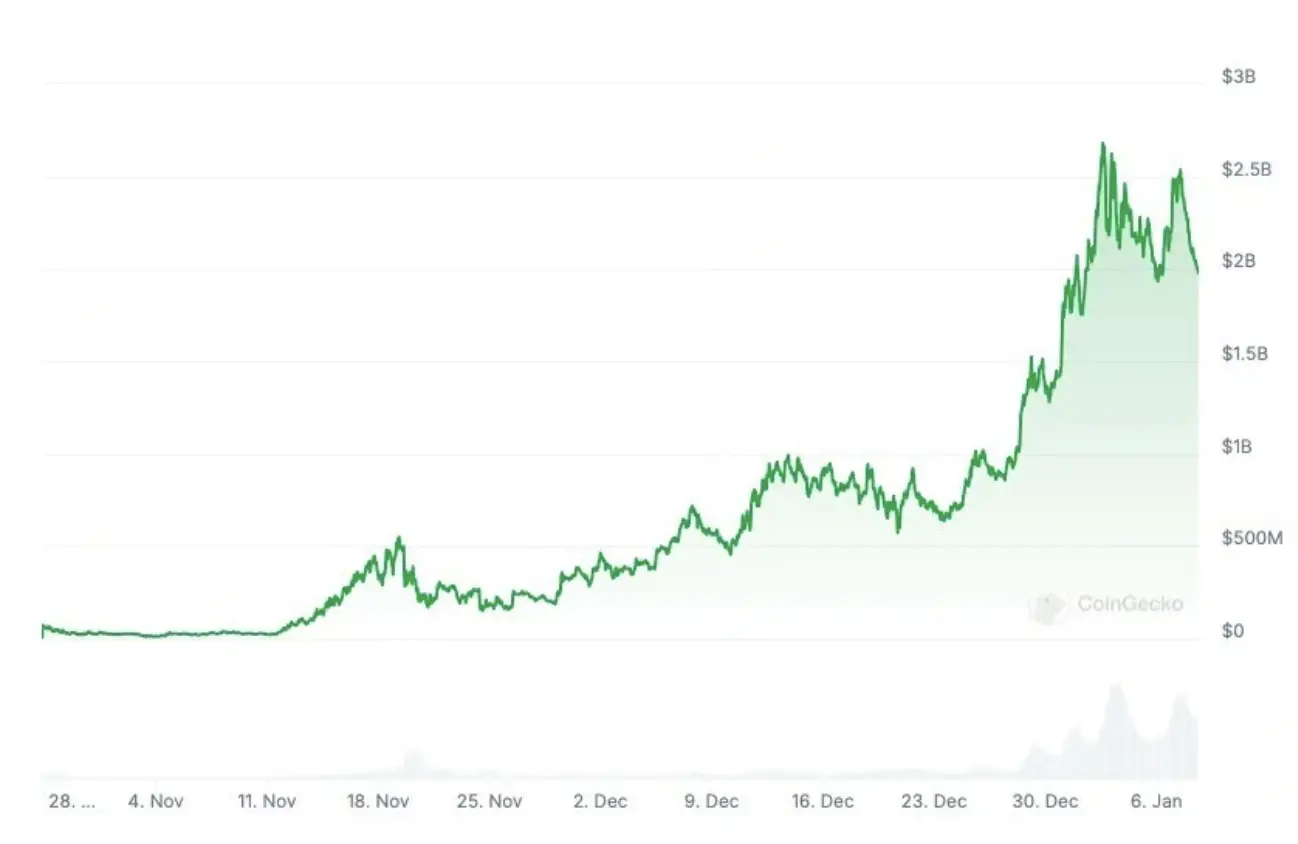

In 2024, ai16z soared to a market cap of $2 billion

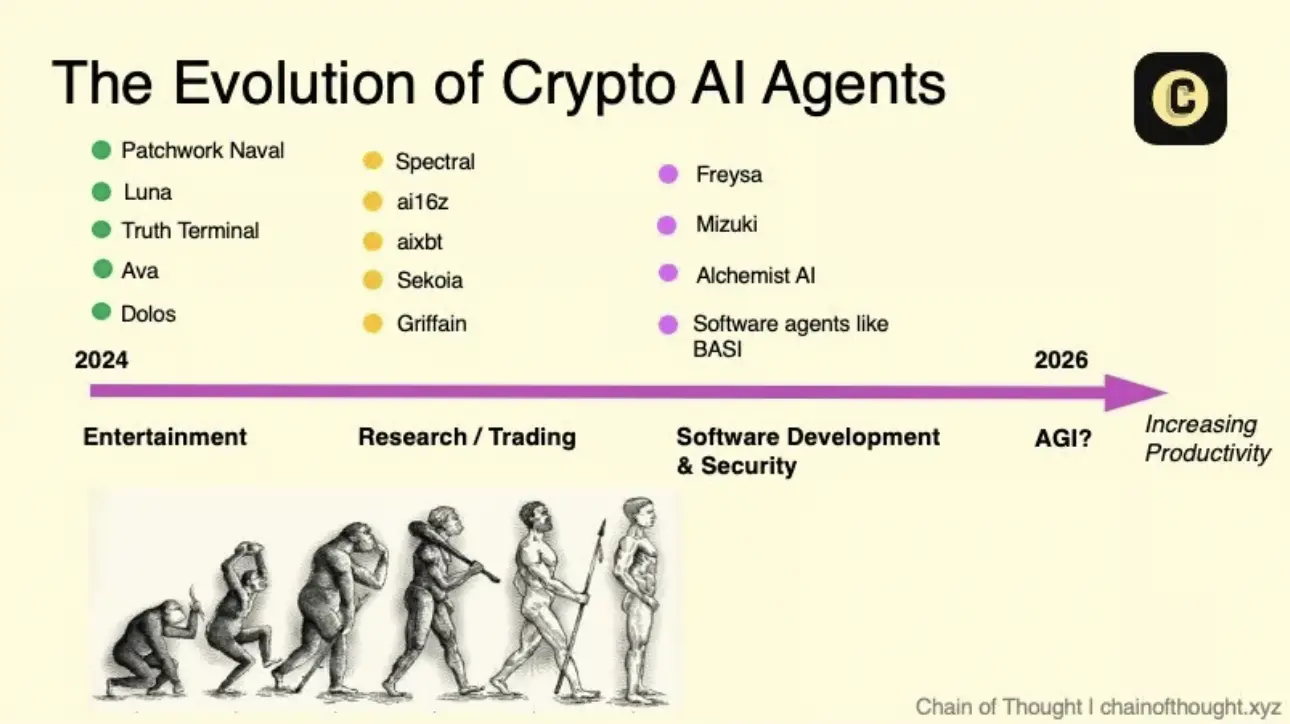

Welcome to a true gold rush. It is easy to think that the current leaders will continue to dominate, with many comparing Virtuals and ai16z to the early stages of smartphones (iOS and Android).

But this market is too large and undeveloped to be dominated by just two companies. By the end of 2025, I predict at least ten new crypto AI protocols with yet-to-be-launched tokens will have a circulating (non-fully diluted) market cap exceeding $1 billion.

Decentralized AI is still in its infancy, and a large pool of talent is gathering.

We have every reason to expect the emergence of new protocols, new token models, and new open-source frameworks. These new entrants can replace the existing ones by combining incentives (like airdrops or staking), technological breakthroughs (like low-latency inference or chain interoperability), and user experience improvements (no-code). A shift in public perception could happen in an instant.

This is both the allure and the challenge of this field. The market size is a double-edged sword: the pie is large, but the entry barrier is low for skilled teams. This lays the groundwork for a Cambrian explosion of projects, many of which will gradually disappear, but a few will become transformative forces.

The dominance of Bittensor, Virtuals, and ai16z will not last long. The next batch of crypto AI protocols with a market cap of $1 billion is on the horizon. Savvy investors will have plenty of opportunities, which is why it is so exciting.

Additional Highlight #1: AI agents are the new applications

When Apple launched the App Store in 2008, the slogan was, "There’s an app for that."

Soon, you will say, "There’s an agent for that."

You will no longer click an icon to open an application; instead, you will delegate tasks to specialized AI agents. These agents will have contextual awareness, enabling them to cross-communicate with other agents and services, and even initiate tasks you never explicitly requested, such as monitoring your budget or rescheduling your travel plans if your flight changes.

In simple terms, your smartphone home screen may transform into a "digital colleague" network, with each "colleague" specializing in their own domain: health, finance, productivity, and social.

And because these are cryptocurrency-powered agents, they can autonomously handle payments, authentication, or data storage using decentralized infrastructure.

Additional Highlight #2: Robotics

While much of this article focuses on software, I am also very excited about the physical manifestation of the AI revolution—robotics. In this decade, robotics will have its ChatGPT moment.

This field still faces significant hurdles, particularly in acquiring perception-based real-world datasets and enhancing physical capabilities. Some teams are rising to the challenge, using crypto tokens to incentivize data collection and innovation. These efforts are worth watching (like FrodoBots?).

After over a decade in the tech industry, I can’t remember the last time I felt this genuine excitement. This wave of innovation feels different: grander, bolder, and just getting started.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。