Author: Frank, PANews

With fame comes controversy. As the most highly regarded new Layer 1 public chain in the current market, Hyperliquid's token market capitalization surpassed $11 billion after its airdrop, with the fully diluted market cap once approaching $35 billion, and ecological data experiencing exponential growth. While the market is extremely optimistic, it has also sparked considerable controversy recently.

These controversies mainly revolve around Hyperliquid's performance as a Layer 1 in decentralized governance and attracting more developers, which has been less than satisfactory. Particularly in terms of node participation, there seems to be a pervasive sense of closure, which again confirms many skeptics' impressions of Hyperliquid as a single-machine chain. The official response has essentially acknowledged these issues within the network, stating that they will be gradually resolved.

An Open Letter Sparks Governance Controversy

On January 8, Kam, an employee from the node operator Chorus One, published an open letter on social media, pointing out numerous issues with Hyperliquid, including closed-source code, a black market for testnet tokens, and restricted decentralization. This statement quickly ignited extensive discussions within the community regarding Hyperliquid's governance.

In the open letter, Kam mentioned that operating testnet nodes is challenging due to issues such as closed-source code, lack of documentation, and excessive reliance on centralized APIs. The incentive mechanism for the testnet has design flaws, leading to black market trading of test tokens. Additionally, there is excessive concentration among mainnet validators, indicating insufficient decentralization.

From the content of this open letter, the criticism is directed at Hyperliquid's low level of decentralization in governance, with the official team and foundation holding absolute control over nodes and staking. Secondly, there is a lack of transparency in technical and operational information, which poses a significant problem for expanding the ecosystem. Thirdly, the economic incentive mechanism is inadequate, making it difficult for external nodes to cover costs. Fourthly, communication between the official team and nodes is poor, preventing timely guidance for node operations and lacking channels for feedback on issues.

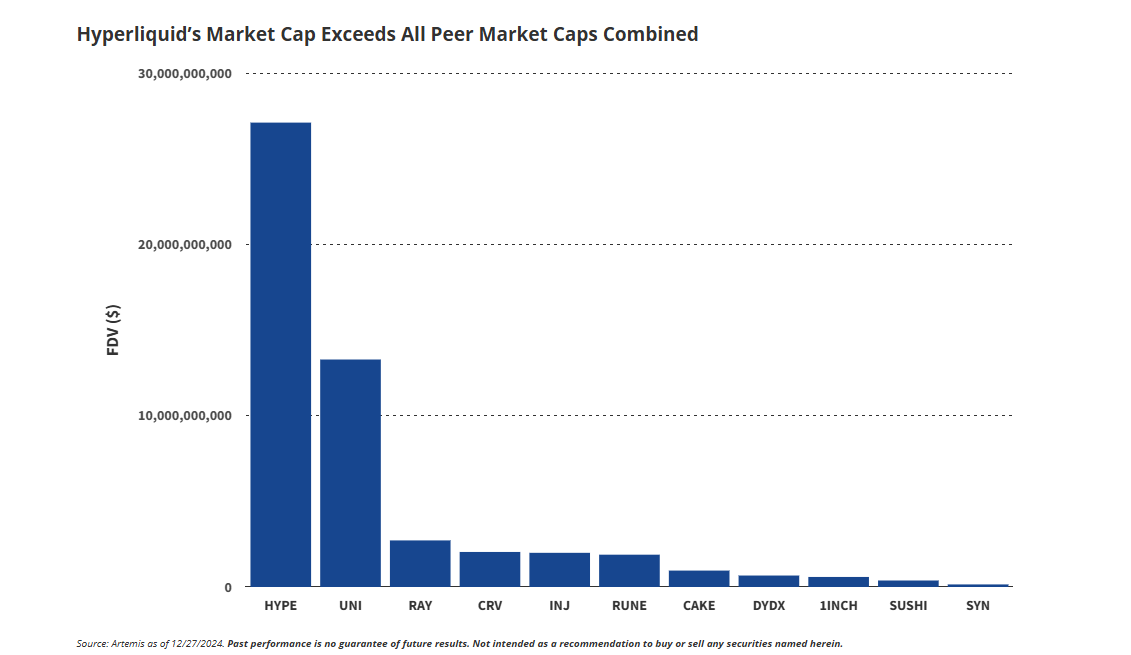

These points largely reflect the main criticisms of Hyperliquid within the industry. A report released by the well-known asset management firm VanEck in December also pointed out that Hyperliquid's valuation was around $28 billion, yet it had not attracted a large developer community. If the expected growth of the developer community cannot be achieved, the price of the HYPE token may struggle to be maintained. Research firm Messari also stated on New Year's Day that Hyperliquid's outstanding performance may have already ended.

