1. Bitcoin Market and Mining Data

From December 30, 2024, to January 5, 2025, Bitcoin's price exhibited certain volatility. The main changes during this period are as follows:

On December 30, 2024, Bitcoin surged above $94,900 but failed to maintain the upward momentum, retreating to around $92,700 by the end of the day, with market sentiment leaning bearish and short positions prevailing. From December 31, 2024, to January 1, 2025, Bitcoin rebounded to above $96,000 after hitting support near $92,000 at year-end, showing a slight increase despite selling pressure above, indicating a return of bullish strength. On the first day of the new year, the price continued to rise, hovering around $94,000, showing an overall upward trend. On January 3, the daily increase significantly expanded, with the price breaking through the key resistance of $95,000 and fluctuating up to above $97,000, indicating active market funds and further strengthening of the trend. On January 4, the price oscillated at high levels, with profit-taking sentiment emerging, suggesting a potential short-term consolidation phase, but overall remained above $96,000, indicating strong support. On January 5, Bitcoin's price continued to fluctuate at high levels, with cautious market sentiment and investors showing strong wait-and-see attitudes, maintaining a price range between $97,000 and $98,000.

Bitcoin Price Trend (2024/12/30-2025/01/05)

Market Dynamics:

With year-end capital reallocation and the initiation of new year investment strategies, Bitcoin, as digital gold, has attracted capital inflows.

Institutional investors may have increased their positions, driving the price to rise rapidly.

Influencing Factors Analysis:

1. Macroeconomic Policy:

Federal Reserve Interest Rate Policy: In 2024, the Federal Reserve cut interest rates multiple times, with the latest adjustment bringing rates to a range of 4.25%-4.5%. Although inflation levels have retreated from peak levels, they remain above the 2% target. According to the latest forecasts, the Federal Reserve may cut rates twice in 2025, totaling 50 basis points. High interest rates may reduce market interest in high-risk assets, including cryptocurrencies.

2. Political Factors:

Trump Administration's Cryptocurrency Policy: President-elect Donald Trump has expressed support for cryptocurrencies, planning to establish a strategic Bitcoin reserve and nominate officials who support cryptocurrencies. These policies may have a positive impact on Bitcoin prices.

3. Market Sentiment:

Investor Sentiment: The Fear and Greed Index stands at 61, indicating that market sentiment leans towards greed, with investors holding an optimistic view of Bitcoin.

4. Technical Factors:

Technical Indicators: Bitcoin's price has broken through the upper limit of a bullish channel, indicating an upward trend. The Relative Strength Index (RSI) also shows buy signals.

Hash Rate Changes:

The Bitcoin network's hash rate experienced significant fluctuations from December 30, 2024, to January 5, 2025. Starting from December 30, 2024, the hash rate declined from 957.78 EH/s to 708.43 EH/s. However, between December 31 and January 1, the network hash rate quickly rebounded to 955.33 EH/s, then fell again to around 655.44 EH/s, showing a fluctuating upward trend. Starting January 2, the hash rate continued to climb to 990.64 EH/s, reaching a historical high of 1,000 EH/s in the early hours of January 3, before dropping to 759.66 EH/s. On January 4, the hash rate stabilized around 750 EH/s. On January 5, it slightly increased and stabilized around 825 EH/s. As of the time of writing, the hash rate is 838.92 EH/s.

This historic growth is noteworthy—the new high of 1,000 EH/s reached on January 3 is nearly double the network hash rate from 12 months ago. This significant change reflects advancements in global mining technology and the intensifying competition within the industry.

Bitcoin Network Hash Rate Data

Bitcoin Network Hash Rate Distribution and Centralization:

It is particularly noteworthy that the United States dominates the Bitcoin network hash rate, contributing over 40% of the global computing power resources. According to TheMinerMag, the two major mining pools in the U.S., Foundry USA and MARA Pool, account for over 38.5% of all mined blocks. Foundry USA's hash rate has increased from 157 EH/s at the beginning of 2024 to approximately 280 EH/s in December, making it the largest single mining pool globally by hash rate, controlling about 36.5% of the total Bitcoin network hash rate.

This regional concentration of computing power raises new considerations for mining efficiency and regulation, while also intensifying attention on the expansion potential of other regional markets.

