Original Author | Arthur Hayes (Co-founder of BitMEX)

Compiled by | Odaily Planet Daily (@OdailyChina)

Translator | Azuma (@azuma_eth)

Editor's Note: This article is a new piece titled "Sasa" published this morning by BitMEX co-founder Arthur Hayes. In it, Arthur analyzes the potential actions of the Federal Reserve and the Treasury Department, as well as the impact of these actions on the overall dollar liquidity situation in the market. Arthur is generally optimistic about the first quarter's market, believing that the disappointment regarding the Trump team's policy shift can be overshadowed by a very positive dollar liquidity environment. However, he also predicts that the market will peak by the end of the first quarter and will not improve until the second half of the year. Arthur also mentions that his fund, Maelstrom, has purchased several DeSci concept coins such as BIO, VITA, ATH, GROW, PSY, CRYO, and NEURON, believing that the market will soon reprice DeSci.

Below is the original content by Arthur, compiled by Odaily Planet Daily. Due to Arthur's free-spirited writing style, there are significant sections in the text that are unrelated to the main content. To facilitate reader understanding, Odaily will make certain cuts during the compilation.

Near the ski resorts in Hokkaido, there grows a type of bamboo called "Sasa." This bamboo has thin stalks, resembling reeds, but it has sharp green leaves that can easily cut the skin if one is not careful. Therefore, skiing can be very dangerous if there is not enough snow covering the slopes.

This year, Hokkaido's snowfall has set a record for the past seventy years, so the ski resorts opened their doors at the end of December, rather than waiting until the first or second week of January as in previous years.

- Odaily Note: These two paragraphs are not entirely irrelevant; you will understand what Arthur is trying to express by the end.

In my previous article "Trump Truth," I predicted that the market had overly high expectations for the policy shifts following Trump's ascension, which would lead to disappointment. I still believe this is a potential negative factor that may weigh on the market in the short term, but at the same time, I must balance it with the positive effects of dollar liquidity. Currently, Bitcoin fluctuates with the changes in the dollar supply. The powers that be at the Federal Reserve and the U.S. Treasury determine the dollar supply in the global financial markets.

