Hokkaido's ski resorts are experiencing the strongest snowfall in 70 years, driven by dollar liquidity in the Bitcoin market. Both showcase significant global dynamics and trends.

Author: Arthur Hayes

Translated by: Baihua Blockchain

Hokkaido's ski resorts are located far from urban areas and offer excellent skiing conditions, with most areas accessible by cable car. At the beginning of the ski season, skiers are most concerned about when there will be enough snow to open the slopes. It becomes a challenge when the bamboo groves in these areas are not yet covered by snow. Although these bamboos are thin and resemble reeds, their green leaves are very sharp and can easily cut the skin if one is not careful. Skiing through these bamboo thickets is very dangerous, as the edges of the skis may slip, leading you into what I call the "man vs. tree" game. Therefore, if there is not enough snow to cover the bamboo, these remote areas can become quite hazardous. This year, Hokkaido has welcomed unprecedented snowfall, the strongest in nearly 70 years. The snow depth is substantial, resulting in ski areas that usually open in the first or second week of January opening in late December this year. As we enter 2025, many cryptocurrency investors are beginning to focus on whether the policies that Donald Trump is about to implement will have long-term impacts. In my recent article "Arthur Hayes: How Trump's New Policies and Global Reactions Affect Cryptocurrency," I explored the high expectations brought by the Trump administration's pro-crypto and pro-business policies, which may lead to market disappointment. While I still believe this poses a potential short-term resistance, I need to adjust this view considering the influence of dollar liquidity. Currently, Bitcoin's trend will be affected by changes in the pace of dollar issuance, which is controlled by the monetary officials of the Federal Reserve (Fed) and the U.S. Treasury, who manage the supply of dollars in the global financial market.