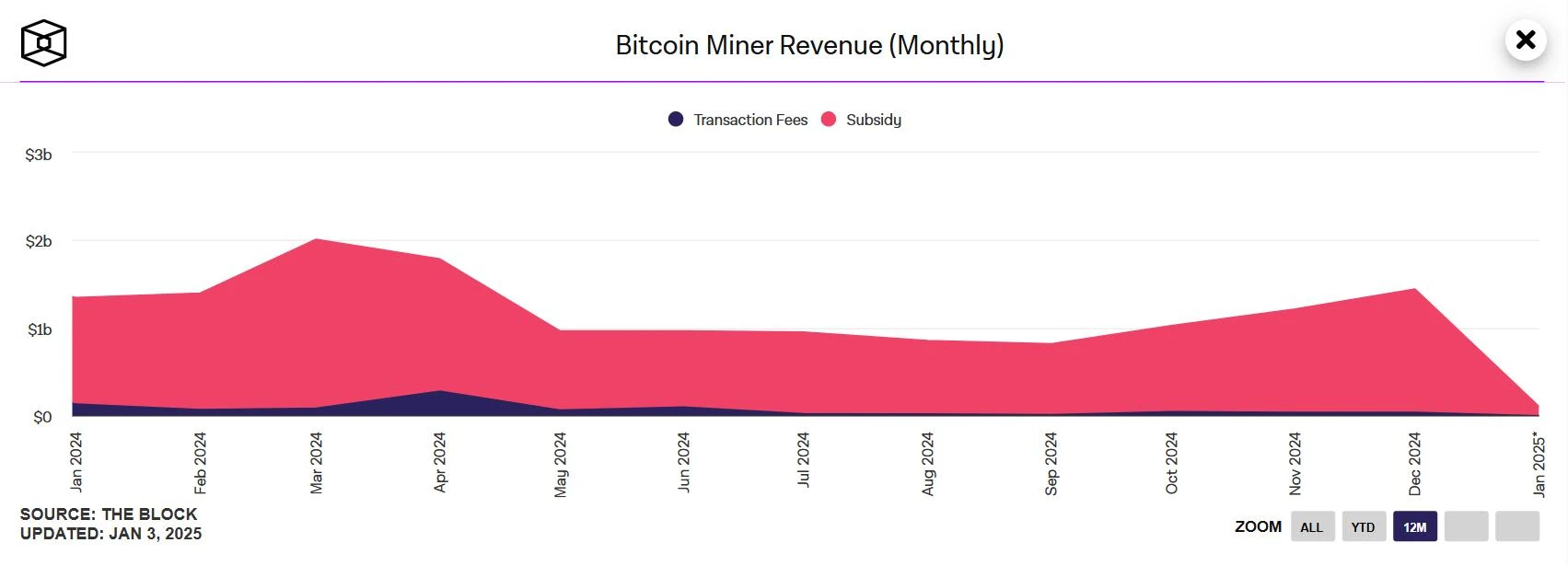

Mining Revenue:

Data from TheBlock shows that Bitcoin miners' revenue reached $1.44 billion in December, marking a new high since May of this year, surpassing November's $1.21 billion in miner revenue. Additionally, of the November miner revenue, $38.73 million came from on-chain fees, while December saw $37.69 million.

Bitcoin Miners' Revenue Data

Energy Costs and Mining Efficiency:

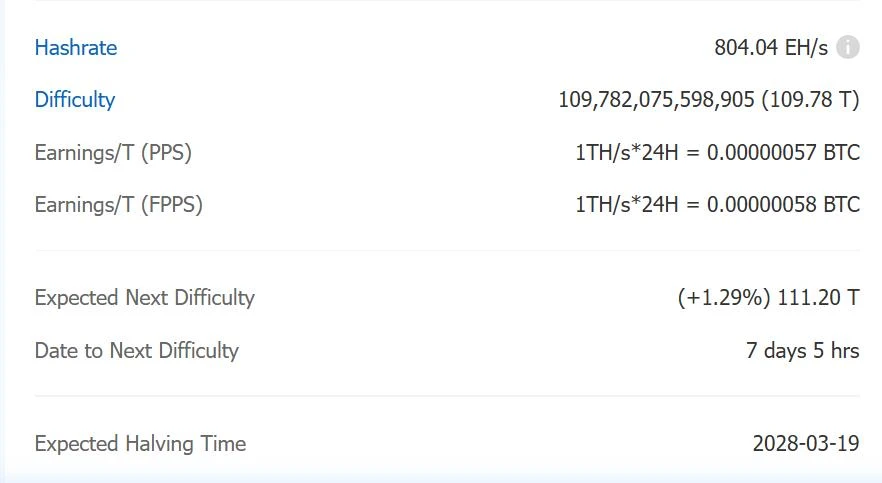

CloverPool data indicates that Bitcoin mining difficulty underwent an adjustment at block height 876,960 (December 30, 2024, 5:55:37), with mining difficulty increased by 1.16% to 109.78 T, setting a new historical high. As of the time of writing, the average network hash rate is 804.04 EH/s. The next mining difficulty is expected to increase by 1.29% to 111.20 T, with less than 8 days until the next adjustment.

From December 30, 2024, to January 5, 2025, both Bitcoin network mining difficulty and hash rate remained at historical highs. Despite improvements in mining machine efficiency, the rapid growth of global hash rate and changes in energy costs present new challenges to mining efficiency and profitability. Miners need to continuously monitor market dynamics and optimize operational strategies to maintain a competitive edge.

Bitcoin Mining Difficulty Data

2. Policy and Regulatory News

People's Bank of China Releases Financial Stability Report, Mentions Hong Kong Cryptocurrency Regulation

On December 30, the People's Bank of China released the "China Financial Stability Report (2024)," which includes mentions of global cryptocurrency regulatory dynamics, with a focus on Hong Kong's compliance progress in cryptocurrency. Given the potential spillover risks of crypto assets to financial system stability, regulatory authorities worldwide are intensifying their oversight of crypto assets. Hong Kong is actively exploring a licensing regime for crypto assets, categorizing virtual assets into two types for regulation: securitized financial assets and non-securitized financial assets, implementing a distinctive "dual license" system for virtual asset trading platform operators, which applies to the Securities and Futures Ordinance and the Anti-Money Laundering Ordinance. Institutions engaged in virtual asset business must apply for registration licenses from relevant regulatory authorities to operate. Additionally, Hong Kong requires large financial institutions such as HSBC and Standard Chartered to include cryptocurrency exchanges in their daily client oversight.

Japan's Financial Services Agency Considers Changing Cryptocurrency Classification to Publicly Investable Financial Assets

On December 30, news emerged that Japan's Financial Services Agency announced plans to start classifying cryptocurrencies like Bitcoin as "financial assets," which may lead to changes in cryptocurrency classification. Official documents indicate that the agency has expressed its position in the 2025 fiscal year tax reform request, hoping to begin treating crypto assets as "financial assets that the general public can invest in."

Currently, Japanese law classifies crypto assets as "payment instruments" under the Payment Services Act. Shifting towards a definition that emphasizes "investment" would represent a form of legitimization for cryptocurrencies, but this change seems contingent on the stability of the cryptocurrency industry. While the document does not call for cryptocurrency tax reform, CoinPost reported that this indicates Japan's controversial crypto tax rules "may be subject to review."

South Korea's Financial Services Commission Delays Decision on Allowing Businesses to Open Cryptocurrency Accounts

On December 30, the South Korean Financial Services Commission announced that the decision on whether to allow businesses to open cryptocurrency accounts will be postponed until 2025. Following the first meeting of the Virtual Assets Committee, the second meeting scheduled for January is expected to revisit the discussion on whether to permit the opening of KRW corporate virtual asset accounts.

Previously, the Financial Services Commission was considering allowing non-profit enterprises such as central government departments, local governments, public institutions, and universities to issue real-name accounts in the first phase, but this issue has not been finalized. Notably, the recent impeachment situation may lead the government to delay further deliberation on the Virtual Assets Committee's discussion results.

3. Mining News

Ten Regions in Russia Fully Ban Cryptocurrency Mining Starting Today

On January 1, news reported that ten regions in Russia have fully banned cryptocurrency mining as of January 1, with three other regions implementing partial bans. The government decree passed on December 23 stipulates a complete ban on mining from January 2025 to March 2031, while in the other three regions, mining will be partially restricted during each heating season (from November 15 to March 15 of the following year, excluding the first year of the ban starting January 1, 2025).

Russian Deputy Prime Minister Alexander Novak stated at the end of December that the number of regions banning cryptocurrency mining could increase if requests are received from governors. The authorities in the Republic of Khakassia have already asked the Ministry of Energy to restrict mining activities in the region.