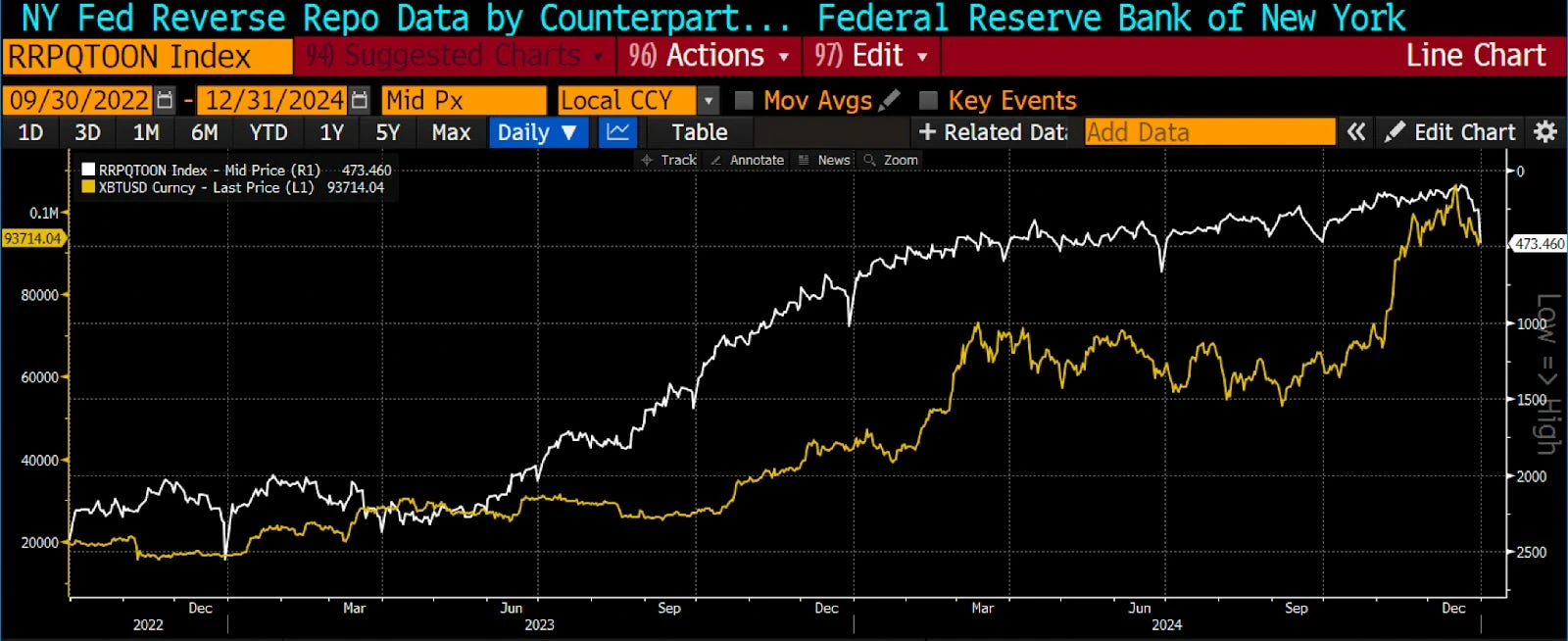

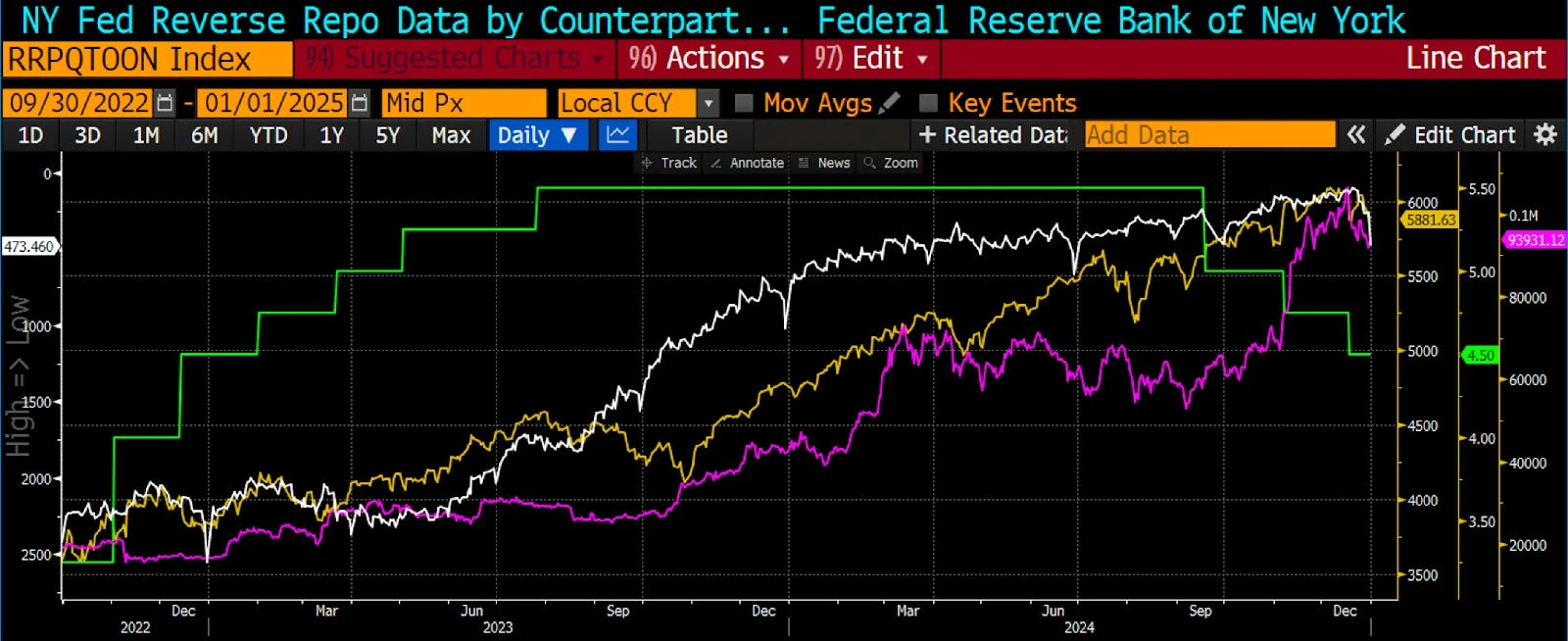

Bitcoin bottomed out in the third quarter of 2022 when the Federal Reserve's reverse repurchase mechanism (RRP) peaked. Under the direction of U.S. Treasury Secretary "Bad Gurl" Yellen (a nickname given by Arthur), the Treasury issued fewer long-term interest-bearing bonds and more short-term zero-coupon notes, pulling over $2 trillion out of the RRP. This injected liquidity into the global financial markets. As a result, cryptocurrencies and stocks (especially large tech stocks listed in the U.S.) plummeted. The above chart shows the comparison between Bitcoin (left, yellow) and RRP (right, white, inverted) — it can be seen that as RRP declines, Bitcoin rises almost in sync.

The question I want to answer is whether, at least in the first quarter of 2025, the positive supply of dollar liquidity can offset the market's disappointment regarding the intensity of Trump's policy shift. If the answer is yes, then one can trade with confidence, and Maelstrom should also amplify risks on the books.

I will first discuss the Federal Reserve, but this is a secondary factor in my analysis. After that, I will discuss how the U.S. Treasury will respond to the debt ceiling issue. If politicians hesitate to raise the debt ceiling, the Treasury will exhaust its General Account (TGA) at the Federal Reserve, injecting liquidity into the system and creating positive momentum for cryptocurrencies.

For brevity, I will not explain why the debits and credits of RRP and TGA have negative and positive impacts on dollar liquidity, respectively. If you haven't read my previous articles, please refer to "Teach Me Daddy" for a detailed mechanism.

Federal Reserve

The pace of the Federal Reserve's quantitative tightening (QT) policy remains at $60 billion per month, which means its balance sheet is shrinking. The forward guidance on the pace of QT has not changed. I will explain the reasons later in this article, but my prediction is that the market will peak in mid to late March, so from January to March, QT will remove $180 billion in liquidity.

