Organized by: Fairy, ChainCatcher

Important News:

- “National Data Infrastructure Construction Guidelines”: Building a Trustworthy Data Circulation System Using Blockchain, Encryption Technology, and Smart Contracts

- Binance Alpha Adds FREYA, pippin, and OPUS

- Metaplanet Plans to Increase BTC Holdings to 10,000 by 2025

- Ripple CEO: 75% of Ripple Labs' Job Vacancies Are Currently in the U.S., “Trump Effect” Has Made Cryptocurrency Great Again

- Data: Vitalik Sold DOG, DINU, and Other MEME Tokens Today for $139,000

“What Important Events Happened in the Last 24 Hours”

Data: Vitalik Sold DOG, DINU, and Other MEME Tokens Today for $139,000

According to Lookonchain monitoring, Vitalik sold some memecoins he received for free today, totaling $139,000 in revenue. He sold 340 billion $DOG for 5.2 $ETH (worth $19,000), 5.048 billion $ESTEE for 116,307 $USDC, and 100 trillion $DINU for 4,181 $USDC.

“National Data Infrastructure Construction Guidelines”: Building a Trustworthy Data Circulation System Using Blockchain, Encryption Technology, and Smart Contracts

According to the “National Data Infrastructure Construction Guidelines” released by the National Development and Reform Commission, the Data Bureau, and the Ministry of Industry and Information Technology, the document clearly proposes using blockchain technology, encryption technology, and smart contracts to build a trustworthy data circulation system. The guidelines encourage industries and localities to explore blockchain networks and privacy-preserving computing platforms, enhance trust and security in the data circulation process, promote the construction of a national integrated distributed data directory and digital identity system, and strengthen the traceability and trustworthiness of data asset certificates. The planning goal is to achieve a scalable trustworthy data circulation pattern covering large and medium-sized cities in the coming years.

Binance Alpha Adds FREYA, pippin, and OPUS

Binance Alpha announced a new batch of project listings, including: FREYA, pippin, and OPUS.

Data: 6 Hong Kong Virtual Asset ETFs Had a Trading Volume of Approximately HKD 105 Million Today

According to Hong Kong stock market data, as of the market close, the trading volume of 6 Hong Kong virtual asset ETFs today was approximately HKD 105 million.

Among them:

The trading volume of Huaxia Bitcoin ETF (3042.HK) was HKD 68.84 million;

The trading volume of Huaxia Ethereum ETF (3046.HK) was HKD 10.32 million;

The trading volume of Harvest Bitcoin ETF (3439.HK) was HKD 11.85 million;

The trading volume of Harvest Ethereum ETF (3179.HK) was HKD 2 million;

The trading volume of Bosera HashKey Bitcoin ETF (3008.HK) was HKD 10.85 million;

The trading volume of Bosera HashKey Ethereum ETF (3009.HK) was HKD 810,000.

Binance Launches Third Phase of Megadrop Project Solv Protocol (SOLV)

Binance launched the third phase of the Megadrop project, the Bitcoin staking protocol Solv Protocol (SOLV). Binance will list Solv Protocol (SOLV) at 18:00 Beijing time on January 17 and open trading pairs SOLV/USDT, SOLV/BNB, SOLV/FDUSD, and SOLV/TRY. Seed tags will be applied to SOLV.

Bithumb Adds FIL/KRW Trading Pair

According to official news, Bithumb has added a trading pair for Filecoin (FIL) against the Korean Won.

Metaplanet Plans to Increase BTC Holdings to 10,000 by 2025

According to Cointelegraph, Japanese listed company Metaplanet announced plans to expand its Bitcoin holdings to 10,000 by 2025. CEO Simon Gerovich stated on January 5 that the company will use the most value-added capital market tools to achieve this goal. Currently, the company holds 1,762 Bitcoins through 19 purchases, valued at approximately $173.4 million.

As Asia's largest corporate Bitcoin holder, Metaplanet ranks 15th globally in Bitcoin holdings among publicly listed companies. The company plans to increase its holdings through various means, including loans, equity, and convertible bonds. The last purchase was on December 23, when it acquired 619.7 Bitcoins, accounting for over 35% of its total holdings, with an average purchase price of $77,196. Gerovich stated that if the U.S. establishes a strategic Bitcoin reserve under the new government, it could trigger a global chain reaction, with Japan and other Asian countries likely to follow.