Following Kam's open letter, several industry figures joined the discussion about Hyperliquid. Charles d'Haussy, CEO of competitor dYdX Foundation, commented, "Closed-source code + limited number of validators + most of the stake weight under one entity + lack of clarity and security in multi-signature bridging. The token price trend should not be overlooked by so many people."

Others argued, "I don't think the black market for testnet speculation is a big issue, as we've seen this in many other protocols."

Official Acknowledgment of Issues, Long Road Ahead for Governance

However, most opinions still express skepticism about the phenomenon of excessive centralization. In response to these doubts, Hyperliquid quickly issued a response that focused on the following six points: 1. All validators are qualified based on their performance on the testnet and cannot obtain seats through purchase; as the blockchain matures, the validator pool will gradually expand. 2. Further efforts will be made to promote the decentralization of the network. 3. Anyone can run an API server pointing to any node; example client code sends requests to specific API servers, but this is not a fundamental requirement of the network. 4. The black market for testnet HYPE is unacceptable, and efforts will continue to improve the onboarding process for the testnet. 5. The node code is currently closed-source; open-sourcing is important, and the project will be open-sourced once it reaches a stable development state; Hyperliquid's development speed is several orders of magnitude faster than most projects, and its scope is also several orders of magnitude larger; the code will be open-sourced when it is safe to do so. 6. Currently, there is only one binary file. Even for a very mature network like Solana, the vast majority of validators run a single client.

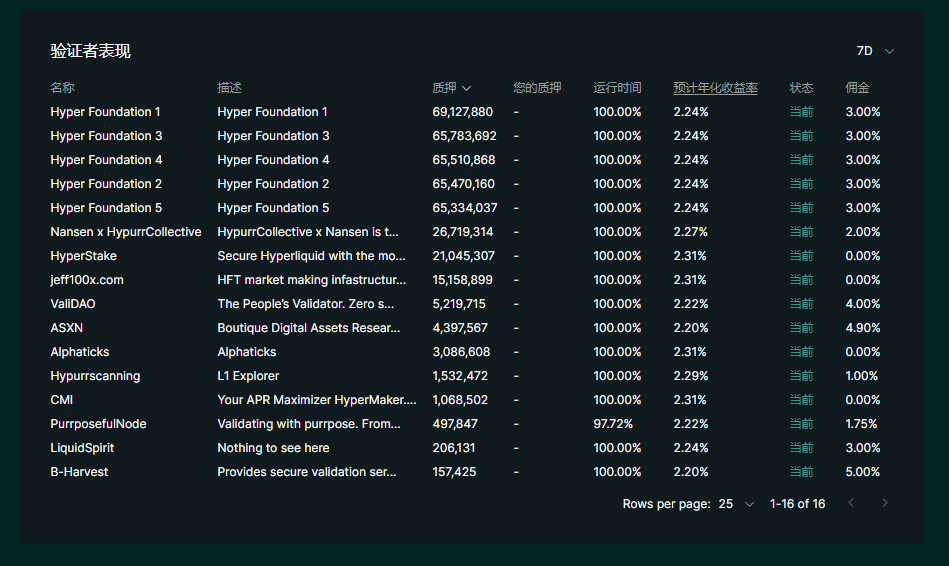

In summary, Hyperliquid's response did not deny the issues raised by Kam but essentially acknowledged that these problems exist within the network and that they will be gradually resolved. From the current data on Hyperliquid's validators, the top five nodes by staking amount are all operated by the official team, with these five nodes alone holding 330 million staked tokens, exceeding the total staked amount of all other nodes combined. Additionally, although the official team has launched a foundation, there has yet to be any governance voting or related channels introduced. From these perspectives, Hyperliquid's open governance indeed has a long way to go.

Valuation Game, Layer 1 Narrative Overcomes All DEXs

Since Hyperliquid's airdrop, the data of the Hyperliquid ecosystem has seen a significant increase. As of January 8, the cumulative number of users reached 300,000, with an additional 100,000 users added in just over a month. Moreover, the TVL data peaked at $2.8 billion in December, increasing 14 times in a single month. According to VanEck's research report, its main competitor dYdX did not exceed $600 million in TVL during its first 15 months, while its token market cap surpassed the total market cap of all its peers.

Hyperliquid's outstanding market performance is greatly related to its dual attributes as a Layer 1 and DEX. As of now, Hyperliquid's Layer 1 attributes are not fully realized; on one hand, the decentralized open governance still has a significant gap compared to mainstream Layer 1s. On the other hand, the richness of the Hyperliquid ecosystem also needs improvement, as the current main applications are primarily operated by the official team.