RRP has fallen to nearly zero. To completely exhaust this mechanism, the Federal Reserve has belatedly changed the policy interest rate on reserve requirements. At the meeting on December 18, 2024, the Federal Reserve lowered the RRP rate by 0.3%, which is 0.05% higher than the reduction in the policy rate. This is to tie the RRP rate to the lower bound of the federal funds rate (FFR).

If you are curious why the Federal Reserve waited until RRP was nearly exhausted to align the rates with the lower bound of the FFR and reduce the attractiveness of deposits in this mechanism, I strongly recommend reading Zoltan Pozar's article "Cheating on Cinderella." The insight I gained from his article is that the Federal Reserve is exhausting all means to stimulate demand for U.S. Treasury issuance before stopping QE, once again granting U.S. commercial bank branches leverage ratio exemptions, and possibly resuming quantitative easing (QE), also known as the "printing press" coming back to work.

Currently, there are two pools of funds that will help control bond yields. For the Federal Reserve, it cannot allow the 10-year U.S. Treasury yield to exceed 5%, as this is the level at which volatility in the bond market erupts (MOVE index). As long as there is liquidity in RRP and TGA, the Federal Reserve does not need to make significant changes to monetary policy and acknowledges that fiscal dominance is at play. Fiscal dominance effectively confirms Powell's subordinate position to Yellen and her successor Scott (Scott Bessent, Trump's newly nominated Treasury Secretary). Sooner or later, I will give that Scott kid a nickname, but I haven't thought of a good one yet. If this affects his decision-making, making me look like a modern-day Scrooge McDuck (a classic animated character known as the richest duck in the world) by choosing dollar depreciation (relative to gold), I will give him a more flattering nickname.