HC Wainwright: Total Market Value of Bitcoin Mining Companies May Exceed $100 Billion by 2025

On January 3, U.S. investment bank HC Wainwright published an article this week, predicting that by the end of 2025, the price of Bitcoin will reach $225,000, which means the market capitalization of Bitcoin will reach $4.5 trillion, accounting for about 25% of the market value of gold. HC Wainwright also expects the total market value of Bitcoin mining companies to exceed $100 billion.

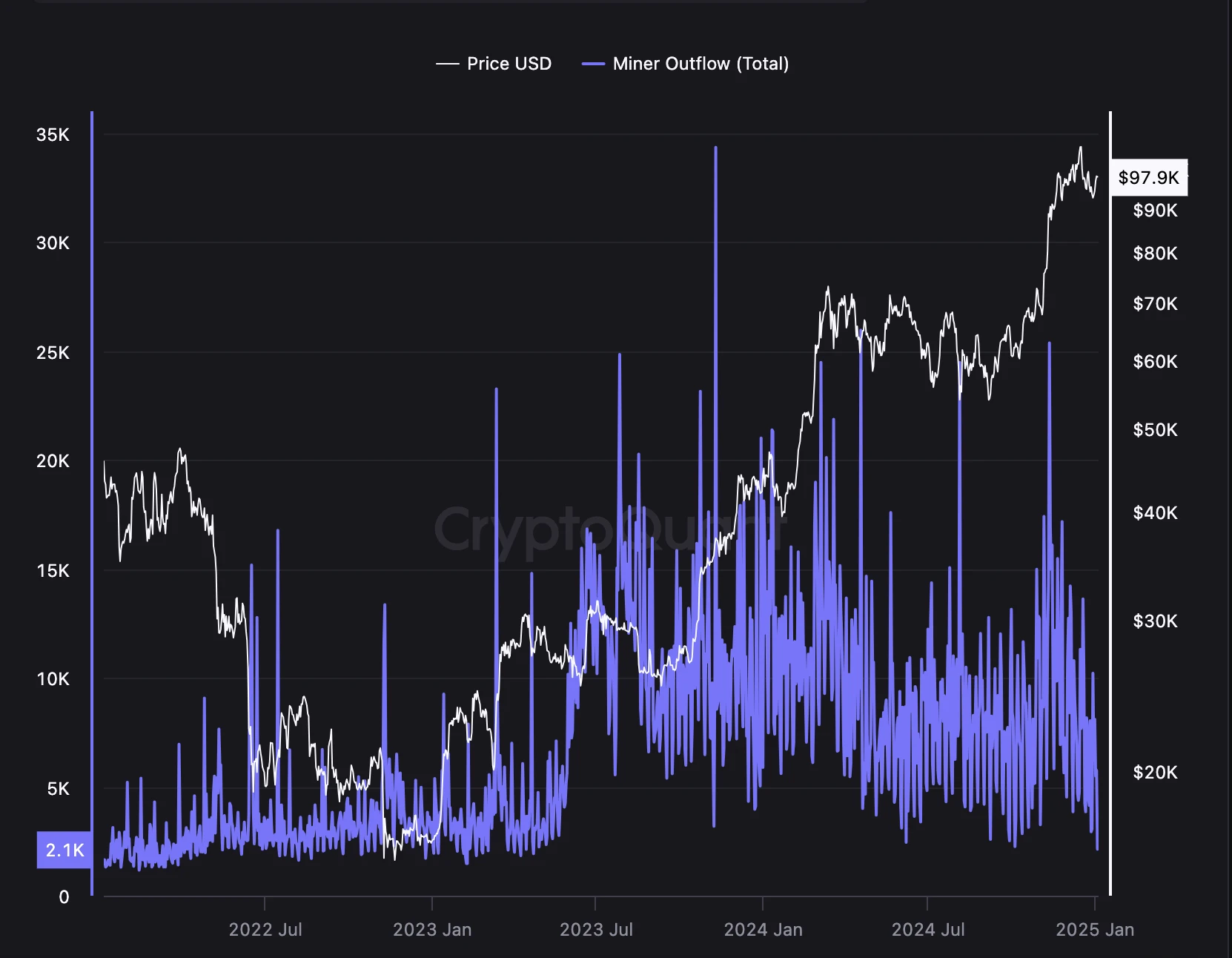

Total BTC Transferred to Exchanges and Miner Outflows Have Significantly Decreased Since Last November