Aave Governance Proposal Aims to Peg Ethena's USDe to USDT, Raising Community Concerns Over Potential Conflicts of Interest

According to Protos, a recent proposal in the Aave governance forum suggested pegging Ethena's USDe to USDT at a 1:1 ratio, raising community concerns over potential conflicts of interest. The proposal recommends replacing the current Chainlink USDe/USD oracle with the USDT price to avoid bad debt caused by liquidations.

Notably, the two authors of the proposal, ChaosLabs and LlamaRisk, have collaborated with Ethena. MakerDAO community member ImperiumPaper expressed concerns, likening it to "a real estate agent representing both the buyer and seller."

Critics pointed out that USDT is fully backed by off-chain assets, while USDe relies on a delta-neutral strategy of ETH long and short positions, facing risks of negative funding rates when market sentiment shifts. Meanwhile, Ethena founder Guy Young denied any conflict of interest, emphasizing that the company has established a risk committee to ensure external oversight of product management.

Bitcoin Mining Company MARA: Has Used 16% of Bitcoin Reserves for Short-Term Third-Party Loans to Generate Returns

According to The Block, Bitcoin mining company MARA disclosed in its December production report that it has used 7,377 Bitcoins (approximately $730 million) for short-term third-party loan operations, accounting for 16.4% of its reserves, to achieve "single-digit" yields.

According to the announcement, MARA purchased 22,065 Bitcoins at an average price of $87,205 in 2024, while mining 9,457 Bitcoins, bringing its total reserves to 44,893 Bitcoins, valued at over $4.4 billion at current prices. The company has exceeded its target of 50 EH/s in computing power, peaking at 53.2 EH/s.

MARA's Vice President of Investor Relations, Robert Samuels, stated that the loan program began in 2024, primarily in collaboration with well-known third-party institutions. CEO Fred Thiel emphasized that the dual strategy of mining and purchasing provides the company with greater flexibility and helps enhance long-term shareholder value.

Ripple CEO: 75% of Ripple Labs' Job Vacancies Are Currently in the U.S., “Trump Effect” Has Made Cryptocurrency Great Again

Ripple CEO Brad Garlinghouse revealed that 75% of Ripple Labs' job vacancies are currently in the U.S., and the company has secured more deals and partnerships in the U.S. after the November 2024 elections than in the previous six months.

Garlinghouse attributed these changes to the incoming Trump administration and Trump's pro-cryptocurrency remarks. In a post on X on January 5, Garlinghouse wrote: "The Trump team has been driving innovation and job growth in the U.S. under the leadership of Scott Bessent, David Sacks, Paul Atkins, and others—they haven't even taken office yet, but however you want to say it, the 'Trump effect' has made cryptocurrency great again."

“What Exciting Articles Are Worth Reading in the Last 24 Hours”

Final Thoughts on Crypto + Agent: Inevitability, Convergence Points, and Development Stages

This article explores three key issues:

- Is Crypto + Agent a short-term concept hype or an inevitable development trend?

- What inseparable and complementary intersections exist between Crypto and Agent?

- What stages will Crypto + Agent go through, and which stage are we currently in?

We Surveyed 42 Key Figures in the Solana Ecosystem: What Are Their Views on the Crypto Industry?

Lightspeed initiated an anonymous survey and distributed it to Solana's founders, heavy users, and others, aiming to gain genuine insights into their views on other ecosystems, venture capital firms, startups, and more.

The survey questions covered various options and provided space for written responses, edited for grammar and clarity.

Forbes Analyst's Account: Why a Traditional Value Investor Bets on Bitcoin?

I still vividly remember my first trip to Las Vegas. It was just a year after I graduated from college, and my best friend gave me a free plane ticket, inviting me to join him for a few days of fun. We stayed at the Hard Rock Hotel, which had a party-like atmosphere, smaller and more intimate gaming areas than the big casinos on the Las Vegas Strip, along with incredibly generous giveaways—an ideal place for someone my age.

Even after 27 years, that memory remains fresh. I remember playing blackjack for several hours. At first, we played at a table with a minimum bet of $10, but an initial streak of good luck quickly led us to increase our bets. In the first two days there, I won about $1,700. But by the third day, my luck took a sharp turn. By the evening, my friend went from winning a few hundred dollars to losing $750. Frustrated, he decided to head back to the room to sleep early.