Once the TGA is exhausted (positive dollar liquidity), and then replenished due to the debt ceiling being reached and raised (negative dollar liquidity), the Federal Reserve will have no means to prevent yields from rising uncontrollably since the decision to begin the easing cycle last September. However, this is not particularly important for the dollar liquidity situation in the first quarter; it is just a thought about how the Federal Reserve's policy might evolve later this year if yields continue to rise.

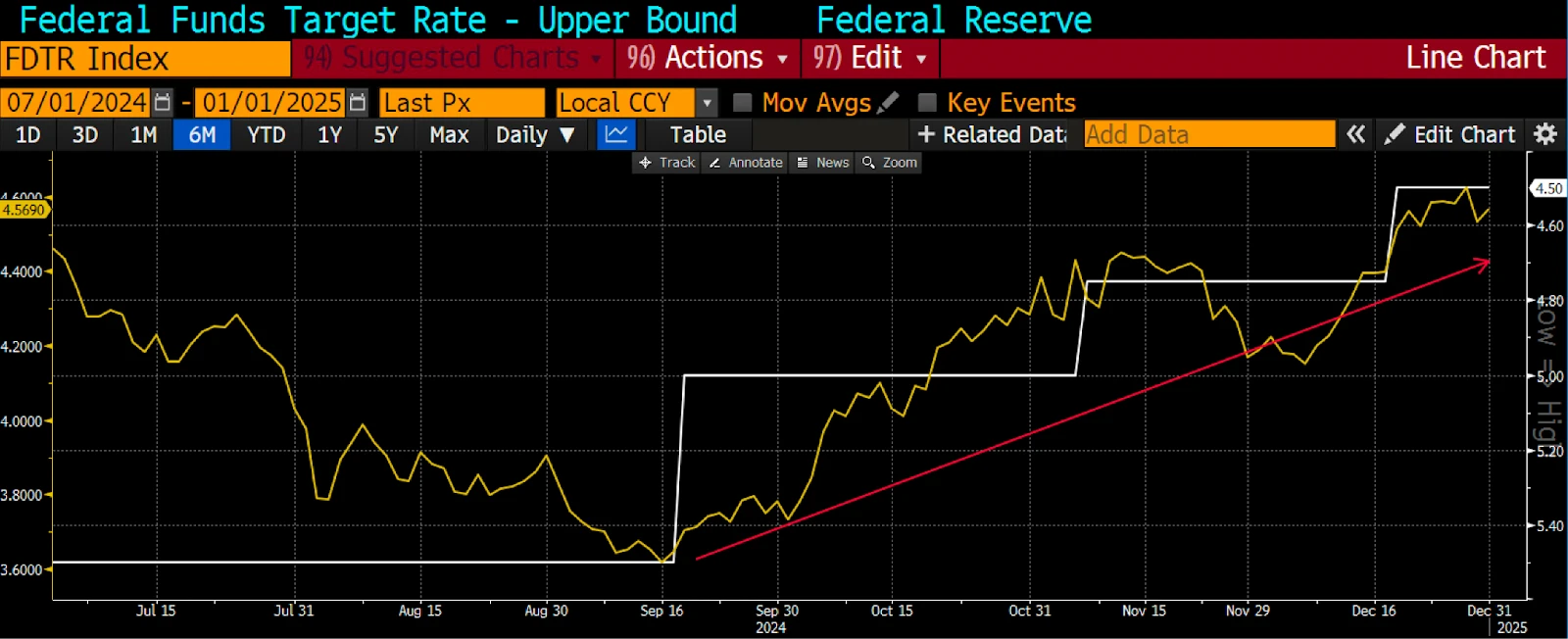

The comparison between the FFR upper limit (right, white, inverted) and the U.S. 10-year yield (left, yellow) clearly shows that as the Federal Reserve lowers rates while inflation is above its 2% target, bond yields have risen.

