Author: Frank, PANews

AI Agents have become a hot topic in on-chain trading, with the AI Agent sector rapidly evolving in the MEME field over just a month, from ai16z to Virtual, and then to Swarms. Faced with the continuously emerging AI Agent tokens, which ones can break through the competition, and which are merely fleeting concepts? There may be multiple angles to consider, but the flow of funds on-chain and changes in major players may still be the most important indicators.

PANews has taken the recently popular Swarms token as the main object of analysis, comparing it with the addresses of six high-market-cap AI Agent tokens, attempting to "carve a boat to seek a sword" and glean some insights. The data range for this analysis includes: the initial purchase and sale situations of the top 1000 holding addresses of the Swarms token (data as of January 6, 2025, 24:00), and the address overlap of six AI-related tokens with a market cap exceeding $100 million, including Fartcoin, GRIFFAIN, ZEREBRO, ai16z, arc, and Swarms (data as of January 7, 2025, 14:00), as well as analysis of internal trading records.

Some quietly lay the groundwork at low prices, while others follow the trend to enter

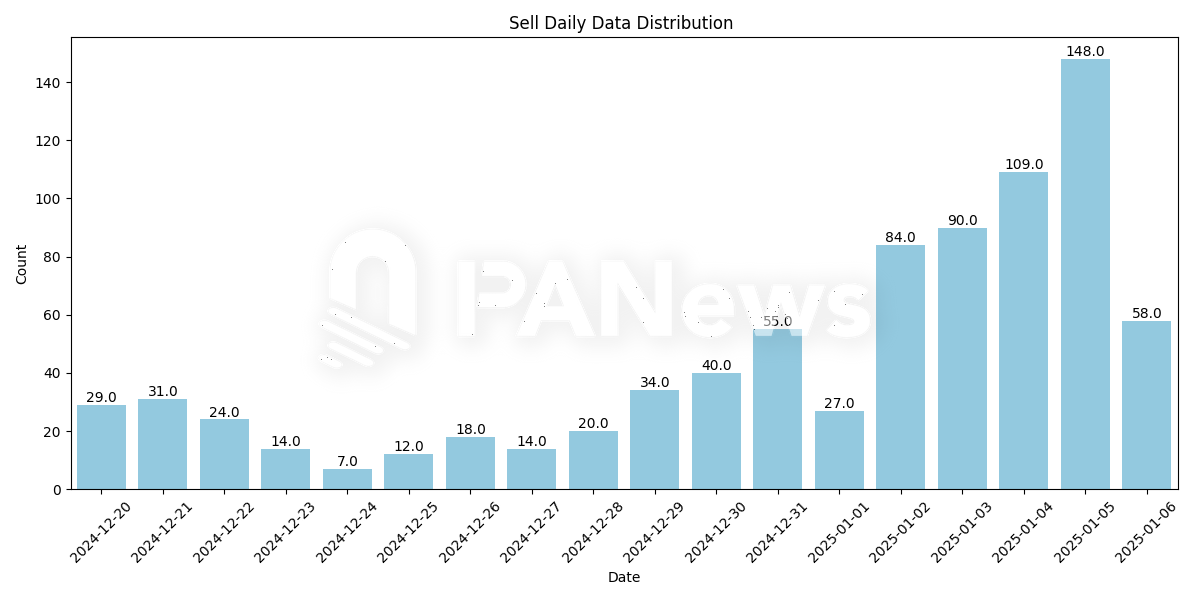

First, looking at the timeline of when major players entered the market, most of them began to enter after January 2, which was 12 days after the token's creation. From a timing perspective, many major players in Swarms only started buying after the Swarms ecosystem began to heat up, failing to complete early positioning.