On January 5, it was reported that the inflow of BTC to exchanges (total BTC transferred to exchanges) and miner outflows (the amount of BTC miners send to exchanges) have significantly decreased since November 2024, indicating reduced selling pressure. According to CryptoQuant data, after experiencing a peak in exchange inflow activities for about two months, the inflow of BTC to exchanges peaked at 98,748 BTC on November 25, 2024. In December 2024, the inflow to exchanges decreased, with the total number of Bitcoins sent to exchanges ranging between 11,000 and 79,000 per day. The decrease in exchange inflows coincided with a reduction in miner outflows, indicating that the selling pressure from Bitcoin miners has decreased, as miners often sell their Bitcoin holdings to cover operational costs.

Miner Outflow Situation from July 2022 to January 2025

4. Bitcoin News

Total On-Chain Holdings of U.S. Spot Bitcoin ETF Exceeds $10 Billion

On December 30, it was reported that, according to Dune data, the total on-chain holdings of the U.S. spot Bitcoin ETF have surpassed 1.12 million BTC, currently around 1.129 million BTC, accounting for 5.70% of the current BTC supply, with the on-chain holdings valued at approximately $10.68 billion.

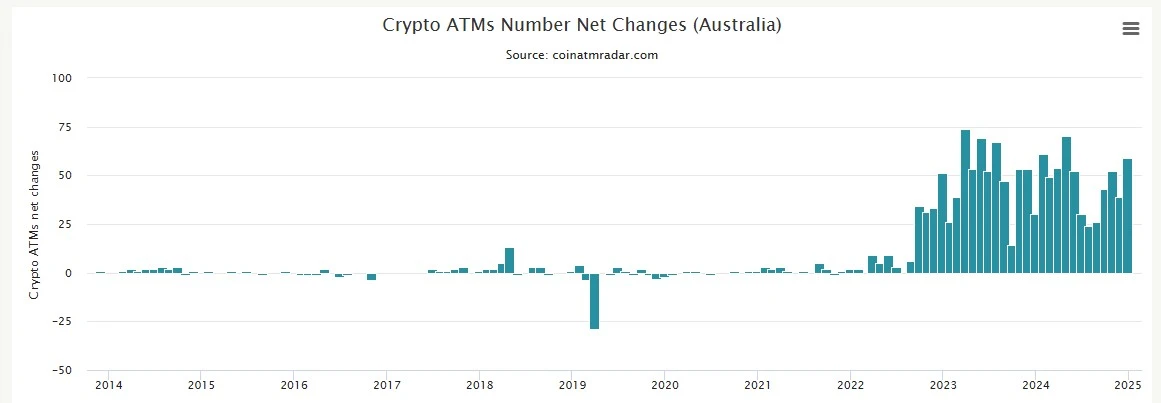

Number of Bitcoin ATMs in Australia Continues to Grow for 29 Consecutive Months

On December 30, Coin ATM Radar data showed that the number of Bitcoin ATMs in Australia has increased for 29 consecutive months. Currently, Australia has 1,359 ATMs, accounting for 3.5% of the total number of Bitcoin ATMs worldwide. Additionally, as of December 29, the U.S. has a total of 31,516 Bitcoin ATMs, meaning the U.S. holds 81.3% of all Bitcoin ATMs globally. Canada ranks second with 3,027 Bitcoin ATMs, accounting for about 7.8% of the entire cryptocurrency ATM market.

Cryptocurrency ATMs Installed or Removed in Australia

Clean Energy Usage Rate in Bitcoin Mining Exceeds 50%, Market Awaits Musk to Fulfill Tesla's Commitment to Resume Accepting Bitcoin Payments

On December 30, it was reported by Watcher.Guru that the clean energy usage rate in the Bitcoin network has now exceeded 50%.

Elon Musk stated in June 2021 that Tesla would resume accepting Bitcoin payments once the clean energy usage rate in Bitcoin mining exceeds 50%.

Global Bitcoin Holding Dynamics: BlackRock Holds Over 550,000 BTC, El Salvador Increases Holdings by 53 BTC

El Salvador: Increased holdings by 53 BTC in the past 30 days, bringing the total holdings to over 6,002.77 BTC, with a market value of approximately $556 million.

Australia's Monochrome: The spot Bitcoin ETF (IBTC) held 266 BTC as of December 30, with assets under management (AUM) of approximately $39.957 million.

