The first Monday of 2025, the market is speculating whether MicroStrategy will announce another increase in holdings tonight.

Last night, MicroStrategy founder Michael Saylor released Bitcoin Tracker information for the ninth consecutive week, but this time he stated, "Some parts of the website are not quite correct." According to previous patterns, MicroStrategy always increases its Bitcoin holdings the day after relevant news is released.

Note: After each purchase of BTC by MicroStrategy, a green dot is marked on the website on the corresponding date, while the BTC price trend line is in blue.

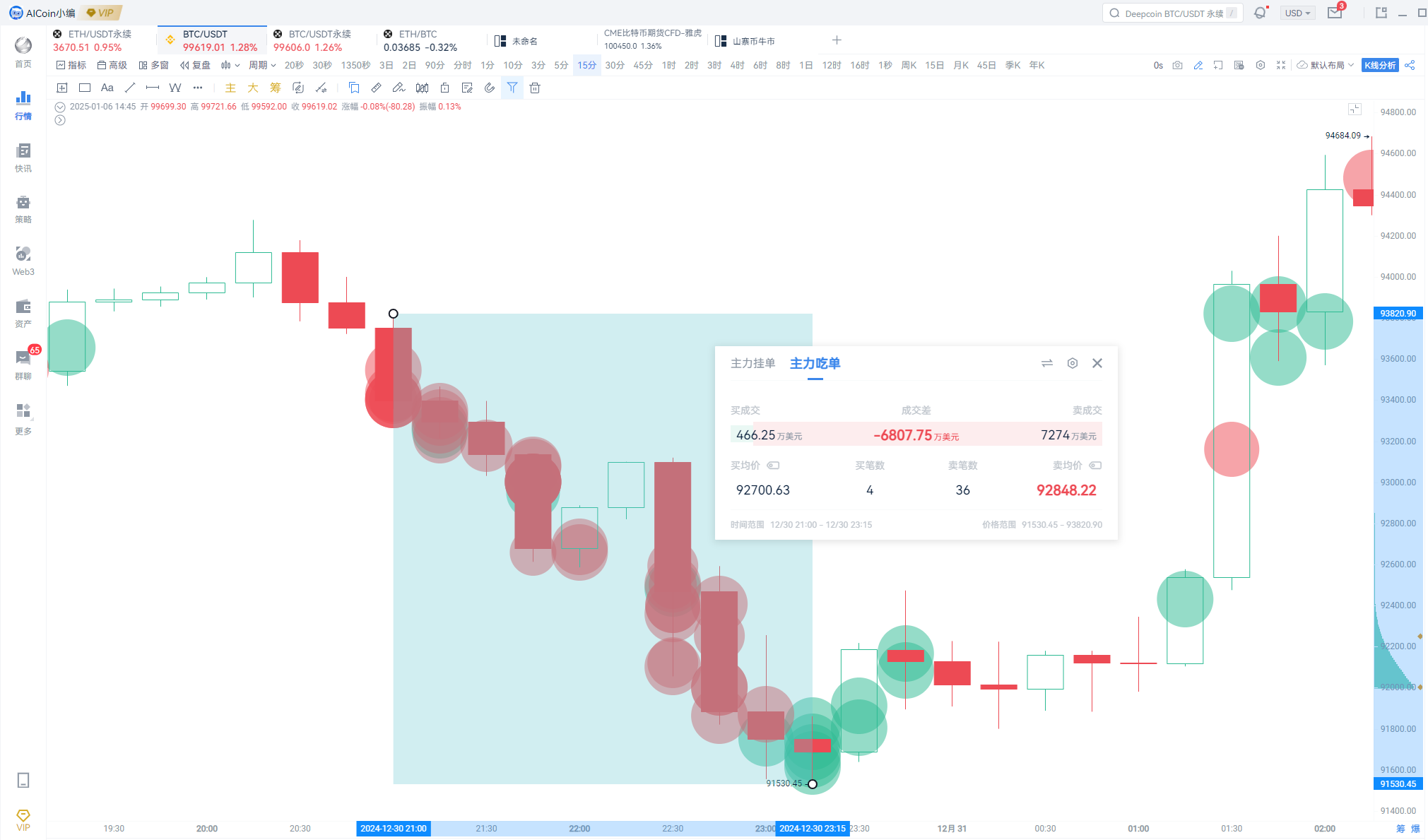

Last Monday night, after MicroStrategy announced its increase, Binance spot traders sold off, selling $68.08 million at market price, causing Bitcoin's price to correct by over 2.4%. Therefore, around 9 PM tonight, lock in on AICoin (aicoin.com) on the PC or APP side in the [News - Twitter] section, and pay attention to the main market price transaction situation in conjunction with large transaction indicators.

