The impact of macro liquidity on the cryptocurrency market is becoming increasingly significant.

Written by: 1912212.eth, Foresight News

On December 17 last year, the cryptocurrency market began to decline following Powell's hawkish remarks. Fast forward to this Tuesday, official data showed that U.S. employment figures were better than expected, and service sector inflation accelerated. These two data points quickly cooled market expectations for a Federal Reserve rate cut, with the market generally anticipating that there may only be one rate cut this year. As a result, Bitcoin fell from above $100,000 to a low of $92,500, while Ethereum dropped from $3,700 to a low of $3,208.

Altcoins were broadly affected, with some experiencing significant declines, erasing all gains made since January 1 over the two days from January 7 to 8. In the 24-hour decline, the DeFi sector saw USUAL drop by 11%, ENA by 6%, and PENDLE by 9%. Meme coins WIF and PEOPLE both fell by over 8%, while layer two public chains like APT, TIA, and ADA saw declines around 5%. MOVE dropped over 9%. In the AI sector, VIRTUAL fell by over 6%. WLD and ARKM saw declines around 5%.

Contract data indicated that in the past 24 hours, liquidations totaled $556 million, with long positions liquidated amounting to $418 million, and the largest single liquidation reaching $15.299 million.

Bitcoin spot ETF data has seen a net inflow for three consecutive days since January 3, with January 3 and January 6 even recording a single-day total net inflow exceeding $900 million. Ethereum spot ETF data, however, has been lackluster, with net outflows on January 2 and January 7, while January 3 and January 6 saw net inflows, with this month's net inflow slightly higher than net outflow. However, according to Trader T data, on January 8, the U.S. Bitcoin spot ETF saw a net outflow of $569 million, and Ethereum had a net outflow of $159 million, which undoubtedly exacerbated the already liquidity-strapped market.

In terms of stablecoin data, after January 1, the market cap of USDT continuously decreased before starting to recover, currently hovering around $137.5 billion.

USDC data, on the other hand, performed well, rising from $43.95 billion to a peak of about $46 billion, with a net inflow exceeding $2 billion. USDC is primarily held by U.S. users, which may indicate that U.S. capital strength is still buying.

Why are market prices continuously declining?

Silk Road's $6.5 billion worth of Bitcoin approved for sale

On the morning of January 9, an official confirmed to DB News that the U.S. Department of Justice has been authorized to liquidate 69,370 BTC (worth about $6.5 billion) seized in the Silk Road case. The Department of Justice requested permission to sell these assets due to Bitcoin price volatility. When asked about the next steps, a DOJ spokesperson stated, "The government will take further action based on the case's ruling."

As a result of this news, Bitcoin briefly dropped over 1%, but quickly rebounded to around $94,000.

Currently, the U.S. Department of Justice has not determined when to sell, and there are only 11 days left until Trump's official inauguration, during which he previously stated he would not sell any Bitcoin after taking office.

According to the latest data from Arkham, the U.S. government currently holds 198,109 Bitcoins, valued at approximately $18.59 billion, and 54,753 Ethereum, valued at approximately $181.3 million.

Federal Reserve rate cut expectations significantly decline

On the evening of January 8, the U.S. December ADP employment figures recorded 122,000, falling short of the market expectation of 140,000, marking the lowest level since August 2024. The number of initial jobless claims for the week ending January 4 was recorded at 201,000, the lowest since the week of February 17, 2024. These two data points further indicate the strength of the U.S. market economy, leading to a further decline in rate cut expectations.

In the Federal Reserve's meeting minutes released in the early hours of January 9, committee members anticipated that the pace of rate cuts in 2025 would significantly slow, with an expectation of only a 75 basis point cut for the entire year. Market futures prices indicate that the degree of policy easing in 2025 may be slightly lower than this expectation. Nevertheless, market participants still hold considerable uncertainty regarding the path of the federal funds rate over the next year.

When discussing inflation developments, participants noted that although inflation has significantly slowed from its peak in 2022, it remains elevated. Participants commented that in 2024, overall inflation rates have slowed, with some recent monthly price readings exceeding expectations. However, most indicated that progress in inflation remains evident across a broad range of core goods and services prices.

Federal Reserve Governor Waller stated on Wednesday that although inflation is expected to stagnate above the 2% target by the end of 2024, based on market expectations and short-term inflation data, the inflation situation in the U.S. continues to improve. He expects inflation to continue to decline in 2025, supporting further rate cuts. Waller emphasized that the U.S. economic fundamentals remain robust, and the job market shows no clear signs of weakness. Regarding the number of rate cuts in 2025, Federal Reserve officials have differing opinions, ranging from zero to five cuts. He believes that although the slow progress of inflation has sparked calls for a slowdown or pause in rate cuts, mid-term inflation will continue to move toward the 2% target, making further rate cut policies appropriate.

