Key Points

● The total market capitalization of cryptocurrencies is $3.65 trillion, up from $3.42 trillion last week, with a weekly increase of 6.7%. As of January 6, 2025, the cumulative net inflow for the U.S. Bitcoin spot ETF is approximately $38.9 billion, with a net inflow of $240 million this week; the cumulative net inflow for the U.S. Ethereum spot ETF is approximately $2.64 billion, with a net outflow of $80 million this week.

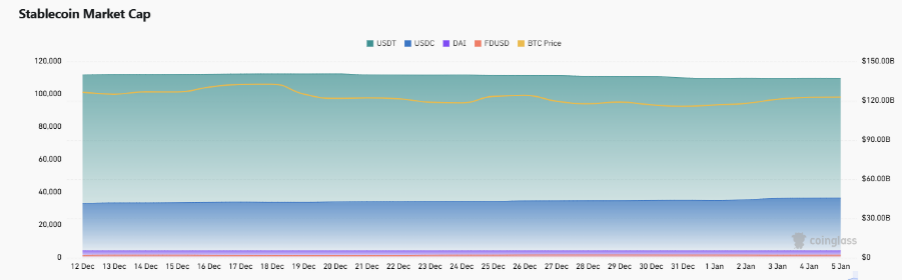

● The total market capitalization of stablecoins is $212 billion, accounting for 5.82% of the total cryptocurrency market capitalization, with a weekly increase of 0.47%. Among them, USDT has a market capitalization of $137.2 billion, accounting for 64.7% of the total stablecoin market capitalization; followed by USDC with a market capitalization of $45.6 billion, accounting for 21.5%; and DAI with a market capitalization of $5.4 billion, accounting for 2.5%.

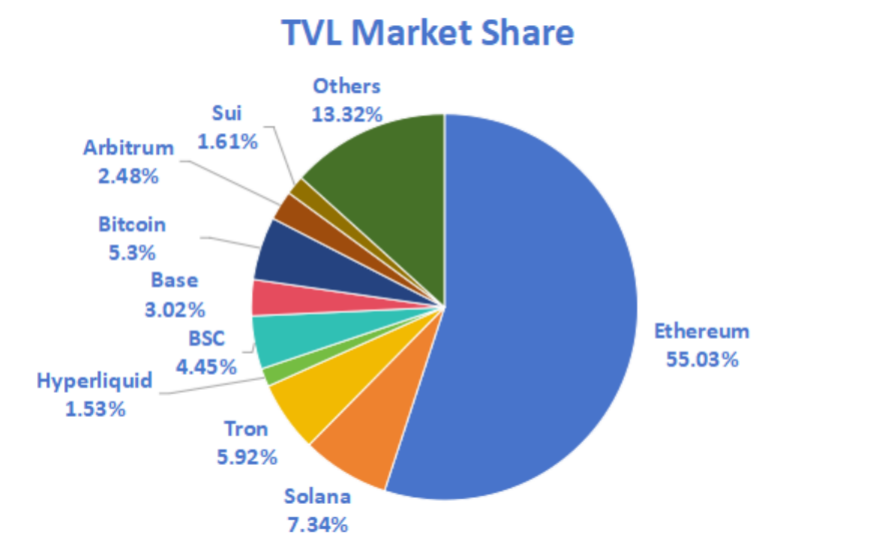

● This week, the total TVL (Total Value Locked) in DeFi is $128.6 billion, with a weekly increase of 5.8%. By public chain classification, the top three public chains by TVL are Ethereum with a share of 55.03%; Solana with a share of 7.34%; and Tron with a share of 5.92%. The overall share remains stable, with Ethereum still being the leader in the DeFi space.

● From on-chain data, this week, among Layer 1 public chains, daily transaction volumes are generally on the rise except for BNB and SUI, with BNB showing the most significant decline of 47.6% compared to last week. In terms of transaction fees, ETH transaction fees have increased the most, rising by 71% compared to last week. In terms of daily active addresses, the overall trend is more active, with SUI showing the most significant increase of 22%. The total TVL of Ethereum Layer 2 has reached $50.68 billion, with an overall increase of 7.9% compared to last week. Arbitrum and Base occupy the top positions with market shares of 38.13% and 26.2%, respectively.