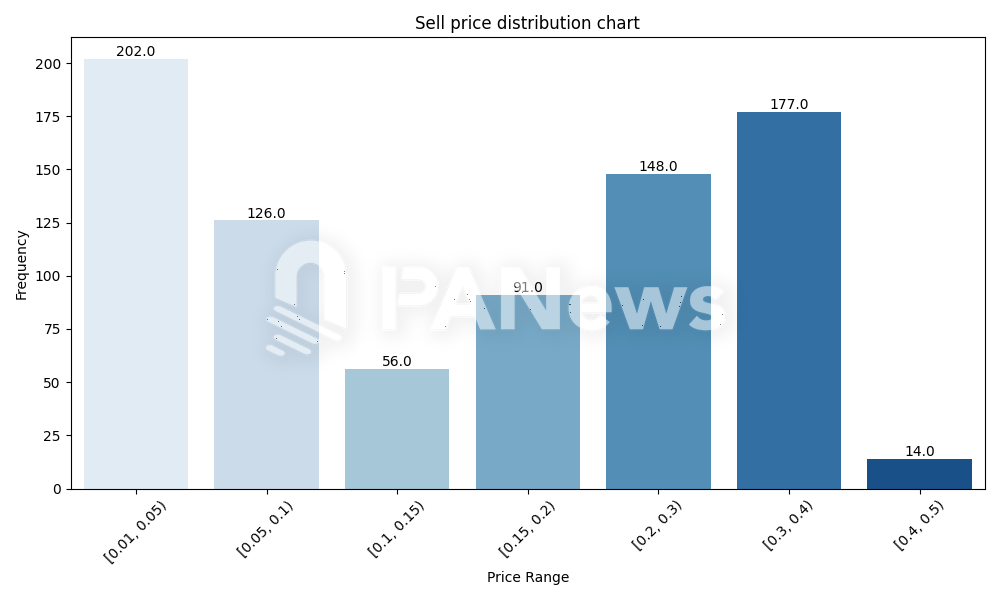

However, from the price curve of Swarms, if one had bought before December 27, the price would have remained below $0.02, with nearly a 30-fold increase from the current highest price of $0.6. Analyzing the initial purchase prices of these addresses, 202 addresses bought in the price range of $0.01 to $0.05, while the highest number of addresses bought in the range of $0.3 to $0.4.

The distribution of these two data points indicates that early investors in Swarms bought in batches at low prices during a period of price decline, and this buying was relatively dispersed, not concentrated in a single time frame. The advantage of this is that they could acquire tokens at a lower price. In contrast, another group of major players began to enter significantly after the discussion around Swarms heated up, but their holding prices do not have a significant competitive advantage.

This distribution of tokens may explain the seemingly large short-term fluctuations in Swarms. If early investors sell at high points, the new major players with higher costs may trigger sensitive nerves on both sides, leading to significant short-term drops.

However, looking at the distribution of tokens, the main tokens of Swarms are relatively dispersed. In the analysis of the top 1000 holding addresses, there are not many tokens sourced from the same address; most addresses' initial token sources are primarily from on-chain exchanges. Therefore, there are few instances of early major players acquiring large amounts of tokens and then dispersing them to multiple addresses.

Additionally, by comparing internal trading addresses, it was found that addresses that purchased on the internal market did not appear among the current top 1000 holding addresses. Thus, the early tokens of this token have essentially completed their rotation.

From the overall data, the average initial purchase price of the Swarms token is $0.17, and the average initial sale price is $0.23, with the average initial purchase amount per address reaching $37,600, and the average initial sale amount approximately $28,200. In comparing the buying and selling situations of individual addresses, the average initial selling price of these addresses is about 2.43 times the buying price.