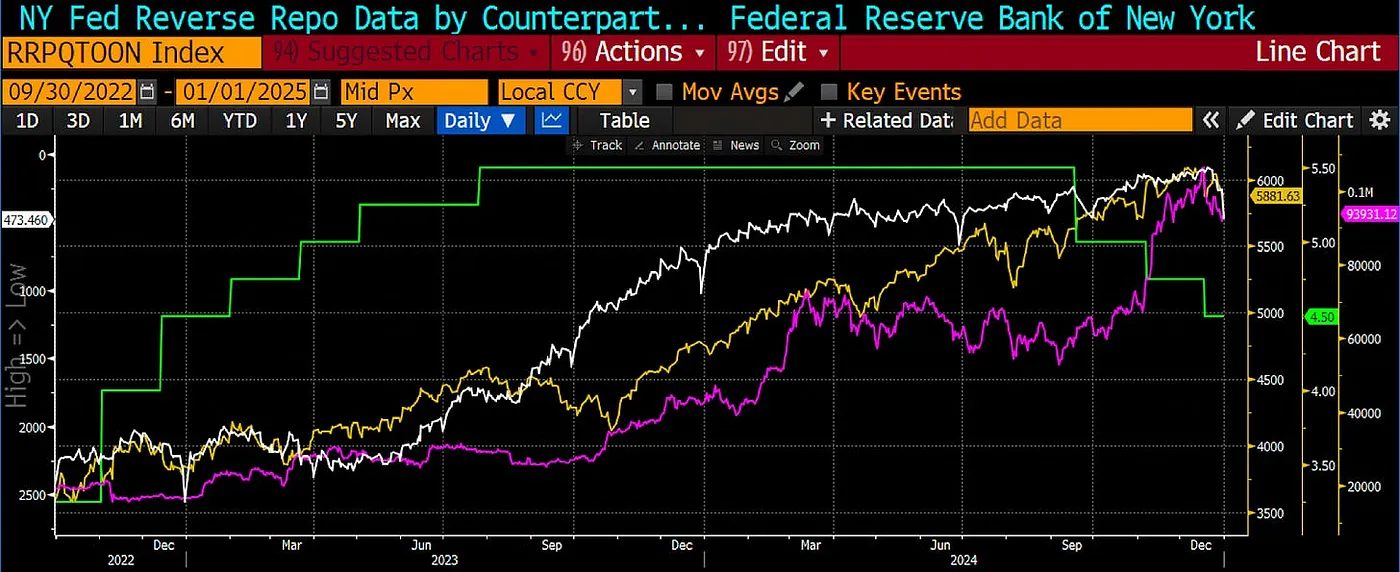

Bitcoin bottomed out in the third quarter of 2022 when the Fed's reverse repurchase agreement (RRP) peaked. At the request of Treasury Secretary Janet Louise Yellen, the Treasury reduced the issuance of long-term coupon bonds and increased the issuance of short-term zero-coupon bills, thereby withdrawing over $2 trillion from the RRP. This effectively injected a large amount of liquidity into the global financial market, leading to significant increases in cryptocurrencies and stocks (especially large tech stocks listed in the U.S.). The chart above shows the relationship between Bitcoin (left, yellow) and RRP (right, white, inverted); it can be seen that when the RRP balance decreases, the price of Bitcoin rises. The question I want to answer is whether, at least in the first quarter of 2025, positive dollar liquidity can offset the market's disappointment regarding the speed and effectiveness of Trump's so-called pro-crypto and pro-business policies. If the answer is yes, then we can increase our risk exposure and add risk positions to our portfolios.

First, I will discuss the Federal Reserve, which plays a secondary role in my analysis. Next, I will analyze how the U.S. Treasury responds to the debt ceiling issue. If politicians hesitate to raise the debt ceiling, the Treasury will reduce the balance in its Treasury General Account (TGA) at the Fed, thereby injecting liquidity into the market and creating positive momentum for cryptocurrencies. For the sake of brevity, I do not intend to explain in detail why the RRP and TGA represent negative and positive dollar liquidity, respectively. If you are not a long-time reader of mine, you can refer to "Teach Me Daddy" for more information on the relevant mechanisms.

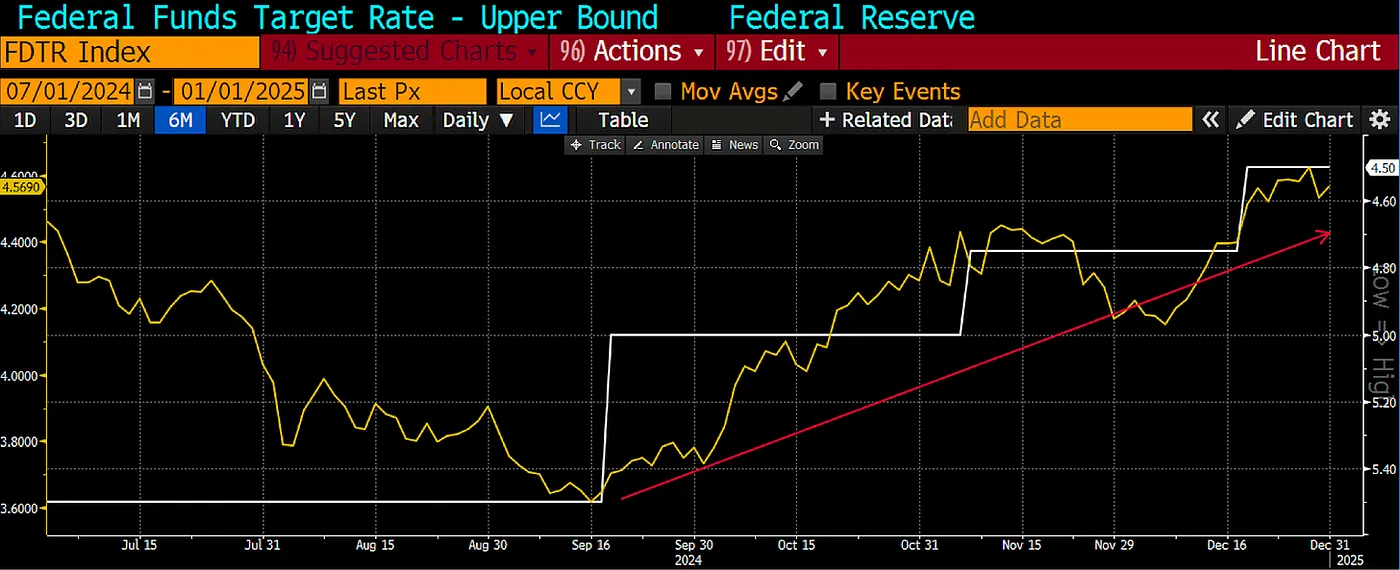

- The Federal Reserve The Fed's quantitative tightening (QT) policy is still progressing at a pace of $60 billion per month, reducing the size of its balance sheet. The Fed has not changed its forward guidance regarding the pace of QT. I will elaborate on my predictions later, but from the current situation, I believe the market will peak in mid to late March, meaning that from January to March, QT will withdraw about $180 billion in liquidity. Currently, the RRP balance has dropped to nearly zero. To fully exhaust this tool, the Fed lowered the RRP rate by 0.30% at the December 18 meeting, a larger reduction than the 0.05% cut in the policy rate, aiming to align the RRP rate with the lower bound of the federal funds rate (FFR).

