Actively expanding one's audience is a very bullish thing. For example, TON uses mini-games to broaden its audience, issue tokens, and bring volume to exchanges.

Now, @SonicSVM is also following this model (not the Sonic $S from Fantom, but Solana Layer2 Sonic).

The precondition for the rise of this type of narrative is that the crypto industry has a natural interest in projects that can bring Web2 users into the Web3 market (after $CHILLGUY took off, many scholars engaged in debates).

However, what truly made the market realize the potential of this type of play on a large scale is Ton. Kaia (Line) and Sonic (TikTok) are successors of this type of play.

This is also the reason why market makers are pushing these tokens— they not only have potential for listing but also possess sufficient buying power (for example, I bought $CATI?).

It is worth mentioning that Telegram, Kaia, and TikTok have completely different user groups, which means that Sonic's TikTok application layer, SonicX, will also be favored by exchanges. Moreover, compared to the low-threshold registration of Telegram, TikTok inherently has a layer of KYC, resulting in more real Web2 users. This is a lucrative opportunity for exchanges. Additionally, the user base scale of TikTok is larger than that of Line.

After discussing Sonic's industry position, let's briefly go over the Sonic project.

Simply put, Sonic is a Solana Layer2 focused on the gaming sector. Personally, I believe that in market perception, technology is not that important; what matters is the actual experience when the market participates in the project, such as Sonic's wallet support, deposit thresholds, transaction smoothness, ecological projects, etc.

It must be mentioned that Sonic has indeed raised quite a bit of money.

Of course, from the perspective of market cap, Sonic is more than just a gaming chain; it is a bridge between Web2 TikTok users and the Web3 Solana ecosystem. How much is the gaming narrative worth? "Bringing Web2 users into the market" is the big narrative? In the crypto industry, which is primarily driven by capital speculation, technology may not be that important; narrative is the core competitiveness of a project.

From a Solana Layer2 gaming chain to a bridge between Web2 and Web3, one can only say that the Sonic team has found a very good narrative positioning for the project. By the way, I really like teams that can follow market narratives at any time; two other good examples are @SolvProtocol and @virtuals_io.