My situation was worse; my $1,700 profit shrank to just $300. But unlike my friend, I wasn't ready to quit. Losing that much money left me feeling unsatisfied, so with the remaining $300, I spotted an empty table with a minimum bet of $100 and thought, why not give it a try? Fortune smiled upon me again, and in less than 20 minutes, I turned that $300 into $3,000. By the time I headed home, I had won a total of about $3,600. For a 23-year-old living in New York City in the late '90s, that was a significant amount of money.

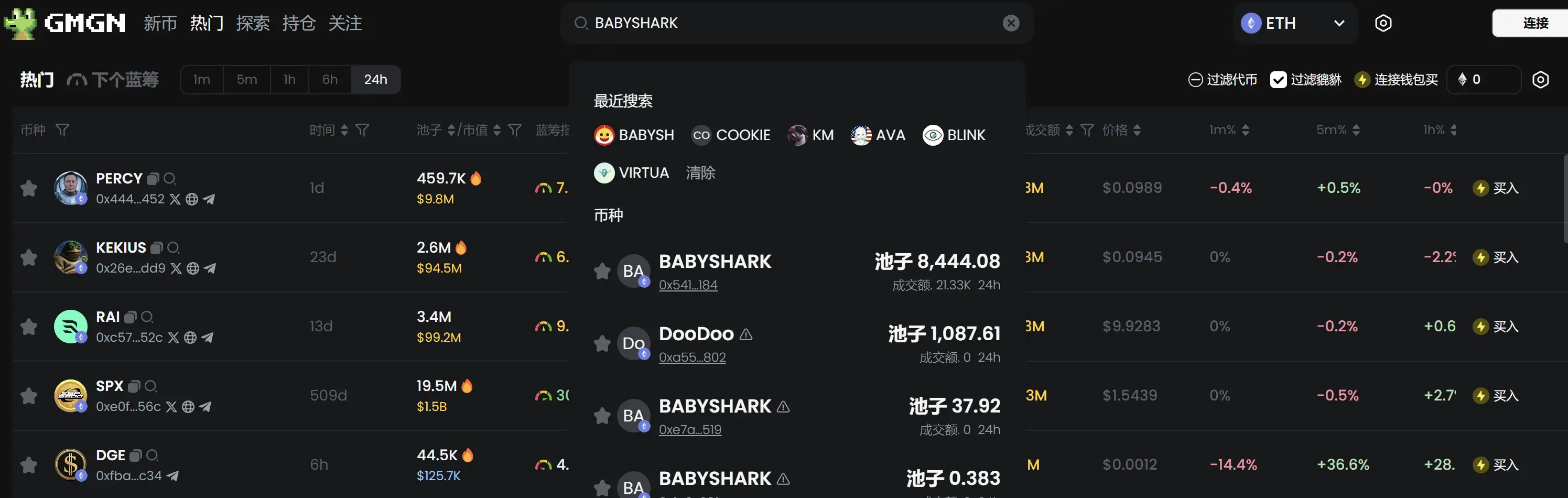