Large transaction indicators: Track the market transaction situation of large holders; buying transactions are bullish; selling transactions are bearish. Experience it now: https://www.aicoin.com/vip

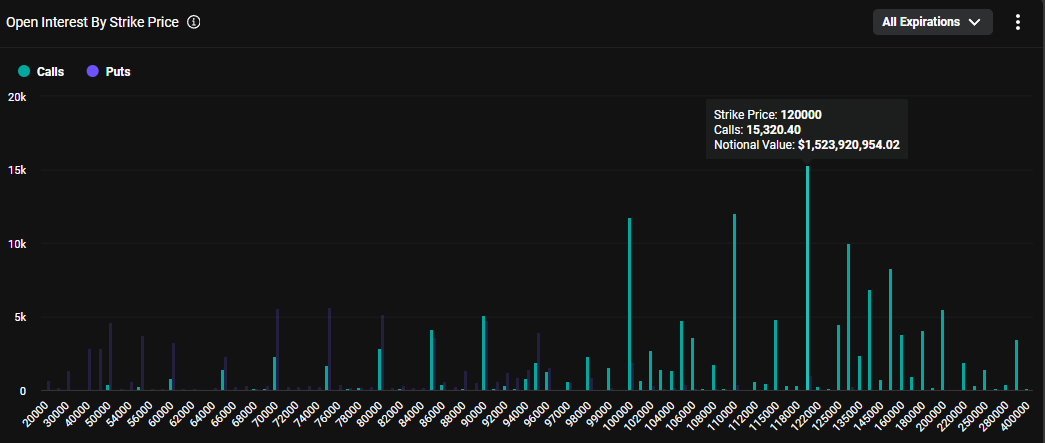

It is particularly noteworthy that as BTC approaches the $100,000 mark, interest in call options in the options market is heating up again, betting that Bitcoin's price will reach new highs after Trump's inauguration. Data shows that on Saturday, a trader on Deribit spent over $6 million to purchase call options with a strike price of $100,000 expiring on March 28. Amberdata stated on X: "This trade is expected to see Bitcoin's price reach new highs just a few months after Trump officially takes office."

Additionally, the $120,000 call option is currently the most popular option on the Deribit platform, with a notional open interest value of $1.52 billion. Amberdata's derivatives director Greg Magadini stated: "The inauguration of Trump and the period following it will be a golden time for favorable announcements and policies, which could serve as catalysts for Bitcoin's rise." Digital asset benchmark provider CF Benchmarks also expressed a similar view, while warning that any potential delays in policy-making could dampen bullish sentiment.