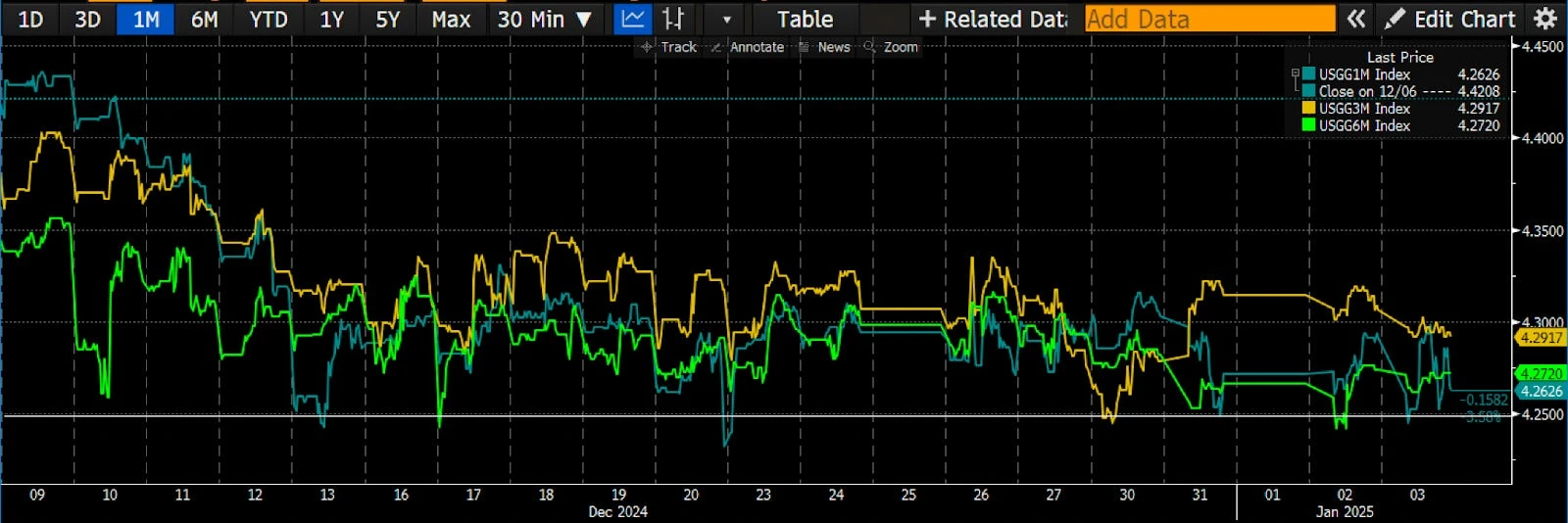

The real issue is the speed at which RRP has dropped from about $237 billion to zero. I expect that as money market funds (MMF) maximize their yields by withdrawing funds and purchasing higher-yielding Treasury bills (T-bills), it will approach zero at some point in the first quarter. In other words, this means that there will be a $237 billion injection of dollar liquidity in the first quarter.

After the RRP rate adjustment on December 18, the yields on Treasury bills with maturities of less than twelve months exceeded 4.25% (white), which is the lower bound of the federal funds rate.

Due to the quantitative easing policy, the Federal Reserve will remove $180 billion in liquidity, while the reduction in RRP balances due to its adjustment of the reward rate will encourage an additional injection of $237 billion in liquidity. This results in a total net injection of $57 billion in liquidity.

