Recently, the surge in U.S. Treasury yields has drawn widespread attention in the financial markets, particularly having a significant impact on the cryptocurrency market. As investors reassess the economic situation, the volatility in the crypto market has intensified, leading to changes in investor sentiment. The rise in Treasury yields is not just a numerical change; it serves as the "heartbeat" of the crypto market, constantly reminding us how the market's pulse interacts with the traditional financial environment. The following will delve into the specific impacts of rising Treasury yields on the crypto market.

The Driving Forces Behind Rising Yields

The increase in U.S. Treasury yields is not coincidental; several key factors are at play:

Federal Reserve's Tightening Policy: Since 2021, the Federal Reserve has been gradually raising the federal funds rate to combat inflation, significantly enhancing the appeal of fixed-income assets. This policy adjustment has prompted investors to reassess their investment strategies, potentially reducing allocations to high-risk assets.

Changes in Economic Data: Recently, data released by the Institute for Supply Management (ISM) indicated that the growth rate of the U.S. services sector in December exceeded expectations, heightening market concerns about "sticky inflation." This optimistic sentiment has driven yields higher.

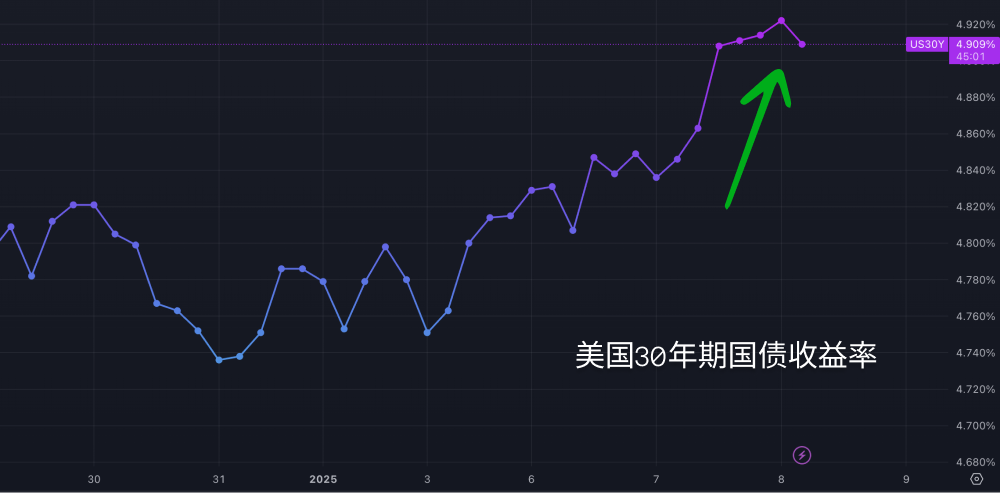

Increased Supply of New Treasuries: The first of three U.S. Treasury auctions this week saw weak demand, coupled with a large issuance of high-rated corporate bonds competing for investor cash, pushing long-term bond yields further up. The yield on 30-year U.S. Treasuries quickly rose to 4.86%, reaching a more than one-year high.

The Turbulence in the Crypto Market

Investor Sentiment Roller Coaster

As Treasury yields rise, investors' preference for high-risk assets diminishes, leading many to reassess their portfolios in the crypto market. A high-interest-rate environment typically means higher borrowing costs, prompting investors to favor more stable assets, such as Treasuries, thereby reducing investments in cryptocurrencies like Bitcoin and Ethereum.

The Wild Price Swings of Crypto Assets

Against the backdrop of rising Treasury yields, the crypto market has experienced severe price volatility. On Tuesday, Bitcoin's price plummeted significantly, with data from AICoin showing a 5% drop to $96,525.50. Ethereum fell by 8%, and the total market capitalization of the broader cryptocurrency market decreased by 7%.

At the same time, cryptocurrency-related stocks were also impacted. The stock prices of Coinbase and MicroStrategy fell by over 8% and 9%, respectively, while Bitcoin mining companies Mara Holdings and Core Scientific saw their stock prices drop by approximately 7% and 6%.

The trigger for this market volatility was the ISM data indicating that the growth rate of the U.S. services sector exceeded expectations, raising concerns about "sticky inflation." The yield on 10-year U.S. Treasuries subsequently rose rapidly, and rising yields typically exert pressure on growth-oriented risk assets.

Subtle Changes in Market Confidence

Despite the pressure from soaring Treasury yields on the crypto market, investor confidence has not completely collapsed. Some analysts point out that expectations for the approval of Bitcoin ETFs (exchange-traded funds) still exist, providing some support for investors. Recent developments regarding BlackRock's ETF application have added to market optimism, although uncertainties stemming from rising yields remain.

Moreover, despite the significant recent volatility, Bitcoin has risen over 3% since the beginning of this year, and for the entire year of 2024, it has recorded a 120% increase. This long-term upward trend has somewhat supported market sentiment.

Changes in Capital Flows: The Tides Rise and Fall

As yields rise, some capital is flowing out of the high-risk crypto market and into fixed-income assets like Treasuries. According to observations from AICoin, changes in capital flows may lead to decreased liquidity in the crypto market, thereby exacerbating market volatility. Investors generally expect that the market may soon benefit from a clearer regulatory framework. For instance, when Bitcoin's price broke the $102,000 level on Monday, the market anticipated that its price would double this year. However, uncertainties regarding the Federal Reserve's future interest rate cuts may still pose volatility risks for cryptocurrency prices.

At the same time, Moody's chief economist Mark Zandi warned that soaring U.S. Treasury yields could lead to a collapse of Bitcoin, altcoins, and other high-risk assets, further triggering instability in the financial markets.

Conclusion: Future Challenges and Opportunities

In summary, the surge in U.S. Treasury yields has had a profound impact on the crypto market, presenting investors with multiple challenges, including emotional fluctuations, price volatility, and changes in capital flows. However, amidst the market uncertainties, opportunities still exist through technological innovations and financial products (such as ETFs).

Investors should remain vigilant, closely monitor market dynamics, and flexibly adjust their investment strategies to cope with the ever-changing financial environment. Regardless of how the market fluctuates, maintaining a rational and prudent investment attitude is always key to facing challenges.

As the economic situation evolves, the future crypto market may encounter new opportunities and challenges, warranting continuous attention from investors. In this unpredictable market, every step could be an adventure, but it is this very adventure that enriches our investment journey.

The above content is for reference only and does not constitute investment advice.

If you have any questions, you can contact us through the following official channels:

AICoin Official Website: www.aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AICoincom

Email: support@aicoin.com

Group Chat: Customer Service Yingying, Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。