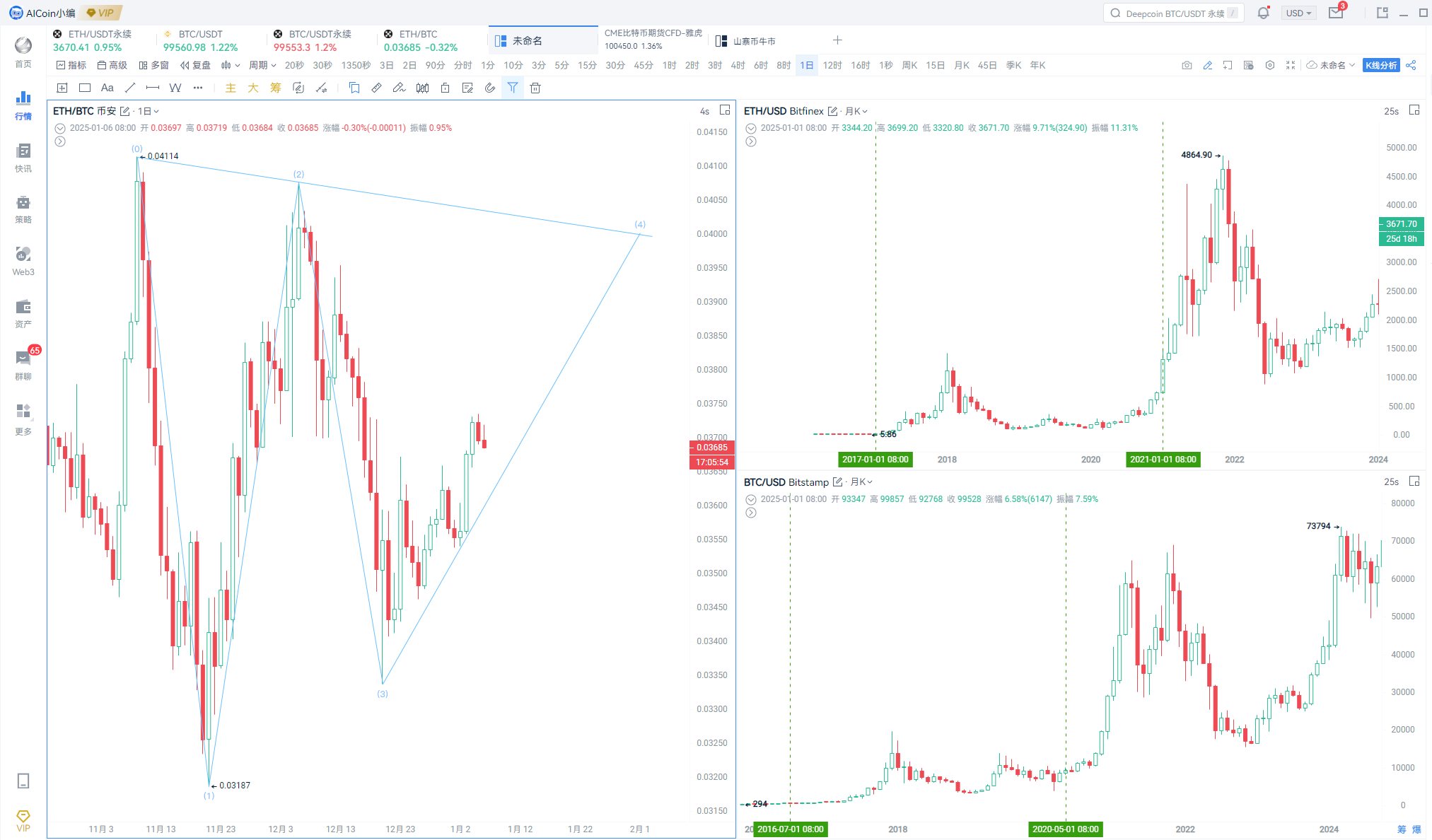

Last Friday, I reminded to pay attention to ETH/BTC, which is currently rebounding, waiting to break through 0.03735, or it may surge to 0.0412.

According to historical data, ETH prices typically explode in the year following Bitcoin's halving, and with the first quarter having an upgrade narrative, we can expect good performance from Ethereum. According to the latest predictions from KOLs, the target for ETH this quarter is $5,000 to $6,000.