● Innovative projects to watch: Beacon Protocol: Beacon opens new private data sources to artificial intelligence while ensuring privacy, redistributing incentives, and establishing a sustainable data economy; 0LiqLend: 0LiqLend is a peer-to-peer yield market that provides lenders with optimal yield strategies; Ape Pro: Ape Pro is Solana's Memecoin terminal, supported by Jupiter Exchange, with a trading fee of only 0.5%.

Table of Contents

1. Total Cryptocurrency Market Capitalization / Bitcoin Market Capitalization Ratio 3

3. ETF Inflow and Outflow Data 5

4. ETH/BTC and ETH/USD Exchange Rates 6

5. Decentralized Finance (DeFi) 7

7. Stablecoin Market Capitalization and Issuance 12

II. This Week's Hot Money Trends 14

1. Top Five VC Coins and Meme Coins by Weekly Increase 14

1. Major Industry Events This Week 16

2. Major Upcoming Events Next Week 17

3. Important Financing and Investment from Last Week

Table of Contents

1. Total Cryptocurrency Market Capitalization / Bitcoin Market Capitalization Ratio 3

3. ETF Inflow and Outflow Data 5

4. ETH/BTC and ETH/USD Exchange Rates 6

5. Decentralized Finance (DeFi) 7

7. Stablecoin Market Capitalization and Issuance 12

II. This Week's Hot Money Trends 14

1. Top Five VC Coins and Meme Coins by Weekly Increase 14

1. Major Industry Events This Week 16

2. Major Upcoming Events Next Week 17

3. Important Financing and Investment from Last Week 17

I. Market Overview

1. Total Cryptocurrency Market Capitalization / Bitcoin Market Capitalization Ratio

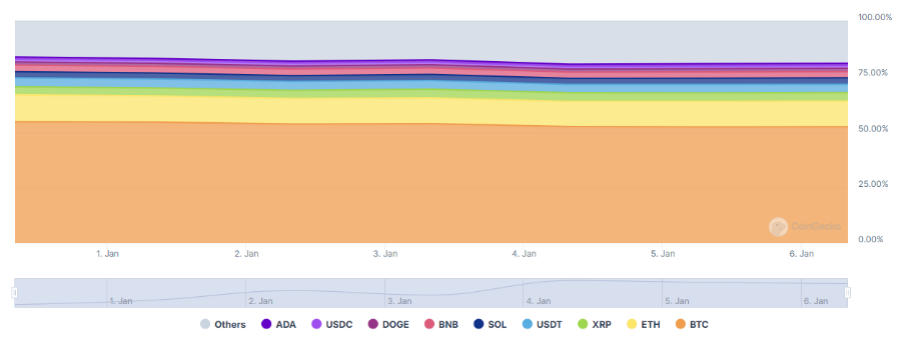

The total market capitalization of cryptocurrencies is $3.65 trillion, up from $3.42 trillion last week, with a weekly increase of 6.7%.

Data Source: cryptorank

As of the time of writing, the market capitalization of Bitcoin (BTC) is $1.94 trillion, accounting for 53.22% of the total cryptocurrency market capitalization. Meanwhile, the market capitalization of stablecoins is $212 billion, accounting for 5.82% of the total cryptocurrency market capitalization.

Data Source: coingeck

2. Fear Index

The cryptocurrency fear index is 76, indicating greed.