If you want to know why the Fed waits until the RRP is nearly exhausted before adjusting the rate to the FFR lower bound, thereby reducing the attractiveness of deposits in that tool, I suggest you read Zoltan Pozsar's article "Cheating on Cinderella." My takeaway from the article is that the Fed is exhausting all means to stimulate demand for U.S. Treasuries before it has to stop QT, provide supplementary leverage exemptions to U.S. commercial banks, or even possibly resume quantitative easing (QE).

Currently, there are two liquidity pools helping to control bond yields. For the Fed, the yield on the 10-year U.S. Treasury cannot exceed 5%, as exceeding this level would trigger volatility in the bond market (MOVE index). As long as there is liquidity in the RRP and TGA, the Fed does not need to make drastic policy adjustments to acknowledge fiscal dominance. Fiscal dominance essentially means that Powell's position is dominated by Yellen, and after January 20, Scott Bessent will also join this camp. Scott will have a nickname, although I haven't thought of a fun name yet. If this affects his decision-making, I will be more courteous in choosing a nickname, especially if he makes me a modern-day "Scrooge McDuck" by devaluing the dollar relative to gold.

Once the Treasury General Account (TGA) is depleted (favorable for dollar liquidity) and replenished after the debt ceiling is reached and raised (unfavorable for dollar liquidity), the Fed will no longer be able to take emergency measures to stop the continued rise in yields that began after the easing cycle started last September. This is not significant for the dollar liquidity situation in the first quarter, but if yields continue to rise, it is just a brief thought about how Fed policy will evolve later this year.

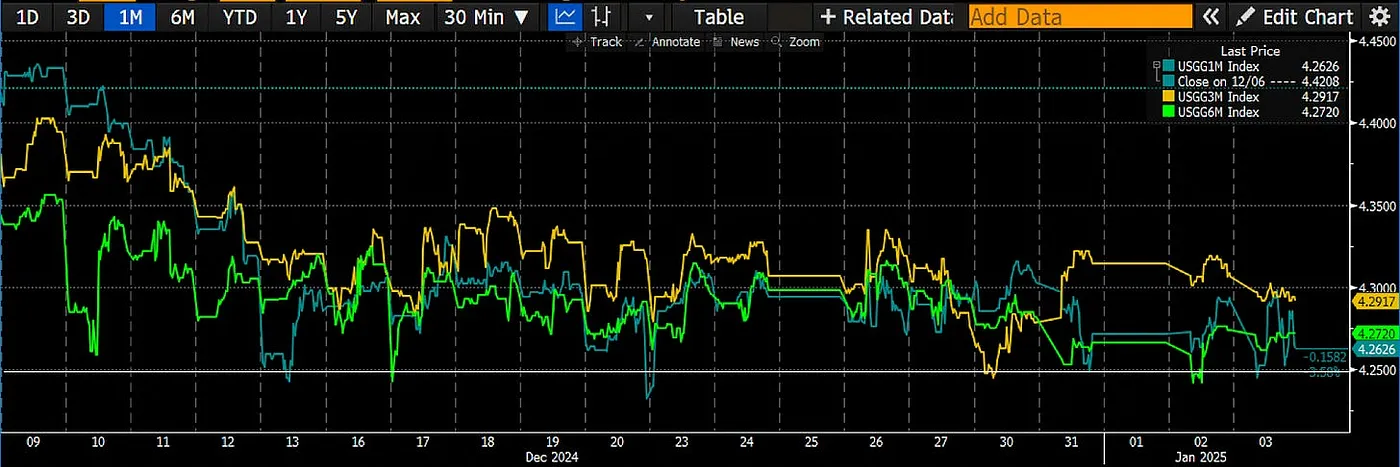

The comparison between the upper limit of the FFR (right, white, inverted) and the yield on the 10-year U.S. Treasury (left, yellow) clearly shows that when inflation is above the 2% target, Fed rate cuts lead to rising bond yields. The real question is the speed at which the RRP balance drops from about $237 billion to zero. I expect it to approach zero in the first quarter, as money market funds (MMFs) maximize returns by withdrawing funds and purchasing higher-yielding Treasury bills (T-bills). To clarify, this means that $237 billion in dollar liquidity will be injected in the first quarter.