According to CME FedWatch data: The probability of the Federal Reserve maintaining interest rates in January is 95.2%, while the probability of a 25 basis point cut is 4.8%. The probability of maintaining the current rate in March is 60.9%, with a cumulative probability of a 25 basis point cut at 37.3% and a cumulative probability of a 50 basis point cut at 1.7%.

As the probability of a Federal Reserve rate cut diminishes, market liquidity injections are slowing, and market prices are struggling to rise. The consumer price index inflation data set to be released on January 15 may cause significant fluctuations in the cryptocurrency market once again.

Future Trends

The correlation between Bitcoin and the S&P 500 index has risen to 0.88, indicating a renewed synchronization between the two markets, marking a shift from the previous divergence trend (since Trump's election, Bitcoin has risen 47%, while the S&P 500 has only risen 4%).

Andre Dragosch, Head of Research at Bitwise Europe, attributes the re-emerging correlation to macroeconomic factors, including the Federal Reserve's revised rate cut forecasts and a strengthening dollar, which continue to exert pressure on both cryptocurrencies and traditional markets. Despite Bitcoin having strong on-chain support, its movements are increasingly influenced by broader market trends, indicating potential short-term risks ahead.

Matrixport's chart report suggests that fluctuations in global liquidity may exert some pressure on Bitcoin, with historical data showing that liquidity changes typically lead Bitcoin price movements by about 13 weeks. With the dollar strengthening after Trump's re-election, global liquidity measured in dollars is beginning to tighten, suggesting that Bitcoin may enter a consolidation phase in the near term.

However, this consolidation is expected to be a temporary phenomenon. Overall, risk assets (especially Bitcoin) still exhibit positive long-term potential. Nevertheless, in a weaker liquidity environment, traders should exercise greater caution, as these indicators have historically proven to be reliable market barometers.

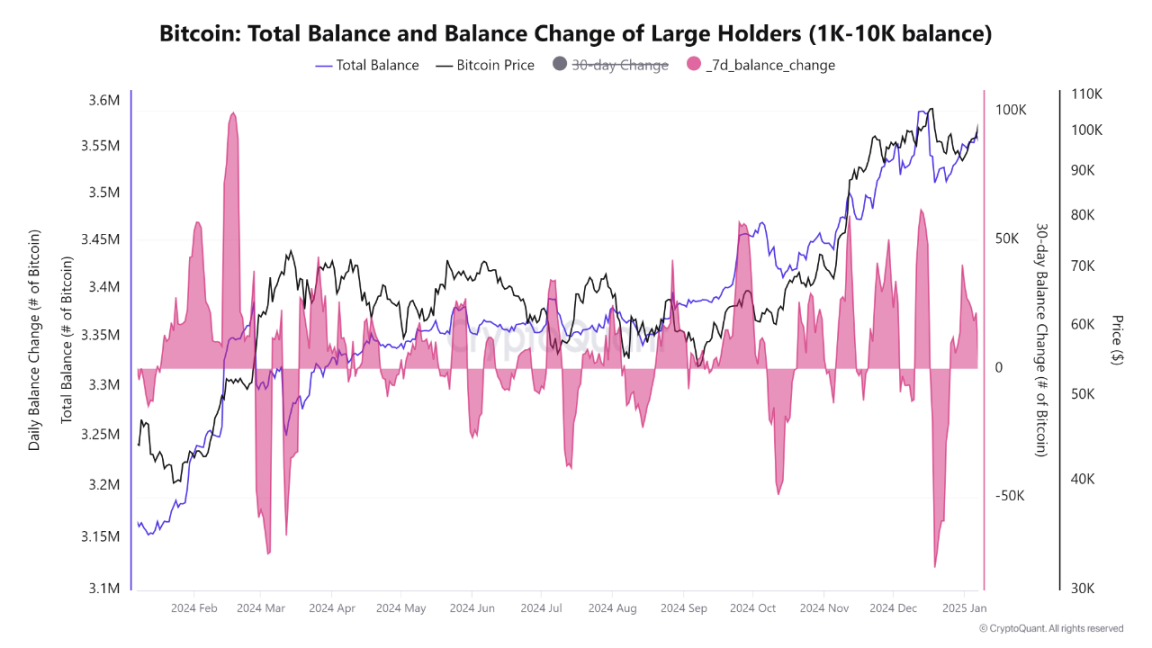

Cauê Oliveira, Head of Research at Blocktrends, stated today that Bitcoin's price fell after reaching an all-time high at the end of 2024, when institutional investors sold off a large amount of Bitcoin, but now they are starting to buy Bitcoin again at prices below $100,000.

Data shows that in the week following December 21, wallets holding 1,000 to 10,000 BTC sold off 79,000 BTC, but after Bitcoin's recent pullback, this group began accumulating again when Bitcoin's price fell below $95,000.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。