As a DEX, Hyperliquid boasts a performance of over 100,000 TPS and a user experience brought by its independent public chain foundation, which presents a relatively obvious advantage.

Therefore, if Hyperliquid is positioned as a DEX, it is clearly successful. However, if positioned as a Layer 1, there is still a long road ahead.

Positioning May Be a Key Factor in Future Market Pricing

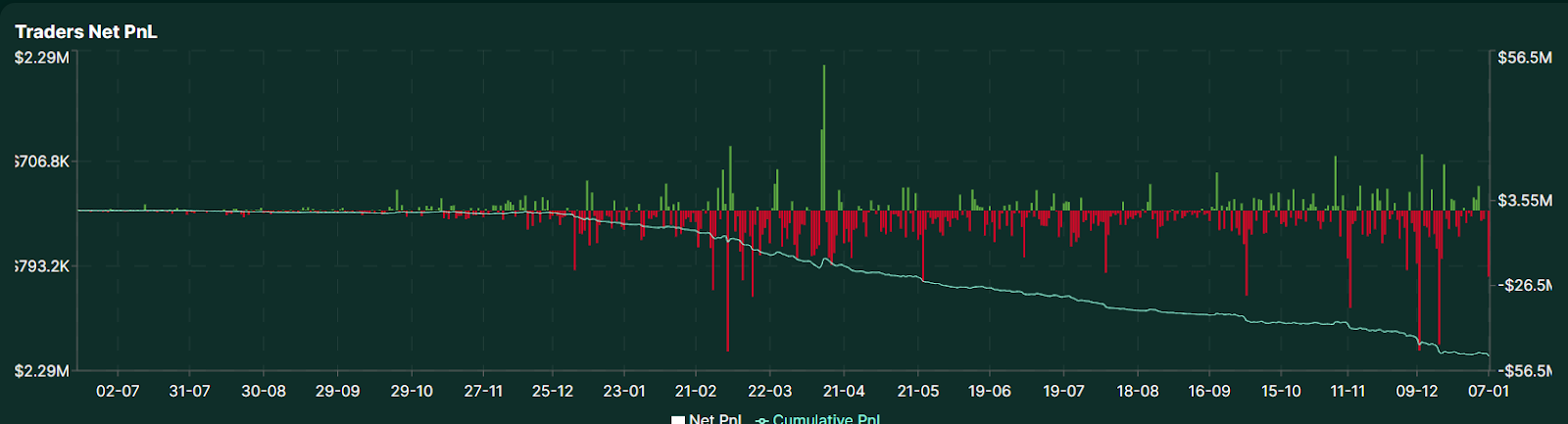

It is also worth mentioning that many believe Hyperliquid could be another gold mine after Solana. However, PANews found in analyzing Hyperliquid's on-chain data that the net profit and loss curve of Hyperliquid traders shows that the overall profit curve of traders has been in the negative for a long time, and as trading activity increases, the total amount of losses continues to expand. As of January 7, 2025, the cumulative loss amount for traders reached $51.3 million, nearly 25 times larger than the same period a year ago. The cumulative liquidation amount also reached $6.69 billion, with the number of open contracts increasing to $3.78 billion. From this perspective, Hyperliquid resembles another new on-chain casino.

On January 6, Hyperliquid announced a partnership with Router Protocol to launch a new cross-chain bridge, beginning to support cross-chain deposits for over 30 networks, including Solana, Sui, Tron, Base, and Ethereum. Compared to the current ability to transfer funds only through Arbitrium, this collaboration can provide Hyperliquid with more flexible channels for capital flow.

Overall, the controversies surrounding Hyperliquid and the reasons many are optimistic about it stem from the same source. As an exchange primarily driven by DEX products, Layer 1 currently seems more like a supporting infrastructure for this exchange. Critics argue that Hyperliquid lacks transparency and a decentralized governance framework as a Layer 1. Supporters believe that Hyperliquid is the only DEX equipped with Layer 1. For Hyperliquid's own development, the situation it faces may always revolve around the contradictions between these two roles.

If it primarily develops as a Layer 1, then Hyperliquid's valuation has much room for growth, along with many issues to address. If it is only positioned as a high-performance DEX, then its valuation far exceeding its peers may raise suspicions of market overvaluation. Moreover, as the ecosystem continues to open up, and HYPE enters more market transactions, shedding the doubts of being a single-machine token, it will also face more uncertainties in the market. These issues present a test of the art of balance for Hyperliquid's official team and a challenging problem that requires careful scrutiny for concerned investors.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。