After the adjustment of the RRP rate on December 18, the yield on Treasury bills (T-bills) with maturities of less than 12 months exceeded 4.25% (white), which is the lower bound of the federal funds rate. The Fed will withdraw $180 billion in liquidity due to quantitative tightening (QT), while the reduction in RRP balance due to rate adjustments will inject an additional $237 billion in liquidity. Thus, the total net liquidity injection amounts to $57 billion.

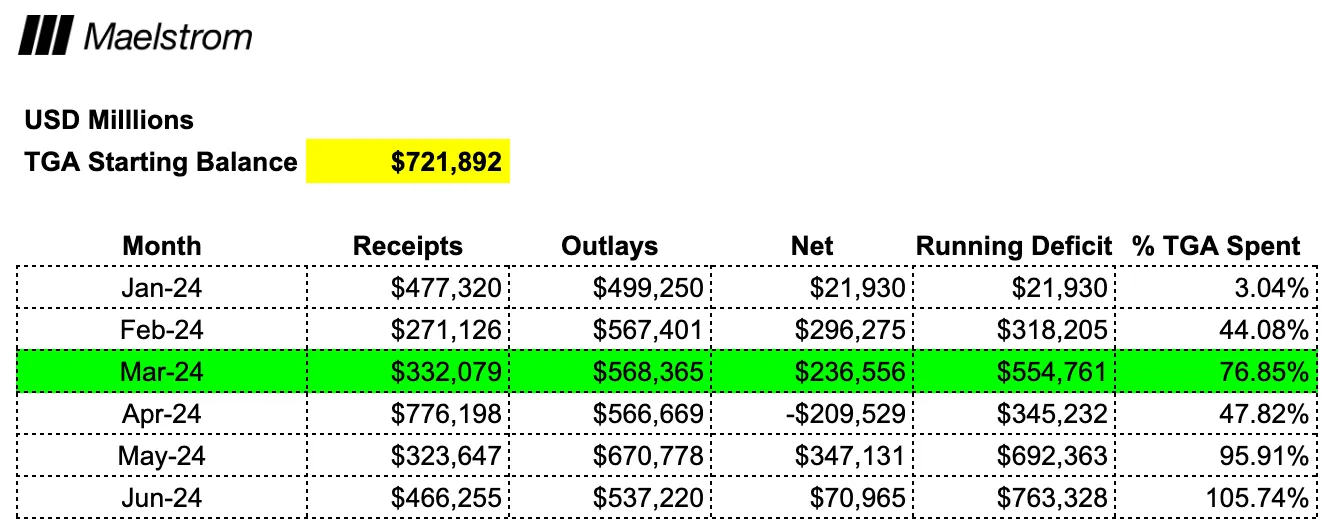

- The Treasury Yellen has indicated to the market that she expects the Treasury to begin taking "extraordinary measures" to fund the U.S. government between January 14 and 23. The Treasury has two ways to pay government bills: it can issue debt (unfavorable for dollar liquidity) or spend funds from its checking account at the Fed (TGA) (favorable for dollar liquidity). Since the total debt cannot increase until Congress raises the debt ceiling, the Treasury can only spend funds from its checking account (TGA). Currently, the TGA balance is $722 billion.

The key to the first assumption is when politicians will agree to raise the debt ceiling. This will be an important test of whether Trump's support among Republican lawmakers is solid. Notably, his governing advantage in the House and Senate—i.e., the Republican majority over the Democrats—is very slim. There is a faction within the Republican Party that likes to appear very tough during every debt ceiling discussion, claiming to care about reducing the size of the massive government. They will delay voting to support raising the debt ceiling until they secure some tangible benefits for their constituencies. Trump has previously failed to persuade them that they will not support the spending bill for the end of 2024 without raising the debt ceiling. As for the Democrats, they suffered a major defeat in the last election due to the "gender-neutral bathroom" incident and are clearly not in a good mood to help Trump unlock government funds to achieve his policy goals.

What do you think about Harris running for president in 2028? In reality, the Democratic presidential candidate is likely to be that charismatic silver-haired man—Gavin Newsom. Therefore, to push things forward, Trump would wisely exclude the debt ceiling issue from any proposed legislation and only mention it when absolutely necessary.

When failing to raise the debt ceiling leads to a technical default on maturing Treasuries or a complete government shutdown, raising the debt ceiling becomes inevitable. Using the Treasury's 2024 revenue and expenditure report as a guide, I estimate that this situation will occur between May and June of this year, when the TGA balance will be completely depleted.