U.S. Treasury

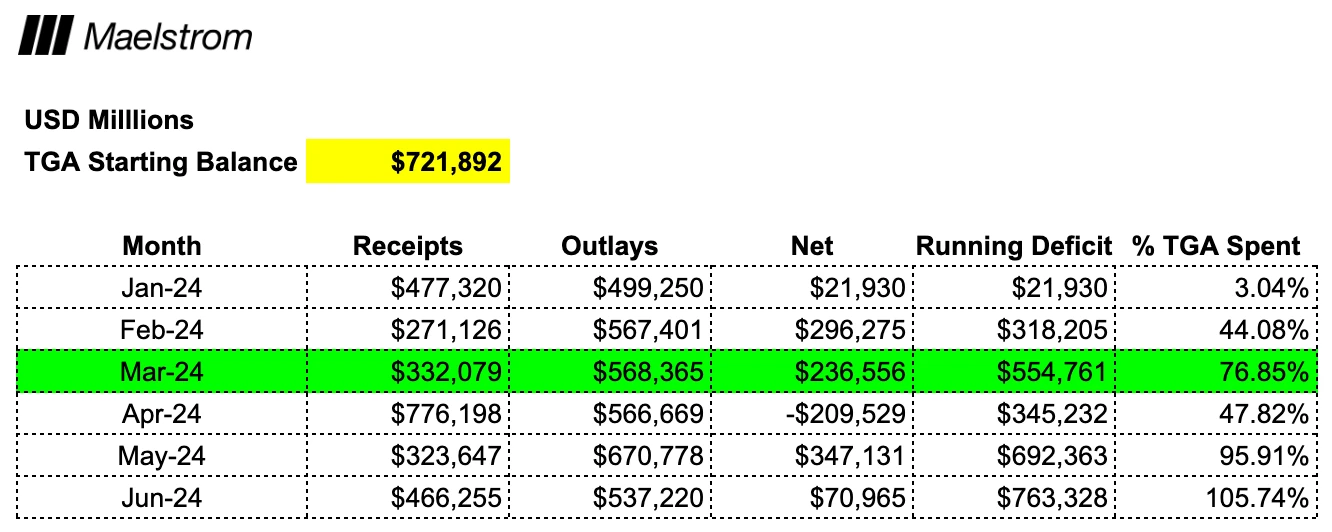

Yellen told the market that she expects the Treasury to take "extraordinary measures" to fund the U.S. government between January 14 and 23. The Treasury has two options for paying government bills. They can either issue debt (negative dollar liquidity) or spend funds from the Federal Reserve's checking account (positive dollar liquidity). Since the total debt will not increase until Congress raises the debt ceiling, the Treasury can only spend from its checking account (TGA). Currently, the TGA balance is $722 billion.

The first significant assumption is when politicians will agree to raise the debt ceiling. This will be the first test of whether Trump's support among Republican lawmakers is solid. It is important to note that Trump's governing advantage — the Republican majority over Democrats in the House and Senate — is very slim. There is a faction within the Republican Party that likes to stand tall and proud, claiming they care about reducing the size of government every time the debt ceiling issue is debated. They will insist on voting to raise the ceiling until they secure some benefits for their constituencies. Trump can no longer persuade them to veto the 2024 year-end spending bill without raising the debt ceiling; the Democrats, having taken a beating in the last election, are also not in the mood to help Trump release government funds to achieve his policy goals. Harris 2028 making a comeback? Does anyone want to see that plot? In fact, the next Democratic presidential nominee will likely be Gavin Newsom. Therefore, to get the job done, Trump would wisely exclude the debt ceiling issue from any legislative proposals until absolutely necessary.

When not raising the debt ceiling leads to a technical default on maturing bonds or a complete government shutdown, it becomes necessary to raise the debt ceiling. According to the Treasury's published 2024 revenue and expenditure situation, I estimate that this situation will occur between May and June of this year, when the TGA balance will be completely exhausted.

