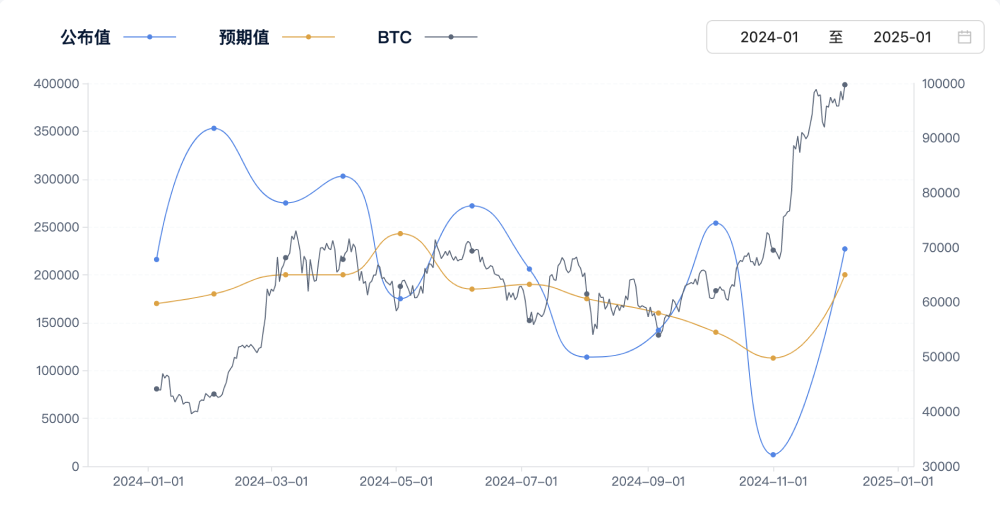

U.S. Non-Farm Payroll (NFP) data has always been regarded as a "health check report" for the global economy, profoundly influencing the movement of the U.S. dollar and generating widespread ripple effects on high-risk assets such as the cryptocurrency market. By reviewing the performance of non-farm data over the past year and the reactions in the crypto market, we can gain a clearer understanding of its potential impact mechanisms.

Data Performance and Market Reaction: Intensified Short-Term Volatility

The performance of non-farm data directly affects market expectations regarding the Federal Reserve's monetary policy, and these policy expectations play a crucial role in the flow of funds in the crypto market:

Negative Data: Strong Economy, Strong Dollar, Pressure on Crypto Market

When non-farm employment data exceeds or meets market expectations, it typically indicates a strong economic performance, leading investors to anticipate that the Federal Reserve may maintain or even strengthen its tightening policy. Dollar assets become more attractive, while high-risk assets like cryptocurrencies face selling pressure.

- Data release on December 19, 2024: 4.50% (in line with expectations)

- Market interpretation: Tightening expectations remain unchanged, funds flow into safe assets

- Bitcoin 5-minute drop: -0.54%

Positive Data: Weak Economy, Easing Expectations Favor Crypto Assets

When non-farm data falls short of expectations, the market interprets this as a signal of economic slowdown, leading investors to speculate that the Federal Reserve may adjust its monetary policy, slow down interest rate hikes, or even shift towards easing, which typically provides short-term support for crypto assets like Bitcoin.

- Data release on September 19, 2024: 5.00% (below the expected 5.25%)

- Market interpretation: Economic slowdown, easing expectations rise

- Bitcoin 5-minute increase: +1.40%

Chain Reaction of the Dollar Index: The Shadow Dancer of the Crypto Market

Non-farm data indirectly impacts the crypto market through the Dollar Index (DXY). Generally, the strength or weakness of the dollar is inversely related to cryptocurrency prices:

- Strong Dollar: High-yield government bonds and dollar assets become the preferred choice, leading to a decline in crypto asset prices.

- Weak Dollar: The appeal of crypto assets as "non-sovereign" currencies increases, resulting in price rises.

For example, after the non-farm data release on June 13, 2024, the dollar index rose sharply in the short term, while Bitcoin quickly dropped by -0.50% within five minutes.

Significant Short-Term Effects, Gradually Diluted Long-Term Impact

Although the release of non-farm data can trigger significant volatility in the crypto market in the short term, its long-term impact is often diluted by other macroeconomic factors, such as:

- Federal Reserve's monetary policy path: Market expectations regarding interest rate cuts or hikes will be more influential than any single data point.

- Industry event-driven factors: Developments such as Bitcoin ETF approvals, large institutional entries, or breakthroughs in blockchain technology may also shift market sentiment.

- Global economic dynamics: Geopolitical risks and changes in monetary policies of other economies have more profound medium- to long-term impacts on crypto assets.

Risks and Opportunities Coexist: How to Formulate Strategies?

As a significant catalyst for short-term market volatility, investors need to find a balance between risks and opportunities:

- Flexibly adjust positions: Appropriately adjust cryptocurrency investment positions before and after the release of non-farm data to avoid irrational decisions due to market fluctuations.

- Monitor dollar trends: Combine non-farm data with the dollar index to assess fund flows and seize opportunities from short-term market sentiment shifts.

- Medium- to long-term layout: Use non-farm data as a reference factor, combined with other macroeconomic indicators, to formulate a more comprehensive investment strategy.

Conclusion: How Will the Crypto Market Respond to Non-Farm Variables in the Future?

From the non-farm data over the past year, it is evident that the crypto market's sensitivity to macroeconomic variables is increasing. This reflects the trend of Bitcoin and other crypto assets gradually integrating into the mainstream financial system. In a context of frequent market fluctuations, investors need to remain vigilant while seeking trading opportunities through volatility. Behind the non-farm data lies a complex interaction between traditional finance and the emerging crypto market. In the future, as more institutions enter the space and policy frameworks improve, the crypto market's response mechanisms to traditional indicators like non-farm data may further mature and stabilize, providing more opportunities for investors while also presenting greater challenges.

Disclaimer: The above content is for reference only and does not constitute investment advice.

If you have any questions, you can contact us through the following official channels:

AICoin Official Website: www.aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AICoincom

Email: support@aicoin.com

Group Chat: Customer Service Yingying、Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。