Visualizing the TGA usage progress helps us understand the speed and intensity of government financing and predict when the effects of withdrawals will be maximized. The market is forward-looking. Given that this data is public and we know how the Treasury operates when it cannot increase the total U.S. debt and its accounts are nearing depletion, the market will seek a new source of dollar liquidity. When the TGA balance is consumed to 76%, March seems to be the moment when the market will ask, "What's next?"

If we add the amount of dollar liquidity from the Federal Reserve and the Treasury until the end of the first quarter, the total will reach $612 billion.

What happens next? Once default and shutdown are imminent, a last-minute agreement will be reached, and the debt ceiling will be raised. At that point, the Treasury will be able to borrow net again and must replenish the TGA balance. This will be unfavorable for dollar liquidity. Another key date in the second quarter is April 15, when taxes are due. From the table above, it is clear that the government's financial situation improves significantly in April, which is unfavorable for dollar liquidity.

If the factors affecting the TGA balance are the only determinants of cryptocurrency prices, I expect a local market peak at the end of the first quarter. In 2024, Bitcoin reached a local peak of about $73,000 in mid-March, followed by a period of consolidation and a decline that began before the tax deadline on April 11.

- How We Choose Strategies The analysis of this issue assumes that dollar liquidity is the most critical marginal driver of overall fiat currency liquidity globally. Here are some other factors to consider:

- Will China accelerate or slow down the RMB credit process?

- Will the Bank of Japan start raising interest rates, which would increase the USD/JPY exchange rate and unwind leveraged arbitrage trades?

- Will Trump and Bessent take action for a large-scale devaluation of the dollar against gold or other major fiat currencies?

- How efficient is the Trump team in rapidly reducing government spending and passing legislation? These significant macroeconomic issues cannot be predetermined, but I am confident in the mathematical principles of RRP and TGA balances over time. This confidence is further strengthened by the market's performance from September 2022 to now: the increase in dollar liquidity due to the decline in RRP directly drove the rise of cryptocurrencies and stocks, despite the Fed and other central banks raising interest rates at the fastest pace since the 1980s.

The comparison of the FFR upper limit (right, green) with Bitcoin (right, magenta) and the S&P 500 index (right, yellow) against RRP (left, white, inverted). Bitcoin and stocks bottomed out in September 2022 and injected over $2 trillion in dollar liquidity as RRP declined, driving the market up. This is the policy that "bad girl" Yellen deliberately chose, withdrawing RRP funds by issuing more short-term Treasury bonds. Powell's policies to tighten financial conditions in the fight against inflation were completely offset.

With all the premises in mind, I believe I have answered the initially posed question. That is, the disappointment of the Trump team regarding its proposed pro-crypto and pro-business legislation can be offset by an extremely positive dollar liquidity environment, with liquidity increases in the first quarter reaching $612 billion. As planned, just like almost every year, the end of the first quarter will be a time to sell, after which one can relax on the beach, at clubs, or in ski resorts in the Southern Hemisphere, waiting for the re-emergence of positive fiat liquidity conditions in the third quarter.

As the Chief Investment Officer of Maelstrom (a venture capital fund focused on high-risk, high-return investment opportunities), I will encourage the adventurers in the fund to adjust their risk to "DEGEN" (extremely risky). The first step in this direction is our decision to enter the emerging decentralized science (DeSci) junk coin space. We like the so-called undervalued junk coins and have purchased $BIO, $VITA, $ATH, $GROW, $PSY, $CRYO, and $NEURON. If you want to delve deeper into why Maelstrom believes the DeSci narrative will appreciate significantly, please read "Degen DeSci."

If things unfold as I have described, I will adjust the benchmark in March and welcome the market's "climax." Of course, anything can happen, but overall, I am bullish. Have I changed my views from previous articles? A bit. Previously, I said that perhaps Trump's "sell-off" would occur from mid-December 2023 to the end of 2024, rather than in mid-January 2025. Does this mean I am sometimes a poor futurist? Yes, but at least I will absorb new information and perspectives and make timely adjustments before they lead to significant losses or missed opportunities. That is the charm of investing. Imagine if every shot you took was a hole-in-one, every three-pointer went in, and every billiard shot pocketed all the balls. Life would be incredibly dull. Damn it, I want failures and successes, and to find joy in both. But hopefully, there will be more successes than failures.

Article link: https://www.hellobtc.com/kp/du/01/5629.html

Source: https://cryptohayes.medium.com/sasa-0b474e218c5d

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。