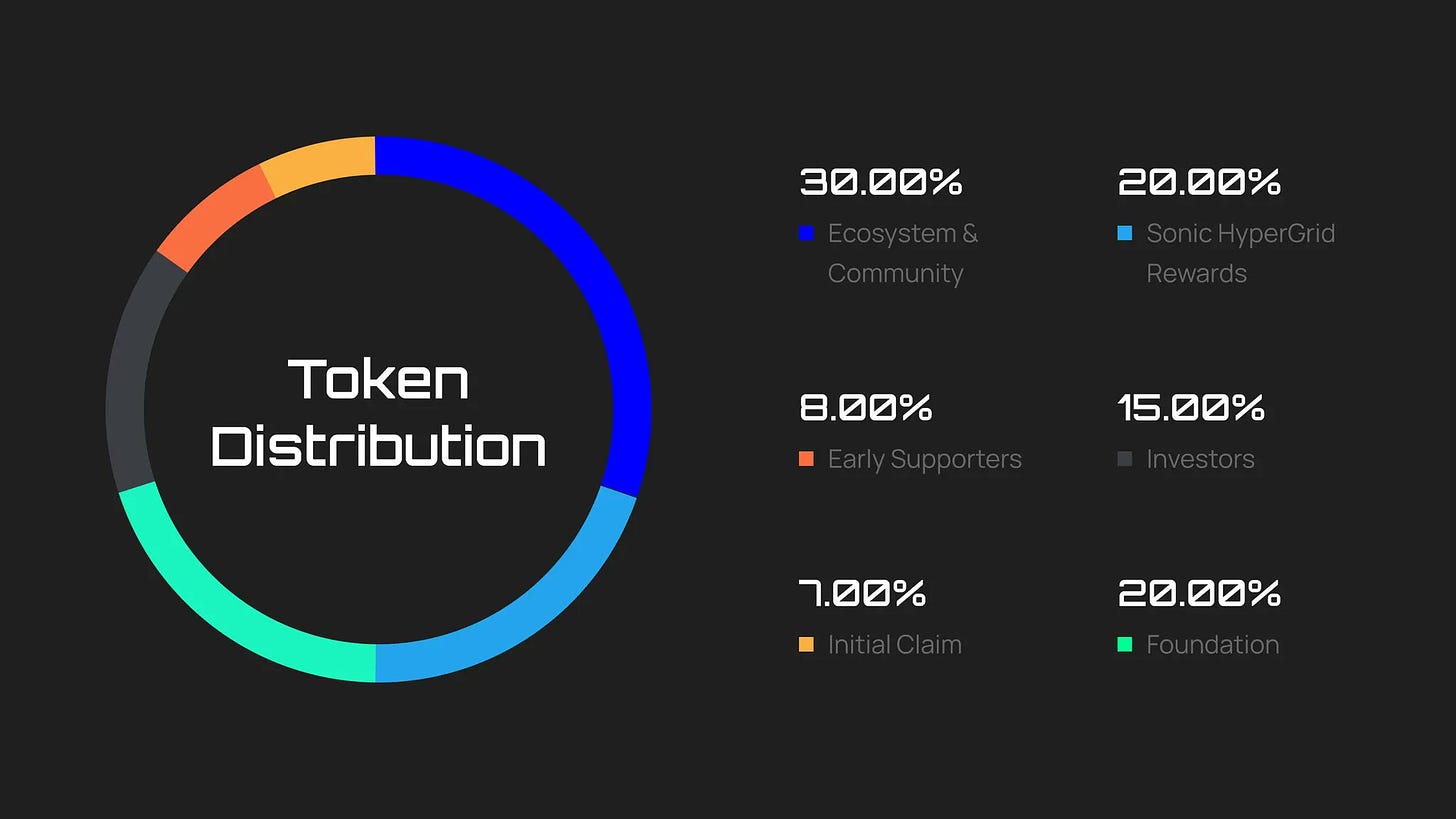

Finally, let's take a look at Sonic's Tokenomics.

The total supply of $SONIC is 2.4B, with an initial circulation of 15% of the total (7% will be used for airdrops at TGE), of which 57% of the tokens will be allocated to the community.

The utility of $SONIC is as follows (investors, the foundation, and the team are not allowed to stake their tokens before unlocking) ⬇️

https://x.com/SonicSVM/status/1874078075643900278

The TEG date for $SONIC is January 7, which is next Tuesday.

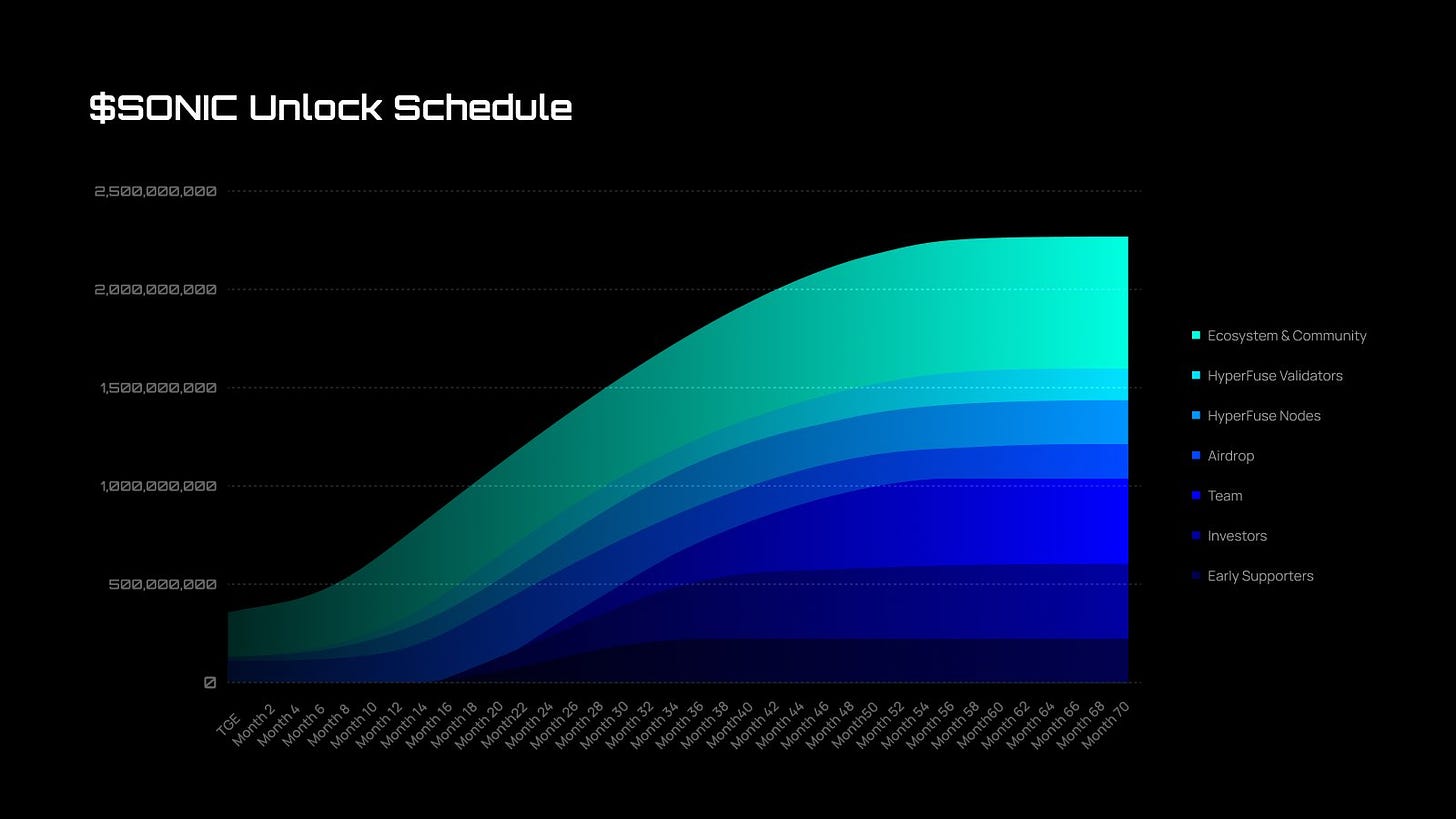

The inflation data for $SONIC is shown in the image below ⬇️

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。