Yuxing Technology (Hong Kong Stock): Recently sold approximately 6.3 million USDT and purchased 78.2 BTC.

BlackRock: As of December 31, 2024, Bitcoin holdings amounted to 551,917.901 BTC, with a total market value of approximately $51.731 billion.

CNBC: Multiple Institutions Optimistic About Bitcoin's 2025 Performance, Highest Expectation at $250,000

On December 31, several industry observers interviewed by CNBC predicted Bitcoin's price in 2025, with the highest expectation being that Bitcoin could rise to $250,000. James Butterfill, head of research at CoinShares, stated that Bitcoin's price could range from $80,000 to $150,000 in 2025. Matrixport indicated that Bitcoin could reach $160,000 by 2025. Alex Thorn, head of research at Galaxy Digital, expects Bitcoin to break $150,000 in the first half of this year and reach $185,000 in the fourth quarter.

The head of research at Standard Chartered expects Bitcoin to reach $200,000 by the end of 2025. Carol Alexander, a finance professor at the University of Sussex, believes Bitcoin's price could reach $200,000 next year. Youwei Yang, chief economist at Bit Mining, predicts Bitcoin's price will reach between $180,000 and $190,000 in 2025. Sid Powell, CEO and co-founder of Maple Finance, predicts Bitcoin's price will reach between $180,000 and $200,000 by the end of 2025. Elitsa Taskova, chief product officer at Nexo, believes Bitcoin will reach $250,000 within a year.

Industry Experts and Institutions Generally Believe Bitcoin's Price Will Reach $180,000 to $200,000 in 2025

On January 1, it was reported that, according to aggregated prediction data from Trader T, industry experts and institutions generally believe Bitcoin's price will reach $180,000 to $200,000 in 2025.

Historically, Bitcoin Has Shown Significant Performance in the First Quarter Following Halving

On January 2, Coinglass data indicated that historically, Bitcoin has shown significant performance in the first quarter following halving, with specific data as follows: Q1 2013: 539.96%; Q1 2017: 11.89%; Q1 2021: 103.17%.

Dennis Porter: A U.S. State Will Start Buying Bitcoin Within 4 Months

On January 2, Dennis Porter, co-founder and CEO of the Satoshi Action Fund (SAF), posted on platform X, stating that a U.S. state is almost 100% certain to start buying Bitcoin within the next four months. He also mentioned that his team is actively pushing for the passage of related legislation, indicating that this is not just a prediction but a reality in progress.

Screenshot of Dennis Porter's Post on Platform X

Investment Bank H.C. Wainwright Raises Bitcoin's Target Price This Year from $140,000 to $225,000

On January 3, it was reported that investment bank H.C. Wainwright raised Bitcoin's target price this year from $140,000 to $225,000, stating that the price increase may be driven by regulatory clarity and institutional adoption.

MicroStrategy Plans to Raise $2 Billion in the First Quarter Through Preferred Stock Issuance to Buy More BTC

On January 4, according to an official announcement, MicroStrategy announced plans to raise up to $2 billion through the issuance of preferred stock, as part of its "21/21 plan," which aims to raise $42 billion over three years (with $21 billion each from equity and fixed income).

The purpose of this issuance is to allow MicroStrategy to continue strengthening its balance sheet and acquire more Bitcoin. The issuance is expected to take place in the first quarter of 2025.

The announcement stated that the decision to proceed with and complete the issuance is at MicroStrategy's discretion and is subject to market and other conditions, allowing MicroStrategy to choose not to proceed or complete the issuance.

This Week, Bitcoin Spot ETF Net Inflow Reached $255.3 Million, Increasing Holdings by 2,421.94 BTC

On January 5, Lin Chen, head of Deribit Asia Pacific business, posted on platform X, stating: "This week, the BTC spot ETF overall showed a slight net inflow. Despite a market closure on Wednesday and a significant net outflow on Thursday, the inflows on the other days compensated for this gap, resulting in a total net inflow of $255.3 million, increasing holdings by 2,421.94 BTC.

Among them, on Thursday, BlackRock's IBIT set a new record for the largest single-day reduction of 3,516.57 BTC, while on Friday, market sentiment improved, with an inflow of 2,601.9 BTC, and Fidelity increased its holdings by 3,684.64 BTC that day. The current BTC price has rebounded, maintaining a wide fluctuation around $98,000."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。