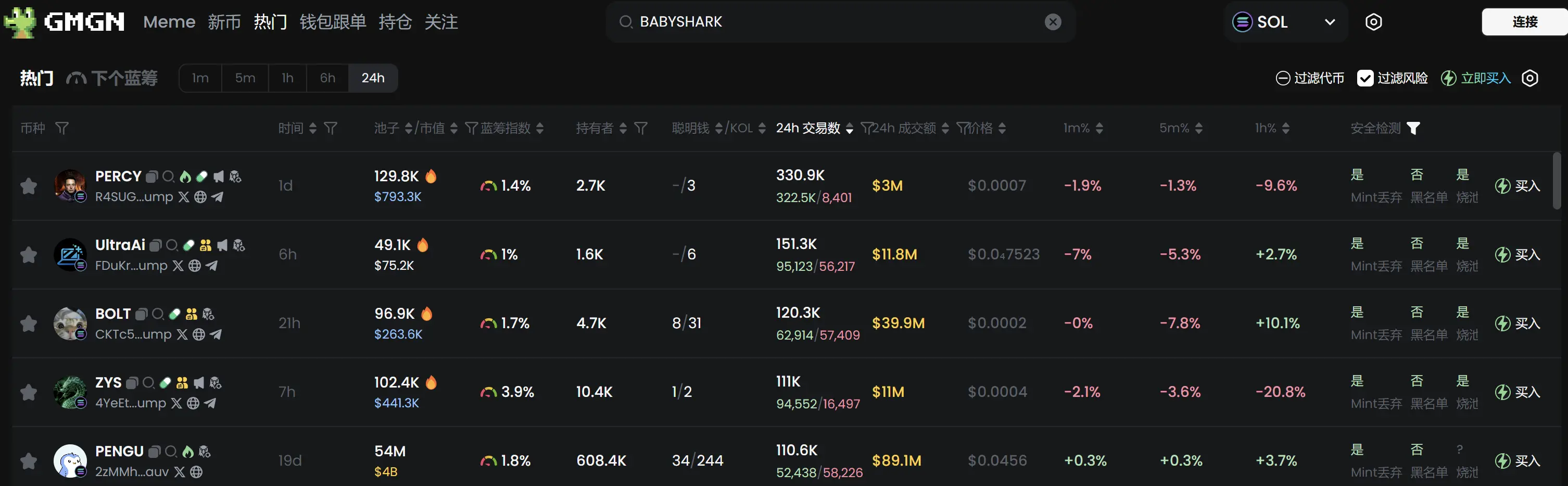

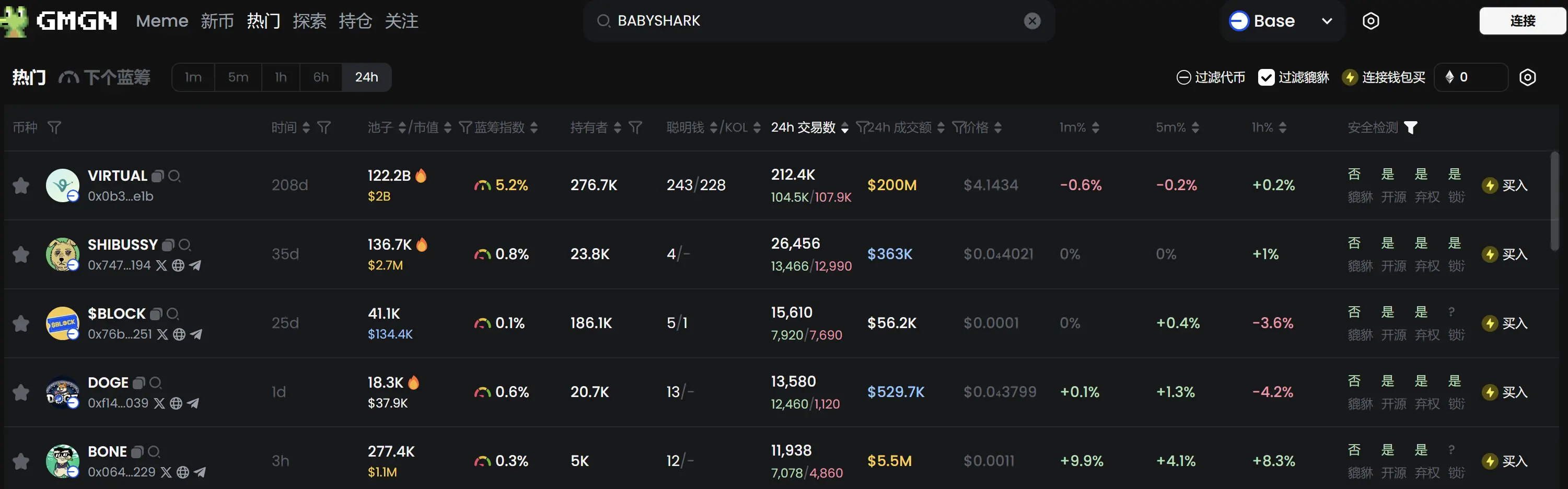

Meme Popularity Rankings

According to the meme token tracking and analysis platform GMGN, as of January 6, 19:40:

The top five trending Ethereum tokens in the past 24 hours are: PERCY, KEKIUS, RAI, SPX, DGE

The top five trending Solana tokens in the past 24 hours are: PERCY, UltraAi, BOLT, ZYS, PENGU

The top five trending Base tokens in the past 24 hours are: VIRTUAL, SHIBUSSY, $BLOCK, DOGE, BONE

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。