Data Source: coinglass

3. ETF Inflow and Outflow Data

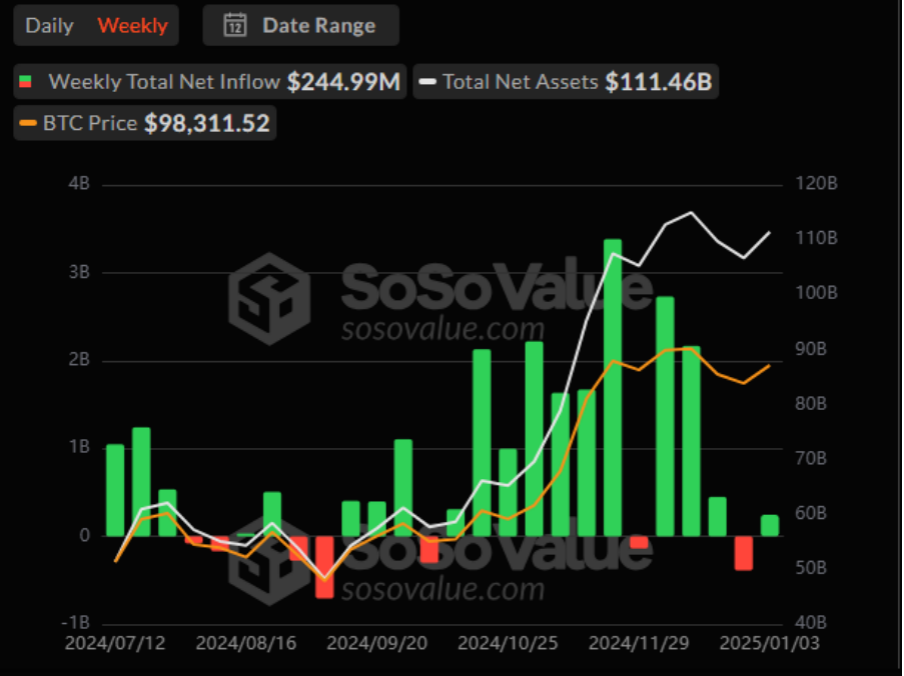

As of January 6, 2025, the cumulative net inflow for the U.S. Bitcoin spot ETF is approximately $38.9 billion, with a net inflow of $240 million this week; the cumulative net inflow for the U.S. Ethereum spot ETF is approximately $2.64 billion, with a net outflow of $38 million this week.

Data Source: sosovalue

4. ETH/BTC and ETH/USD Exchange Rates

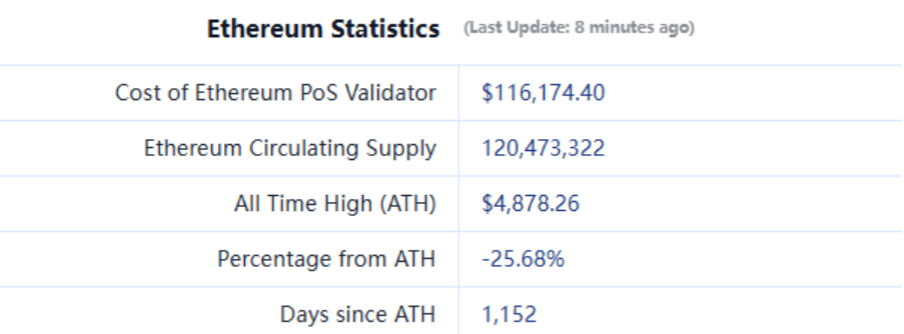

ETHUSD: Current price $3,627, historical highest price $4,878, down approximately 25.64% from the highest price.

ETHBTC: Currently at 0.036935, historical highest at 0.1238.

Data Source: ratiogang

5. Decentralized Finance (DeFi)

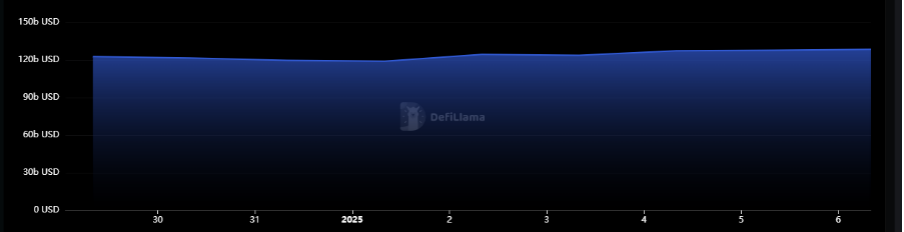

According to DeFiLlama, the total TVL in DeFi this week is $128.6 billion, with a weekly increase of 5.8%.