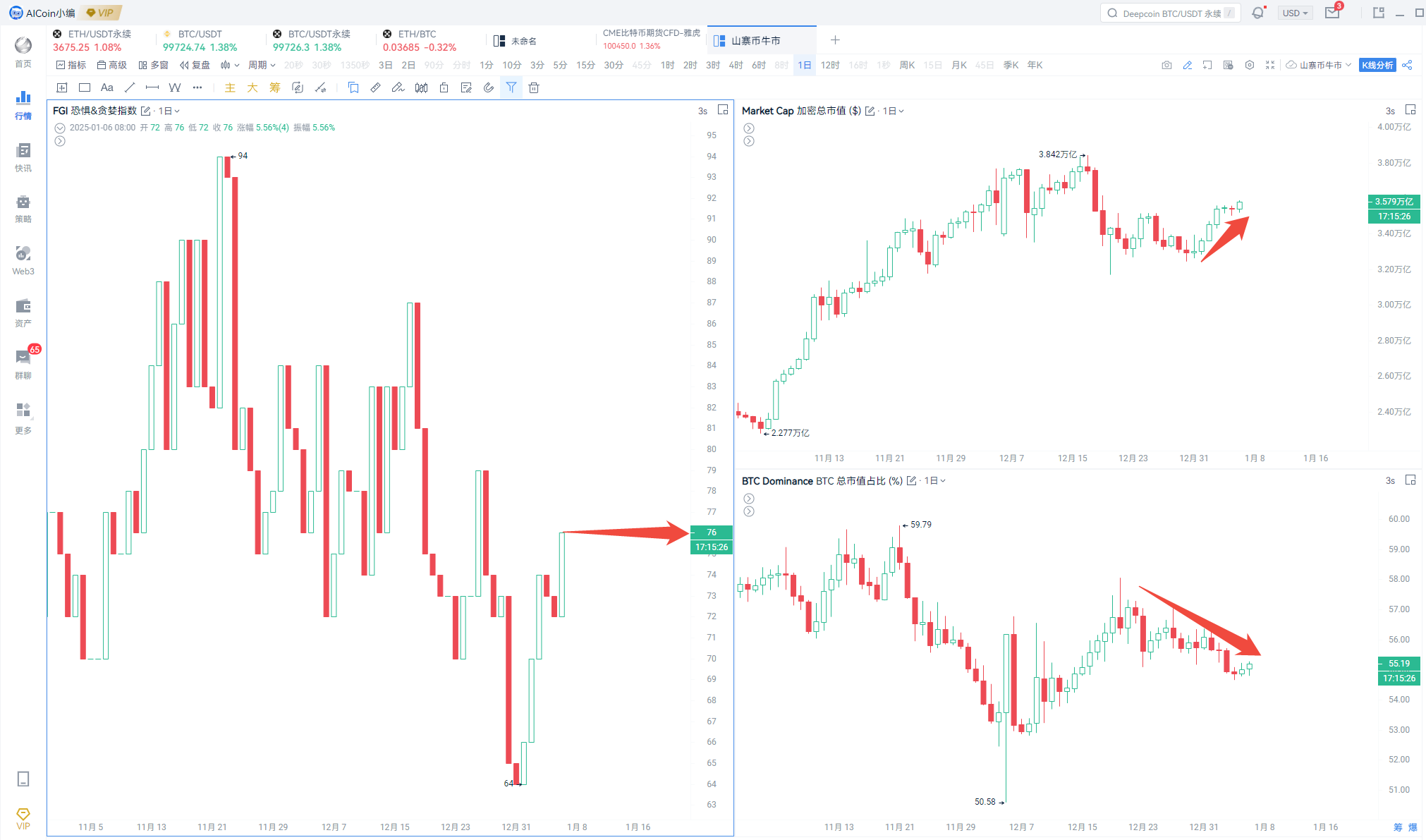

Moreover, the Fear & Greed Index has risen to 76, shifting from greed to extreme greed, while the total market capitalization of cryptocurrencies continues to grow, accompanied by a decline in BTC's market share, indicating potential explosive opportunities for leading altcoins.

Currently, SUI has taken the lead in rising, and among the top 50 cryptocurrencies by market capitalization, BGB, PEPE, BNB, NEAR, and STX are also worth watching.

SUI: In a 45-minute custom period, the price is entangled with the EMA24 moving average, and the MACD shows signs of a top divergence. Watch for support in the 5.153 to 5.216 range, with resistance above at 5.6.

BGB: The price has corrected over 30% from its high, and the 6-hour period has consistently found support at the EMA52 moving average. If the MACD forms a golden cross and the fast and slow lines cross the zero axis, the price is expected to test 7.25, or even reach a high of 8.5.

PEPE: Can be continuously monitored, as Binance spot traders are densely placing orders on both sides of the current price, providing opportunities on pullbacks.

NEAR: The daily level has already risen above the EMA52; if it closes today above 6.135, it is expected to challenge 6.93.

STX: It has cumulatively dropped 52% over the past month, and the 6-hour moving average shows signs of a golden cross. The 12-hour and daily levels are approaching key moving average resistance at 1.8; if it breaks through, it may surge to 2.5.

The content is for sharing only and for reference, not constituting any investment advice!

If you have any questions, feel free to join the 【PRO CLUB】 group to discuss with the editor~

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。