Original | Odaily Planet Daily (@OdailyChina)

Author | Nan Zhi (@Assassin_Malvo)

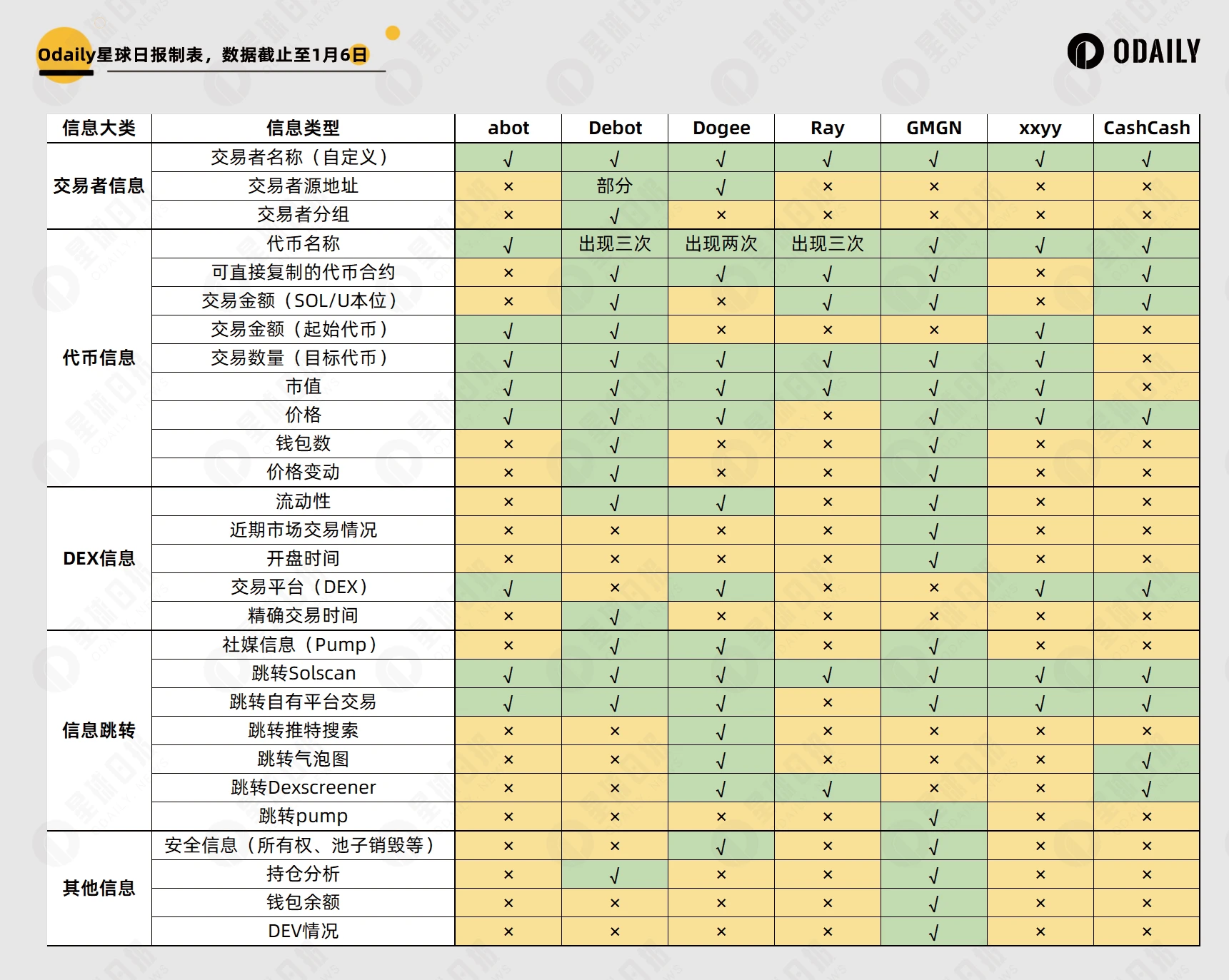

After abot announced it would cease operations, a new batch of trading tools has emerged and began public testing and promotion in recent weeks. In this article, we will break down and analyze the monitoring functions of various tools, listing their differences and advantages and disadvantages for readers to reference in their choices.