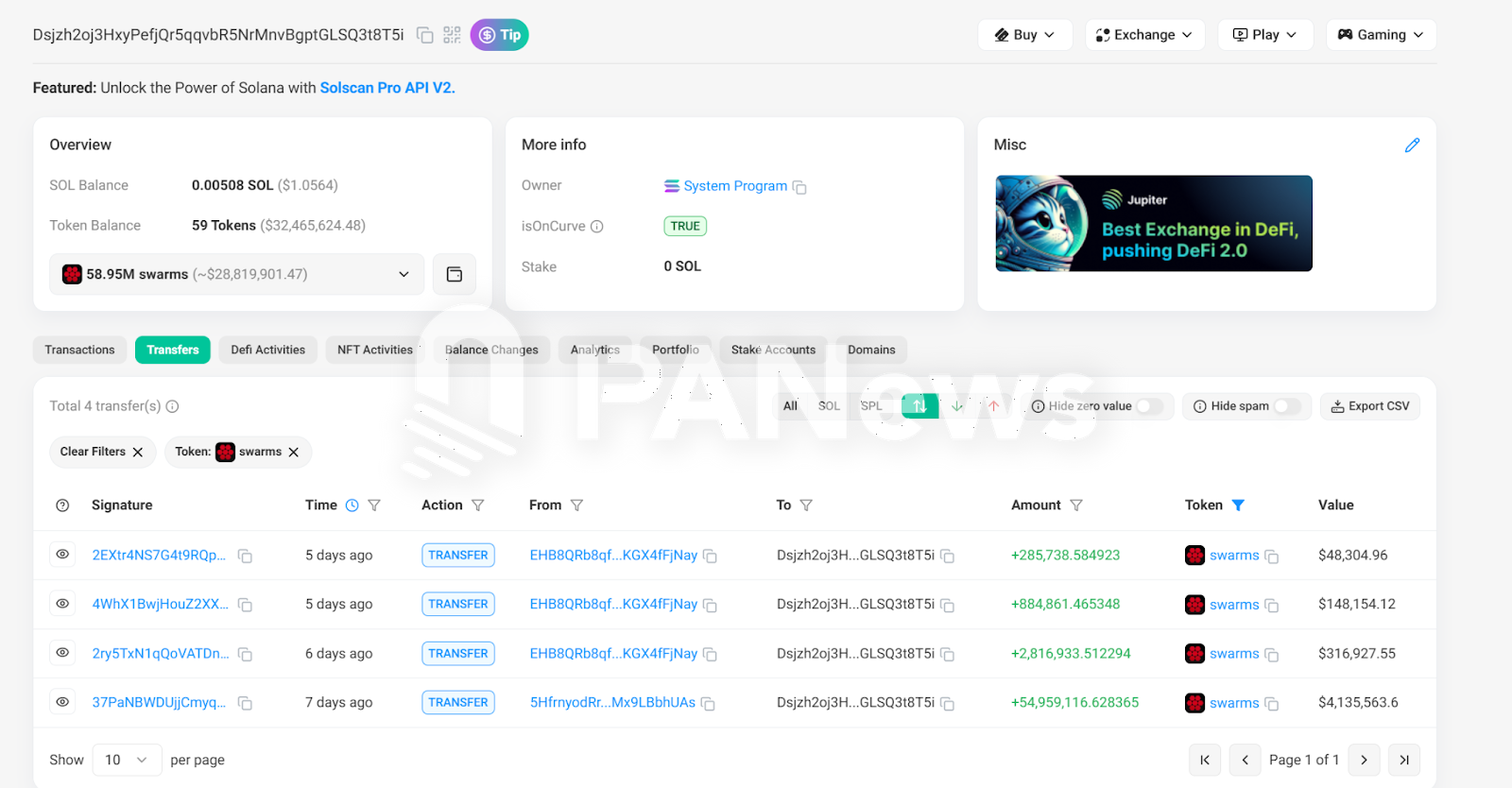

The highest major player has made $25 million in profit without selling

Compared to other MEME tokens, the aforementioned average initial purchase amount is significantly higher, primarily influenced by some major addresses. The address with the highest initial transfer amount is Dsjzh2oj3HxyPefjQr5qqvbR5NrMnvBgptGLSQ3t8T5i, which transferred approximately $4.13 million from another address on December 31, followed by additional transfers of about $500,000, with the current holding value at $27.33 million.

The address from which it transferred, 5HfrnyodRraAw63aRVPueD5Er4D1sRKMZBMx9LBbhUAs, began purchasing in large quantities as early as December 20 at 8:22 AM, continuously buying, spending a total of $1.89 million to acquire 54.95 million Swarms at an average price of about $0.034, currently yielding a profit of about $25.44 million.

Tracking shows that the earliest associated purchase from this address began at 7:13 AM (the opening time for Swarms was around December 20 at 6:45 AM). Notably, this address's associated funding address also began purchasing ai16z tokens as early as October 27, with a profit multiple of about 36 times.