Data Source: defillama

By public chain classification, the top three public chains by TVL are Ethereum with a share of 55.03%; Solana with a share of 7.34%; and Tron with a share of 5.92%. The overall share remains stable, with Ethereum still being the leader in the DeFi space.

Data Source: CoinW Research Institute, defillama

Data as of January 6, 2025

6. On-Chain Data

Layer 1 Related Data

Mainly analyzing the current data of major Layer 1 chains including ETH, SOL, BNB, TON, SUI, and APT based on daily transaction volume, daily active addresses, and transaction fees.

Data Source: CoinW Research Institute, defillama, Nansen

Data as of January 6, 2025

● Daily Transaction Volume and Transaction Fees: Daily transaction volume and transaction fees are core indicators of public chain activity and user experience. In daily transaction volume, this week, all chains except BNB and SUI are on an upward trend, with BNB showing the most significant decline of 47.6% compared to last week. In terms of transaction fees, ETH transaction fees have increased the most, rising by 71% compared to last week.

● Daily Active Addresses and TVL: Daily active addresses reflect the ecological participation and user stickiness of public chains, while TVL reflects user trust in the platform. In terms of daily active addresses, the overall trend is more active, with SUI showing the most significant increase of 22%. In terms of TVL, ETH remains a leader among public chains.

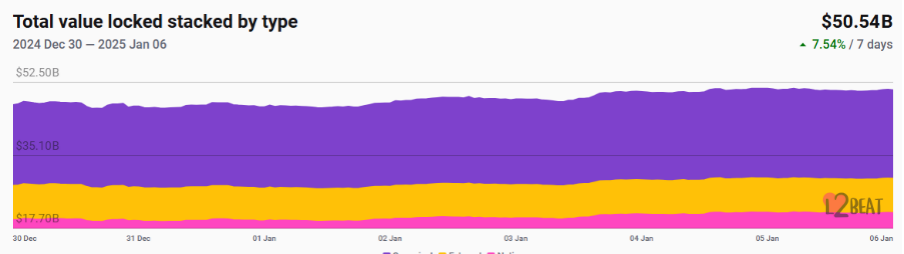

Layer 2 Related Data

According to L2Beat data, the total TVL of Ethereum Layer 2 has reached $50.68 billion, with an overall increase of 7.9% compared to last week.

Data Source: L2Beat

Data as of January 6, 2025

● Arbitrum and Base occupy the top positions with market shares of 38.13% and 26.2%, respectively.

Data Source: footprint

Data as of January 6, 2025

7. Stablecoin Market Capitalization and Issuance

According to Coinglass data, the total market capitalization of stablecoins is currently $212 billion, setting a new historical high, with a weekly increase of 0.47%. Among them, USDT has a market capitalization of $137.2 billion, accounting for 64.7% of the total stablecoin market capitalization; followed by USDC with a market capitalization of $45.6 billion, accounting for 21.5%; and DAI with a market capitalization of $5.4 billion, accounting for 2.5%.

Data Source: CoinW Research Institute, Coinglass

Data as of January 6, 2025

According to Whale Alert data, this week, the USDC treasury has issued a total of 1.85 billion USDC, representing a 70% increase in the total issuance of stablecoins compared to last week.

Data Source: Whale Alert

Data as of January 6, 2025

II. This Week's Hot Money Trends

1. Top Five VC Coins and Meme Coins by Weekly Increase

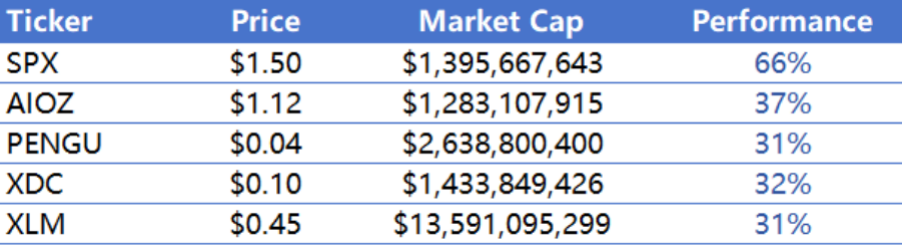

The top five VC coins by increase over the past week

Data Source: CoinW Research Institute, coinmarketcap

Data as of January 6, 2025

The top five Meme coins by increase over the past week

Data Source: CoinW Research Institute, coinmarketcap

Data as of January 6, 2025

2. New Project Insights

● Beacon Protocol: Beacon opens new private data sources to artificial intelligence while ensuring privacy, redistributing incentives, and establishing a sustainable data economy. By introducing on-chain orchestration control to off-chain private data, the Beacon protocol will usher in a new era of secure and fair use of private data for artificial intelligence.