Monitoring Function Breakdown

Trader Information

All listed bots support displaying custom names for monitoring targets, with the only exception being Debot, which provides some fields from the trader's address and the group the trader belongs to.

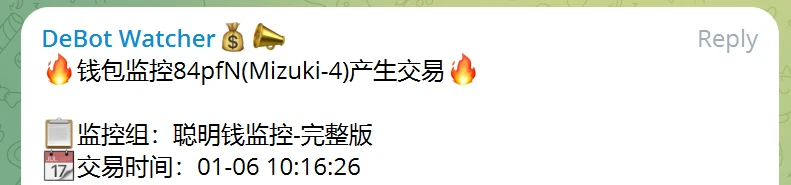

Address fields are usually not valuable. The reason for the group information is that Debot offers monitoring of operational changes within each group, for example, it can monitor if a group simultaneously buys or sells the same token within X minutes. Therefore, it is suitable for monitoring clusters of large holders of specific tokens or for discovering if holders are collectively reducing their positions in a certain token, but in high-frequency scenarios, this information is redundant; users only care about "what coins were bought," not who is collectively buying or selling.

Token Information

Directly copyable token contracts: Most platforms can directly jump to their own trading bot to initiate transactions without needing to copy the contract. xxyy, following abot, does not provide this data and has launched a jump to pepeboost trading, but since xxyy and pepeboost accounts do not interconnect, it is not beneficial for xxyy users.

Transaction amount (starting token): If a trader uses Meme token A to exchange for token B, conventional monitoring tools will only show that N dollars worth of token B was purchased, while abot will show how much of the starting trading token was spent.

Wallet count, price changes: Displays how many holders the token currently has and how much the price has changed over a specific time period. Typically shown through price websites (like Dexscreener) or trading tool web pages, this is usually redundant information.

From the comprehensive table, it can be seen that abot, xxyy, and CashCash belong to the first tier with the least amount of information, while Ray and Dogee have relatively more, and Debot and GMGN are very detailed.

However, based on the analysis, the additional information provided is usually redundant; at least in most scenarios, users do not care, and only users focused on Telegram trading, who spend little time on web pages or Twitter, need it.

Information Jump

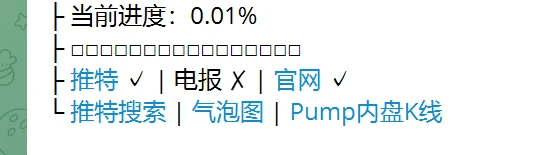

Dogee provides the most information in this section, as it does not have a web version tool, while other tools can usually click to jump to external information links like Twitter and official websites on their web pages. Therefore, there is no distinction of superiority here; the difference lies in whether users primarily trade on the web or on Telegram.

Other Information

Since the current focus is mainly on pump tokens, there are no security issues, and security information on Solana is considered redundant (some tools support EVM monitoring, which is not within the discussion scope). DEV information is quite critical and can usually also be obtained on web pages.

In position analysis, Debot and GMGN provide relatively comprehensive information, including how many times the address has bought and sold this token, the amount held, and profits.

Summary

In summary, if users want to use monitoring tools to discover "smart money is buying a certain token," and then check information on Twitter, official websites, and K-line websites, treating purchase information as a reference rather than a key decision factor, then a simpler monitoring style like abot, including Ray, xxyy, CashCash, etc., is more suitable.

If users want to obtain the information that "smart money is collectively buying a certain token," they should also choose a simpler monitoring style like abot. Additionally, Debot has launched a separate monitoring function that can provide specialized alerts for collective purchases, but it is not suitable to use its address monitoring to uncover this information.

If users prefer to obtain information and make quick decisions in one place on Telegram, then tools with very comprehensive information like GMGN and Debot are more suitable.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。