Key Indicators: (December 30 4 PM -> January 6 4 PM Hong Kong Time)

- BTC against USD increased by 6.2% (93.5k USD -> 99.3k USD), ETH against USD increased by 7.4% (3.4k -> 3.65k USD)

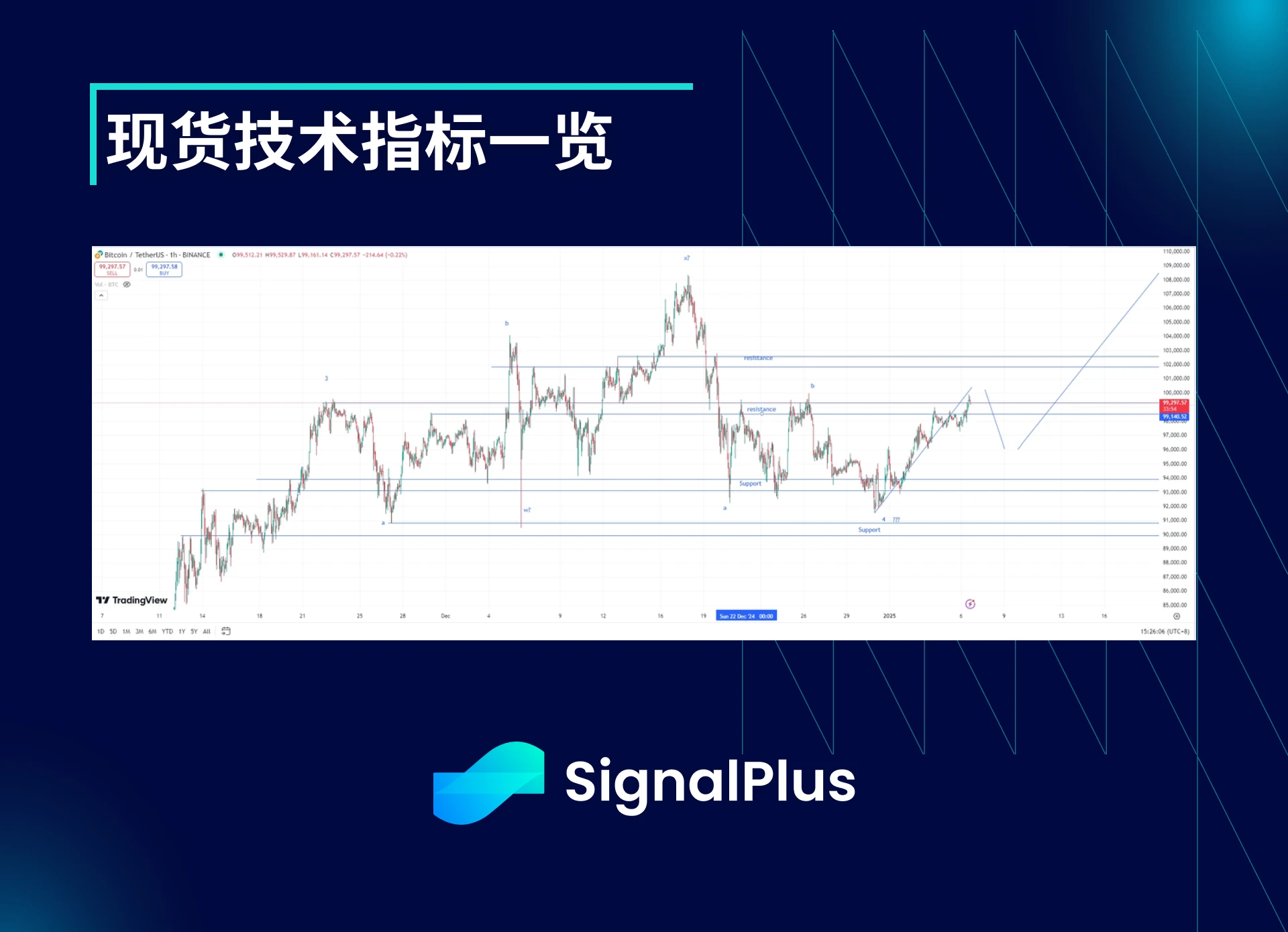

Spot Technical Indicators

At the end of the year, the coin price maintained the support level of 92k USD. As the new year began, we saw the market start to show a willingness to buy, with the coin price slightly rising towards the resistance level of 100k USD. This strongly suggests that the market is gearing up for the next upward movement and accumulating long positions during the pullback. We believe that in the long term, the coin price will range between 115-120k USD.

We believe that the short-term price peak will be at 100k USD or slightly above it, and we expect sellers to appear around that level. If there is a lack of follow-up buying, it may trigger a pullback to the range of 95-96k USD. However, if the price fully breaks through 100k USD, the next peak will appear at 102-103k USD, followed by 104-105k USD, and eventually reaching the previous high of 108.5k USD. On the downside, the initial support level is at 95-96k USD, and further declines could reach below 92k USD.

Market Themes

It was another turbulent holiday week. The cryptocurrency market once again dipped within a certain range, with BTC against USD breaking below 93k USD; ETH against USD breaking below 3.3k USD. However, the arrival of the new year has brought upward momentum to the market. It seems that the market is adjusting positions ahead of Trump's inauguration this month.

Among other assets, the "Trump trade" has also regained momentum. The US dollar is dominant in trading against G10/Asia, while the S&P 500 index (SPX) has started to rebound after a decline at the beginning of the year.

On the macro front, there is relatively little data this week until the non-farm payroll data is released on Friday. The market is particularly looking forward to this data, especially after the Fed's relatively hawkish stance in December caught the market off guard. If there are any unexpected downturns, the market may quickly reprice in preparation for faster rate cuts.

BTC Implied Volatility

Despite significant fluctuations in the coin price, the overall actual volatility has been continuously declining, further leading to a sustained decrease in implied volatility, especially for January expirations. Currently, the implied volatility for January expirations is already lower than the same period last week, despite the influx of trading related to Trump's inauguration and ETF rebalancing at the beginning of the year.

At the far end of the curve, implied volatility still shows resilient buying interest. This is because the market continues to digest the large demand that appeared in December, especially for expirations in February and March. Considering that a downward correction has already occurred for January expirations, we expect to see the implied volatility at the far end gradually return to normal.

BTC Skew/Kurtosis

With the market's liquidity fully restored and the market returning from the low price point at the end of the year with lower actual volatility, this week's skew shows a downward trend. If the market continues to rise slowly before the inauguration, we expect actual volatility to perform poorly, as the market distribution on the upside is relatively even. However, if we see the coin price sharply decline again, market players may actively participate in bets above the price.

For the same reasons mentioned above, kurtosis remains low. Demand for wingside has begun to decrease as the spot market has moved away from the potentially large slippage around 90k USD. At the same time, demand for single buy orders above has gradually decreased or shifted to bullish spreads, applying selling pressure on kurtosis. The low correlation between spot and skew has also dragged down the price of kurtosis.

You can use the SignalPlus trading indicator feature at t.signalplus.com for more real-time cryptocurrency information. If you want to receive our updates instantly, feel free to follow our Twitter account @SignalPlusCN, or join our WeChat group (add assistant WeChat: SignalPlus123), Telegram group, and Discord community to interact and communicate with more friends.

SignalPlus Official Website: https://www.signalplus.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。