● 0LiqLend: 0LiqLend is a peer-to-peer yield market that provides lenders with optimal yield strategies.

● Ape Pro: Ape Pro is Solana's Memecoin terminal, supported by Jupiter Exchange, with a trading fee of only 0.5%.

III. Industry News

1. Major Industry Events This Week

● Nimble released its Q1 roadmap, focusing on Agent development and token launch. The composable AI protocol NimbleNetwork has published its Q1 2025 roadmap, which includes: Agent Launchpad, focusing on Agent growth, and token launch.

● DWF Labs released a report stating that the Memecoin market has grown from $2 billion to $12 billion by 2024, indicating that this is not a fleeting phenomenon but the emergence of a new asset class. This growth reflects the market's recognition of social capital as a legitimate source of value in the digital age.

● Game publisher Xterio announced its token economic model, with a total supply of 1 billion XTER tokens and an initial circulation of 112.5 million tokens, with the TGE scheduled for January 8. Among them, community allocation is 28%, with 20 million tokens fully unlocked at TGE; ecosystem allocation is 26%, with 20 million tokens fully unlocked at TGE; investor allocation is 15%; team allocation is 12%; 9% of tokens are allocated for marketing, with 15 million tokens fully unlocked at TGE; 4.25% of tokens are allocated to the treasury, and 5.75% of tokens are used to provide liquidity and staking during TEG. The initial circulation of XTER is 112.5 million tokens.

● The 3A blockchain game Seraph Foundation officially launched its TGE on January 6, 2025, along with the S1 Genesis Season. As a blockchain game that integrates blockchain and AI technology, Seraph aims to lead Web3 gaming into a new era. Additionally, the official stated that detailed information about the Seraph token economic model will be announced in subsequent announcements.

● BounceBit announced the launch of RWA trading features supporting tokenized securities on the BounceClub Quanto platform, with the first batch of assets including MSTR (MicroStrategy), COIN (Coinbase), and BB (BlackBerry). Users can use BB tokens as collateral for up to 200x leverage trading.

2. Major Upcoming Events Next Week

● The Synthetix LP incentive program on Base will continue until January 7, targeting liquidity providers (LP) on the Base chain, with rewards including 80,000 SNX and 100,000 USDC.

● The Wavedrop 2 event of the re-staking protocol Swell Network has ended, and claims will be open until January 10.

● Game infrastructure and AI game studio Xterio officially announced that its Token Generation Event (TGE) is scheduled to start on January 8, 2025. The official stated that this will open a new era that integrates AI, gaming, and community.

● Tokens SONIC from @SonicSVM, WANDER from blockchain game @WanderCorpo, XTER from @XterioGames, and VIBE from @VibrantXFinance will launch their TGE this week.

● The @unichain mainnet plans to enable permissionless proof-of-failure functionality on January 6, with the mainnet set to launch in the first quarter.

3. Important Financing and Investment from Last Week

● AlloyX, Series A, raised $10 million, with investors including Solomon Fund, Arbitrum, Offchain Labs, and others. AlloyX is a DeFi protocol that aggregates tokenized credit, bringing liquidity, composability, and efficiency to real-world assets (RWA). AlloyX enables protocols, decentralized autonomous organizations (DAOs), and institutional investors to easily and conveniently formulate diversified investment strategies in RWA. (December 30, 2024)

● Fold, Debt Financing, raised $20 million, with investors including ATW Partners and others. Fold is a payment application that allows users to earn Bitcoin. Users can earn Bitcoin through everyday shopping by using the Fold Visa debit card and purchasing gift cards from the Fold Store. (January 2, 2025)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。