Additionally, another address, 5NQTp9jHbzS4N9yKMWxwm8pPZW3RFSFPze3Edwss7iLe, transferred approximately $3.63 million worth of Swarms tokens on January 4. According to on-chain traces, this address also dispersed purchases through several addresses around January 2, ultimately consolidating the tokens into one address, which currently has a holding value of about $5.26 million.

Another address, H1zFMUjYLzJwcfgXEtwiJ2ykvxmBr7JW6afW29PkcEAe, also used a similar method, holding about $2.27 million, although the initial source of this address's tokens came from the Bitget exchange, followed by multiple on-chain purchases.

The total initial transfer amount for these three addresses reached approximately $10.53 million. Looking at the purchasing process, the initial strategy involved multiple addresses making dispersed purchases, and once the heat around Swarms increased, all tokens were consolidated into a few addresses, becoming smart money in the eyes of on-chain hunters.

27% of addresses purchase multiple AI Agents; who is driving AI Agents?

In addition to analyzing the addresses of the Swarms token, PANews also conducted a comparative analysis of the top 1000 holding addresses of Fartcoin, GRIFFAIN, ZEREBRO, ai16z, arc, and Swarms. The analysis revealed that among the 6000 addresses involved, 1647 addresses appeared repeatedly, meaning that about 27% of addresses purchased multiple AI Agent-related tokens, with ZEREBRO seemingly being the favorite token among AI major players, with 405 addresses purchasing this token. Next were arc (368 addresses) and ai16z (334 addresses).

Among these addresses, the one with the highest holdings is DJnHztNmw1H56uYm98PNu5eVZ5yhi9482rZ9zA22TUUz, which currently holds AI-themed tokens worth about $49.86 million, with approximately $42.7 million in ai16z alone. Moreover, this is not the entirety of this address's holdings; as early as a month ago, this address had already profited tens of millions of dollars by purchasing ZEREBRO, GRIFFAIN, and other tokens.

Additionally, 3xzTSh7KSFsnhzVvuGWXMmA3xaA89gCCM1MSS1Ga6ka6 also holds about $42.84 million in AI-related tokens, with an on-chain holding value exceeding $73 million. According to social media information, this address is likely the wallet address of the early AI Agent address Truth Terminal.

Furthermore, there are many similar addresses; among the 1647 major addresses, the total value of AI-related tokens held exceeds $1.58 billion, with about 29 addresses holding more than $10 million in AI tokens, totaling approximately $690 million.

Rather than saying that AI Agents may be the hottest trend in 2025, it is more accurate to say that AI Agents are essentially a better narrative for large capital investors.

Analyzing trading behavior outweighs tracking smart money addresses

As the analysis of on-chain data deepens, tracking smart money seems to have become a popular trend. However, from the perspective of major players, when laying out early positions, they do not want too many retail investors to enter the market and compete for low-priced tokens. Therefore, constantly changing wallets and making dispersed purchases have become basic operations for major players.

As a result, blindly chasing smart money may gradually become ineffective and could even lead to being maliciously harvested. However, in multiple analyses of the operations of holding major players, even with the use of new addresses and dispersed purchases, there are still management difficulties and issues with fund consolidation. Therefore, in most cases, major players still need to consolidate the funds from various wallets into one or a few wallet addresses for easier management, and they can stimulate more following users to enter the market through small purchases during peak periods. Secondly, to quickly collect tokens in the early stages, these early investors had to concentrate on making large purchases within a certain time frame. Although the amounts were relatively dispersed, this regular purchasing could still become a signal. After all, their investment amounts often range from hundreds of thousands to millions of dollars; without a certain level of operational determination, they generally would not make frenzied purchases.

In summary, for ordinary retail investors, if they insist on using on-chain tracking to chase smart money, it may be more effective to focus on on-chain behaviors rather than chasing smart money addresses. Of course, an important prerequisite is to think like major players about what kind of narrative will be a good story; otherwise, in the face of an endless stream of new tokens, blind chasing is no different from searching for a needle in a haystack.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。