Understanding the speed and intensity at which the TGA provides funding to the government helps predict when a reduction in funding will have the greatest effect. The market is forward-looking, and given that this is all public data, and we know how the Treasury will operate when the account is close to depletion and cannot increase the total U.S. debt, the market will look for new sources of dollar liquidity. With 76% exhausted, March seems to be a time when the market will start asking, "What happens next?"

If we combine the dollar liquidity from the Federal Reserve and the Treasury by the end of the first quarter, the total will reach $612 billion.

What happens next?

Once default and shutdown are imminent, an agreement will be reached at the last minute to raise the debt ceiling. At that point, the Treasury will again be free to net borrow and must refill the TGA. This has a negative impact on dollar liquidity.

Another important date in the second quarter is April 15, which is the tax deadline. From the table above, it is clear that the government's financial situation improves significantly in April, which is also negative for dollar liquidity.

If the factors affecting the TGA balance are the only determinants of cryptocurrency prices, then I expect a local peak at the end of the first quarter. In 2024, Bitcoin reached a local peak of about $73,000 in mid-March, then began to consolidate and started a multi-month decline before the April 15 tax deadline.

Trading Strategy

The problem with this analysis is that it assumes dollar liquidity is the most critical marginal driver of total global fiat liquidity. Here are some other influencing factors:

Will China accelerate or slow down the creation of renminbi credit?

Will the Bank of Japan begin to raise its policy interest rates, causing the dollar to appreciate against the yen and unwinding leveraged arbitrage trades?

Will Trump and Scott significantly devalue the dollar against gold or other major fiat currencies overnight?

How efficient is the Trump team in rapidly reducing government spending and turning bills into law?

These significant macroeconomic questions cannot be known in advance, but I am confident in the mathematical calculations of RRP and TGA balances over time. My confidence is further supported by the market's performance since September 2022: the increase in dollar liquidity due to the decline in RRP balances directly led to the rise of cryptocurrencies and stocks, despite the Federal Reserve and other central banks raising interest rates at the fastest pace since 1980.

FFR upper limit (right, green) vs. Bitcoin (right, magenta) vs. S&P 500 index (right, yellow) vs. RRP (left, white, inverted). Bitcoin and stocks rebounded from their lows in September 2022, with the decline in RRP injecting over $2 trillion in liquidity into the global market. This was a deliberate policy choice by Yellen to issue more Treasuries to consume reserves. Powell's actions to tighten financial conditions in the fight against inflation were completely offset.

Considering all these factors, I believe I have answered the initial question posed. That is, the market's disappointment regarding the effects of the Trump team's policy shift can be overshadowed by a very positive dollar liquidity environment, potentially increasing liquidity by up to $612 billion in the first quarter. As in previous years, we will sell as expected at the end of the first quarter, relaxing on the beach, by the sea, or at a ski resort in the Southern Hemisphere, waiting for the re-emergence of a positive fiat liquidity environment in the third quarter.

As the Chief Investment Officer of Maelstrom, I will encourage the fund's adventurers to set their risk to DEGEN (extreme). The first step in this regard is our decision to enter the thriving DeSci space. We like undervalued shitcoins and have purchased BIO, VITA, ATH, GROW, PSY, CRYO, and NEURON. For more on why Maelstrom believes the DeSci narrative is poised for a higher revaluation, read "Degen DeSci." If things unfold as I have described, I will reduce my positions sometime in March and then start to enjoy myself.

Of course, anything can happen, but overall I am bullish. Does this mean my views from the previous article have changed? Somewhat. Perhaps the sell-off due to disappointment in the effects of Trump's policy shift has already occurred at the end of 2024, rather than in mid-January 2025. Does this mean I am sometimes a poor predictor? Yes, but at least I will absorb new information and perspectives and adjust in a timely manner before significant losses or missed opportunities occur.

This is why the investment game is so appealing. Imagine if you could hole-in-one every time you played golf, hit a three-pointer from half-court every time you played basketball, and clear the table every time you played billiards. What would life even mean? QTMD, both failure and success are necessary so that you can derive joy from success, but I hope that overall success can outweigh failure.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。