The negative impact of OTC auctions on prices may not last long.

Author: shushu

Just ten days after the U.S. government once again committed to providing $6 billion in military security assistance to Ukraine, the U.S. Department of Justice is preparing to initiate the liquidation of a large amount of Bitcoin assets.

On January 9, an official confirmed to DB News that the Department of Justice has been authorized to dispose of 69,370 Bitcoins seized in connection with the infamous Silk Road case. This asset currently has a market value of approximately $6.5 billion.

It is reported that the Department of Justice requested permission to sell these assets due to Bitcoin price fluctuations. When asked about the next steps, a Department of Justice spokesperson stated, "The government will take further action based on the judgment in this case."

After the news broke, Bitcoin fell over 2.5% in 24 hours, and as of the time of writing, the price was $94,400.

One of the most influential milestones in Bitcoin's history: Silk Road

In October 2013, a young man named Ross Ulbricht was arrested in a library in San Francisco, using the alias "Dread Pirate Roberts" (DPR), marking the end of the notorious drug and weapon trading website "Silk Road." In 2015, Ross Ulbricht was sentenced to life in prison.

This dark web marketplace, which emerged in 2011, initially provided a platform for trading various illegal goods and services in a "eBay-like" model, such as drugs, fake documents, and hacking tools. Due to the anonymity of the dark web and Bitcoin as the primary payment method, Silk Road rapidly grew and was regarded as one of the most famous and largest illegal markets on the dark web.

From 2012 to 2013, U.S. law enforcement agencies, including the FBI and DEA, began closely monitoring Silk Road and secretly deployed undercover agents. Due to the platform's frequent and large-scale transactions, as well as its involvement in illegal activities across multiple countries, U.S. law enforcement agencies targeted it as a key focus for crackdown.

During the investigation of the Silk Road case, the FBI seized approximately 170,000 Bitcoins from the platform's servers and Ross Ulbricht's personal digital wallet, making it one of the largest Bitcoin law enforcement seizures in history at that time.

When law enforcement arrested Ross Ulbricht, they gained access to relevant cryptocurrency wallets through the laptops and server information seized on-site. Since Bitcoin transactions require a private key for transfer, once law enforcement obtains a valid private key, they can transfer the corresponding Bitcoins from the suspect's address to an official "custodial" wallet.

The U.S. government is not selling Bitcoin for the first time

Since 2014, the U.S. government has auctioned off Bitcoins seized from the Silk Road case multiple times, and the timing and impact on market prices are worth reviewing.

In June 2014, the U.S. government held its first public auction of Bitcoins seized from Silk Road. The U.S. Marshals Service auctioned approximately 30,000 Bitcoins. Bidders included many investment institutions and individuals, with well-known investor Tim Draper winning multiple bids. In subsequent auctions, the government sold the remaining Bitcoins in batches.

After the auction, Bitcoin's price remained stable around $600 without experiencing a "collapse." The auction process demonstrated active bidding from institutional investors, which helped reinforce Bitcoin's "legitimacy."

In December 2014, a second auction of 50,000 Bitcoins, nearly double the size of the first auction, was met with similarly pessimistic market expectations. However, after the auction concluded, Bitcoin continued to fluctuate within the $300 to $400 range without experiencing a continuous decline.

In March 2015, another 50,000 Bitcoins were auctioned, and by this time, Bitcoin had recovered from its previous lows. The market's prior panic sentiment further diminished, and the price quickly stabilized after slight fluctuations between $280 and $300.

In November 2015, the U.S. government’s cumulative auction of hundreds of thousands of Bitcoins at the end of the year did not trigger significant market turmoil. On the contrary, due to continuous bidding from buyers, these auctions were interpreted as a symbol of Bitcoin gradually gaining more "legitimate investment" status.

To this day, the U.S. Department of Justice has been authorized to liquidate the remaining 69,370 BTC (valued at approximately $6.5 billion) from the Silk Road case, with the wallet address marked as "bc1qa5" having been dormant for over four years.

Based on past sales history, Bitcoin prices may experience a brief period of price panic, but in the long run, due to the U.S. government's previous practice of OTC auctions, it is unlikely to sell at market price, and the negative impact on Bitcoin prices will not last long.

Trump's pardon and Bitcoin reserve promise may delay the sale?

In May 2024, during his presidential campaign, Trump promised at the Libertarian National Convention in Washington, D.C., that if he is elected president again, he would reduce the sentence of Silk Road founder Ross Ulbricht on the first day. On July 28, Trump reiterated his commitment to reducing the sentence of Ross Ulbricht during his speech at the Bitcoin 2024 conference.

On November 14, Ross William Ulbricht posted on the X platform for the first time after the U.S. elections, expressing, "I sincerely thank everyone who voted for President Trump. I believe he will fulfill his promise and give me a second chance. After spending over 11 years in darkness, I finally see the light of freedom at the end of the tunnel. Thank you very much."

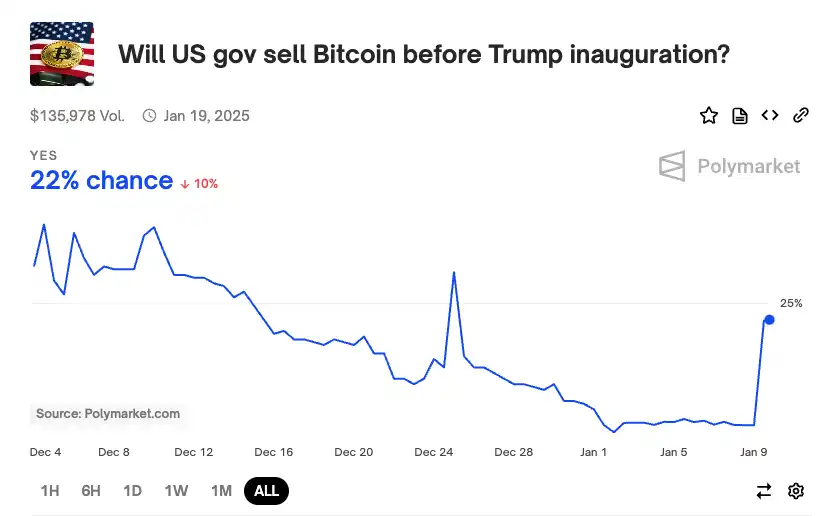

As of now, the betting on PolyMarket regarding "Will the U.S. government sell Bitcoin before Trump takes office?" has become a hot topic, with a betting volume of $136,310, and the probability of selling Bitcoin before Trump takes office is 22%.

Given that Trump previously promised to reduce the sentence of Silk Road founder Ross and has repeatedly stated that he will make the U.S. the world's cryptocurrency capital and embrace cryptocurrencies.

Therefore, most people believe that Ross may be granted a reduced sentence or even pardoned. Similarly, in the betting topic on PolyMarket regarding "Who will be pardoned within 100 days of Trump's presidency?" the likelihood of Ross being pardoned is very high, with the current probability of pardon at 73%.

Due to Trump's promise regarding Bitcoin reserves, if the U.S. government does not sell before January 20, when Trump officially takes office, market speculation suggests that the Bitcoins seized in the Silk Road case may not be sold.

How much Bitcoin does the U.S. government still hold?

According to data from Bitcoin Treasuries, the U.S. government holds 207,189 Bitcoins, accounting for 0.987%. Based on the current Bitcoin price, the total value of the Bitcoins held by the U.S. government is $19,544,018,200.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。